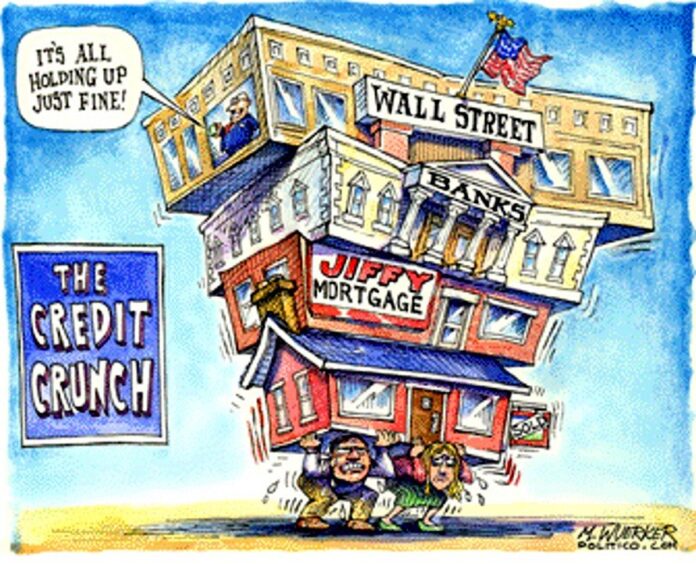

So today... once again, the market makes a new high... AND So does the Foreclosure rates! What? Are the foreclosure rates and the market locked in step together, like the dollar and the market was? Granted, the dollar being sold hard everyday by the Obama Gangster Gang doesn't get the market up as high as it used too... but they still trade on opposite sides for now.

This foreclosure matter is another deal. So here we have an article by CNN telling us that the foreclosure rates rose 7% from last quarter to a record of 930,000 now. And the stock market rallies some more. WTF? Seriously? Who is doing all the buying for the these companies to have great earnings?

Maybe it's like Anna commented on yesterdays' post, that people aren't paying their mortgage, and instead using that money to buy more stuff (in her case, some hot sexy outfit's from Victoria's Secret... you got too love sexy women).

Or maybe people should be standing up to the crooked banksters like this guy did...

Where is the "so called help" that Obama promised? You remember, the promise to help home owner's keep their homes. What a joke that is! Why should a bank refinance your home when they can steal it from you by foreclosing on it. Why should the bank's loan out any new mortgages when they can make more money manipulating trading the stock market?

Think I'm kidding? How about this story of an "insider" who came out and reported that JP Morgan was manipulating the metals market (story here). That's why the market is going up... it's not people buying, it's just manipulation, using the publics' money.

Yes folks, the so called "Bail Out" funds! You remember that don't you? They were suppose too stimulate the economy right? Just in case you have forgotten about them, or wonder where the money went... here's the story again.

Step One... The government scares congress into having an emergency meeting in late 2008, quoting that the banks will fail and the world will collapse if they don't pass an emergency bailout program to save the banks (in reality it was only the 5-6 largest and most crooked banks that were mainly in trouble, as the small to mid-size banks would be allowed to fail... to eliminate the competition of course).

Step Two... The government passes the bailout plan, and proceeds to borrow money from the Federal Reserve Bank (a private entity ran by crooked banksters, created in 1913 by banksters, with the sole intent on profiting from the government by controlling the monetary system... aka MONEY!).

Step Three... The government prints I.O.U's (aka... treasury bonds), and gives them to the Federal Reserve in exchange for Cash, instead of just printing the cash themselves, at zero percent interest... because they gave up that right to print money themselves in 1913, when they gave it to the Federal Reserve. (A right that was written in the Constitution when America was created, that was to always be done by Congress).

Step Four... The government then takes the cash they borrowed (at whatever interest rate the bonds are worth.... currently 1+ percent on 2 year bonds and longer term), and then loans the money back to the banks (at near zero percent interest), with instructions to get the economy going again by loaning out the money to the public. (Yes, you read that right, they basically pay the banks on money they are loaning them! Huh? Yes, stupid I know! But well planned so the banksters can get richer, which secures the politicians a nice fat job at one of those banks when their term is up).

