Tuesday Update...

(to watch on youtube: http://www.youtube.com/watch?v=JDoJ71M7qaI)

I'm looking for one more down day and then I expect the bullish trend will resume.

Red

_____________________________________________________

This May 6th is the one year anniversary of the flash crash from last year, which makes the odds of it repeating slim... but!

(to watch on youtube: http://www.youtube.com/watch?v=0fzuK_ZRWjQ )

There are many things going on that "could" lead to another big sell off coming. There is the Simpson's video where the clock with one hand on the "eleven" and the other hand between the 5 and 6... which could mean "5 minutes until 6 o'clock", or 5-6... as in May the 6th. We have yet to figure this one out, but the possibility of this episode meaning something, and telling us sheep of the up coming disaster is very strong. The question is... "how do we interpret the video"?

The next thing of major concern is the Legatus meeting over the weekend. Reinhardt is the person who discovered that the gangsters would meet through this fake Catholic organization and make changes that would determine where the economy (and the stock market) would head to next. He correctly predict the stock market crash of 2008 based on when these meeting were held. Basically, the gangsters meet and funnel all their stolen money (from us sheep) through secret bank accounts in the Vatican (the root of all evil on this planet), and then once the checks have cleared they debase the stock market.

Not every Legatus Meeting is a turning point!

Well, the last few meeting haven't produced any real change in the stock market, but I personally feel that we are now long over due for a surprise crash. Everyone is now bullish, expecting the market to rise to 1430-1440 area for the completion of the inverted head and shoulders pattern. What if we only go up to the FP level on the SPY of 138.86 (about 1388 spx), and then roll over hard... or crash? All the dip buyers would be expecting the market to go up to the 1400+ level and would continue to buy from the gangsters as they unload their long positions into the unsuspecting retail bulls.

I see many people that were bearish now switching to bullish. Ron Walker of the chart pattern trader now has a bullish count on the market, with much higher highs forecasted. I respect him a lot, but I don't agree with his bullish count. I have been bullish for awhile now, as I still think we will hit the FP on SPY before selling off. However, I've been wrong on the expected breaking of the rising wedge as the market continues to defy gravity... day in, and day out. This just goes to show you how hard it is to forecast a rigged market.

My feelings are that we will sell off a little on Monday, in the morning session, and then rally back up as dip sticks (err... dip buyers) come in and push us up toward the FP level on the SPY. Whether we hit it on Monday or later in the week is unknown? I thought we might hit it on Friday as that was 4-29 (by speculating that the volume on the FP of 4,290 shares was a code for the insiders that the date it would be hit was 4-29), but that failed to happen. So, we wait until it is hit to make re-assessments of the market.

Not every FP is a turning point!

I seen the FP of DIA 118.16 get hit, but it wasn't the turning point. Instead, the market just sold off for one day and then continued higher. We could have the same thing happen here with the SPY FP... as it could be hit, but the market might only "pause" and then continue higher. While I don't think that will happen, we can't rule it out either. Also, the odds of another flash crash happening on the same day as last year are extremely rare. That doesn't mean it can't happen, as these gangsters are on their last leg right now, and it truly would surprise the most people if it was repeated.

For now, I'm just looking for the SPY FP to be hit and then see if the market looks ready to tank or not. Monday should be a bullish day, but I still think we will drop in the morning session. I've been wrong on that all of last week, but we've started a new week now, so things could be different. I've noticed that when they want to trap the bears they tend to keep the market up until the last day of the week. Maybe that's because we have weekly options now, and they want to make the puts expire worthless? I don't know the reason, but it happens a lot.

Then they sell it off early then next week not allowing the bears to profit, as very few bears are brave enough to go short over the weekend. That would of course allow them to reset the overbought charts and give them the juice needed to go back up higher later in the week. I've seen this happen several times lately... maybe it will happen this week too?

>>>>>>>>> I'm going to cut this post short, as I need to help Anna with some technical issues.

