CNBC posts that we are going to have a "Jobless Recovery"! HUH? How the hell does that work? Just curious, as I'm not the brightest tool in the wood shed. If we don't have any new jobs, and people that aren't working don't have any money too spend... then who's buying?

The people that still have a job sure ain't! The company I work for may not survive, as the work load has been cut down by 75% or more. We have about 40 tech's covering 4-5 states, and work is down to 1-2 "half day's" of work per week. It's the worst I've seen it. Last year, during this same time period (which is normally slow), I worked 4-5 days a week.

Now, it's more like 1-2 days... and those day's are only half days. Do you think I'm spending any money? How about the other 39 tech's? Other friend's of mine are also struggling as work loads drop, and all overtime is cut out. If you still have a job, you should count yourself lucky. Mine may disappear during this great jobless recovery...

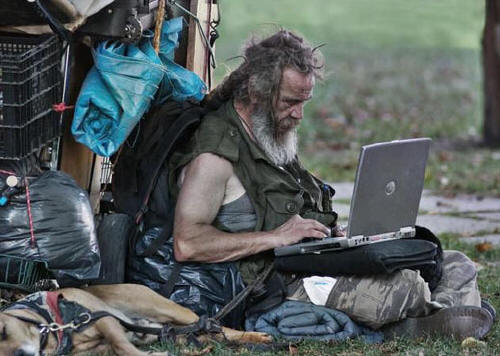

If so, I'll be sure to take my laptop with me, to the homeless shelter. I'll have to hide it, or they might think I'm rich or something? I'll walk to McDonald's and steal their free internet, so I can continue doing these worthless daily posts... or bitch sessions.

If I'm ever going to be right calling the market, I'd better get used too saying... "the market is going UP again today", as the word "Down" is now a forbidden word (just like the media won't say Hussein... Obama's middle name? WTF?). Who really cares anyway what his name is? I just call him "the Puppet", just like the President before him, and the one before him, and on and on...

The country is ruled by the elite few, and the President, Secretary of State, and the Federal Reserve Chairman are all just their puppets that they put out there in the public eye, so they can hide safely behind the scenes. So if I sound bitter... well I am!

I'm sick of wasting my time looking at charts that tell me this market should rollover, but yet it continues up as the Great Jobless Recovery creates all these great earnings. It's all horse shit! (Sorry for language) I talk to people every day when I'm working out in the public, and everyone tells me the same thing... the economy is getting worst, not better.

At least the economy was still booming during the 1999 tech bubble (thanks to Ronald Reagan, not Bill Clinton). People had jobs then, and they were spending money. Who's spending money now? I guess I'm just plain stupid, as I don't get it... nor do I see it!

As for tomorrow... more of same B.S.

Red

We are traders.

We do not trade economies.

We trade markets.

We do not even trade markets, we trade individual stocks/commodities.

Trading is about finding a cheaper object which after owning can be sold at higher cost.

Period.

You are right about that… I can't deny it. But, I have too write about something entertaining, because this market isn't.

when (if) it rolls want to be there

dude you are awesome. we have a facebook page 'tza/tna,' and have 115 members…and we always post your daily analysis, because you say exactly what we feel and know to be true…and a lot of us are not TNA holders…but TZA…me being one of them, and what a patty whack I'm taking. I just want you to know that you are a hoot, and I ALWAYS enjoy your posts…keep up the great work. oh, and I agree with the arrow. i don't think the market knows what red looks like anymore, and when it does, we should just have a red pointing sideways, because sideways is down…i've taken a 30% beating…don't ask how!

Thanks Bob…

I just speak my mind, and don't sugarcoat anything. I'm wrong a lot, but at least I'm able to entertain you guys (and gals).

Red, maybe that big green arrow on your page is what we need for a sell off! It's as good as any other indicator I have seen at lately!

Red, don't you realize that folks aren't paying their mortgage and that frees up billions of dollars for them to spend on the economy just think about the GDP if I stopped paying 2 mortgages about 2000$ the money I could spend at Victoria's Secret LOL that is what is happening (not a good scenario)

Too Funny girl… Yes, it's sad but true!

Good point.

I have one friend who has already done that, and another couple is planning to do the same. Strategy default.

Nobody needs a job Red, just go long PCLN! LOL

I got word yesterday the operators harvested a good amount of speculative capital. One large individual trader & one fund.

