Time is running out for the bulls as the 22nd/23rd is the turn window where the top should happen. Then we should rollover again with next week being the most bearish. Again, I don't have a clue on how low we could go as while I'm only looking for a double bottom there are others (who are quite good) that are looking for a crash like move, which they have targets from 3000-4100, but anything that big would certainly look and feel like a crash. I'm just looking for 4700-4800, but I'm certainly open to something bigger, which I'm sure there will be some kind of "event" to blame it on. What that is... I don't know?

But... I think there's more upside coming first. I still think we get some kind of squeeze first to take out the stops on the bears. Anywhere from 4600-4800 would be the zone I would be looking for as that would get everyone bullish again. Give me that rally and I'm a bear again. And it should happen this week. While the turn window is just that "a window", it's not an exact science, but it should be close.

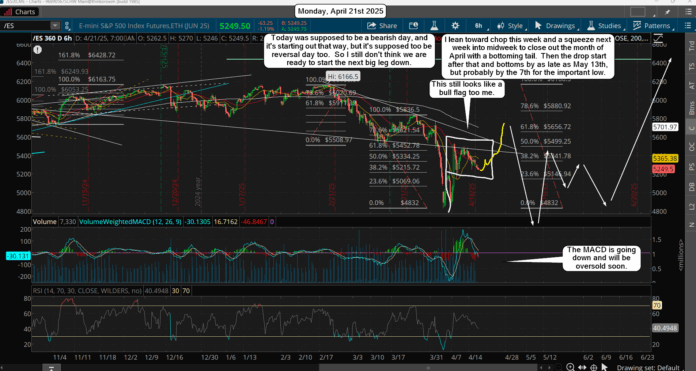

Next week the 29th/30th are where a bounce can happen for another top of some kind. I'm thinking we get the squeeze early this week to complete the B wave, then we drop some into this Friday for the wave 1 of the bigger C wave down (or 5th wave?). Then next week, into the 30th (most likely, due to the importance of closing the month out with some kind of bottoming tail), we get the wave 2 bounce. Then from the 1st of May, into as late as the 13th, we get the entire drop for the larger C wave (or 5th wave?).

My thoughts are that if we do NOT get the squeeze then we'll drop in a 5th wave, but if we get the rally to 5600-5800 then it's a larger B wave up, not wave 4... therefore the next big drop will be a C wave, not a wave 5.

Next week is going to be super crazy I think as if we get a top this week (the squeeze) then early next week we should see the wave 2 up bounce for the C down, and that rally could fool many into thinking all is good because it might retrace 80-90% of the drop for the wave 1? If so, not many will see the wave 3 down late next week inside the C wave. I lean toward the 30th closing out above the current low by some decent amount, like 5200+ roughly, but again... it could reach 5500, 5600 or more? Then the wave 3 down starts on the 1st of May.

The bottom line here is that: 1: we need a squeeze to 5600-5800, 2: this week is when it should happen, but not a guarantee, 3: a wave 1 down inside a C wave should follow into the end of the week ("if" we get the squeeze?), 4: a bounce for a wave 2 should top into the 29th/30th (again... if we top this week), and 5: the biggest drop should start around May 1st, which will be the larger C wave.

One wild card is that the two periods where a top could happen (22nd/23rd or 29th/30th) could flip... meaning we could see the high on the second date, not the first. While I'm lending (actually, just wishing and hoping) to get the high this week, I could be totally off and we just chop this week and hit the upside target zone next week. Patience is the key here as I'm just not ready to short until I see a final squeeze first to take out the bears.

Last, just something to note... there's an FOMC meeting on May 6th-7th, which could be a bottom? And the Legatus Jubilee ends on May 2nd, so while this could chop around into as late as the 13th of May I think the lowest low could be between the 2nd to 7th, with just a retest of that low the following week.

Have a blessed day.

They are setting up that box and handle pattern. We’ll know by tomorrow.

I would look for a high on the 24th. 90 degrees ago on

January 24th was a major high.

It could be the 25th. We had the premeltdown high on March 25. But astrology gets aggressively warlike by then.

I’d love to see a squeeze into this Friday. If we do I think we could hit 5700, and that should be enough to take out the shorts. A dream would be to the 586.86 FP on the SPY but I don’t think it can get that high.

I’m going to push my denouement date back. We could get a rally into next week. Your targets could then get hit. Some technical indicators are saying that the rally is still early.

There is a date that works with the 1947 pre ritual and it’s the return to Pearl Harbor day.

We have the jobs number tomorrow, so it’s possible that they use it to breakout and do the squeeze? If not, then I’d say it will top next Mon/Tues

Geccko,

I had to turn on a reCAPTCHA to stop all the spam comments, which wordpress caught them and kept them in a draft mode where you didn’t see them, but on my end I did. Every time I logged in I’d see 5-10 spam messages that I’d have to delete and block. It’s a pain in the butt. So I turned on the captcha thing but it’s not working properly. Not sure why? But you can comment by simply logging into the site as a member first and then it will allow to do so. If you need help setting up an account just let me know and I will set it up for you.

Red