Step Five... The banksters ignore the government and take the money and buy up their own stock to the ridiculous levels that they currently are at. Why take risk's loaning money to the public for mortgage's at 5% when you can make more money in the stock market? Plus, those loans would be highly risky as the people that the government wants the banks to lend money too, are the people that lost their job's from the banks mortgage bubble that they created that topped in 2007.

Step Six... The banksters pay off common media personal to entice the retail public to get back into the market at the top, so they can unload their bloated stocks to them.

Step Seven... The banksters start to "get short" on the market, while telling the public to buy, buy, buy!

Step Eight... The banksters release some hugely negative event that causes a meltdown in the market, and then tell the media puppets to start telling the public how bad everything is... which causes more selling, fueling the fire and forcing the market down even more.

Step Nine... The banksters go to the government and claim that they are going to fail if they don't get another bailout. The government gives them another bailout.

Step Ten... The banksters take the bailout money, sell out of all their short positions (with a huge profit... stealing the publics' lifesavings from their 401k plans, etc...), and combine that new free money and stolen profits, and start buying up their own stocks again... rallying the market once more again.

Step Eleven... Later, Rinse, Repeat...

Red

P.S. Support Ron Paul, as he want's to get rid of the Federal Reserve and give Congress back the right that was originally theirs in the first place. And support the Tea Party Movement, as those folks are actually out there with signs, on street corners protesting the crooked banksters, etc... I'm simply doing my part to spread the word with this blog, as I sure as hell can't forecast the correct move in the stock market! Ok, well I'll give it a shot for tomorrow... UP as usual (secretly hoping for a crash though)

Happy Illegal Personal Income Tax Day!

dude right on man! spot on! i have a neighbor who hasn't paid a dime on his mortgage for the last 18 months. not one cent. he bought his home for 600,000 it is now worth ~ no joke ~ 380,000 (Fort Mill, SC). How do you think he bought his family xmas presents? how do you you think he bought his new mini van? etc…this is a true story. I'll spare you of the details of how got himself into this situation, but the treasury came back and said, we'll forgive the deliquincy, but we'll keep the same interest rate…he told them to take a flyin' hike. I just spoke with him yesterday. Didn't Bill Gross say yesterday that is what is keeping the retail sales going…it's something like one billion a month. you know though, I don't blame my neighbor, or the guy who bulldozed his house…they're in essence saying f you govt, fat cat bankers, ppt gang…stick it where the sun don't shine you bastards…and I'm right there with them!!

I think the whole story on the guy who bulldozed his house, is that he built the entire house himself, and that he wanted to give the bank back exact how he got it… an empty lot!

He get my vote…

Stock market is like this since inception. Can RON do something about it? I doubt. They are too powerful…

So next question – how can we profit from it?

Very true… now let's just get someone from the “inside” to post here, and let us know what they plan next. That would be ideal.

I'm sure there are good people working for crooked banksters, that hate it, but are stuck in that position. They can't leave because they are paid well, and no other job pays that good.

You can't blame them for that, but it would be nice to see more whistle blowers come out like the guy who exposed JPM's illegal scheme.

Come out like that is really taking a big chance, as you might end up dead. But posting here to help out the little guy would be a nice first step.

Wishful thinking of course, but we can still dream…

Someone claims that he is insider and knows everything about those crooks… I've read it fully but could not understand the gap or diagonal trick… Let me know if you get some luck. My email: tradersu @ yahoo-dot-com

http://www.bearfactsspecialistreport.com/Specia…

Is that the guy who used to write the Ney's Report or something? Ignore him.

That said, my first investment book is Joe Granville's book on OBV. Good old Joe Granville actually taught me to make my first trade. Up 100%! Ruined my life since. I could have been a doctor or a lawyer, or a NASA scientist, and making all kind of epic contribution to humanity. Now I work as a janitor at HBS and moonlighting at McDick.

Nah, this guy is good. Just take those printouts and keep in restroom. You will be able to finish it that way…

Still trying to find how to make money out of it. As per these articles, block trade activity and gap analysis is the key…

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1197 – 1207. It looks like the ES will drop 30 points or more from the 1210-15 target zone.

