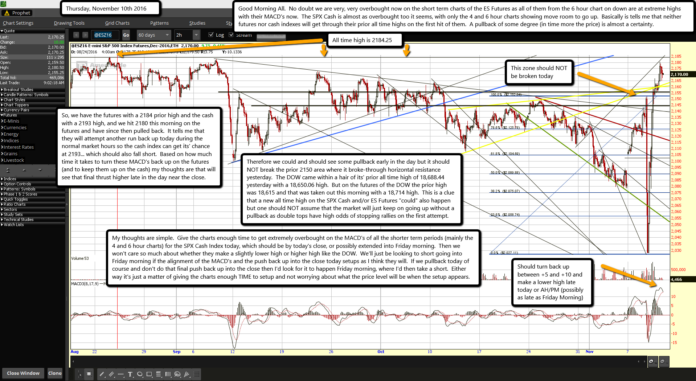

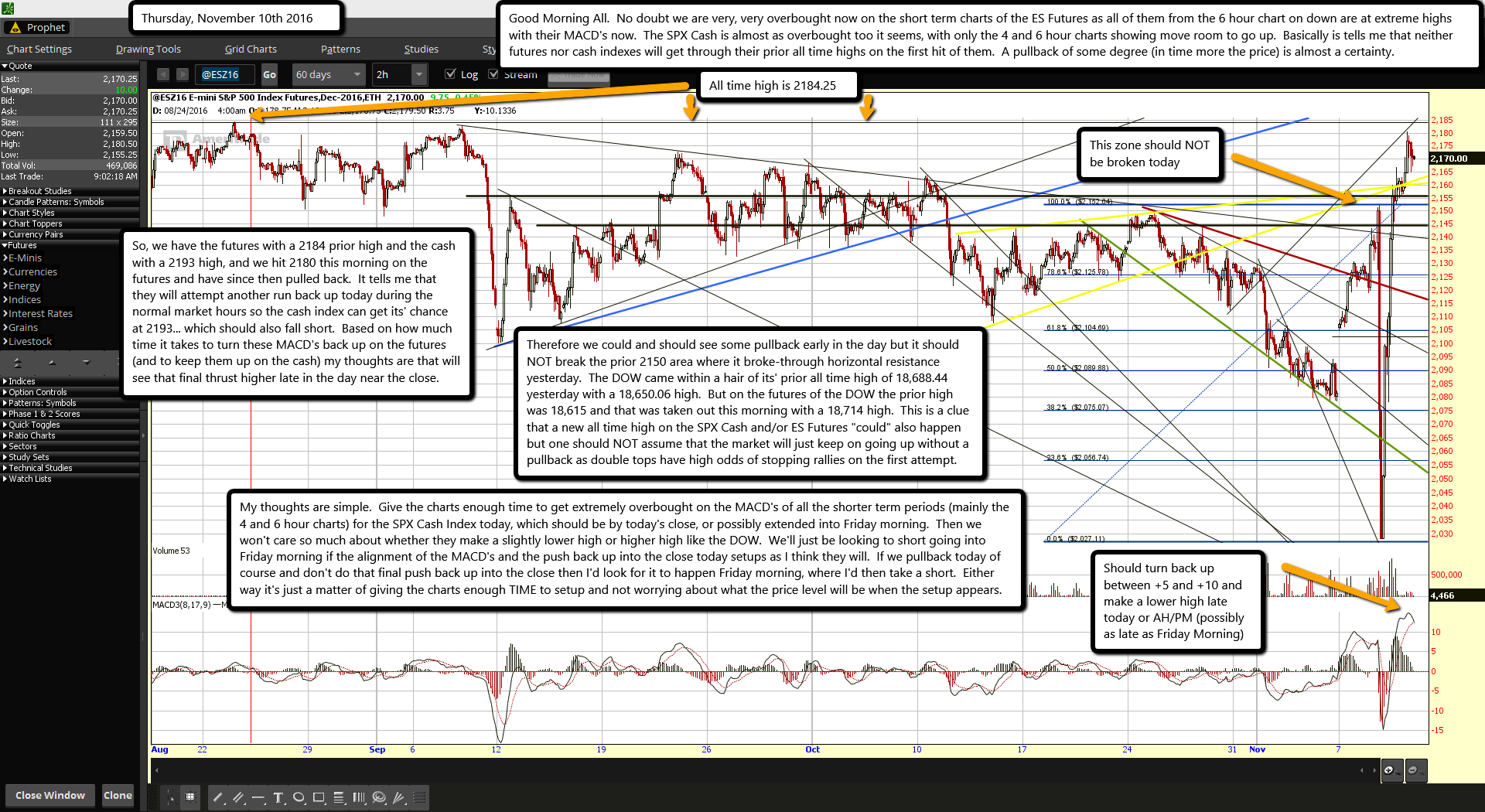

Good Morning All. No doubt we are very, very overbought now on the short term charts of the ES Futures as all of them from the 6 hour chart on down are at extreme highs with their MACD's now. The SPX Cash is almost as overbought too it seems, with only the 4 and 6 hour charts showing move room to go up. Basically is tells me that neither futures nor cash indexes will get through their prior all time highs on the first hit of them. A pullback of some degree (in time more the price) is almost a certainty.

So, we have the futures with a 2184 prior high and the cash with a 2193 high, and we hit 2180 this morning on the futures and have since then pulled back. It tells me that they will attempt another run back up today during the normal market hours so the cash index can get its' chance at 2193... which should also fall short. Based on how much time it takes to turn these MACD's back up on the futures (and to keep them up on the cash) my thoughts are that will see that final thrust higher late in the day near the close.

Therefore we could and should see some pullback early in the day but it should NOT break the prior 2150 area where it broke-through horizontal resistance yesterday. The DOW came within a hair of its' prior all time high of 18,688.44 yesterday with a 18,650.06 high. But on the futures of the DOW the prior high was 18,615 and that was taken out this morning with a 18,714 high. This is a clue that a new all time high on the SPX Cash and/or ES Futures "could" also happen but one should NOT assume that the market will just keep on going up without a pullback as double tops have high odds of stopping rallies on the first attempt.

My thoughts are simple. Give the charts enough time to get extremely overbought on the MACD's of all the shorter term periods (mainly the 4 and 6 hour charts) for the SPX Cash Index today, which should be by today's close, or possibly extended into Friday morning. Then we won't care so much about whether they make a slightly lower high or higher high like the DOW. We'll just be looking to short going into Friday morning if the alignment of the MACD's and the push back up into the close today setups as I think they will. If we pullback today of course and don't do that final push back up into the close then I'd look for it to happen Friday morning, where I'd then take a short. Either way it's just a matter of giving the charts enough TIME to setup and not worrying about what the price level will be when the setup appears.