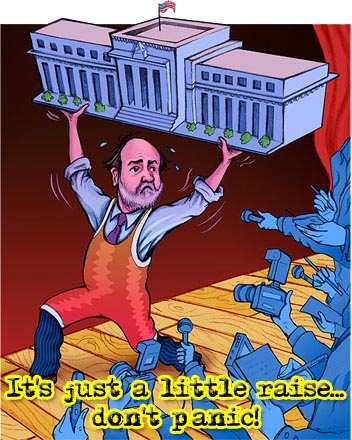

After hours the Fed released that they are increasing rates from .50 to .75, which caused a sell off to start and will most likely continue into tomorrow morning. But, trading tomorrow will be risky if you are thinking that we will tank into the close. That may not happen, as they aren't in the habit of giving you your money... they like to take it instead.

I fully expect the market makers to close it around 109-110 by the end of the day, as they don't want to lose money by paying out money to the option holders that have puts. I'm expecting early morning selling, and then a grind back up to 110 by the end of the day. The key time frame is 9:30 am to 11:00 am, and that should mark the low of the day tomorrow.

On another note, I was able to see a fake print of 107.38 spy on the 10 minute charts, which I added to yesterday's post. This might be the place that they are planning to take the market to soon. When, I don't know? I don't think that will happen tomorrow, as we have too much support right now. But, you should keep that target on your mind for when we do finally sell off.

So, tomorrow the key will be to watch for the selling volume to die off early in the morning, and get out of your shorts. If we sell off to 107.38 tomorrow, I'd be shocked. The market isn't ready to rollover yet folks. We still need another week of choppy trading to set up a big bear flag on the weekly chart of the spy. I do think we will put in the high for the market next week, before the large wave 3 down occurs.

As most of you know I make a really bad trade about a week ago and took a beating with some 106 puts I bought that will expire worthless tomorrow. That's one of the reasons I try to think a little clearer this time. So, knowing how manipulated this market is I fully expect the sell off tomorrow to be bought back up. The news out tomorrow is the PPI and CPI... which you can guarantee will be positive. That's the perfect way to raise rates (which the market won't like, and will be negative), is to add good news in with the bad news.

Timing is everything here folks, and they ain't stupid. When they are really ready to tank this market, they will release nothing but bad news. Right now they are still trying to hold the market up, so they will mix them together to have everyone's head spinning.

So, for the bears... you have a chance to save yourself tomorrow. If we hit 107.38 (not likely), you had better bailout of all shorts! The daily charts are still pointing up and won't rollover until next week. I really think they want too go tag that 1127.38 gap (spx) that Sundancer pointed out. I have the 112.00-112.50 spy area as major resistance, which is just a hair below the 1127.38 spx level. I would estimate that to be about 113.00 on the spy, as it trades a little higher then the spx. If anyone knows how to convert those two, please let me know.

Remember, nothing ever goes exactly as planned. I'm getting better at this, but I make mistakes too. Sundancer has again been of great help in informing us of the key levels that the market wants to go to. There is also someone else I want to shout out a big Thank You too, and that's...

Anna over at Hot Option Babe (her free blog) and Options Black Board (her subscription service). I have learned so much from her about the market, and how to trade options, that I wouldn't have made it this far without her. She is a personal friend to me, as well as a mentor. Yes folks, I do subscribe to some paid services, and her service is the best. The banner I have on the right side of this page isn't a Google Ad... it's put there by me, because I highly recommend her service.

So, if you can't day trade, but would like to learn how to swing trade options... go sign up, as it's well worth your money. Just take the trades that she does, and you will be happy that you did. She is one of the best traders I know... seriously folks, no kidding aside.

Of course I can't post her trades here, as that information is for the subscriber only... I can tell you that she gets a large percentage of them correct. I'm not going to claim a percentage on her behalf, but from my point of view, I'd estimate she's 75-85% correct on her calls. Remember, that's what I see... and not what she's claiming. On the one's she gets wrong, she more then makes up for those loss with profits from the others.

Moving on...

I'm torn on what to expect next week, as I see both bullish and bearish sides to the argument. I think we should start to head down soon though, so I'll just try to piece that together on my weekend post. Let's just get through tomorrow first... OK?

So, timing is everything tomorrow. The support levels on the way down are at 110.35 (but we are already below that after hours), 109.60-109.70, then 109.00 for gap fill from 02/04. After that is the 108.00-108.40 area, which is the gap from 02/16, and finally the 107.38 level.