1204.50 -1210.50 actual yesterday (6 points)

1201.25 low last night (1201 was low 1 day earlier)

1197-1207 estimate for today (10 points)

1203 currently, so estimate is -6 to +4 from here (slightly bearish)

Carl has been saying, for as long as I can recall, that QQQQ was headed to 50. The message never changed, so I never paid any attention to it.

Well, today the message changed:

QQQ: The 50.00 target has been reached and a drop to 48. 80 or so is now likely.

I guess that makes Carl somewhat bearish for the moment.

“Bearish”… what's that? Never heard the word before… Aren't all the bears extinct now? LOL

Carl has been a bit off lately. Either not trading at all, or trading with a loss. Obviously, this market does not suit his indicators or his style or something.

His range picking has been pretty good, but I do agree that his choice of smaller numbers in his estimates does mess with the mind.

I'm not putting the guy down… I've been off on every call. I was just joking, as I rarely see him talk about the bearish side. 🙂

Carl is fair game. No way to hurt his feelings 🙂

I suspect his bearishness won't last long. Perhaps a day or so.

whenever the $SPX stops it's reaction will either be extremely shallow or extremely deep

$SPX 3.6.2009 : 6.11.2009 = 43.41%

$SPX 6.11.2009: 7.8.2009 = -9.09%

43.41/9.09 = 4.77

$SPX 7.8.2009 : 9.23.2009 = 24.25%

$SPX 9.23.2009: 10.2.2009 = -5.57%

24.25/5.57 = 4.35

AVG. of 4.77 : 4.35 = 4.56

$SPX 10.2.2009 : $SPX 10.21.2009 = 7.98%

$SPX 10.21.2009: $SPX 11.2.2009 = -6.54%

7.98/6.54 = 1.22

$SPX 11.2.2009 : 1.19.2009 = 11.76%

$SPX 1.19.2009 : 2.5.2010 = -9.21%

11.76/9.21 = 1.27

AVG of 1.22 : 1.27 = 1.245

Current high on $SPX = 16.22%

16.22/4.56(AVG of 1:2 reaction) = 3.55% (1170.92)

16.22/1.245(AVG of 3:4 reaction)= 13.02%(1055.92)

I think the target down is likely the 1055.92 one, as they have told us that Dow 10k is a target down. The question is when will it start?

if you look at the last 2 reactions

9.21 – 6.54 = 2.67/6.54=.408

9.21*1.408=12.96%

so the 1.245 (AVG) that gives us 13.02% synchs with 12.96%

if you look back @ the $SPX before it's 2007 terminal high

the final reaction turned out to be a 1.18 mult.

upthrust = 14.07% : 11.9% downthrust = 1.18 co-relational to our last 2 reactions of 1.22 & 1.27

167 print on GS

Debasement 101 on the financials, harvesting speculative capital, I'm sure it's just a coincidence after the operators pumps GS to 185.60 that NEWS comes out about GS

Folks don't let the diversion fool you

XLF $15 de-leverage area est. 3.22.2010

You mean you saw a 167 fake print on GS just now?

final harvest will be @ 135.24

Does this look like the start of the down move, as in… next week down, or probably just a shake out, and then some more up?

this is it!!

initiation gap came today

86,000,000 on the XLF 90 minutes into session

it's trading 165's now

155's now

harvest crops @ 135.24

SC your going to be able to quit MCd's now

http://www.youtube.com/watch?v=EPrSVkTRb24

woohoo!

your puts may be ITM by EOD

Paycheck friday

Anybody have GS puts today?

If you did can I have a ride on your new yacht

the 170 put went from .05 to 14.48,

And I'll bet those Goldman Boys bought tons of those puts, just before they released the news. LOL

Yep, many ignorant fools lost everything today. Imagine all the fools that sold naked puts all week.

That would really hurt! I've never done that, and never will. I'm not the brightest crayon in the box, but I'm not the dullest either.

Looks like we are rallying a little now. I'm probably going to get short with a 118/113 put spread, or a 117/112 put spread (May of course). I think this squeeze higher will be the last one for awhile.

