Surprise, surprise, surprise... the market dumps with all the bears asleep (including me). I honestly had given up on the pullback to the 5700 zone as every tiny pullback over the past 2 weeks got bought up, but support finally broke yesterday and down it went.

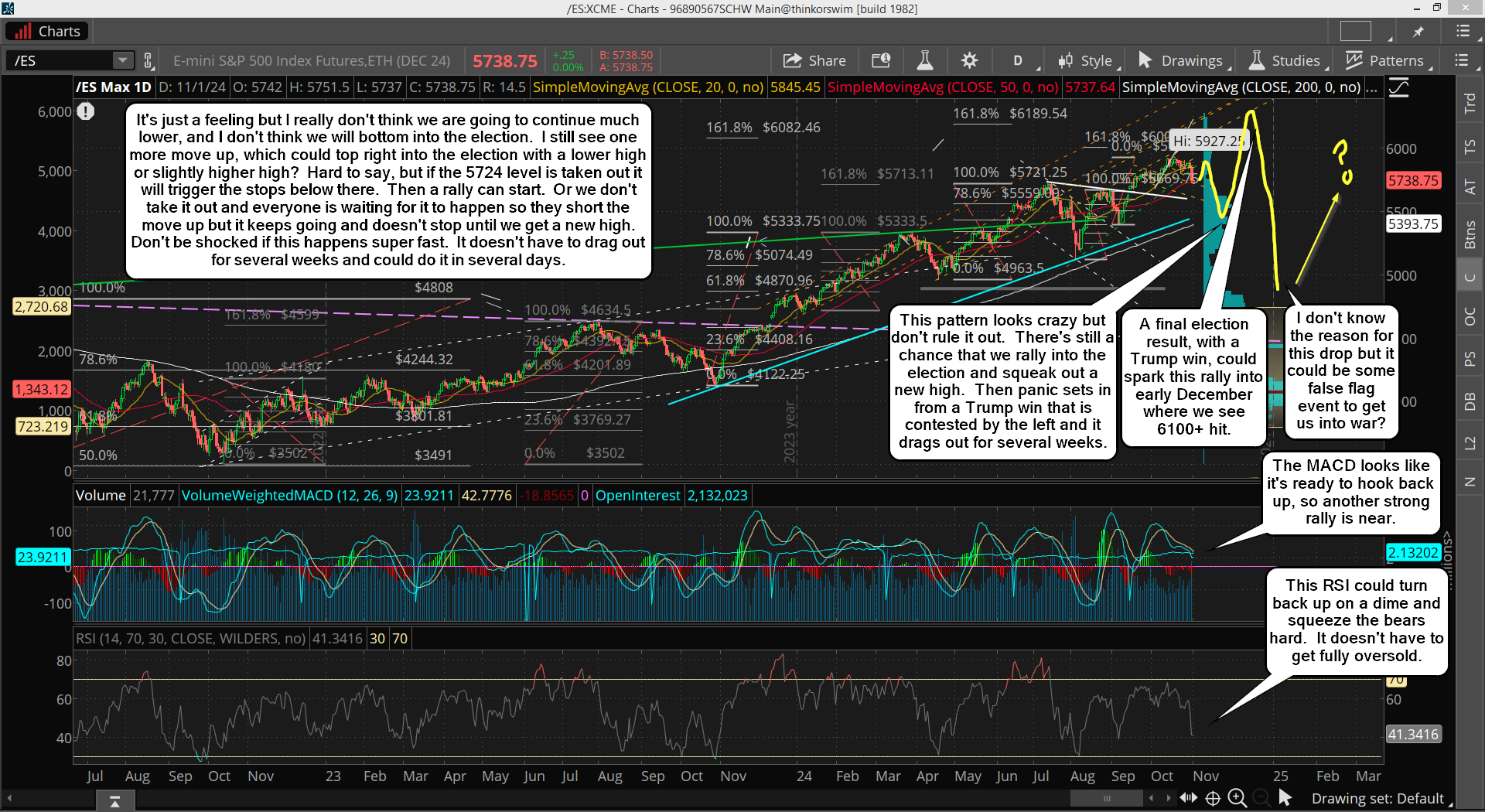

As of the close yesterday we hit a low of 5738 and we are right into the horizontal support zone from 9/23 to 10/8 period, which the lowest low back then was 5721, and that may or may not be taken out before we start the next big squeeze for Tiny Wave 5, inside Small Wave 5, inside Medium Wave 3, and while I don't know how high it goes, or what day it tops, I lean toward one of my FET's of 6082.46 or 6189.54, and "time wise" think a week after the election is the most likely period... possibly right into OPEX on the 15th?