I guess harvest means the end of the growing season, meaning they pulled out. Thanks Sun – this is more important than anything.

By harvesting do you mean gathered (bought equities) or sold them (received the benefits from an action).

It means they bet on the wrong side of the trade, and their money is now in the other party's account.

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1198 – 1210. It looks like the ES will drop 30 points or more from the 1210-15 target zone.

1196 -1207.25 actual yesterday (11.25 points)

1201 low last night

1198-1210 estimate for today (12 points)

1204 currently, so estimate is -6 to +6 from here (neutral)

I'm trading Carl's range today. Long SPXU at 26.80.

Good Timing

Good trade.

Looks like there was another opportunity near my entry price!

$DJI is @ it's last daily containment pt. (11,136)

http://www.flickr.com/photos/47091634@N04/45235…

Should the $DJI bust through these last 2 then a stampede may ensue

Here's a chart of the $RUT after it broke through it's last daily containment on 3.9.2010

http://www.flickr.com/photos/47091634@N04/45235…

$NDX 2039.97 =100.22% off lows

$RUT 725.13 =111.66% off lows

Lottery Play.

The marketmakers are betting that SPY will not go down to 118 and below by May 21. They are willing to bet 4 to1.

Buy SPY MAY 119 put. Sell SPY MAY 118 Put. Debit 0.25.

If the SPY drops to/below 118 , that Vertical spread pays out at $1.00.

Well, i have swapped my options into this 4:1 bet. SPY 118, Come to daddy! Me luv u long long.

That's not good for me since they control the market and I have 119 puts.

Current $SPX high of 1213.92 is 16.22% of 2.5.2010 low.

1st $SPX high coming out of 7.8.2009 low came @ 17.11% which would be equal to 1223.21.

$SPX 1225 is it's last daily containment pt.

Everybody and their grandma is talking about some magical fib level, well if it hits that magical level then you can guarantee a stampede is right around the corner as everybody thinks the market is going to die there

lol.. they did that with the 38.2, 50, 61.8, 76 whatever level already. Nothing. Nada. Pivot high. Pivot low. 21 day cycle, 40 day biblical cycle. Come and gone. Nada. Zip. Nothing. lol

At the 50% retrace level (which got hit in Early December) they got everyone short, made a fake move down to 1058-ish (?) and then squeezed everyone to new highs. It would not surprise me to see a repeat of that play before a real correction.

Here's an easy setup for tomorrow:

$SPX currently has 5 consecutive higher closes than opens on the daily, *IF* $SPX closes above 1210.77 then it will have 6 consecutive higher closes than opens.

In the past 333 trading days, no occurrences more than 6 consecutive higher closes than opens.

I mentioned last week that there was some similarities between Nov 08' OPX & the current market dynamics.

So far things are playing out well as we are getting a melt up in the face of incredible odds. (Nov. 08' OPX we got a melt down in the face of incredible odds) Should things continue to play out the high should be today or early tomorrow with a big reversal into fridays close.

Thanks Sundancer. I was gone all day but appreciate the posts. Let the selling begin please!

keep an eye on DAG,last thing they haven't ran up yet

Next you will hear the Iceland Voc. will hurt growing season

setup triggered as $SPX closed above 1210.77

thank Q operators

Carl at day’s end:

1198-1210 estimate for today (12 points)

1204.50 -1210.50 actual today (6 points)

Nailed the high of the day.

Trades: No Trades today

Grade: C (lost no money)

Hi there!!

HAD THREE yes three huge options earnings winners in the optionsblackboard.com chat room Google, ISRG, and AMD

I will post videos on all of them this weekend

swwwwwwwwwwwweeeeeeet!!

Congratulations Anna…

It's tough for anyone to make money in this market, so I'm glad you figured out how to do it successfully. That's your special gift… playing earnings on stocks I mean.

Keep up the good work girl.

deja vous?

CSX,JPM,GOOG,AMD,ISRG not doing to well after EPS.

BAC wait and see…

am I excited to short like I did in January? not yet. why? because I'm scared…lol

buy I shorted LVS,ATPG,HIG yesterday and today for a swing, doing well,…. and X but covered…

tomorrow I'll be watching GOOG, watching a gap fill attempt, if it fails and the talking heads can't spin this I'll enter more shorts. Come bullish Monday, if lame I'll enter the rest.

if I don't do well I'll blame it on Easter.

