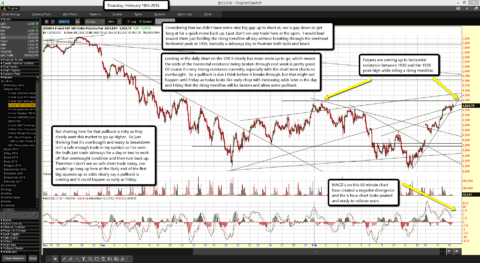

Futures are coming up to horizontal resistance between 1930 and the 1938 peak high while riding a rising trendline.

Futures are coming up to horizontal resistance between 1930 and the 1938 peak high while riding a rising trendline.

MACD's on this 60 minute chart have created a negative divergence and the 6 hour chart looks peaked and ready to rollover soon.

Considering that we didn't have some nice big gap up to short at, nor a gap down to get long at for a quick move back up, I just don't see any trade here at the open. I would lead toward them just holding the rising trendline all day without breaking through the overhead horizontal peak at 1938, basically a sideways day to frustrate both bulls and bears.

Looking at the daily chart on the SPX it clearly has more room up to go, which means the odds of the horizontal resistance being broken-through next week is pretty good. Of course it's very strong resistance currently, especially with the short term charts so overbought. So a pullback is due I think before it breaks through, but that might not happen until Friday as today looks like early chop with increasing odds later in the day and Friday that the rising trendline will be broken and allow some pullback.

But shorting here for that pullback is risky as they clearly want this market to go up higher. So just thinking that it's overbought and ready to breakdown isn't a safe enough trade in my opinion as I've seen the bulls just trade sideways for a day or two to work off that overbought condition and then turn back up. Therefore I don't see an safe short trade today, nor would I go long up here at the likely end of the first big squeeze up as odds clearly say a pullback is coming and it could happen as early as Friday.