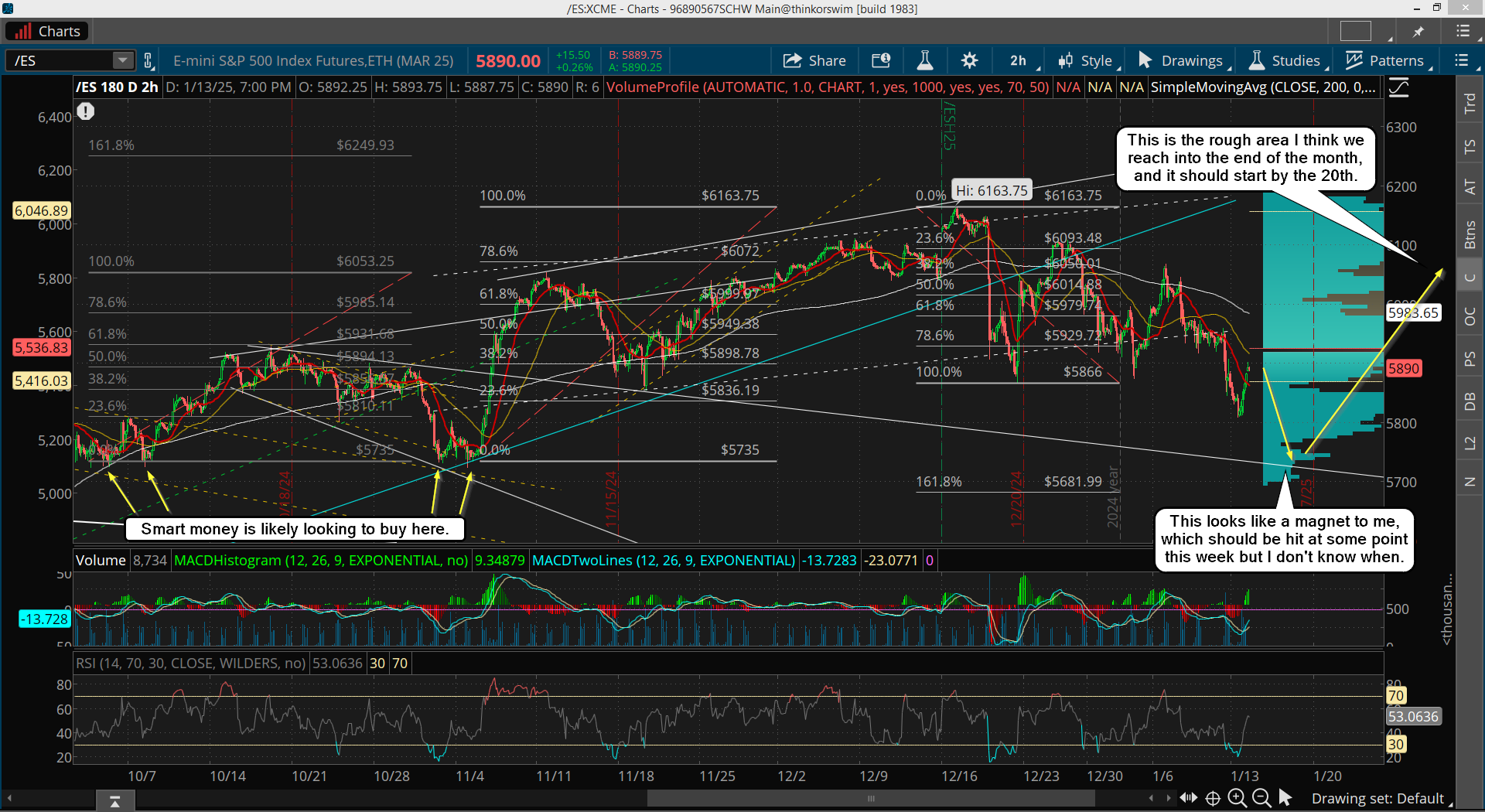

We found a bottom yesterday at the 5809 low on the ES, and have been bouncing back up ever since. Looking at the oversold RSI on the 6hr chart it tells me this bounce could last a few days, which opens the door for the CPI on Wednesday to end the bounce and for the market to roll back over again for another move down.

That last move might end that day or carry into Thursday or Friday. It's hard too say for sure on the "when" but the price level is something else, which I think is more predictable in this scenario. I'm looking for a hit of the falling white trendline, which is anywhere from 5730 to 5710 between now and this Friday. Beside the CPI this Wednesday there's the Jobs Number on Thursday, so we have "things" that can cause moves in either direction.

I don't know how it's going to play out but my best guess is that "if" we rally today to get the RSI on the 2hr chart overbought (I don't expect that to happen on the 6hr) then Wednesday would could rollover again after the CPI. (2hr chart below)...

If we pullback some first today then the CPI might cause some fast squeeze up first to get the RSI (2hr) overbought that day instead... then we rollover. The jobs number on Thursday would then just be more bad news to get that last push lower into the mid-low 5700's on the ES where I think we bottom at. The 11/1-11/4 low around 5735 will be big support, which is also the lows from 10/2, 10/3 and 10/7, so that zone will be a spot where smart money wants to buy at.

Will it make it all the way there or not is a question I can't answer, but I'm a bull if it does. I previously thought we would have bottomed by now and would be rallying into the 20th but it's looking like we are going to bottom right before it and start a powerful squeeze up afterwards.

That move up should last into the end of the month I think and should ONLY make a lower high now that we've went lower then expected, and took too much time to get there. I'm now going to go back to my original thoughts that we'll see a blow off top this summer as too much damage has been done to see that blow off into early February. It's not some much about "price" but more about "time" that's changed the plan and lowered the odds of such a move happening. Anything is possible I guess but for me odds are now much lower that a new high will happen into the end of this month... especially if we hit the low 5700's late this week before we even start the rally. (6hr chart below)...

My point here is that's not likely that the down move is over yet and that it can play out differently depending on how the two upcoming "events" are used, but the end result should still be a trip lower to tag the falling white trendline, or at least get close to it. More patience is needed here if you want to catch a powerful squeeze back up into the end of this month.

My guess is that that it will retrace 61.8% to 78.6% to squeeze out of the bears, and lure in some bulls looking for the blow off top to happen. But "time" will NOT support it and we will be at the end of the month (most likely) when this happens and February should be a nasty down month, which will not support the bulls at all.

Have a blessed day.