I have a feeling we will retrace to 1170 there about and then resume the up trend to new highs. I don't think it will be “sell in may and go away”.

TNA opened down 0.06%. Today’s gap was filled. TNA was up 1.6% at the high, and closed up 0.9%.

Recent unfilled gaps: $55.95 to $56.03, $61.45 to $62.30

The Full Moon trade ended yesterday, with TNA up 15.8% in 11 days.

We are now in a New Moon Trade, which tends to favor TZA.

AmericanBulls has TZA with a Hold signal, so this trade will be in cash until TZA receives a buy signal.

Volume for TZA today was about average for the past 20 days.

$RVX (VIX for $RUT) was up 3.2% today with TZA down 1.2%. A divergence. Good for TZA.

TZA has had black candles for the past 6 days, falling hard lately. Bad for TZA.

The low for TZA today was $5.80, the lowest TZA price since American was discovered by the Chinese (1421, for those not familiar).

Ultimate Oscillator for TZA fell for the 9th day, from 25 to 23 today. A reading of 23 is very near 20, which some will allow is a reasonable low point. Good for TZA soon, perhaps not tomorrow.

MACD on the monthly chart has been flat far below zero for days, and is now falling from there. Bad for TZA.

Bollinger Bands for $RVX (VIX for $RUT): Today’s white candle closed above the bottom Bollinger band. MACD seems to have topped and is coming down. Looks like $RVX might fall tomorrow. Bad for TZA.

Bollinger Bands for $RUT: Today’s white candle for $RUT closed above the top Bollinger Band for the 2nd day. Two prior closes above the top Bollinger Band higher led to a higher $RUT. MACD is working back up. Bad for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s doji candle closed below the upper Bollinger Band after closing above that Bnad yesterday. The upper Bollinger Band is rising. This could be the second day of a 3-day sell signal. Good for TZA, for the time being.

TZA had a much lower high, lower low and lower close – Good for TZA.

Money flow for the Total Stock Market was $1,382 million flowing out of the market. Bearish – Good for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Futures as I type this are down 10 on /NQ and down 6 on /ES,

Overall, it looks bad for TZA. (But looking good based on those falling futures)

The Daily view from Americanbulls

TNA was a Hold yesterday, and rose today, remaining a Hold. The TNA buy was at $56.50. TNA closed at $66.06, up 16.9% since the buy. The candlestick today was a White Candlestick (normal buying pressure).

TZA was a Wait yesterday, fell today, and remains a Wait. The candlestick for today was a Black Spinning Top (complete indecision between bulls & bears). The TZA sell price was $6.51. TZA closed today at $5.83, down 10.4% since the sell.

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 16.9%

Summary of Positive $RUT based ETFs & a few popular ETFs & stocks (Market positive): +13

Hold: IWM(1x, up 5.8%), UWM(2x, up 12.2%), TNA(3x, up 16.9%), IYR(1x RE, up 0.6%), URE(2x RE, up 1.0%), DRN(3x RE, up 7.2%), AAPL(up 2.7%), SPY(up 1.9%), QQQQ(up 3.6%), DIA(up 2.3%), UCO (2x oil), ERX(3x energy)

New Confirmed BUY: AMZN

Transition to Market Positive: none

Transition to Market Negative: +1

Not Very Highly Reliable SELL-IF: USO (oil)

Highly Reliable SELL-IF: GS

Not Very Reliable SELL-IF: GOOG

Market Negative: none

Comment: Bullish overall, Bullish Oil, Bullish $RUT, Bullish Real Estate

Action for TNA or TZA for tomorrow: None

The Daily view from Americanbulls

TNA was a Hold yesterday, and rose today, remaining a Hold. The TNA buy was at $56.50. TNA closed at $66.06, up 16.9% since the buy. The candlestick today was a White Candlestick (normal buying pressure).

TZA was a Wait yesterday, fell today, and remains a Wait. The candlestick for today was a Black Spinning Top (complete indecision between bulls & bears). The TZA sell price was $6.51. TZA closed today at $5.83, down 10.4% since the sell.