I really don't think they will take it all the way down to 107.38 tomorrow, but it is possible. If they do... again, get out of all shorts. This market isn't ready to roll over yet. Next week is a different story though. The current pain is still at 109 tonight, and I will update you with that information should it change tomorrow morning. I do believe they will close this market where it makes them the most profit. Whether or not this current pain number is accurate or not, I don't know. I suspect that the 110 level is the real number... not 109, but regardless of where it is, I'm not expecting a huge crash tomorrow.

Let's all try to stay in this game until we see what next week bring us. I suspect they would like to close the month out good, and hit their key levels first... before tanking it. Next week will bring a lot of whipsaw action as the bulls and bears fight it out. I'm going to try and stay out of their way, what about you?

Red

Thanks Red. Is this the catalyst that will bring us down to 1020 or just a blip in the road that will be shrugged off before we get to 1130? I guess only time will tell.

Monica, they closed the market today above a few key level of 110.35 spy, and that was the 2nd day in a row. That confirms the move, and it will now be a lot easier to go back above it.

I don't think we are quite ready for a huge sell off yet. I think we will choppy around next week, and possibly go up to the next major resistance level of 112.00-112.50? Don't know if we will make it there or not, but starting the big sell off now is just too easy… and you know it's not that simple.

If it was, everyone would be rich. That 107.38 level would be a nice B wave down, if you counted the 104 low to 111 high today as wave A… which would leave us with wave C up next week.

I'm not a great EW person, but that looks pretty simple to chart out to me. I just feel that rolling over here, and starting the next leg down, is too obvious. And you know what that means… if everyone thinks it's going one direction, you should go the other.

The daily charts are still pointing up too, so they need a week to peak out and roll over. Plus, the weekly needs a more defined bear flag. It's coming, but not yet…

I dunno Red. The market closed above key resistance levels today making a lot of shorts cover. I almost covered myself. So what better time to take the market down? The daily's may look up but don't longer time frames trump them out? And, we are overbought on the McClellan Oscillator. Everyone in my book is waiting for 1127 to get short. It's impossible to know the answer. Probably the best thing for me to do is take some shorts off the table tomorrow and hang on to the other 1/2.

Check this out Red –

http://stockcharts.com/h-sc/ui?s=$nymo

If you see 107.38… get out of all shorts, and wait until the chop fest is over next week.

Will do. Have that number plastered in my head. We got down to 1044 weeks ago, right? Why 1047? Is that because the retail traders overshot to the downside?

Yes, even though they picked 1047 as to where they were going to take it, the momentum going down was huge, and it's hard to stop a snowball once it gets rolling.

Bottom line… they overshot it.

Red,

Excellent post.

Point of clarification: it's a hike in the interest rate for the discount window. The interest rate that most of us care about was not actually changed.

That distinction seems not to matter, but it might as some point.

Yes Earl,

It's not for us… only the banks care about this hike.

http://saboyagraficos.blogspot.com/2010/02/ther…

That was me jumping out the window earlier today… too funny! Thank goodness I fell in a pool.

I told everyone that yes you jumped… but, your shirt got caught on the eaves trough.

Hi RDL – like your style & honesty… Keep it coming…. I am still short (on MAR though) but if I bail today at around 107 I am deep red as well…. just dunno…. see you over at Anna's….

Hi RDL – like your style & honesty… Keep it coming…. I am still short (on MAR though) but if I bail today at around 107 I am deep red as well…. just dunno…. see you over at Anna's….

I told everyone that yes you jumped… but, your shirt got caught on the eaves trough.

maybe the banks are fully loaded with shorts and want to maximize the profit from the slide? we are just small potatoes that hitch a ride alone…..

I said yesterday that we would bottom out when London opens at around 1090. We bottomed when London opened at 1092.

I hope I”m wrong I didn't take my own advice and listened to Hot Babe options thinking were going down to 1072. That's too far concidering the news, bought two put that are now underwater.

hope it goes down a lot more

Ben,

No one said that we are going to 1072 tomorrow. Only that it's major support and should stop any big fall. Stop buying wildcard puts that are never going to pay off. You should only be doing spreads, never straight puts.

On her free blog she states: “but I am looking for around 1072 tomorrow sometime”

I told her that Ben, and she agreed that it could happen? It might still happen, but at this point I seriously doubt it. So, we're off on this call. You can't get every call right, but you can post what could happen, and where support lies.

and Mae West said, “Why don't ya' come up and see some time”!

update 8:04 est

SPY currently trading 110.39

the de-leverage area established yesterday for the shortest term regulators is SPY 110.35, I posted this chart after the close yesterday

http://www.flickr.com/photos/47091634@N04/43683…

Here's some current setups:

1. SPX 195 min. chart has 7 consecutive higher closes putting it in the 93 percentile for at least 1 lower close, given the current gap the morning session should provide a lower close