Red

Silver is taking a beating right now…

http://mrtopstep.com/2011/05/01/mr-topstep-charts-silver-limit-down/

Maybe a sign of things to come? We all know that commodities will sell off when the general market does…

Not saying there definitely won’t be a flash crash (no one is expecting it, so it’s not out of the question), but as long as the money flows, the HFTs will keep pumping. Oh yeah, I just got notified that the President is going to speak on bin Laden being killed. Excellent timing, I say.

“Bin Laden killed”? When did that happen? I haven’t had the news on all weekend.

Breaking news, the president should be speaking soon. The timing is suspect, as far as I’m concerned. Here is a live feed where Obama will be speaking:

http://www.zerohedge.com/article/follow-presidents-announcement-nation-live-0

So they finally killed Tim Osman (aka Osama Bin Laden), the CIA plant from the 1970’s… LOL

http://www.youtube.com/watch?v=ygNiiNKJ3jQ&feature=player_embedded

(number 19th in her list)

I wonder if George Bush and Dick Cheney will miss their old “oil” buddy?

Is there a mistake or is the ES up 12 points to 1371? WTF?

What better way to make the stock market AND the USD go up at the same time. Woo-hoo! They’re really pulling out all the stops!

BIN LADEN dead.

spread the blog o sphere news.

(gangsters!)

ah. dupe. my bad.

Wow, thinkorswim just hiked their silver margin to twice that of CME. Carefully planned and flawlessly executed effort to tank commodities and pump the stock market and the USD. Damn, they really had their ducks in a row on this one.

I’m still puzzled as to “why” the stock market is rallying? Shouldn’t they be concerned that profits will fall off a cliff if we don’t have any bad guys to kill? War is big money… no enemies equals no money! Well, I guess they’ll just make up a new bad guy.

Everything is good news to the stock market. Profits off a cliff, good news! More money printing! Profits going up, good news! More money printing! Bin Laden dead, dollar rallies, good news! More money printing to keep the dollar falling!

Woo-hoo!

they got Bin laden..he’s dead. (head shot)… congratulations to all the folks involved in bringing him to justice.

Actually, I think justice was brought to him, at 3200 fps.

Gang, Bin Laden was just a patsy for 911… he was never responsible for it, Bush, Cheney, Clinton, (the cabal) was. Never forget that. Listen to this audio interview of a 18 year old marine woman who was there when her superiors ordered that Flight 93 must be shot down…

http://projectcamelot.org/elizabeth_nelson_flight_93.html

Just one of many story’s that clearly points to 911 as being an “inside job”… not by middle eastern terrorists, but by white house terrorists!

yep… but a perfect excuse for a flagpole rally..

the market is totally disconnected from the reality.

Get all the bulls on the train, and all the bears turn to bulls… then pull out the Illuminati deck of cards and blow up something later this week… wiping out all the bulls and bears alike!

that would be the exact purpose that is the market designed for..

Interesting update on Legatus over at R’s site…

http://www.enterprisecorruption.com/

ES Chart: http://niftychartsandpatterns.blogspot.com/2011/05/s-500-futures-before-opening-bell.html

Looks like the bin laden effect is wearing off…

Thanks to Dzimer for sending me this link…

http://www.youtube.com/watch?v=MBt5mMAfB5c

Very scary!

Indeed! That video was made a month and a half ago, wonder if they have it reasonably contained by now.

Yes, it’s an old video, but still important. Remember the gangsters aren’t done with Japan. They will try again I believe.

ES Hour chart: http://niftychartsandpatterns.blogspot.com/2011/05/es-trend-line-violated.html

What do you think of silver San?