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 16.9%

Summary of Positive $RUT based ETFs & a few popular ETFs & stocks (Market positive): +13

Hold: IWM(1x, up 5.8%), UWM(2x, up 12.2%), TNA(3x, up 16.9%), IYR(1x RE, up 0.6%), URE(2x RE, up 1.0%), DRN(3x RE, up 7.2%), AAPL(up 2.7%), SPY(up 1.9%), QQQQ(up 3.6%), DIA(up 2.3%), UCO (2x oil), ERX(3x energy)

New Confirmed BUY: AMZN

Transition to Market Positive: none

Transition to Market Negative: +1

Not Very Highly Reliable SELL-IF: USO (oil)

Highly Reliable SELL-IF: GS

Not Very Reliable SELL-IF: GOOG

Market Negative: none

Comment: Bullish overall, Bullish Oil, Bullish $RUT, Bullish Real Estate

Action for TNA or TZA for tomorrow: None

TNA opened down 0.06%. Today’s gap was filled. TNA was up 1.6% at the high, and closed up 0.9%.

Recent unfilled gaps: $55.95 to $56.03, $61.45 to $62.30

The Full Moon trade ended yesterday, with TNA up 15.8% in 11 days.

We are now in a New Moon Trade, which tends to favor TZA.

AmericanBulls has TZA with a Hold signal, so this trade will be in cash until TZA receives a buy signal.

Volume for TZA today was about average for the past 20 days.

$RVX (VIX for $RUT) was up 3.2% today with TZA down 1.2%. A divergence. Good for TZA.

TZA has had black candles for the past 6 days, falling hard lately. Bad for TZA.

The low for TZA today was $5.80, the lowest TZA price since American was discovered by the Chinese (1421, for those not familiar).

Ultimate Oscillator for TZA fell for the 9th day, from 25 to 23 today. A reading of 23 is very near 20, which some will allow is a reasonable low point. Good for TZA soon, perhaps not tomorrow.

MACD on the monthly chart has been flat far below zero for days, and is now falling from there. Bad for TZA.

Bollinger Bands for $RVX (VIX for $RUT): Today’s white candle closed above the bottom Bollinger band. MACD seems to have topped and is coming down. Looks like $RVX might fall tomorrow. Bad for TZA.

Bollinger Bands for $RUT: Today’s white candle for $RUT closed above the top Bollinger Band for the 2nd day. Two prior closes above the top Bollinger Band higher led to a higher $RUT. MACD is working back up. Bad for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s doji candle closed below the upper Bollinger Band after closing above that Bnad yesterday. The upper Bollinger Band is rising. This could be the second day of a 3-day sell signal. Good for TZA, for the time being.

TZA had a much lower high, lower low and lower close – Good for TZA.

Money flow for the Total Stock Market was $1,382 million flowing out of the market. Bearish – Good for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Futures as I type this are down 10 on /NQ and down 6 on /ES,

Overall, it looks bad for TZA. (But looking good based on those falling futures)

I have a feeling we will retrace to 1170 there about and then resume the up trend to new highs. I don't think it will be “sell in may and go away”.

deja vous?

CSX,JPM,GOOG,AMD,ISRG not doing to well after EPS.

BAC wait and see…

am I excited to short like I did in January? not yet. why? because I'm scared…lol

buy I shorted LVS,ATPG,HIG yesterday and today for a swing, doing well,…. and X but covered…

tomorrow I'll be watching GOOG, watching a gap fill attempt, if it fails and the talking heads can't spin this I'll enter more shorts. Come bullish Monday, if lame I'll enter the rest.

if I don't do well I'll blame it on Easter.

Hi there!!

HAD THREE yes three huge options earnings winners in the optionsblackboard.com chat room Google, ISRG, and AMD

I will post videos on all of them this weekend

swwwwwwwwwwwweeeeeeet!!

Congratulations Anna…

It's tough for anyone to make money in this market, so I'm glad you figured out how to do it successfully. That's your special gift… playing earnings on stocks I mean.

Keep up the good work girl.

keep an eye on DAG,last thing they haven't ran up yet

Next you will hear the Iceland Voc. will hurt growing season

At the 50% retrace level (which got hit in Early December) they got everyone short, made a fake move down to 1058-ish (?) and then squeezed everyone to new highs. It would not surprise me to see a repeat of that play before a real correction.