2. Yesterday was the 3rd consecutive gap down on a thursday, so next thursday will either be a flat or gap up.

3. If this gap holds for the next hour and a half, it will be the 2nd consecutive friday gap down and since the payroll number is in 2 weeks, next friday will likely be a flat or gap up because if they were to gap the market down next friday, it would give away the payroll number given the 3 consecutive gap down setup

4. Daily max containment pt: yesterday was the second consecutive higher close over the max containment pt. which was the first time since the dancing with the max containment pt. began on 1/22/2010. SPY 110.12 area is of interest @ the open

I will talk about the monthly setup this weekend, but what I'll say know is that in order for a multi-month reversal to take place we'll need a monthly close over $SPX 1115.10

So, we need to open above 110.12, and close above 110.35… is that correct?

yep

And in-between the open and the close, do you expect some panic selling in the morning, only to be bought back up in the afternoon? I'm just trying to make sense of that 107.38 fake print from yesterday, and how it ties in to the picture.

no, they will throw some bait to the bears in the morning as they might knock out the stops below the daily max contain pt. @ 110.12 but nothing too far away from that

they haven't let the trapped shorts out all week, and I don't see today being any different

I checked the tape yesterday after the close and didn't see the 107.38 print, now on tuesday there were several prints on the tape @ 107.82, we already know this move is manufactured because of the 1127.38 gap

the monthly setup is very important as it will tell whether we are going to the SPX major de-leverage area @ 965.95

It looks like the 1092 spx area was the low over night, so that would seem like a likely spot to drop to in the morning before a run up in the afternoon. Am I reading that correctly?

Also, the print you saw on last Tuesday for 107.82, do you think that might be where they take it down to next Monday or Tuesday, before a final run up to 1127.38? It just seems like they need to work off some of the over bought conditions first, before going higher. Plus, that would give them some more bears to squeeze.

market needs to hit it's 20 ema on the 30 min first which is @ 110.35, then next up will be the 20 ema on the 60 which is @ 109.95, algos will be jumping all over those two cycles

next week is all about the month end setup, so could they take it down to 107.82, yes, however the likely hood of closing over SPX 1115.10 then becomes very slim and terminates a potential multi-month reversal

oscillators always look stretched coming off a IT low, you'll always notice that after an IT low in a bull market it gives birth to a uni-directional move

the market will lead and i will follow

i was going to show you this chart the other day

with the gap up on tuesday they left a whole bunch of people on an island that was created with the gap down on 2/4/2010

http://www.flickr.com/photos/47091634@N04/43698…

That looks like it needs to be filled, but as you said, if the go that low next week, they might not be able to get back above 1116 for the monthly close. So, that gap should go unfilled until we start the crash down in March.

For today, is unlikely to go below 109.95 as you stated?

the gap will get filled after the market forces all those people who shorted into the rabbit hole to close their positions

yesterday at the close the $SPX went and kissed the 240MA on the 60, $SPX 1097 should hold on a 120 print so that's about equal to the SPY 109.95 area

Ok, thanks…

That's my target to bailout then. After that gap gets closed, I guess we can expect a run up the rest of the day with a final close above 110.35, which I wouldn't be surprised if they put in a new high.

From Carl just now:

March S&P E-mini Futures: Today's day session range estimate is 1093-1107. The market has shrugged off the hike in the US discount rate which was announced after yesterday's pit close. The market will reach 1200 over the next three months.

Note:

1088-1105 yesterdays estimated range

1093-1107 todays estimated range

GM Earl. I don't have any idea what to do today!

Gcocks,

My steps lately have not worked out well. Tempted to quit taking steps 🙂

Earl, Does that mean you are going to just roll with it.

I added TZA at 9.21

Looking for any excuse to hedge with TNA, but so far RVX is rising, supporting TZA.

$VIX Weekly Setup

http://www.flickr.com/photos/47091634@N04/43699…

The one VIX spike in janaury and the other VIX spike in february both back tested the $VIX's controlling trend line from 12/18/2006 and today it will take a miracle in order for it to close above it's 12/1/2008 trendline

I have a long term de-leverage area from many months back on the $VIX @ 16.26

Now what would be an ideal setup is if the $VIX back tests it's 10/2/2009 trendline on the daily around the 16.26 area, today the trendline is @ 17.63

That sets up the lowest possible cost for buying puts when we finally top. Just the way they like it. The 110.35 level was hit at 10:00, and bounce back up from it perfectly. Amazing to say the least.