$SPX cliff part 2 1191

http://www.flickr.com/photos/47091634@N04/45260…

takes out max contain on the 60 & Red's puts maybe good by 4:00

dancing continues with the edge of the cliff

I posted last week that a black swan was coming,

last night in another thread I laid out my game plan for today and Monday “short”

up 29,000.00

Congratulations. When I grow up, I want to be just like you.

What's your thoughts for Monday Sundancer? Gap down or squeeze up?

a large majority of people that are short now will cover by the days end, the train won't stop to let them back on

When the train doesn't stop to let them back on, they will start buying the dips

Meaning that we will rally back up a little today as they close out their positions, and wait to get short again on the usual bullish Monday.

Only bullish Monday doesn't happen this time, and they missed the train ride down…

I think a lot of people will be looking for a chance to get short on the backtest… that never happens!

SPY is going to print north of 400,000,000 million shares and people are talking about a short squeeze

the short squeeze just happened… 35 trading days straight

Ok, thanks…

I'm going to wait until the end of the day and get short when everyone closes out their positions (or maybe here shortly if it keeps going up?).

Looking back at the previous sell off's, I didn't see any backtests. It was straight down, multiple days in a row. I think everyone is expecting a backtest now, but past history shows it won't happen.

If the SEC takes down GS, it will do a tremendeous public service in restoring integrity to the finanical system, albeit temporarily.

This is an epic battle of our life time. It will be interesting to see how big the corruptive power of GS is, if they manage to make this go away. Every decade, one or two major snakepits, eh… I mean WallStreet powerhouses, blow up. The snakes will just move on to other snakepits. The more things change, the more they stay the same.

Missed all the action today. Selling my VIX calls, hanging onto my SPY puts.

I was wondering where you were? Glad to see you here now…

Yep – off to Vero Beach. Sold my vix calls at HOD but hanging onto the May puts. Will be back by Monday. Hope this isn't a one day thing but don't think it is.

Good job Monica…

I think we are going to rally for a little bit longer today, but I see Monday as the start of the big fall. A lot of people are going to be fooled on Monday I believe.

The last chance to get short is today… at least I believe it is before we hit a temporary resting area around 112-113 spy.

Of course we all know the finally bottom, before a rally higher, but I'm looking for a pause around that level… probably mid-late next week.

Have fun at the beach girl!

I think we bounce back up on Monday and (briefly?) reclaim 1200. I'm planning to short that bounce.

It's possible that we bounce back up on Monday Dreadwin, but it should be short lived. Look at this chart and look at all the previous selloffs. Once it started, there wasn't any bounce for at least 3 days of selling first.

http://stockcharts.com/def/servlet/Favorites.CS…

Counterpoint: This could be a “surprise” news driven event like Dubai. It looks to me like a lot of bulls got robbed of their payday at opex.

Is the trendline from February still intact? Looks to me like it still is. (It certainly is in oil. Take a look at $OVX — this was a dip buying opportunity in oil).

Take a look at a chart of IYT (Dow transports). What does it suggest to you? To me, it looks like we had a wave 4 down, and might still have a wave 5 up!

What I would like to see is a broken “from February” trendline followed by the “unsuccessful” back-test. Let's be patient, disciplined, and make lots of $$$.

Rinse and repeat, Monica. But lets have an encore first!

SC , is that sarcasm ?

Is it necessary to tell people how much you are making? Don't you think that is rather amateurish?

A portfolio % increase is a much better way of saying it. Let's us all imagine we have the same size portfolio 🙂

If you count cans, then I have a really big portfolio collected over the weekends.

no I don't think it is at all and a lot of traders do. I don't know why you have serious insecurity issues but good luck with them.

yep.. must be b/c I am a janitor and I work at McDick.

I covered a lot of my swing shorts… but kept some.

I'll short into the next spike, maybe Monday.

If 119 spy breaks (which is Dow 11,000 too)… it's look out below! I think the next major support is 117.50 spy. Will they sell off into the close?

Slept in, SPXU hit my target price and got sold before I came in this morning. I was only expecting a move to 1200, not 1190, so I left some gains on the table. I think we head sideways to into the close. Maybe a move up to 1200. Monday is short squeeze day.

