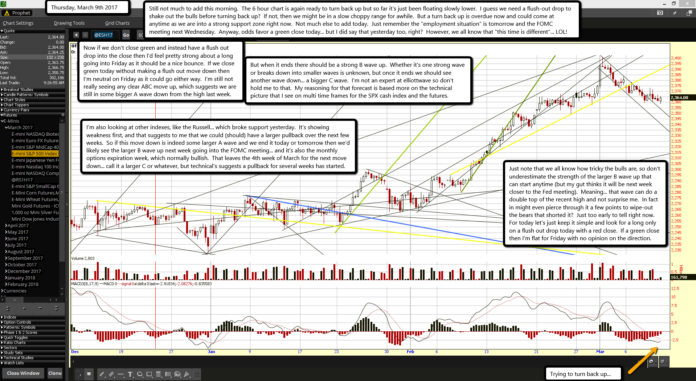

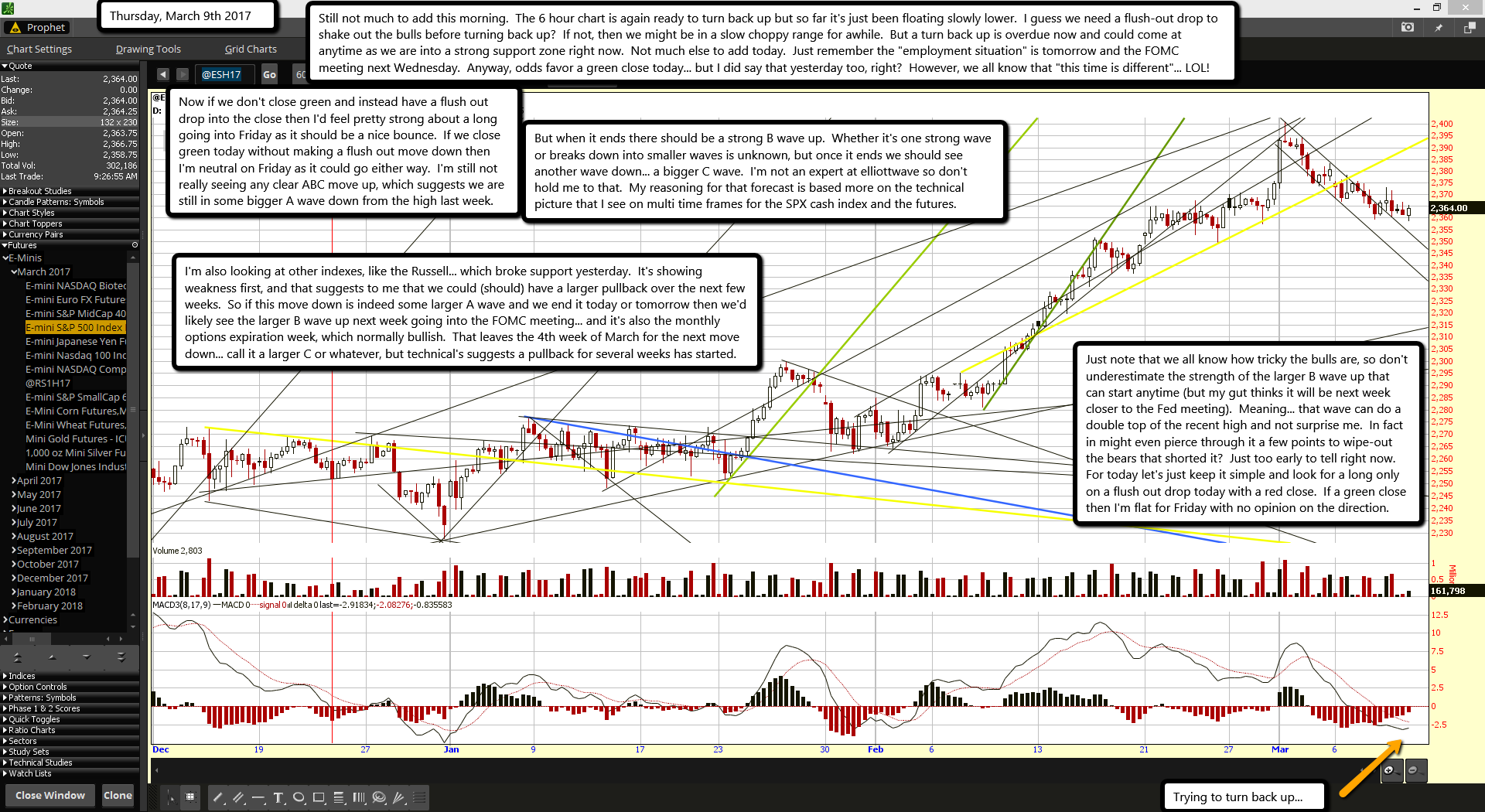

Still not much to add this morning. The 6 hour chart is again ready to turn back up but so far it's just been floating slowly lower. I guess we need a flush-out drop to shake out the bulls before turning back up? If not, then we might be in a slow choppy range for awhile. But a turn back up is overdue now and could come at anytime as we are into a strong support zone right now. Not much else to add today. Just remember the "employment situation" is tomorrow and the FOMC meeting next Wednesday. Anyway, odds favor a green close today... but I did say that yesterday too, right? However, we all know that "this time is different"... LOL!

Now if we don't close green and instead have a flush out drop into the close then I'd feel pretty strong about a long going into Friday as it should be a nice bounce. If we close green today without making a flush out move down then I'm neutral on Friday as it could go either way. I'm still not really seeing any clear ABC move up, which suggests we are still in some bigger A wave down from the high last week.

But when it ends there should be a strong B wave up. Whether it's one strong wave or breaks down into smaller waves is unknown, but once it ends we should see another wave down... a bigger C wave. I'm not an expert at elliottwave so don't hold me to that. My reasoning for that forecast is based more on the technical picture that I see on multi time frames for the SPX cash index and the futures.

I'm also looking at other indexes, like the Russell... which broke support yesterday. It's showing weakness first, and that suggests to me that we could (should) have a larger pullback over the next few weeks. So if this move down is indeed some larger A wave and we end it today or tomorrow then we'd likely see the larger B wave up next week going into the FOMC meeting... and it's also the monthly options expiration week, which normally bullish. That leaves the 4th week of March for the next move down... call it a larger C or whatever, but technical's suggests a pullback for several weeks has started.

Just note that we all know how tricky the bulls are, so don't underestimate the strength of the larger B wave up that can start anytime (but my gut thinks it will be next week closer to the Fed meeting). Meaning... that wave can do a double top of the recent high and not surprise me. In fact in might even pierce through it a few points to wipe-out the bears that shorted it? Just too early to tell right now. For today let's just keep it simple and look for a long only on a flush out drop today with a red close. If a green close then I'm flat for Friday with no opinion on the direction.