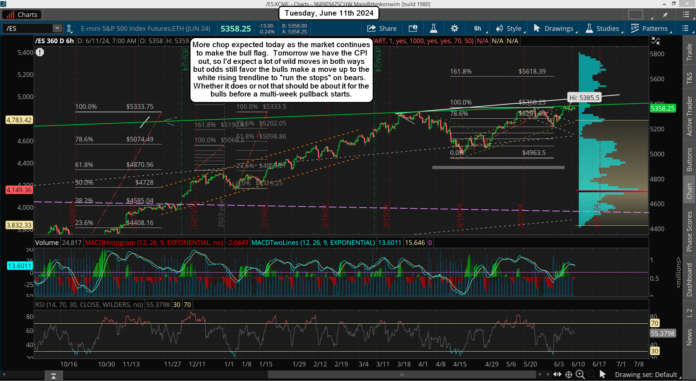

A whole lot of nothing yesterday as we drifted lower in the first half of the day and floated back up the second half. Still no clear direction but a move is coming tomorrow after the CPi and/or the FOMC. The market has been in a tight range the last several days and forming a bull flag, as well as a "cup and handle pattern", which both are bulls of course.

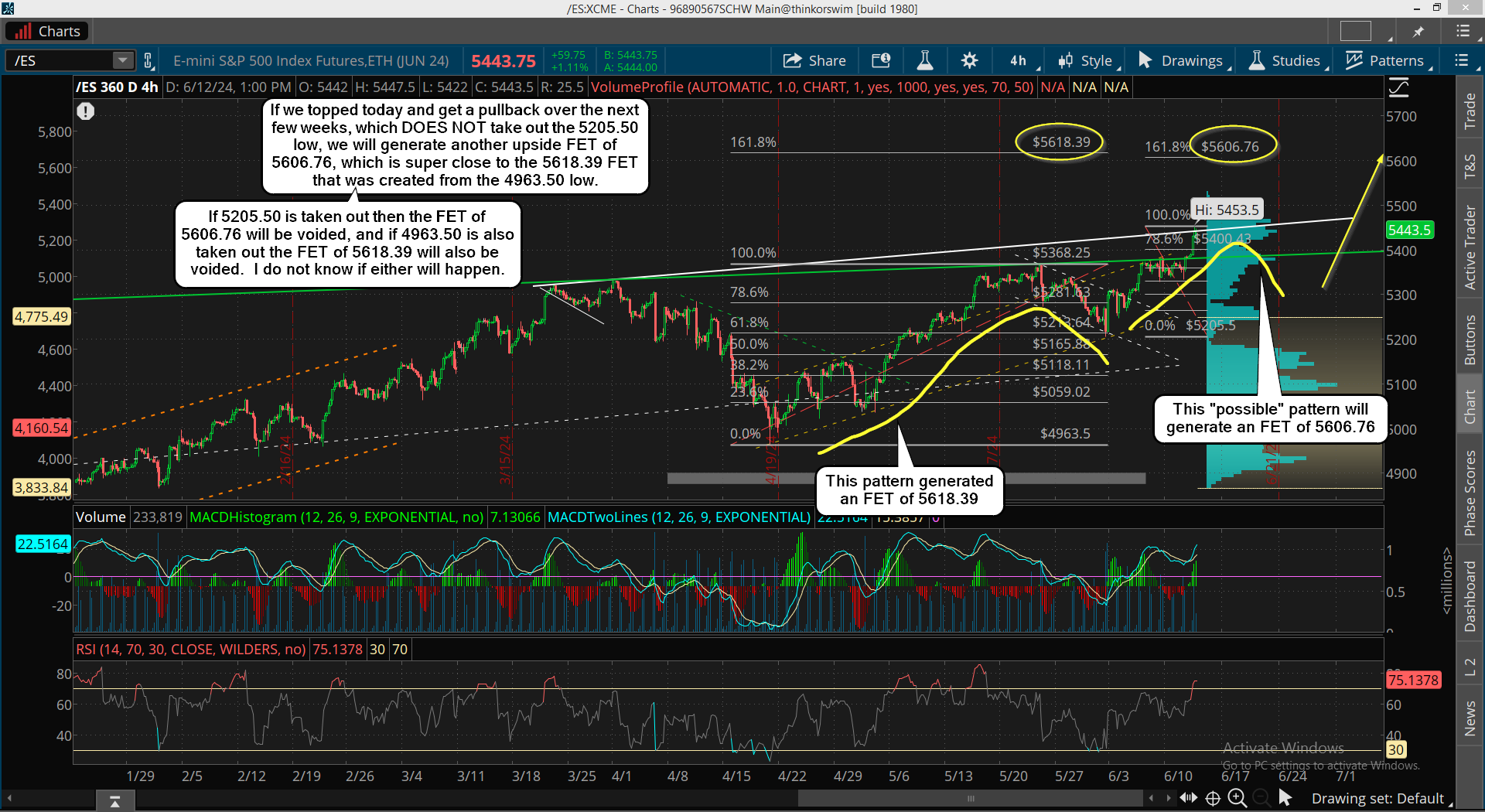

The typical trick is to rally higher first in a short squeeze to kill the bears and trap the bulls before a drop. Technicals are still short term bullish but medium term they are overbought so a pullback should still happen before this month ends, and usually in the second half of the month. But that pullback could start from a higher level, like the hitting of the rising white trendline up around 5450 on Wednesday.

As for today we'll probably chop around some more as everyone is waiting on the CPI and the FOMC. My lean is still that we'll hit the rising white trendline, but that doesn't mean we don't have a shakeout drop first, like after the CPI maybe? Then back up after the FOMC would be my best guess on how it plays out. Nothing but a waiting game now.

Have a blessed day.

I was going to write that they’ve held it up so far that it could do one spike higher. But there hasn’t been a pullback and both main indices are at the upper Bollinger Band.

The Mars Pluto square didn’t do anything today except maybe hit the Dow a little. I overlooked the Sun Saturn square. Both squares should be active for a few more days. 6-14 has the Sun, Venus, and Mercury lined up in Gemini with a square to Saturn in Pisces and the moon joins in with another square. Neptune is also nearby in Pisces. The moon will aspect them all that day.

Meanwhile a certain indicator remains negative and it should get even more negative today. It’s offshoot just dropped below its last moving average of significance (actually today) except for a very long term one that really isn’t useful.

There is a case to be made for one more 4 and 5 wave to take place. Maybe an early CPI drop and then pop. The 13th would be an ideal date for a top one year 9 months off the 10-13-2022 top.

We’re getting near or actual Hindenburg signals every day. I don’t know if the new lows actually qualify.

Hmmm, the SP ended the day finally at a new high. Maybe we got our waves 4 and 5.

I do see a pullback coming but it could be just another “higher low”, as I see 2 FET’s now around the same zone.