WOW! What a squeeze yesterday after a wonderful victory for America with a Trump win. Now we have a chance to save the country from the satanists that have been destroying it for the last 4 years. Let's all pray he can do it as nothing can be done with God's helping hand. I do believe God put him in place to give all us sinners another chance to bring America back to a republic, the way it was originally created.

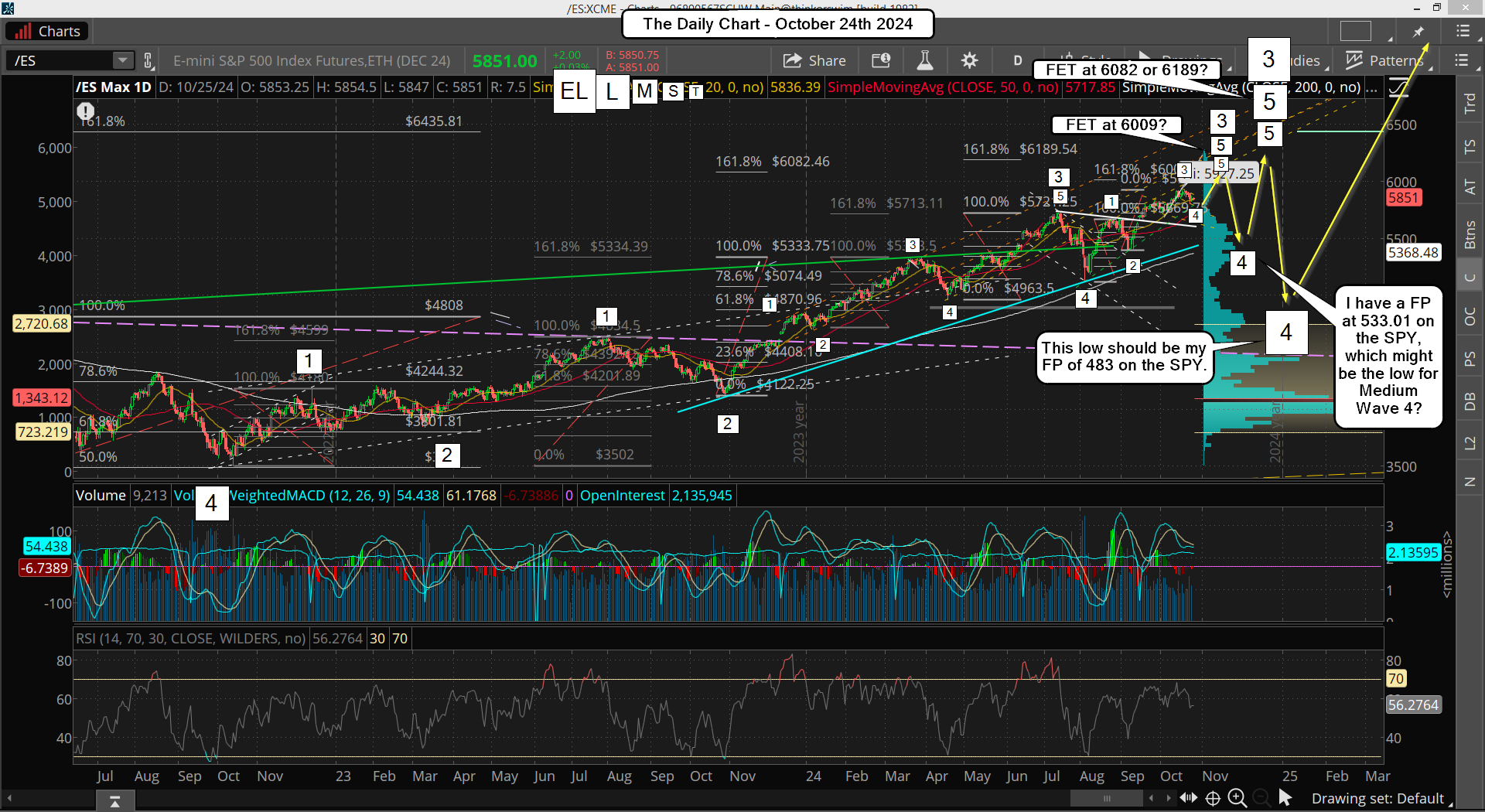

A country formed from the Bible with Christian values, but has turned into Sodom and Gomorrah in the past many decades. President Trump can fix a lot of things now but the market isn't one of them. It's all based on cycles and no president has ever controlled it. It was in a bull cycle since the 2022 low and will enter a bear cycle in 2025. As for the short term, the market is topping for this current move up, which played out like I posted on this wave count below from October 25th, 2024.

Recently I wasn't thinking we'd have any higher high before the coming pullback, which I think will be to the 533 FP on the SPY, but it did it all in one day when not many were expecting it. Today we have the FOMC at 2pm and I have a strong feeling we have topped and will start down after today and will bottom at the 533 FP in the next week or two.

Once done we should see one more rally up to 6100+ into early December to top it all out before the next big drop to the 483 FP's on the Yahoo site. After that we rally hard all of January, but I don't know how high? Will it be just a 61.8% bounce or we see one more even higher high before we enter the bear market? That part is unknown right now so we'll have to just cross that bridge when we get there. For now though I think we've top and will start down for the next couple of weeks.

An Alternative Path...

I want to always be open to the market surprising me with some curve ball, so here's another possibility. If the two FP's on the Yahoo site are not real, and only the one for 533.01 from some other platform (looks like Think or Swim but I don't know?), then the drop should unfold differently.

Putting those 2 FP's form Yahoo aside, and pretending they aren't real, then we will only pullback small over the next few days (meaning NOT down to the 533.01 FP) and then we will go back up to 6100+ into the end of this month. Once that final high is hit it will be from that level that we'll see the drop to the 533.01 into mid-December. That would then be the low before a rally starts back up that will last through most all of January of next year.

Now that's not my lean but it's possible that we don't go any lower then that FP on the first drop and then the rally up in January will make a lower high from which possibility then we see the drop to the 483 FP into February or March? It's something that could happen but I just don't feel it will.

I mean, we still have 3 weeks in November and we could easily drop to 533 and rally back up to 6100+ into the first week of December without too much trouble I think. I'm open to whatever path the market wants to take but I just can't see both (or just the 483) FP's not being real targets. Each one was put out twice, so that's double conformation that they will both be hit at some point.

The "when" part is what very hard to figure out but I have to think that we'll see the higher one of 533 first and save the lower one until after we reach 6100+ early next month. And I also think that if we drop to 533 in the next 2 weeks all the bulls will turn into bears and stop "buying the dips", which I know they will do if we only pullback like 200 or 300 points. We need to pullback deep enough to get all the bulls to flip to becoming bears and then the market can squeeze them back up to reach that 6100+ target in December where everyone will think the low is in as December is commonly a bullish month. But that's when it falls off the cliff to hit the 483 FP before December ends.

Anyway, just thinking out loud...

Have a blessed day.