Yeah well, it is still good to wake up and find green in your accounts. I wish it can be like that everyday. haha

Now I'm short DTO at 58.90. Unlike yesterday, I don't have a particularly good entry. I think oil bounces, not sure about equities.

No clue on that one. Seeing conflicting signals.

$OVX chart:

http://www.screencast.com/users/dreadwin/folder…

Note the distinct “lack of move” in the oil volatility index (compared with other volatility indexes). There was a -2.6% move in $WTIC. $OVX barely budged. Every time there seems to be a move down in price, all of the supply gets gobbled up. I'm waiting to get short oil on a big dip below the lower BB. We're close!

My charts show oil going down. But they are trendfollowing. They don't predict trend change.

$SPX numbers for the weekly close

needs a close below 1191 (purple containment on weekly)

SPY

119.18 (initiation debasement gap #1 weekly 9.29.2008)

*IF* $DJI closes above 10,996.75 then it will have 7 consecutive higher closes than opens on the weekly

in the past 249 weeks no occurrences more than 7

Hopefully people were short on the $SPX setup I posted yesterday

Here's an easy setup for tomorrow:

$SPX currently has 5 consecutive higher closes than opens on the daily, *IF* $SPX closes above 1210.77 then it will have 6 consecutive higher closes than opens.

In the past 333 trading days, no occurrences more than 6 consecutive higher closes than opens.

$DJI closed above 10,996.75

setup triggered

goose is cooked for next week

It ought to be fun seeing the MOC queue build up into the close

The “MOC queue”? What's that?

A Market-on-Close (MOC) order is a market order that is submitted to execute as close to the closing price as possible.

Gang, I think we can go a little bit higher here. I think 120.05 spy is possible. That's from looking at charts of course, which haven't been working a lot lately, but that also lines up with 1200 spx, and I think they want to take it there again.

I don't think it will hold, as I do believe this is the moment we bears have been looking for. I think Monday will close down, and the whole next week will close down.

The first resting area should be around the 50 day moving average (currently around 1140 spx, but a pierce of it is to be expected.

If all goes well, I'll close out my shorts on the pierce, and wait a few days for some consolation and small bounce. I'll then re-enter with new shorts, with a final target down of at least 107.38 spy, but with the down momentuem, I'd expect more like the 105 area before stopping.

Then, I'll look to go long into the summer months, expecting a final high of Dow 11,816 area. That's the plan, but it never really works out that way. Wishful thinking though…

Looks like that was it for the day. I did go short with a vertical put spread, buying the 118 May put and selling the 113 May put for $1.04 per contract.

Now I wait…

XLF is going to have it's largest volume day since March 09'

Even though I know all of this is planned, as Goldman was probably already short their own stock, (before they released the news), it still feels good to see those jerks in trouble!

GS weekly close numbers 159.26

close below there & it opens the door for the final harvest number of 135.24

IYR's goose is cooked

fakeout above red containment on wednesday, once yellow containment fails, long fall till light purple

http://www.flickr.com/photos/47091634@N04/45266…

Incredible how 1 day wiped out 2 months of gains on Goldman Sachs. Now that's how you steal billions of dollars from the retail investors!

it's a beautiful thing to watch the operators harvest speculative capital

Well boy they sure took a lot today! I don't know if they plan on rallying up some on Monday or not, but I didn't want to be left out if they didn't.

I think the correction has begun…

I would be surprised if there isn't a gap down on Monday, the operators parked the $SPX right @ max containment on the 60 min. The last time they did this was 2.12.

Carl at day’s end:

1197-1207 estimate for today (10 points)

1182.75-1206 actual today (23.25 points)

Nailed the high of the day. Really missed the low of the day, but knowing about it ahead of time was probably illegal.

Trades: No Trades today.

Grade: C (lost no money)

It's not illegal if you don't get caught! LOL. But today them Goldman boys did get caught! ROFLMAO!

I figure GS has lawyers and will stall any litigation until after Obama is ejected from the White House, at which time everyone will agree to disagree and go back to work.

I seem to be alone, but I think GS makes plenty of money legally (legally in court, not what we might think is legal), and simply never actually breaks a law except by accident (there are lots of laws, and it's easy to break one if you never heard of it).

