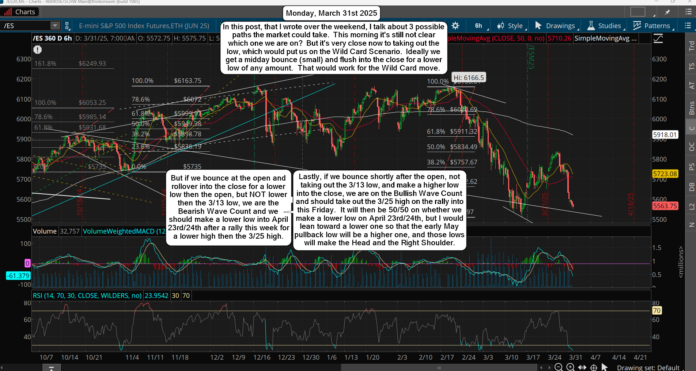

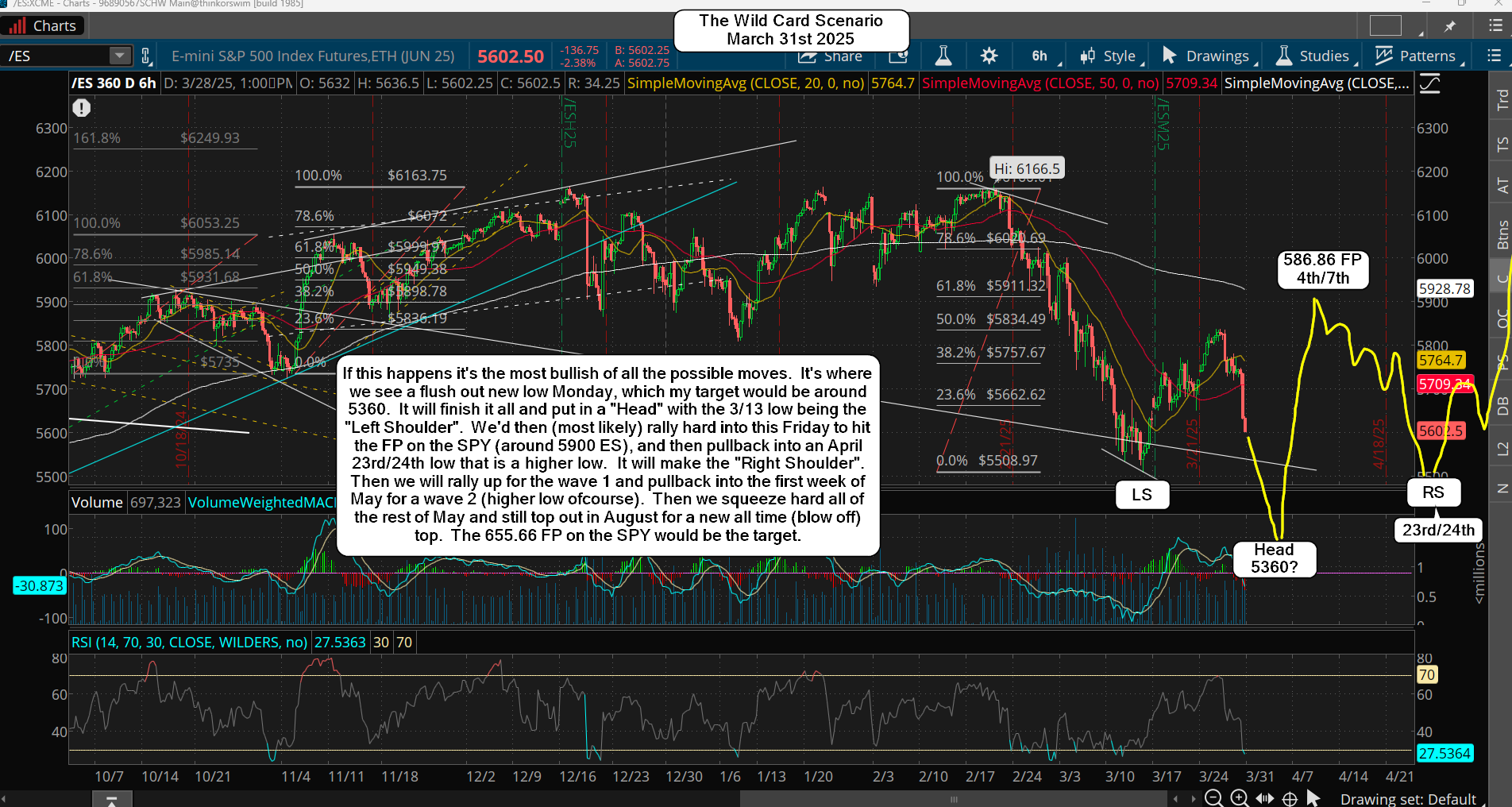

The market broken down Friday and went deeper then I expected. I was gone all day so I couldn't post, and I was expecting more of a pullback, but not that deep. This has likely changed the wave count a little but that's not known for certain just yet, so I'll cover both scenario's. Let's go over the more bullish counts first. With it we had an ABC up from the from the 3/13 low that ended the A wave with the 3/25 high of 5835, which had a smaller A, B and C inside it. Normally A waves have 5 waves inside them but this one only had 3... which then means the drop from that low into Friday was a B, and that leaves a C wave up still left, which should go to the 586.86 FP on the SPY (roughly 5900 ES). Below is that chart...

The Bullish Wave Count...

