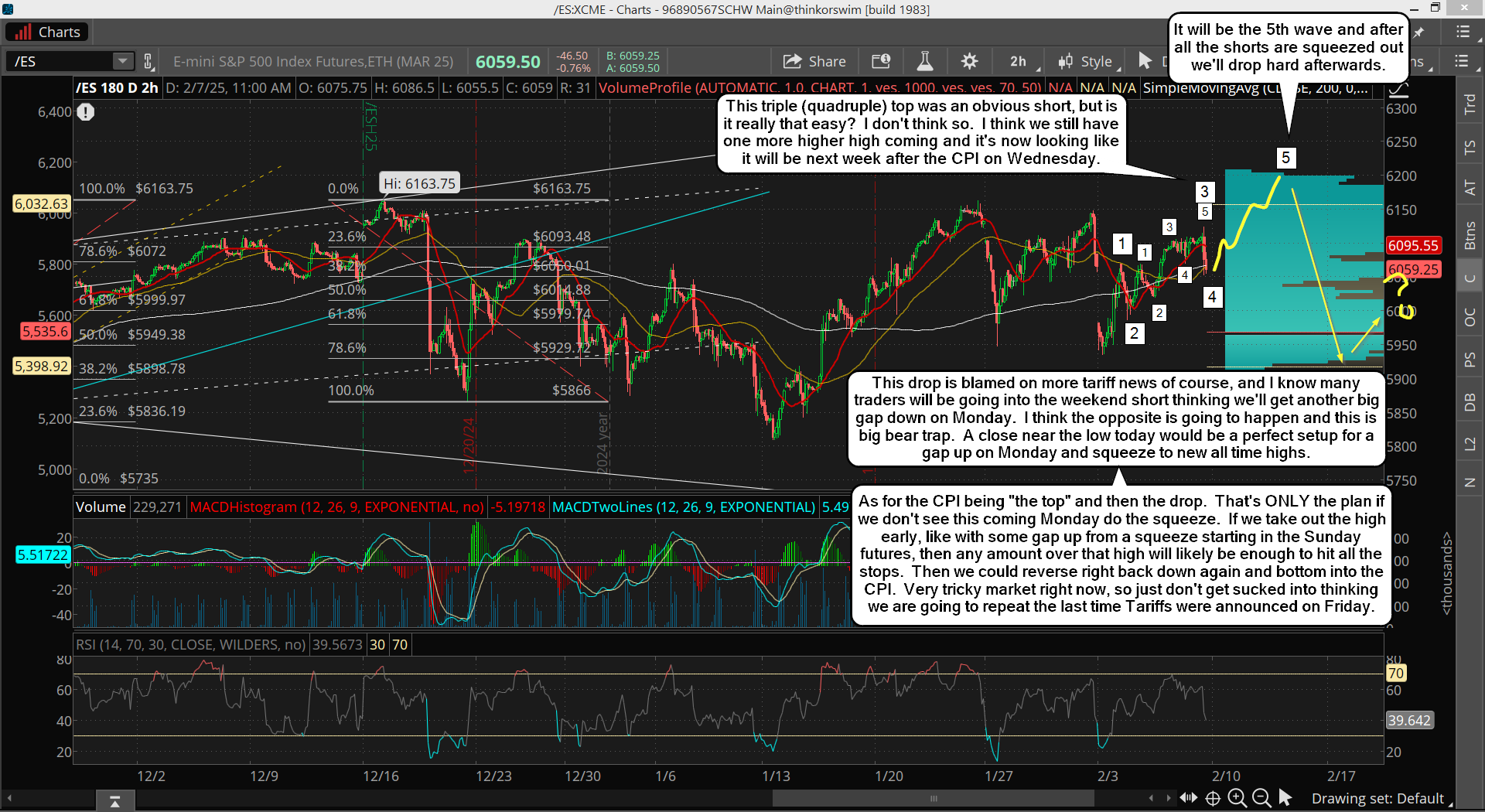

This week is quite bearish on the bigger cycles, which means decline should be fast and scary, but short lived. It should start Monday and can last as long as this Thursday, but might also end Wednesday after a flush out bottom it put in from a bad CPI number. Then it's back up again in a grind for a week or two before another drop late month into early March. As for the coming low, it could pierce the 5900 level to get close to the 1/13/25 low, but I think it's going to stay above it and not take it out.

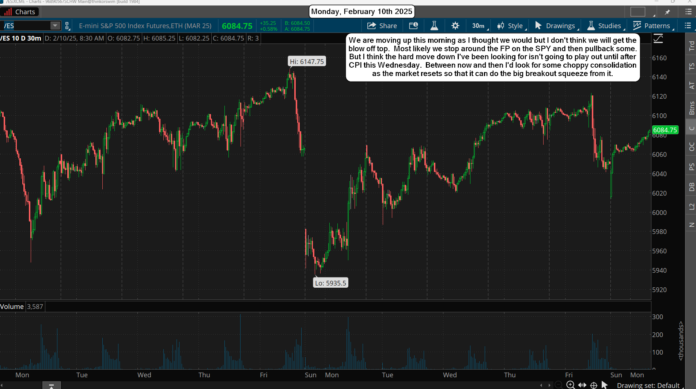

That's yet to be known for sure but I do think it takes out the recent double bottoms from 1/27 and 2/3. As for the short term, I posted a chart on X Friday showing a possible path, which points to one more move up to complete a wave 5, and that might happen today, hard to say?