LEO

For a Silver Bull Hour looks weak, Day looks better, Week looks strong : http://niftychartsandpatterns.blogspot.com/2011/05/silver-week-day-and-hour-chart.html

May 11th earthquake in Taiwan?

http://beforeitsnews.com/story/602/778/Magnitude_-14_quake_or_fraud.html

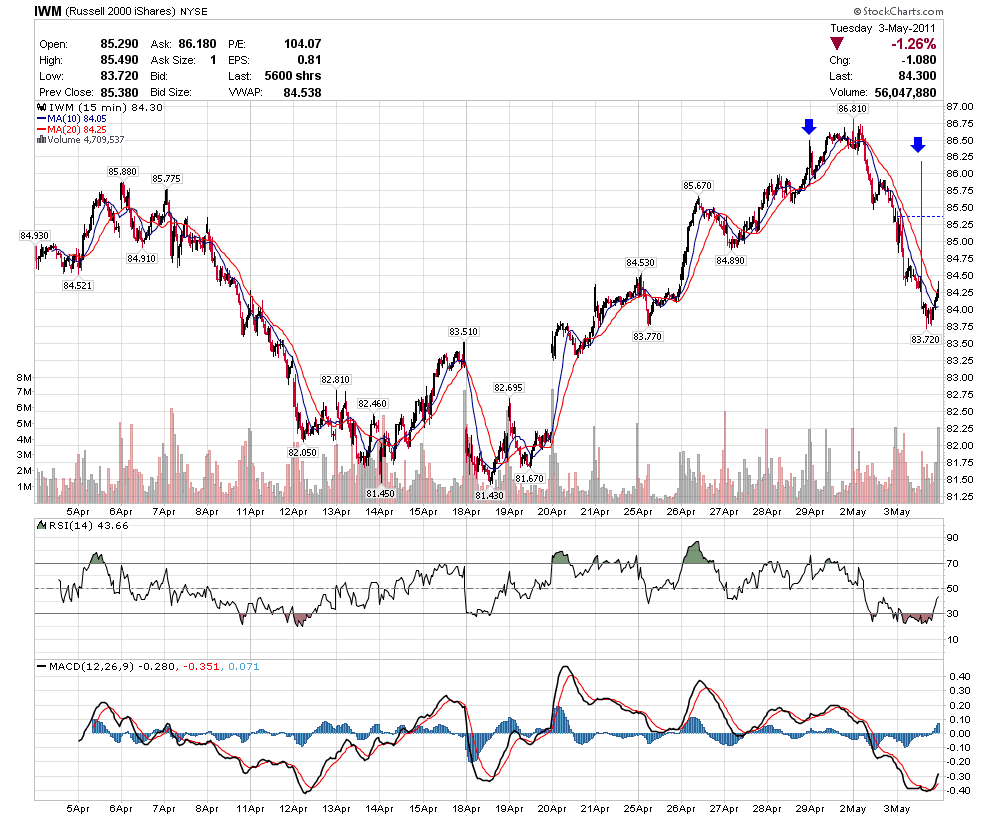

Pullback in IWM as I predicted.

It might have some more downside to come?

if i do an ABCD at 77.41 on IWM i get 89.9 as a potential MAY high.

Well gang… the volume was low on today’s sell off. I think we’ll bounce back up tomorrow. Looks like we finally broke the rising wedge, and could be forming a channel?

imo,IWM tuesday range 85.2-85.9, range worked on DIA from fri, DIA showed a 12,850 to minus 50 for monday, my overnight charts working, for now.

today’s market action suggests to me, we will trade sideways thru MAY…12,850, is a short sell signal, until proven wrong

the reason i’m staying out of the SLV trade, is that the FEDERAL reserve wants to control the volatility on SLV…DON’T FIGHT THE FED…they probably need silver to be at a stable price because of all the electronics manufacturing.

GLD has different fundamentals, than SLV, GLD is beginning to price in JAPAN QE3–this is a 1650 target price.

hey Red, it’s on of those moving pictures, you have to click on it, it HIlarious

I don’t know if you figured it out yet but the Simpsons date… Bin Laden killed on 5/1/11 add 5 and 1 and you got 6 and 11.. The hands on the Simpsons clock.. They were telling us Bin Laden’s kill date..

