This market is likely going to hold up into the end of this month and grind higher. I thought we might have topped last week but there's still too much "time" left before the bullish period turns to a bearish period. It could drag out into early October a little too, but that's about when the bullish time period (cycle) ends and the bearish coming in play. Any early pullback this week will likely be reversed as the bulls are still in control for another week and early next week. They never make this easy (shocker... LOL), but I still think we will get a nasty drop before the election. It might not even start though until the second half of October. But weakness will start to come into the market by mid-month. Let's zoom out and look at the big picture...

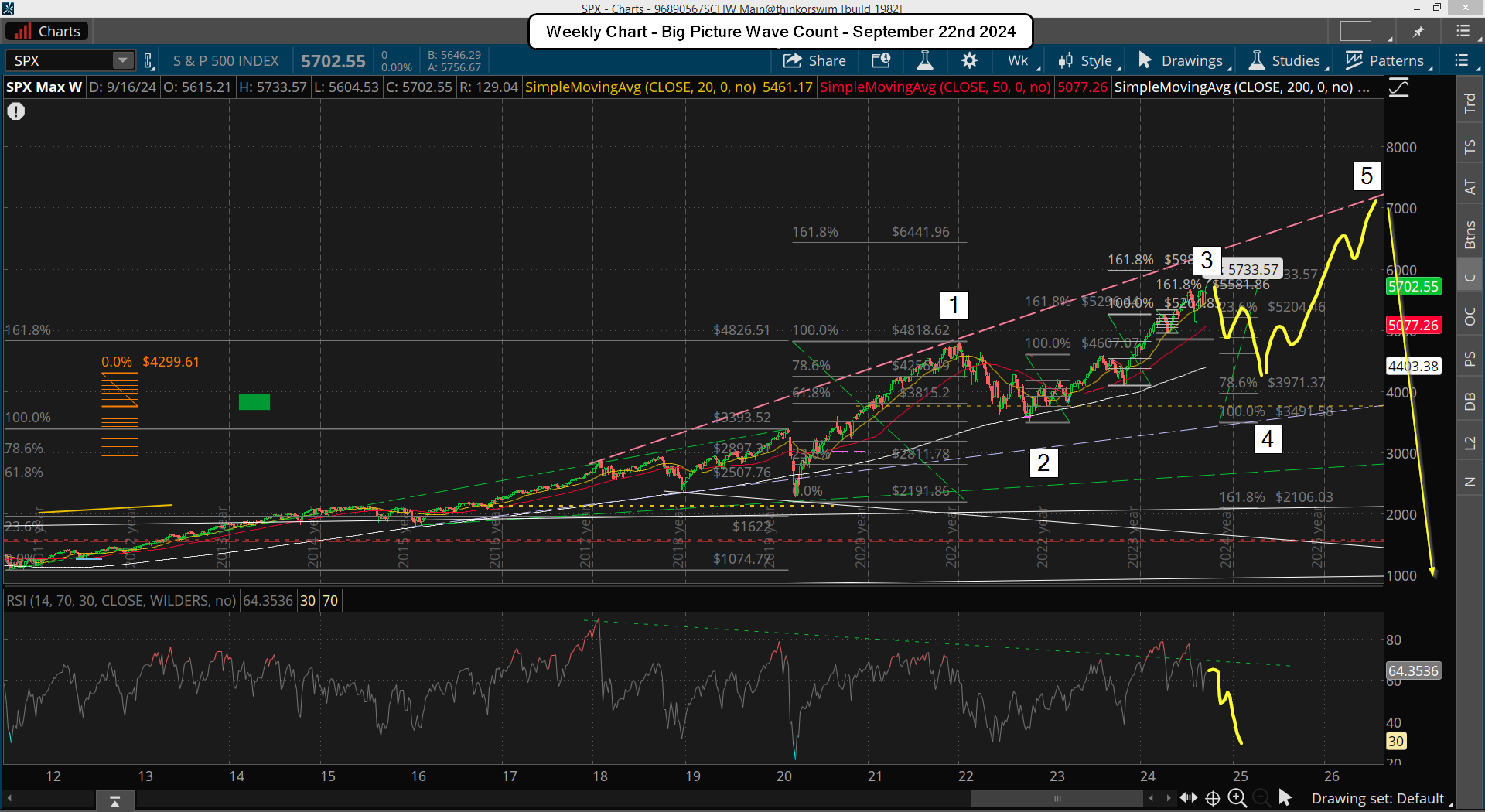

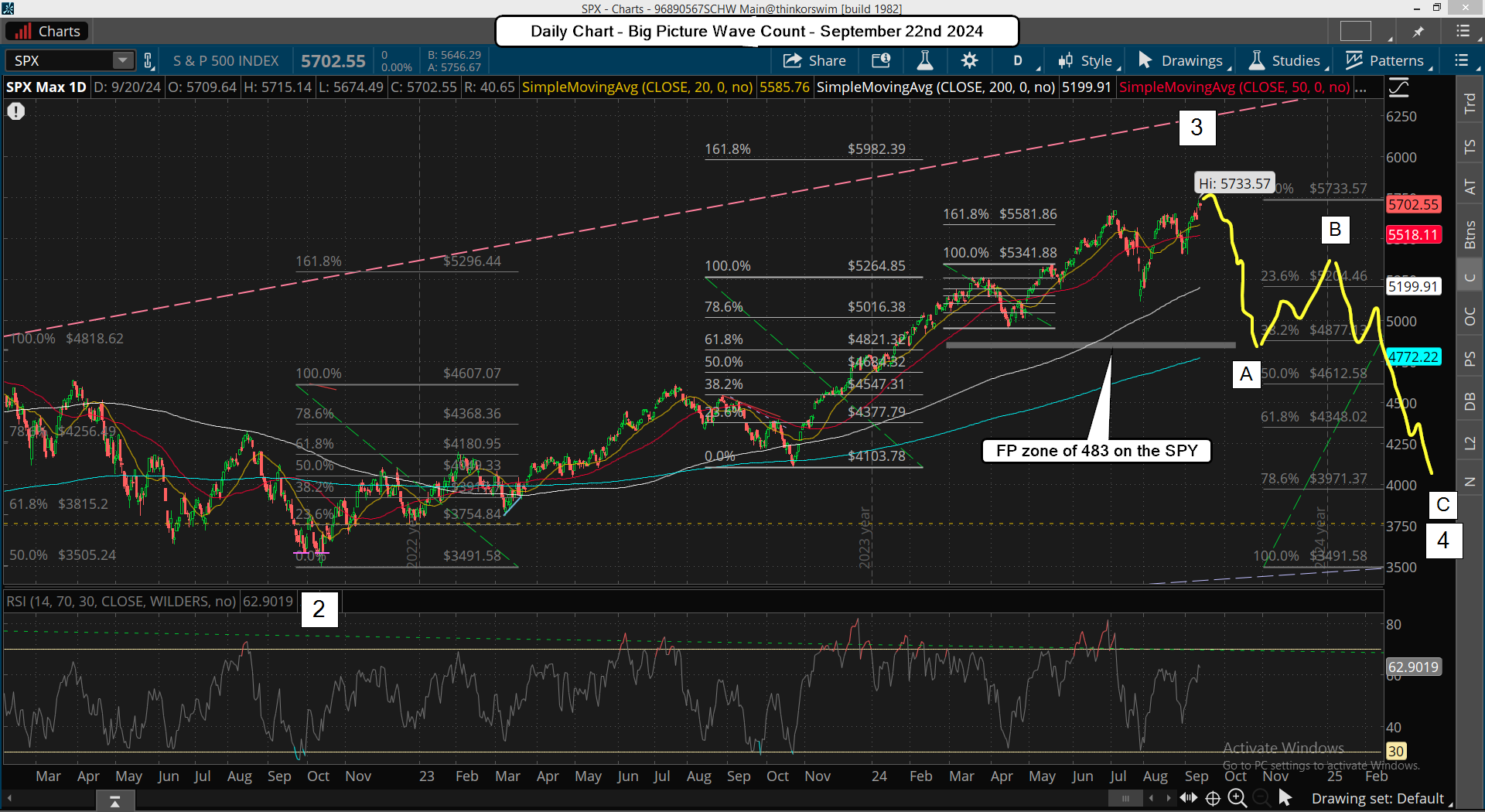

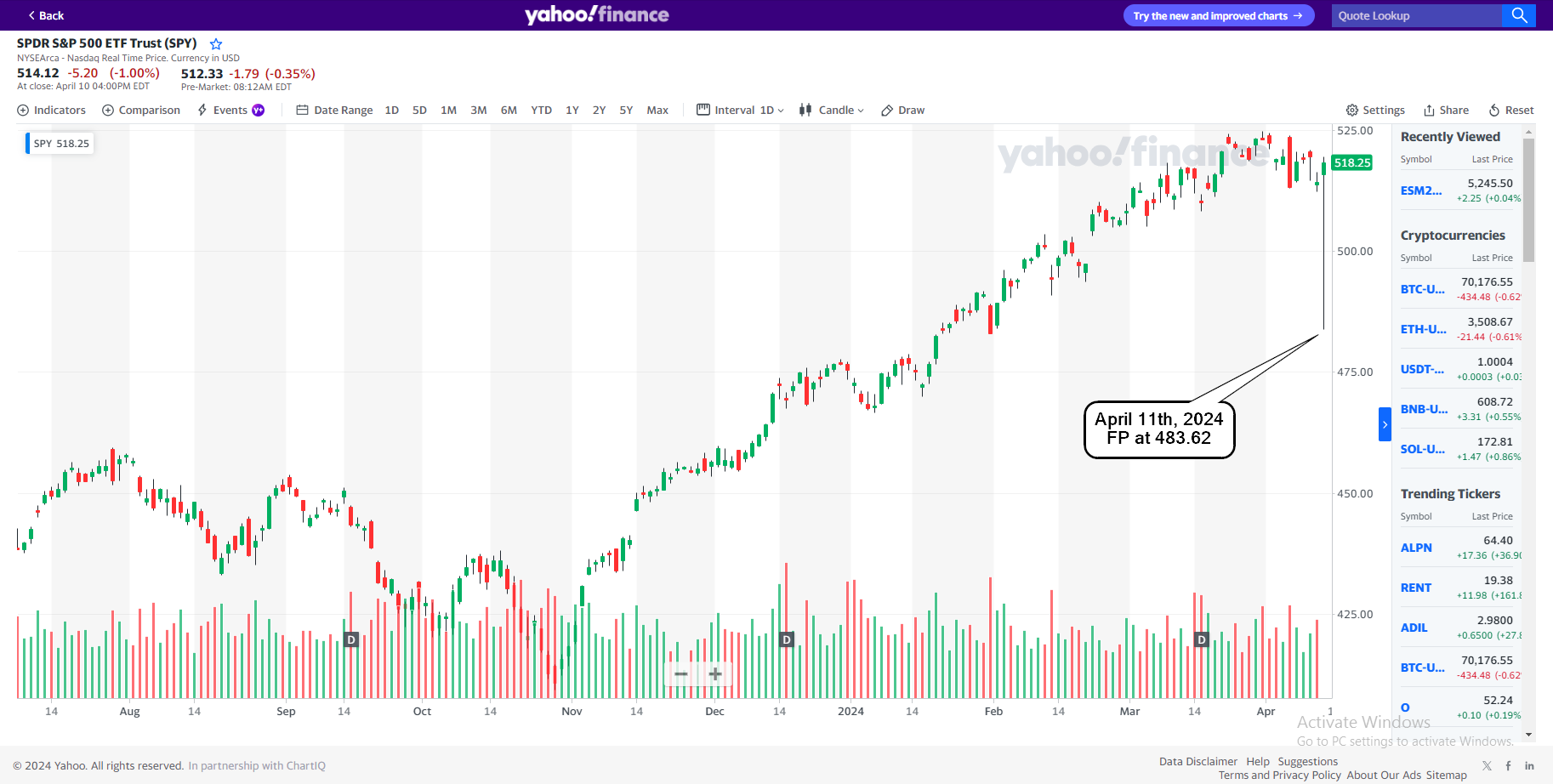