Legally to the letter of the law… probably so? But legally to the intent of the law written… hell no! Those guys are as crooked as they come. They just find loop holes to exploit, and use their power and influence to keep anyone questioning them tied up for years from their team of pit bull lawyers.

But, you are right on nothing happening to them. It will be drawn out for years, and forgotten about when the next be story of corruption comes out.

There could be a lot of law suits filed as Obama seeks to criminalize profit and nationalize private enterprise.

TZA opened up 0.86%. Today’s gap was filled. TZA was up 6.1% at the high, and closed up 3.9%.

We are now in a New Moon Trade, which tends to favor TZA

AmericanBulls had TZA with a Hold signal for today, so this trade was in cash all day. There should be a BUY-IF signal for TZA after the close, for a possible buy Monday morning.

Volume for TZA today was the 3rd highest in the last 6 months, but the two higher volumes were on down days. This was the highest up volume in 6 months. On the other hand, TZA price is the lowest in 6 months, and while the volume is high today, the price weighted volume (# shares traded times share price, or the amount of money that changed hands) wasn’t anything special.

Still, people will look at this as a good thing, so, so will I: Good for TZA.

$RVX (VIX for $RUT) was up 6.6% today with TZA up 3.9%. No divergence.

TZA had black candles for 6 days, falling hard lately, but up nicely today. Good for TZA.

The low for TZA yesterday was $5.80, the lowest TZA price ever. Today’s low was 2 cents higher.

Ultimate Oscillator for TZA fell for 9 days, then rose today from 23 to 27. The low reading of 23 was very near 20, which some will allow is a reasonable low point. Good for TZA.

MACD on the monthly chart has been flat far below zero for days, and remains that way today. Bad for TZA.

Bollinger Bands for $RVX (VIX for $RUT): Today’s long white candle closed above the Bollinger mid line (was at the bottom Bollinger band 2 days ago). MACD seems to be heading back up. Looks like $RVX might rise tomorrow. Good for TZA.

Bollinger Bands for $RUT: Today’s long black candle for $RUT closed below the top Bollinger band after closing above it for two days. This might be the beginning of a falling $RUT. MACD is still working upwards, but might be topping. Good for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s black candle closed far below the upper Bollinger Band after closing above that Band two days ago. The upper Bollinger Band is still rising. This looks like the third day of a successful 3-day sell signal. Good for TZA.

TZA had a much higher high, lower low and much higher close – Good for TZA.

Money flow for the Total Stock Market was $5,934 million flowing out of the market. A fairly large number. Bearish – Good for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks good for TZA.

SPY 364,000,000

2nd highest daily volume in the past 222 trading days

Maybe the third time is a charm, and I should put up my “Black Monday” picture for my weekend up? I've put it up twice now, and been wrong both times.

Not that I'm worried about embarrassing myself again, as I'm pretty used too that now. But, at some point when I call wolf… there's really going to be a wolf there.

you should have bought some calls today, LOL

It would have guaranteed a black monday

Damn I'm good at calling this market! Just do the opposite of what I do, and you'll be rich! He He He…

when does AAPL report earnings next week

Apr 20. GS also reports same day

I don't think we got to worry about GS surprising anyone at this point. LOL

Here's what I found on Apple…

Apple Sets Q2 2010 Earnings Report for April 20th

April 12th, 2010 at 2:54 PM – Apple Stock Watch by Bryan Chaffin

Apple announced that its fiscal second quarter 2010 earning report will be released on April 20th. A conference call with financial analysts will be held the same day after the markets close, at 5:00 PM EDT (2:00 PM PDT).

The company will offer a simulcast of the conference call, and The Mac Observer will offer full coverage of the earnings report and conference call.

Shares in Apple traded slightly higher in the afternoon trading session on Monday. As of this writing, the stock was trading at US$242.86, a gain of $1.07 (+0.44%), on moderately light volume.

The AAPL orchard is ripe for picking

I noticed the operators closed the $NDX @ 2012 (666/Pi=212 boiling pt.)