I can see it now.

Mr. President, we can execute operation Geronimo on Mmmmmm (?)

Jan 5, Feb 4, Mar 3, April 2, or May 1st – pick one.

jajajajaja

I like the Hitler death one better, but a search shows April 30th, not May 1st.

close enough?

It was actually already 02/05/2011 in Pakistan when he was shot.

2+5+2/11

9/11

ES Hour chart: http://niftychartsandpatterns.blogspot.com/2011/05/s-500-futures-before-opening-bell_03.html

SLV Chart: http://niftychartsandpatterns.blogspot.com/2011/05/slv-tests-20-day-moving-average.html

Sorry gang, I didn’t have time to do an update yesterday. We did of course break the trendline and have now formed a channel. We now have two possible outcomes.

1. We chop around most of the day allowing the short term charts to get oversold on the MACD’s and Histogram Bars. Then rally back up late today or tomorrow. The rally should go up to our FP on SPY (about 1388 spx), and I suspect it will be hit by the end of the week.

2. Or, we chop around most of the day putting in a doji candle. Then tomorrow we would do the same thing, but then allowing the oversold short term charts to get overbought again. That would set up Thursday and Friday for another leg down, possibly to the 1340 area. Then a rebound into next week toward the 1388 spx level.

Personally I think this up move is too strong to sell off to the 1340 right now. I think number 1 will play out and a bottom will be put in today. There just doesn’t seem to be much news out to cause a larger move down. I suspect that the selling pressure will dry up by noon and allow the market to float higher into the close. Don’t get me wrong, a big move down is coming, but I just don’t think this is it yet.

The ES is still holding a double bottom, but if it breaks we could go deeper. The market is looking weak, but getting oversold short term.

Pin bar and bearish engulfing of Dow Jones: http://niftychartsandpatterns.blogspot.com/2011/05/dow-jones-pin-bar-reversal-candle.html

Yes, the market is looking pretty bearish right now. I’m surprised they are taking it down this much. Where do you see support on the Dow and SPX?

The candles looks very bearish to me. A red candle today will give good confirmation Then dow may retrace to 12480 level.

Doubt they will rebrake that neckline this early…

I must agree Kevin. This selling is very controlled. We should see a rebound tomorrow I believe.

Yeah, hopefully a gap down shake out bounce near the neckline. Very buyable support area. I am seeing some nice volume in the dollar. Keeping an eye on that. I’d love to see the dollar rebound (hurting commodities) and the S&P continue higher to the FP. Would be nice. Are you listening,… GANGSTERS!

hey Leo, i believe we MIGHT open lower tomorrow but if we do, heading up from there until we get overbought on the daily DOW/NQ/SPX again. two days ago at the open, RSI was literally 100 on daily DOW. I see us heading back there and facing resistance and hitting new highs again. The big momma jama crash shouldnt start til june 5th.

Why June 5th? I do see us putting in a new high, as the rsi doesn’t have any negative divergence… which would be extremely rare to see. The market should make a new high and the rsi should make a lower high… then we can sell off!

The VIX daily RSI is at 100 right now as well. Looks like the market is going to head higher from here. Silver daily is at RSI of 0.00. That should start recovering or retracing some of the selloff pretty soon as well.

Yes, silver got pounded today and yesterday. I see a rebound on it too. It’s just way oversold right now.

Not sure how much the market likes symmetry but we are almost 30 days off of every move that happened last year. This wont last forever but the weekly Elliott waves are mirror but 30 days off. So the fllash crash started may 5th last year and that puts us at june 5th this year. Plus if you measure the move of hte 5th wave up (started in early feb of last year and ended in early may), then it pushes out to early June as well. Also the open interest as well benefits the bankers to keep SPY between 135 and 138 at may month end. A crash will put us lower than that. Im betting on june 5th.