With CPI out this Wednesday I'm thinking we are going to go into it with a low as I already said, so the move up today to a new high might not play out. I'll just say that if we do make a higher high today it's a short with an exit either into the CPI or after it.

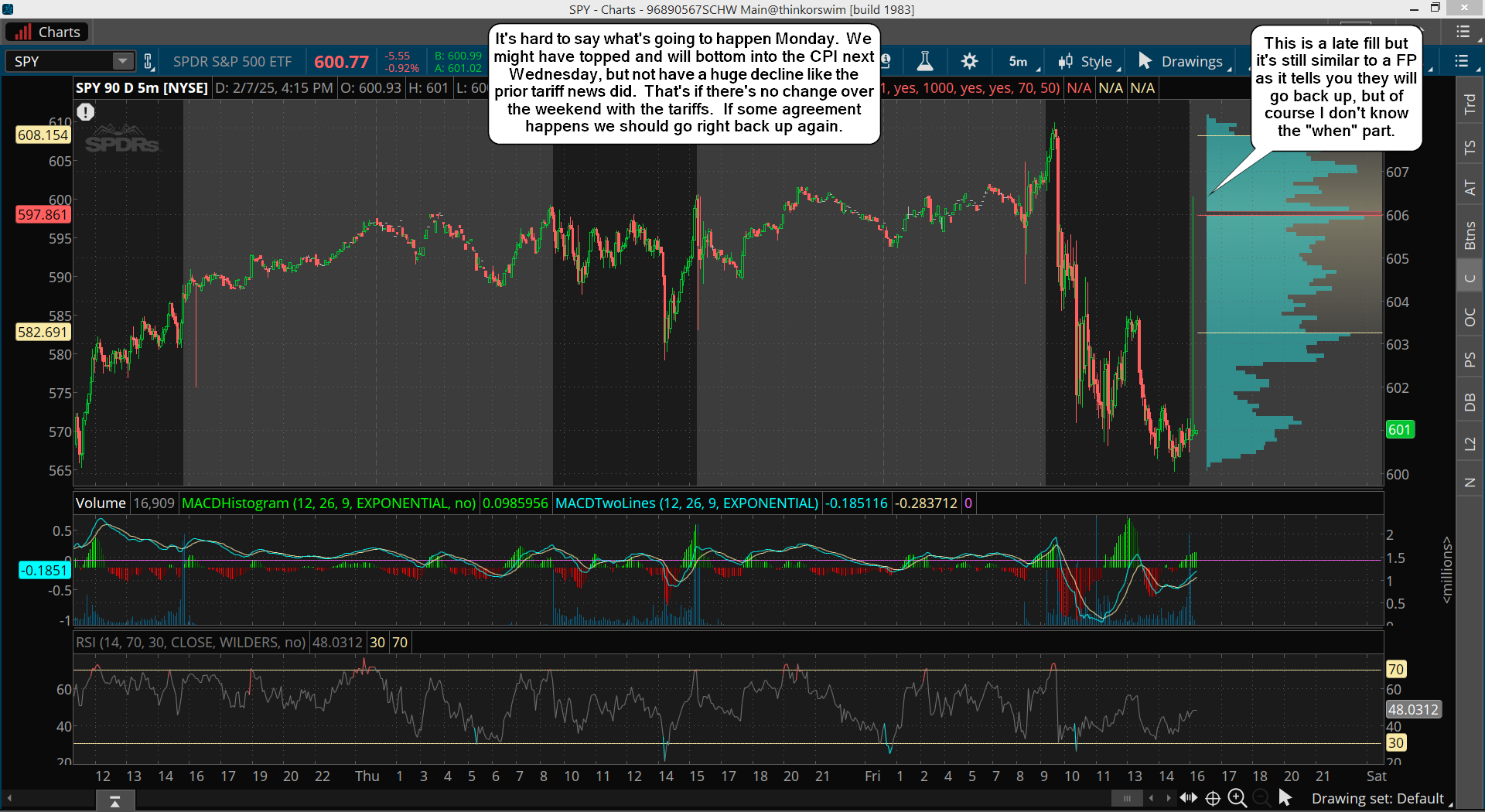

I also posted another chart on X of a possible Fake Print, which might be the target to get hit on any rally up today? Here's that chart...

If it is hit though it's only a lower high, but that might be all we get? It will still be a short in my opinion. But it will be a weaker short as without those stops take out above the all time high there's going to be too many bears below, which will limit any decline. I'd then lean toward the 2/2 low of 5936 ES "not" getting taken out and a higher low happening into the CPI (most likely), and a surprise "good number" sparks a rally back up again. More up's and down's that go nowhere to frustrate bulls and bears alike, as both are looking for a trend move, but that might be months away?

Have a blessed day.