Thank Q operators, yes the boiling point is getting near

Just curious, but do you only go long on your positions, or do you short too? I remember when you said you liquidated your longs when we hit 1127, but I never knew if you actually play the short side too, or just wait for the correction and only go long.

I know I'll be going long with you when we hit 1050-1070 spx (which is also around 10,000 dow), as I do believe that will be the bottom, before a large summer move up.

i allocate capital to setups; long or short, I liquidated my inventory for the gap setup @ 1127.

I usually have 25-40 setups in progress @ one time. They are all on different time frames.

I don't use options or futures as I often acquire multiple lots on one setup isolating the time element. Containment pts. are moving targets, de-leverage areas are fixed.

I trade backwards to how 99% of people trade. I think I already confuse too many people just talking about containment pts.

LOL… yes you do confuse many people, but everyone love's to read your posts. I'm certainly confused by it, but trying to learn. My trading style is obviously not very successful, so learning a style that is successful, would be the most logical thing to do.

I do understand that the containment points move, as they are some type of moving average. I also understand that the de-leverage area's are fixed, although I don't know how you find them?

Of course the fake prints help, but I'm sure that's not the way you calculate them, as all the fake prints aren't accurate. I find the daily to be more accurate, especially when they are a long way away from where the market is at when they are printed.

So, I'll continue to try and figure out what you are saying. Maybe I'll figure it out one day. LOL In the meantime, I plan on staying short when you are, and going long when you do.

I remember when I kept shorting when you were bullish… up to 1127, and of course the market did indeed go up instead of down. I'm really tired of losing money… so I sure hope I made the correct decision today by going short.

Looking back at the previous down moves, I see 3-4 weeks of a correction coming, and then it's back to rallying mode throughout the summer. Making the right moves here is really important now, as these opportunities don't come around everyday… (crossing my fingers now).

Red I don;t think we will go down to 107 this time. I think the bottom will be 115 to 117 and then a rally to new highs. June July is a different story

I've been wrong many times before, but the fake print I got weeks ago tells me the target is around 107.38 spy. I won't be going long until that target area is reached.

The Daily view from Americanbulls

TNA was a Hold yesterday, and fell today, earning a SELL-IF signal. The TNA buy was at $56.50. TNA closed at $63.54, up 12.4% since the buy. The candlestick today was a Black Candlestick (normal selling pressure). The last two candlesticks formed a not very highly reliable Bearish Engulfing Pattern.

TZA was a Wait yesterday, rose today, earning a BUY-IF signal. The TZA sell price was $6.51. TZA closed today at $6.06, down 6.8% since the sell. The candlestick for today was a White Candlestick (normal buying pressure). The last two candlesticks formed a not very highly reliable Bullish Engulfing Pattern. The last three candlesticks formed a highly reliable Bullish Morning Star Pattern.

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 12.4%

Summary of Positive $RUT based ETFs & a few popular ETFs & stocks (Market positive): -4

Hold: IYR(1x RE, down 1.49%), URE(2x RE, down 3.3%), DRN(3x RE, down 0.6%), QQQQ(up 2.4%), DIA(up 1.0%), UCO (2x oil, down 1.4%), AMZN(down 1.6%)

Transition to Market Positive: none

Transition to Market Negative: -2

Highly reliable SELL-IF: IWM(1x), UWM(2x), SPY, ERX(3x energy)

Not very highly reliable SELL-IF: TNA(3x),

Low reliability SELL-IF: AAPL,

Market Negative: -3

New Confirmed SELL: USO(oil), GS, GOOG

Comment: Bearish overall, Bearish Oil, Bearish $RUT, Bearish Real Estate

Action for TNA or TZA for tomorrow: Possibly Buy TZA, Possibly Sell TNA.

i couldn't say it better myself.

sad red very sad. If there is so much money in trading then I think companies like starbucks should have an investment arm for trading. LOL

sad red very sad. If there is so much money in trading then I think companies like starbucks should have an investment arm for trading. LOL

Red I don;t think we will go down to 107 this time. I think the bottom will be 115 to 117 and then a rally to new highs. June July is a different story

I've been wrong many times before, but the fake print I got weeks ago tells me the target is around 107.38 spy. I won't be going long until that target area is reached.