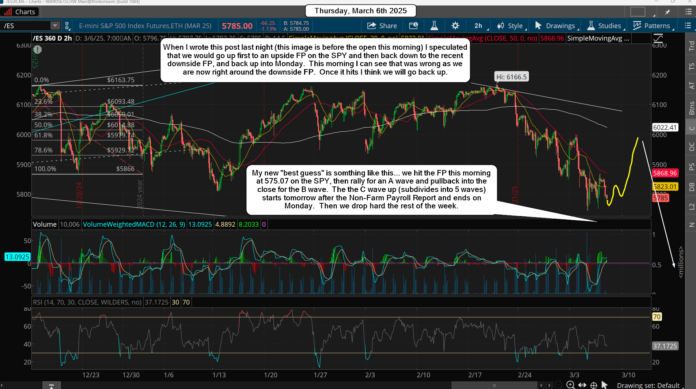

Down early in the day and rally into late in the day repeated again yesterday as the market carves our a short term bottom before another move down. There was another FP on the SPY of 575.07 around 1:26 pm EST yesterday, which leads me to think we are in for some wild swings in both directions before we drop hard again. As I posted yesterday about the various upside FP's on the SPY I think we will see them hit and the downside one too. I just don't know the order at which this happens?

My best guess is that we go up to the 587.96 or 589.07 FP first (like today maybe?) and then down to the new 575.07 FP (Friday after Non-Farm Payroll?), followed by one last rally up into Monday to hit the highest FP at 594.22 on the SPY. That's a bunch of wild swings but keep in mind that the market loves to trick and trap both sides before another large trend move, which should be down hard into the end of next week.

I'm not interested in going against the trend, which is down right now of course. I'm more interested in shorting the rips to the FP's as I think we will see the 5500-5600 level hit on the next big drop. So, if we rally up today to at least the 587.96 FP I think it's a short to the 575.07 new FP, and from there we could (should) see another move up (how high I don't know?) which might go up to one of the higher FP's into Monday?

Hard too know for sure on that one, but if that happens it's another chance to short in my humble opinion. It's not easy when the market is in one of these modes but the next drop, which should start next week, is going to wipe out a ton of bulls.

Have a blessed day.