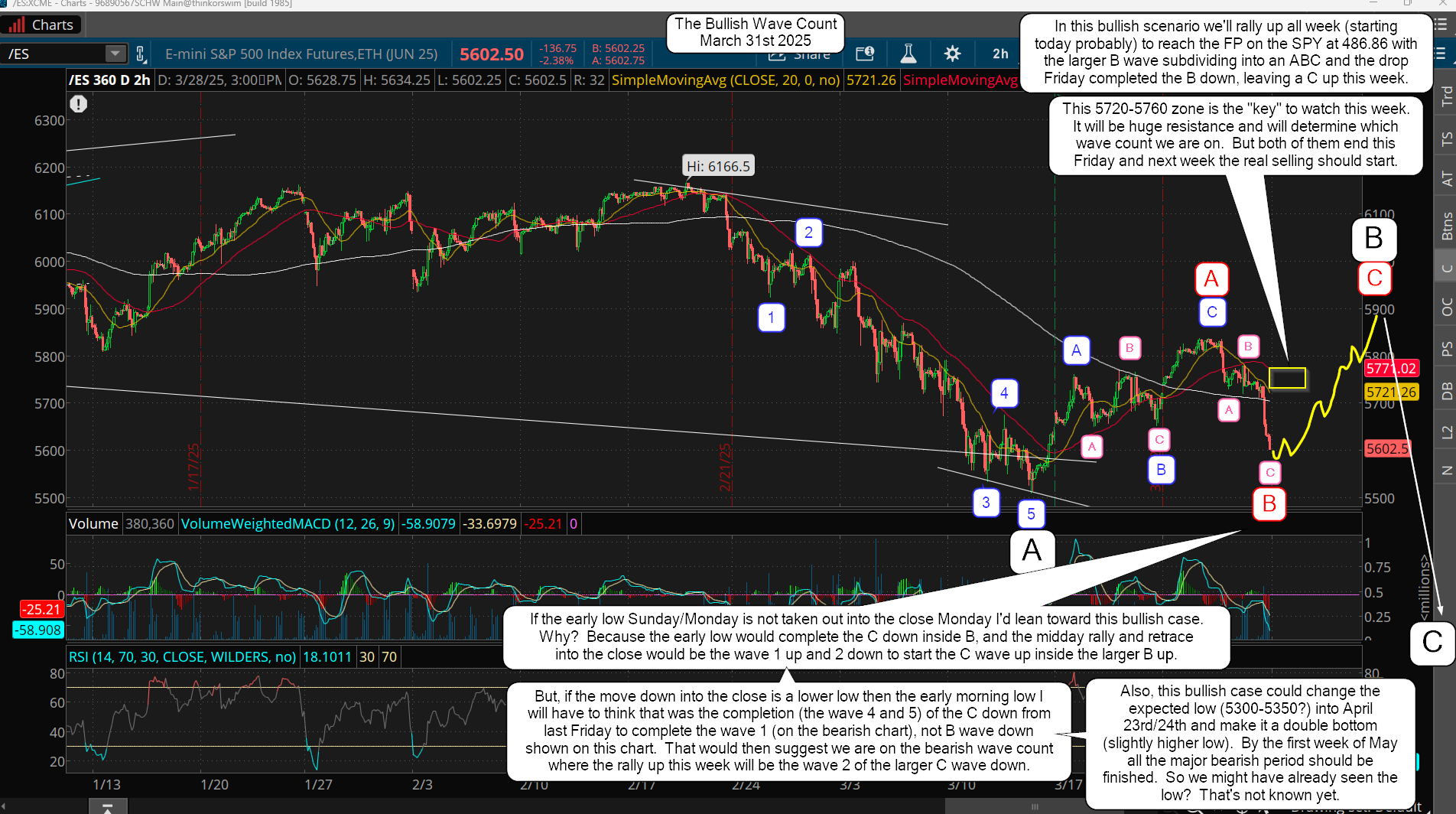

Next is the bearish case. This is where the same ABC up happened into the 5835 top, but that ends the ABC as it doesn't subdivide in this case but finish the B wave right there. Whereas in the bullish case that same B wave hasn't ended as there's still a C sub-wave still to come this week (the rally to the FP), and then the B wave ends and the C wave down starts. But in this bearish case the C wave down has already started and we did the wave 3 inside that C on Friday, leaving the 4 and 5 yet to complete (today probably).

In this case we'd still see a rally this week but it will be a lower high. Basically, the rally would get stopped in the 5720-5760 zone (roughly). In this case I think we'd see an ABC up into this Friday to complete this move.

For example... if we finish the wave 4 and 5 down today, which completes the wave 1 down inside wave C, we could see a strong A wave up on Tuesday (into early Wednesday), then pullback (half?) on Wednesday (into Thursday) for the B wave, and finally a C wave up into the close on Friday to end the wave 2 up. Then next week for the nasty wave 3 inside C down, and that wave will unfold in 5 waves too, then a 4 bounce and a 5 down to finish the C, which will end it all from the all time high on 2/19... and that could be right into the 23rd/24th of April. Here's that chart...

The Bearish Wave Count...

If Friday would have held the 5700 zone of support and NOT taken the 5651 low on 3/21 I'd say odds are good that we'd see the C wave up to the FP on the SPY to complete the B wave (again, into this Friday), and then we'd start the C wave down. But that's looking less likely to play out now (unless the wild card scenario happens).

In fact, the first rally up (Tuesday/Wednesday) will run into resistance around that 3/21 low (and 3/18 low). That could be the A wave inside a wave 2 up (again, the bearish case), and the pullback will get the bears fully loaded but it should not take out the expected low put in Monday, which will be a B wave.

Then a C wave up into this Friday to complete the wave 2 should take out those double bottoms and reach the 5720-5760 zone. That will make everyone all bulled up again looking for a breakout next week. But if this wave count is right next week will be a blood bath as it will be a wave 3 inside a C wave down. For today, I'm looking for the wave 4 bounce and wave 5 down to complete the wave 1 inside C down (for this scenario).