May expiration friday*** not may monthend.

You mean the monthly options? What Friday? It’s on the third Friday of every month. You aren’t talking about quarterly’s or weekly’s are you?

3rd friday of this month. sorry i misspoke when i said monthend. i work in business intelligence and when we say monthend, we normally are talking about fiscal lol. anyways, i believe we are heading up from here cause vix needs to backup and we need to at least retrace some of this selloff. i bought QQQ calls today and will hold until tomorrow.

I hope you did a spread on them, as the falling vix will kill your option value even if the market rallies. You neutralize that effect when you buy an option close to the money and sell one out of the money.

SPY fake print just in.. 136.62

SPX Chart: http://niftychartsandpatterns.blogspot.com/2011/05/s-500-analysis-after-closing-bell.html

Yesterday was 111 days from 1-11-11…….On Sunday, we got the MayDay ritual here on the holiest of days for the insiders 235years from the founding of the “enlightened ones”. 235====15×15.6666666 or 6×6.666666666. On Friday, the SP high was 696.77 pts from the 666.79 low and yesterday’s high was 703.79 pts from that mark. 1369====37×37.

All last week I waited to hear Bradley’s song to mark the commeration of the 19year anniversary of a certain 4-29-29 ritual and finally I heard the song on Sunday at 5:58 pm (8:58pm eastern time). Amazingly just as I turned my radio on, the song was starting. Less than two hours later, there was the MayDay ritual.

http://www.youtube.com/watch?v=Nktfou15U5A

Interesting URL there at the end: 152251…..as well as some of the numerical values in the song.

http://www.lyrics007.com/Sublime%20lyrics/April%2026%2c%201992

One of their other songs is titled 5446. In it,Brad sings that 5446 and 5447 are his favorite numbers. I can see a 54 in the URL above. 69==54. 541 backwards is 154 or 77+77. 54 numbers are one of the featured numbers of SP errr Sucker Punch. SP===1619. May 2 would have been 19years6days from Bradley’s date, Thursday for the real one.

