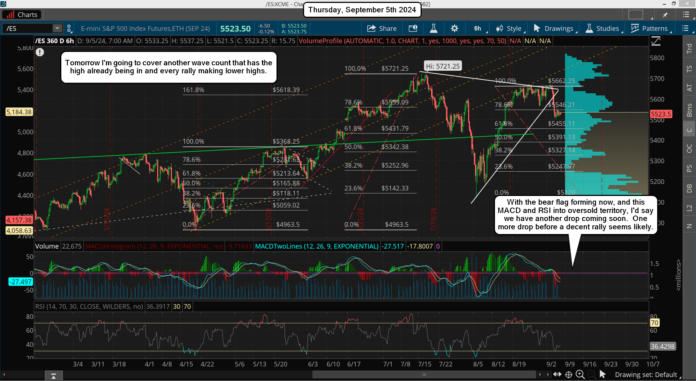

We got pretty much what I expected yesterday... chop. I still don't see anything bullish on the short term as the weekly chart is certainly in favor of going lower, and the daily chart could go deeper too. But price really isn't something that is easy to forecast. The technicals just suggests that this market isn't oversold enough to start a strong rally up to new all time highs again.

It looks like it should drag out into next week from what I see, but that doesn't mean it's going to go a lot lower. It just means that the upside rallies should not break the prior lower highs in that 5650-5670 zone. So if we get a decent rally up this Friday I don't see that zone breaking as it's strong resistance right now.

And on the downside there shouldn't be much left for today because the short term charts are getting close to turning back up from being oversold. I think we get some more weakness today but by Friday we rally up higher to try and hit the 5650-5670 zone. It might drag into next Monday but if it happens I'd still be bearish and look for another move lower later into next week. Because the bearish period has so much "time" left I do think we'll get some kind of ABC down before we end my wave 4, which will setup OPEX week for the start of wave 5 up.

Have a blessed day.