Do you still see the 109.95 level being hit today, or is that not going to happen today?

it took 40 periods for the SPY to hit it's 20ema on the 30 min

now the SPY is @ 25 periods without a hit of the 20 ema on the 60 and the ema is rising every period currently @ 110.14

watch these numbers on the 11:30 print SPY 111.05 and 110.94, the 160 & 240 are bunched together there

If I understand correctly, I need it below 110.94 by 11:30 in order for it to go down to 109.95. If it closes above 110.94, then it won't go retest the 109.95… correct?

yeah their is no supply from algo's anymore because we keep losing max containment pts.

the operators are going to force the trapped shorts to puke up their positions

195 min print @ 12:45

max contain pt = SPY 111.06

they left a 3 min gap @ SPX 1107.95 from the 11:12 candle

this jerky action is all stop running

SPX closed right on its 320 on the 60 min and right on it's 160 on the 120 print

If there is no supply, wouldn't we need to sell back down to bring some in? What's the reason of leaving the gap at 1107.95? And the 12:45 print of 111.06 or below would mean we go back down some… correct?

I see 2 fake prints at 110.50 on my 10 minute chart. Is that the likely target, or is 109.95 still in play if we close below 111.06 on the 12:45 print?

supply meaning algo's short selling, sorry i wasn't clear

yeah I've got a de-lever tick @ 110.50 which is probably going to align with the 20 ema on the 60 which is currently @ 110.28

So that 110.50 level will probably be my last chance to get out of my shorts, as it's not likely to go to 109.95 to fill that gap?

yeah if they give you the opportunity @ 110.50 take it, 109.95 is out given the setup on the 60

SPX 3 min gap 1107.95 filled

Sundancer, does your statistical analysis still make you right more than 60% of the time? from what I can tell so far, you have been very accurate.

yeah way more than that, but i only take setups on a pure statistical basis that have extremely high odds

many of my statistical studies are reversal based so probability tells me capital allocation and max contain pts. give me a idea of the max extension of a move

Alright, thanks.

Out of TZA at 9.18

SPY 111.38 Level, the operators like to gap around this level on the daily

12/11/2009 into 12/14/2009 gap over 111.38

12/16/2009 into 12/17/2009 gap under 111.38

12/21/2009 into 12/22/2009 gap over 111.38

1/21/2010 into 1/22/2010 gap under 111.38

this is the level to watch into the close and open on monday

I don't see anyway this is going back to 110.50 today, even with that print. The dollar's getting hammered.

trend weeks like to close near their highs

looks like their giving the market enough room next week so it can go and run the stops above 1150, after it fills the 1127.38 gap

How far above 1150 do see it going? Any key levels up there to be hit?

1159.87 is the max contain pt. on the monthly

the 640 MA on the daily is coming in @ 1149.84 today

That's interesting. I have R1 at 111.36. at moment it is above this level.

Sun and Red, I am enjoying reading both posts, thanks for the info.

I have been intrigued by your view of the market Sundancer,, what technique is it that you use, and where may we study up on it? I apologize if this has already been asked by someone else.

i just use mathematics as a statistical approach that helps me define probability on setups, incorporate “max contain pts.” which are MA, more importantly understanding how the market dances with various max contain pts. and basic trendline analysis

combine that with mathematical computations from the regulatory aspect of the market which gives me the long term de-leverage points

the only advice is to get yourself real familiar with a spreadsheet and start crunching numbers

$RUT IWM update:

http://www.flickr.com/photos/47091634@N04/43712…

Daily chart

next stop will be the 720 which held it on 1/19/2010

$RUT 720?

he is mentioning the 720 day moving average

Thanks!

Carl's projections on /ES

1093-1107 todays estimated range (14 point range)

1098-1111 todays actual range (13 point range)

Carl was 4-5 points low on the top and bottom, but got the range right. Not too bad.

Carl posted no trades today.

I'm all cash for the weekend. TZA is getting irritating.

SPY daily chart

http://www.flickr.com/photos/47091634@N04/43706…

currently sitting on a springboard

Sundancer

Cant read your chart – where is the tgt above?

thx

TZA closed down 0.6% today.

We are in a New Moon Trade (favors TZA).

[ After four days, this trade is DOWN 9.8% ]

(In the recent past, moon trades has been in the area of 10% down, only to bounce back to near even by the end of the trade.)

Volume today for TZA has been roughly the same these past 4 days (each of the 4 days lower than any of the the previous 20 days).

RVX (VIX for RUT) closed 0.6% higher, breaking a string of 7 lower days in a row.

TZA has now been down eight days in a row.

Ultimate Oscillator was 20.81 today — oversold.

Overall, it looks like TZA might fall again on Monday.

You are killing me Earl! Say it isn't so! You have been right unfortunately.

he is mentioning the 720 day moving average

Thanks!