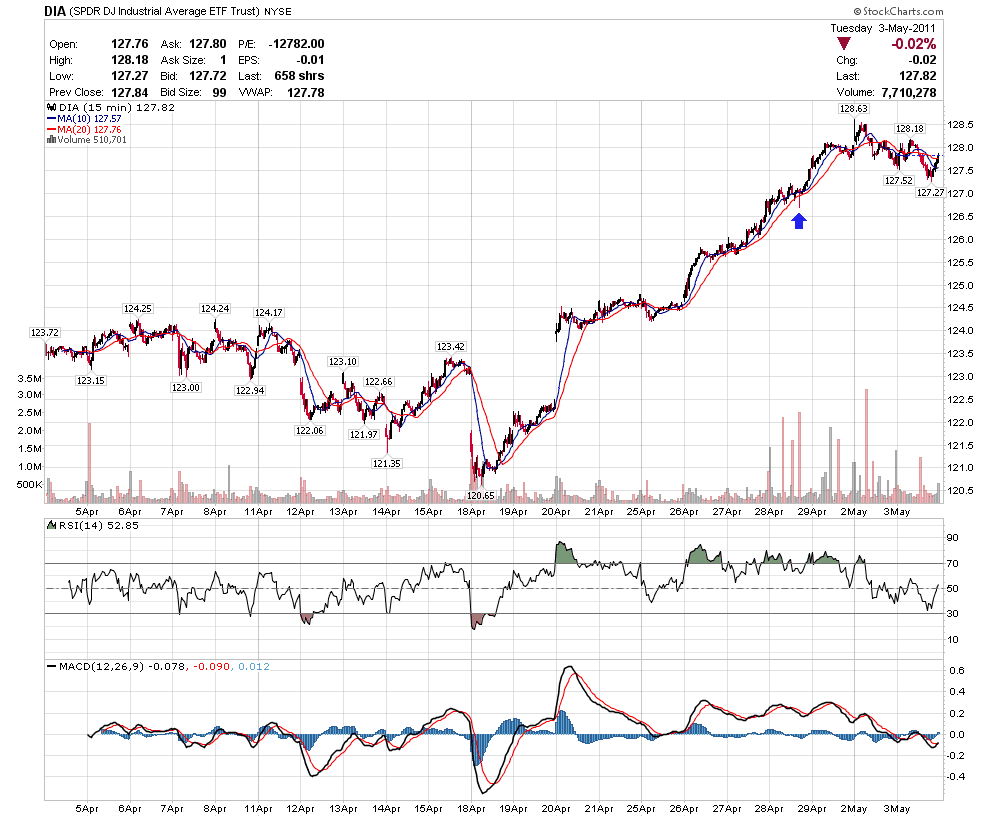

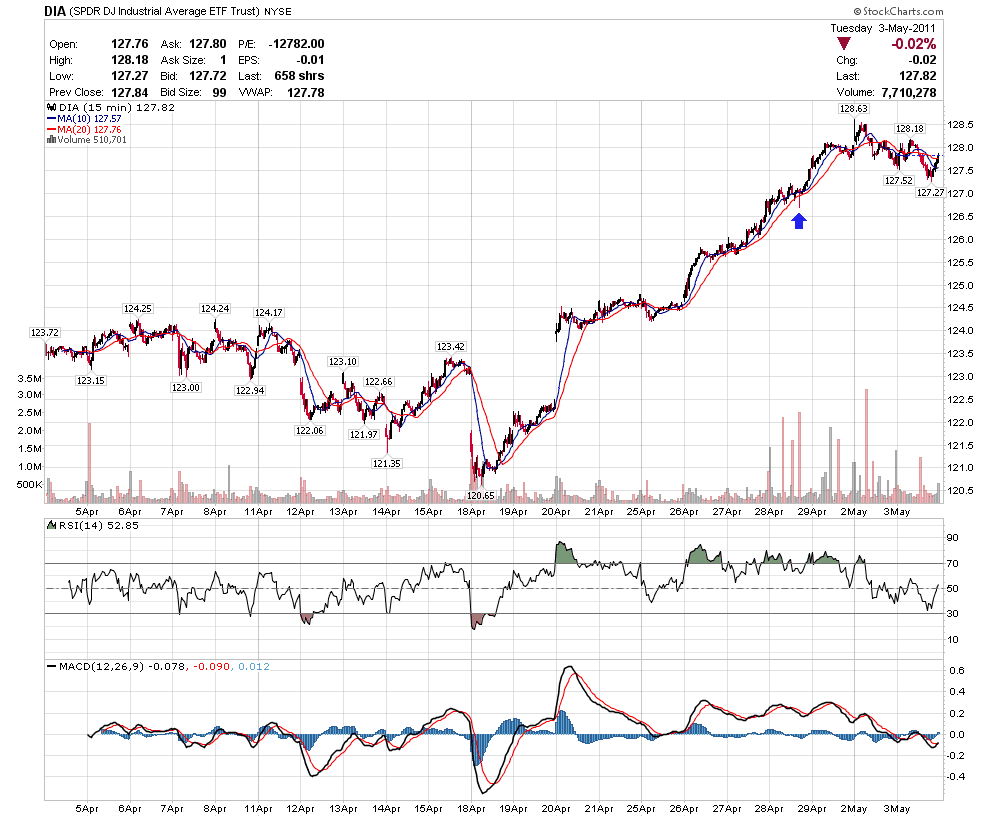

The NY Fed has issued a new market signal. For those who followed my prediction in IWM that it would sell off, IWM went from 86.80 to 83.72 before bottoming in the past two days, just as the Fed indicated. I’ve been doing this a long time. I know that the market is centrally planned.