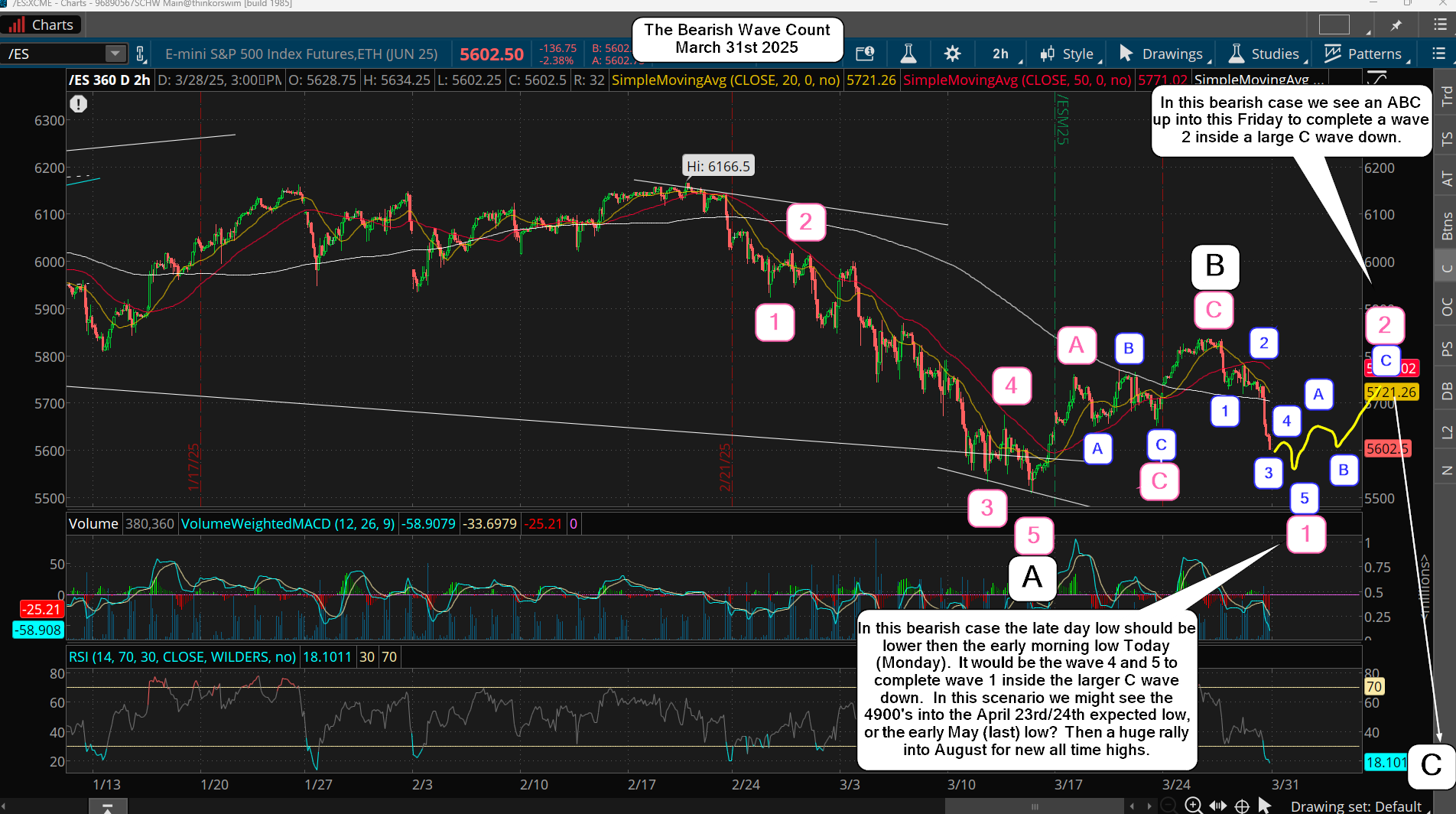

The Wild Card Scenario...

Remember that I write my posts for the next trading day after the close of the current day (and over the weekend for Monday posts), so I never know how the open is going to be. ONLY the feature image is done the morning of the current trading day.

This wild card move would be the most bullish as it get the low put in now so it's done, finished, kaput. It won't make a lower low into the April 23rd/24th period but a higher one. I personally would love to see it as it's the easiest to trade I think. Why? Because if we flush out now we get all the bulls out and nothing be bears left, who will short the entire move up, which should squeeze all the way to the FP on the SPY of 486.86 into this Friday (possibly Monday the 7th).

Then the move down into the 23rd/24th will be hard to trade as there will be a ton of new bears looking for the C wave to 4900 (or wherever). So it will be a choppy one with many fast drops and fast squeezes back up to shake out both sides. It will be an ABC move of course, and probably a larger degree wave 2, whereas the rally to the 486.86 FP will be the wave 1 up.

This is my favorite scenario. Will it play out? Only time will time. Due note that in both the bullish and bearish wave counts the low is not taken out now. By not doing it now it suggests it will happen in late April. But if we get the flush out today then I think the lows will be in and we won't see 4900 or any other crazy target until late this year during the expected crash.

Keep in the common pattern for the market to revisit a prior years' high whenever it's a bearish year. I think we'll see the 4808 high from 2022 hit this year in the fall. If we top at 6500+ that's going to be one very large drop, but again, it's a very common pattern to this this happen. And, by the time we get to August I think the 200 week SMA on the Weekly chart will (ironically) be around that level. It's at 4684.14 today.

Have a blessed day.

It is a double bottom on the SP500 but we closed positive. That would vary from certain historical instances of a first wave bottom. I think we are following the 2000 scenario and we probably get a flash crash scenario like the first two trading days of April 2000 over the next two days. Maybe we completely erase todays bar on Tuesday with the hard plunge on Wednesday (to the 100 week average on SP and Nasdaq). Then a big bounce into the end of the week.

The daily Bollinger Bands need to reset. The market touched the weekly Bollinger Band this week today so it’s still in hugging mode. We would need a couple of negative days to align with 2000 via a certain indicator and get it’s offspring into a more sinister location (with attendant mega sells).

We’re also in Mercury Retrograde so the fierce selling should be taking place in this period. I don’t like early April numerologically speaking but we’ll see how the markets take us.

The market has to establish its opening monthly range for the first several days of the month so it really shouldn’t go anywhere anyway.