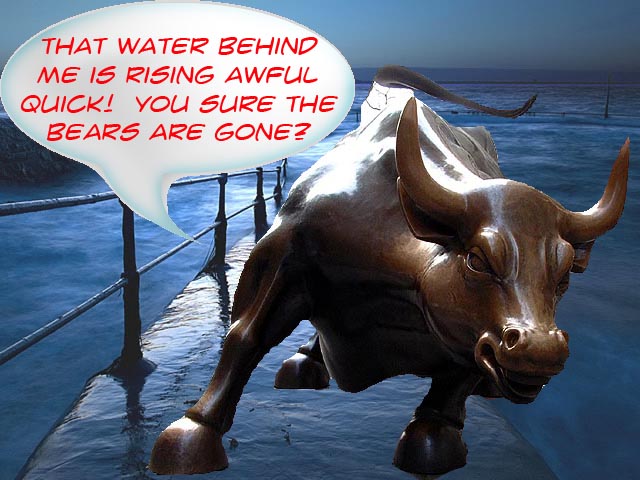

I'm still looking for the market to go to 1108 spx before any significant correction down. I believe it will be reached next week by Wednesday. Option expiration was Friday for most stocks and indexes, but the VIX expiration is actually this coming week, on the 21st... which is Wednesday. That's one reason that I don't think any major sell-off will occur until after the October month is closed out.

Those market makers don't want lose any money, so they need to keep the vix low until those positions expire worthless. After that... well that's another story. November should be a down month, as I expect a nice drop to occur in the next few months. Why you ask? Well, it's not all based on Technical Analysis, Elliottwaves, Fib Levels, or Turn Dates. Nope, it's based on insider information.

You see... TA, EW, Fib's, Astro turn dates and any other method you can think off, hasn't worked too well lately. In the past... yes, they all worked well. But today things are different. Massive printing of money equals massive manipulation of the markets. So, you can basically throw all that charting out the window. If the government wants the market to go higher... it will.

With that said, I don't mean to imply that charting is worthless. Quite the opposite is true. Charting is still valuable. But, basing a decision on charts alone is foolish as the government can keep print more money to buy up any dips in the market. Just when the charts say that the market is ready to crash... BAM! Here comes the PPT to the rescue.

Going short against the government is suicide, and going long with companies that are borderline bankrupt is also suicide. So, what do you do? You wait until the government pulls the money from the market and allows it to behave normally... that's what! When that happens, it will go down of course, as the economic conditions are still horrible. If the government would just stay out the market and let it find a true bottom we would get this recession over with quicker and start a real recovery. But, crooks do what they do best... lie, steal, and cheat to get what they want.

How does that benefit us? Well, I believe that there are individuals that know what's going on... and most importantly what going to happen next. I think that one of those people is the guy known as "Mr. TopStep". He and his group of traders most likely have inside information, which they share with anyone who wants to know. All you have to do is watch their video's on youtube.

I don't think that you should throw all other methods away and only do what they are doing, but they do know more then the average trader. And after all, aren't most people who visit and read blogs every day just average traders? I know I am... how about you? If you had access to some inside information, from Goldman, JP Morgan, or some other bank "in the know", would you be looking for information on the future market direction on some blog, or would you listen to that source?

If I had that kind of information I wouldn't waste my time reading blogs everyday. I do so because I feel that many of those posters have better knowledge then me. Of course figuring out which ones is the really hard trick to do. With that said, I think that listening to someone who is trading on the floor of the S&P futures is someone who most likely has some inside information, or at least more accurate information then most do.

And, he's willing to share it with anyone who wants it. Just watch the free video's he posts on youtube. Again, I want to say that you shouldn't make your decision to buy or sell based solely on what Mr. TopStep says, but you should listen and take that into consideration before making a decision in the market. About a month ago he said that the market wants to close that gap from October, 2008. Here's the video...

As you can see, we are almost there. In the past, when the market gets inside the gap area and pulls back, it almost always trys again until it closes the gap. Rarely does it go inside the gap window and not close it. Since the market pulled back Friday, and the gap isn't closed yet (on a daily bias), I believe the market will rally one final time early next week to finally close that gap at 1108 SPX (110.34 spy). Here's Mr. TopSteps' latest video...

Then, the market should pull back to the 900 area or so, before another rally up. Now, you may be asking... will that rally up break the current high, or the future 1108 high (if it makes it there next week)?

That's up the in air at this time. If the government injects more money, then maybe is the answer.

If they don't, then "Hell NO" is the answer... Dow 4000 here we come!

But for now, let's just focus on the present... and that says that the market is going to close the gap this week and then sell off. I'm just going to sit and wait until the high is hit, then go short.

Red