Our new signals indicate a couple possibilities. Either the market rebounds to IWM 86.50 in the next few sessions (possibly either tomorrow) and then sells off to DIA 126.60 — this is my preferred scenario.

IWM sell level

DIA buy level

The second option is that we drop to DIA 126.60 tomorrow and then rally up to the IWM 86.50. This is less likely in my opinion. The first scenario is a typical A-B-C pattern and is far more likely.

Follow my blog if you want to know the truth about the markets and not waste your time on technical analysis and wave counts. Totally meaningless and unnecessary in a centrally planned market. Spread the word so not only the banks can benefit.

What is your blog address?

Refresh page for Tuesday update…

Now there is all this talk of Andre Either challenging Joe Dimaggio’s 56 (flashcrash#) game hitting streak now that he is halfway there at 28 (4×7 or 7777). DiMaggio attained that record in 1941 or 69year ago. Anything with a connection to 1941/41 or 69 gets my attention real quickly now. His hitting streak started on 5-15-41 (5-54-11???) which makes 5-4, 69years 11months 19days later or 69 with a mirrorred 911 combo. The CSX888 incident, the runaway train that provided the inspiration for the movie UNSTOPPABLE occurred on 5-15-2001 which makes tomorrow 9years 11months 19 days later.

Now all eyes await whether Either gets to 29 in a row tonight.

The Thrice won their 64th game tonight (88) after winning 58 during the regular season. As the enlightened one’s favored team, it appears that they were tanking during the regular season to achieve the 58 win mark. Over at http://www.cbssports.com they are flashing a 3-15 (45??) combo in the Heat-Celtics photo on the main page.

Darn, they took the Heat photo off the main page (click on the Heat score to see it) and replaced it with a photo of Francisco Liriano who pitched a no-hitter. Liriano’s number ===47 LOL. Rituals upon rituals upon rituals.

In the Heat photo, combining the 2 from the 20 Celtic number shown to 3-15 makes it 9-11 (2) or 29 in reverse. Also 47 (3-1,5-2).

299 days tomorrow from 7-9 unveiling of the Thrice number last year. Thrice #====17×8 or 8.5 x 16 or 8.5x 4×4…..8-4 or 4-8 another number they have been throwing around. Obama’s birthday on his fake birth certificate is 8-4…..1(96)1. Notice the other signature dates 8-7 and 8-8 1961.

Oh and 307days from 7-1-1 low from last year.

Another way to look at it is… today is 5-4-11,…5×4+11=31. 31+The indian’s game score total last night (the day after Bin Laden news) of 4-1 = 36. 36x (simpson’s clock 5 of 6) 56= 1960,.. I think that is the target for the Nasdaq based on my analysis.

I don’t see Tuesday refresh.

today is the 3rd, is it not?

anywho, strange day, No Mutual Fund Monday or Tuesday.

not even a POMO save.

if futures hold overnight, I see positivity tomorrow.

otherwise, my wimpy puts will actual grow some.

ES Chart: http://niftychartsandpatterns.blogspot.com/2011/05/s-500-futures-before-opening-bell_04.html

So basically, we are looking for 1348 es to break, and then a big move down. What level to you see as support lower?

Correction may take ES to 1342 and below 1342 its near 1335-1336 level.

Falling wedge of silver: http://niftychartsandpatterns.blogspot.com/2011/05/falling-wedge-of-silver.html

The DIA print has been filled. I take this as a buy level with the IWM print as the target. We’ll see. I played both trades and took profits on puts this morning.

Uncle Ben, I thought u said iwm 82.5buy, dow126area buy

This is classic re-test of the breakout, which is normally a buy.

This is classic re-test of the breakout, which is normally a buy.

Thanks

ES Hour chart: http://niftychartsandpatterns.blogspot.com/2011/05/es-hour-chart-analysis.html

Looks like we are close to support right now and are in an area where we should find a temporary bottom, allowing for a bounce tomorrow I believe. This morning I expected an ABC move back up, but the tape was too weak I guess. Now it looks like tomorrow will produce the rally. For how long or high is unknown, but after the rally, we still could have another move down coming.