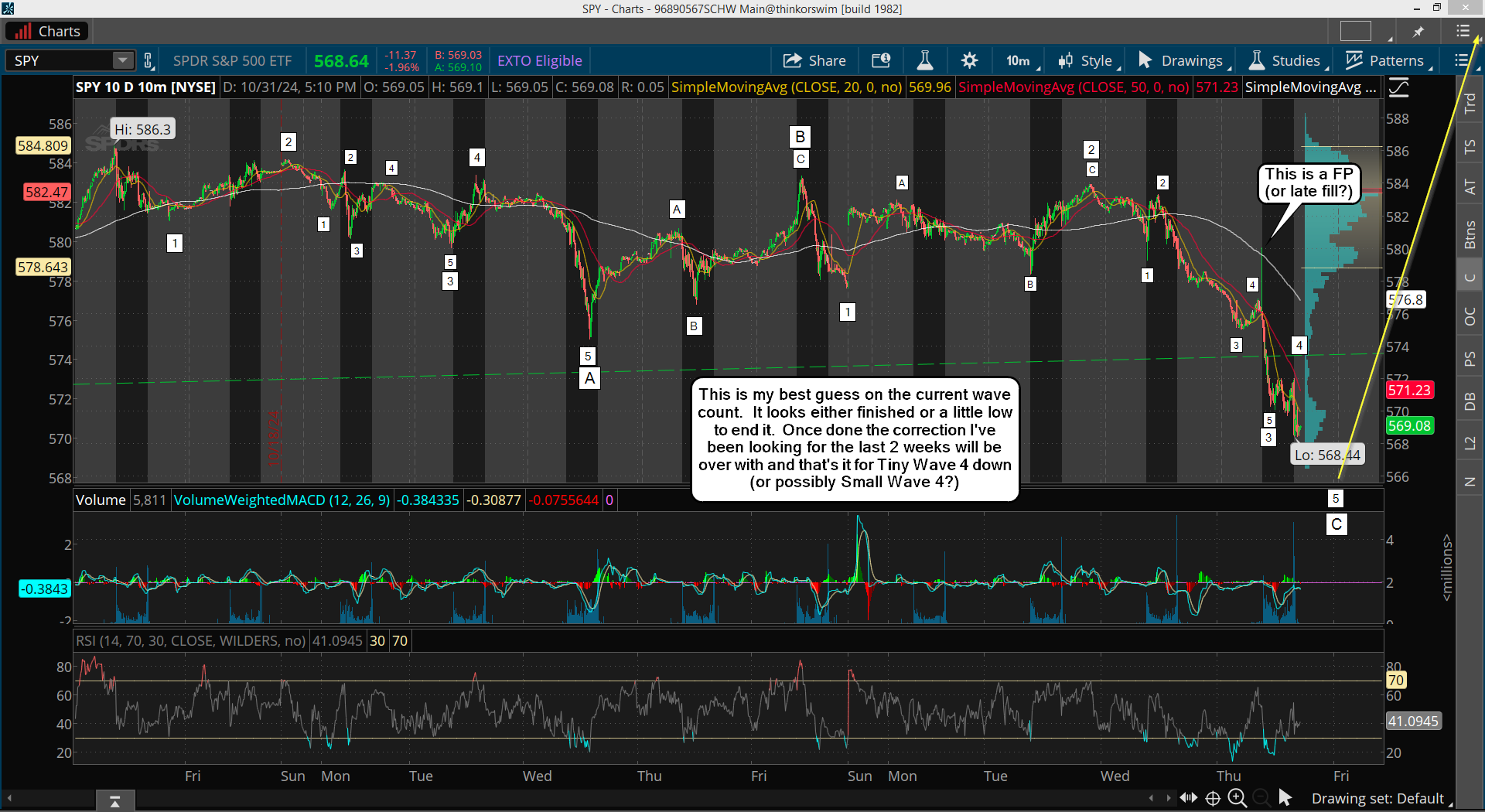

Here's a chart...

But... we could see it there much, much faster as a Trump win could cause a euphoria type move, which seems likely right now. I know the deep state is going to cheat, so it's possible that they delay the result for weeks to try and cheat, but that's also suggesting a big drop after the election as fear of the unknown sets in.

I just don't see it right now as this pullback is resetting the overbought charts and we should explode higher next week as that's what the technicals say. Yes, I was thinking we would top into the election but right now it's looking like they are bottoming instead as we go into it. If we bottom today it's likely we'll see a wave 1 up on Monday and wave 2 down into the election Tuesday. Then a Trump win will cause the wave 3 up to follow, and it should be a powerful move. Bottom line here, I'm looking for a big squeeze starting very soon.

Here's a chart...

As you can see we dropped right into the support zone with 5724 marking the lowest low on 10/2, which I'm unsure on whether or not that it pierced to hit some stops or if it holds with a higher low. But all short term charts are oversold now, so it's just a matter of time before we see a big squeeze. I think we could see it start today as many Fridays' have a late day rally.

My only real worry is that the daily chart could go lower before it gets fully oversold. In the past it would stop prior to reaching the oversold level on the RSI and turn back up, but with the weekly chart pointing down and putting bearish pressure on the market I must be open for it to reach a fully oversold position prior to starting a big rally up.

The Daily Chart...

There are many unknowns coming in the next few days (and weeks), so I'm just trying to point them all out. A grind up into the week of OPEX with 6100+ would be perfect to put the bears to sleep. But that would mean a clean, uncontested election and I don't think we will get that. So I'm still open to the possibility of a squeeze up into the election that double tops and then there's no clear win... so down we go, probably to my 533.01 FP on the SPY. We'll see..

Have a great weekend.