Did you see the FP for appl? 321.87 at 10:51

sent screen shot to Red

Well, it’s showing up in my trading account, but not on the nasdaq site…

http://www.nasdaq.com/aspx/nasdaqlastsale.aspx?symbol=AAPL&symbol=VXX&symbol=QQQ&symbol=IWM&symbol=DIA&symbol=SPY&selected=AAPL

Not sure if it’s valid or not? I would like to know the volume on the individual trade that created it, but I don’t know how to get that?

Did you see the FP for appl? 321.87 at 10:51

sent screen shot to Red

sorry for the duplicate … fat fingers

Wow! Maybe we do get our Flash Crash this week Dee? Thanks, I see it on my daily charts too.

Usually all the FP dont make headlines, but there are articles out now about how AAPL dipped 7% from somebody just selling a 100 shares or something

http://www.reuters.com/article/2011/05/04/us-apple-stock-idUSTRE7434TA20110504

Is that the exact amount… a 100 shares?

ok – so wonder what this means??? I didn’t show any volume on the time when it happened… is it a sign? would just bring it down to the bottom of the channel at support… ???

Remember this print gang?

It showed up at midnight the day before the flash crash. It makes you wonder about tomorrow?

Possibly we bounce up tomorrow and then have a Flash Crash? Scary… to say the least. Maybe it will happen on Friday this time?

Looks like we are finally bouncing. The 135.00 area on the SPY is the key here, as it’s about where the upper trendline is in the falling channel the market is in. A break of that level and I think we will see our rally into tomorrow morning.

But, I still think that we will go back down again. This move down today is too strong. I could see a rally in the morning tomorrow, but a sell off in the evening… putting in another lower low. We’ll see I guess, but the selling doesn’t look over yet.

And, let’s not forget about the recent Legatus Meeting between April 30th-May 2nd. It’s over now, and we could actually see another “Flash Crash”? It’s possible, but I’m not sure about it yet? I need to see what kind of rally we get tomorrow first.

SPY Fibs: http://niftychartsandpatterns.blogspot.com/2011/05/spy-fibonacci-levels.html

SLV Chart anlaysis: http://niftychartsandpatterns.blogspot.com/2011/05/slv-analysis-after-closing-bell.html

ACI chart, has a fairly stable price channel. I can use this stability to help me in going long the other coal stocks, probably.

Andre Eithier’s hit streak extended to 29 games yesterday but he didn’t play today due to some injury that suddenly hit him keeping his streak intact at 29 games. DiMaggio hit 15home runs and had 55 rbis during his 56 game hit streak. 15-55. 5s are a plenty in Sucker Punch. Bradley, the singer for April 26,1992 died on 5-25, 19(96) ie 5-5×5

Only problem is that McClellan Oscillator is still at a somewhat high level as well as it’s Summation Index but commodities are selling off and the dollar looks to have put in a bottom today. Once the dollar starts screaming higher, things will start to get Fast and Furious (FAB FIVE—haha—just noticed this—I’ll have to see that movie)

The numerology is getting out of control. I can’t keep up with all of it.

NBA telecast displayed that Derek Rose was the youngest MVP in NBA history at 22years 212 days. (They flashed the other youngest winner–mostly at 23years, one at 23years9days. Then at halftime, in one of analysis segments, they froze the game with score tied at 15-15 with 4:19 left (the day of infamy number) —6 (shot clock??) or 4:19-6.

Well, the days 5-15 and 5-8 won’t work because the market is closed on those days but the key day has to have some sort of 54–55—15 combo.

5-19 would be the Marilyn Manson date—he was born on 1-5,1969 (so he says) and tried to release an album on that date in 2009 and released one on September 15,19(96)…9-15-96