On the SPX weekly chart are my long term thought. I believe we are going to have an ABC correction into 2025 which is a wave 4 of a much larger degree with the wave 3 up starting at the 2022 low. The final high for the wave 5 should be in late 2026 or early 2027. At that point we will see another 1929 style crash. For the now though the first A wave down of the wave 4 should hit my FP from the Yahoo site back in March of this year. It's 483 on the SPY, which of course should be pierced and then I think the A wave is done. From there I think we rally up 50%+ for the B wave into the end of the year, and that will be followed by the C wave down in the first quarter of 2025. I'd look for the 200 week simple moving average to be hit and pierced but the 2022 low should NOT be taken out. My guess is at least 61.8% up to 78.6% will be the retrace low from 2022 low up to the current all time high. Now let's look at the daily chart below...

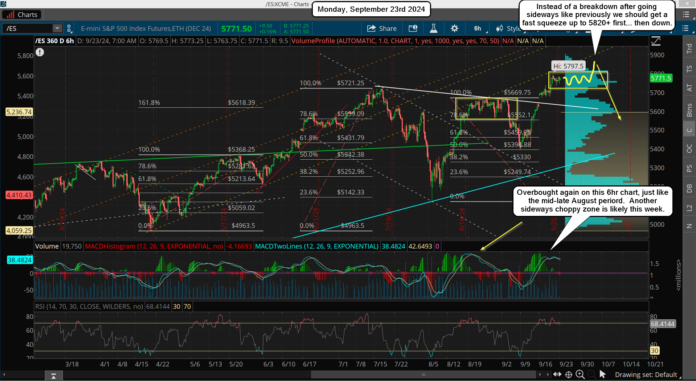

The daily chart above shows you my thoughts going into the end of this year and early 2025. For the short term this week still has a bullish bias to it, so I don't expect to see much happen but chop. We could pullback any day this week for a brief shakeout but afterwards it should go back up again. The 5800 level (and a pierce through it) on the ES is like a magnet for the bulls. We could see 5820-40 hit in a blow off move into this Friday or next Monday as the month closes out. After that we should start to see the early parts of the expected correction for the A wave start. It would be the wave 1's and 2's of course and might be tricky that first week of October. Then mid-late month is when I'd expect to see the wave 3, 4 and 5 of the A wave down take us to the 483 SPY FP.

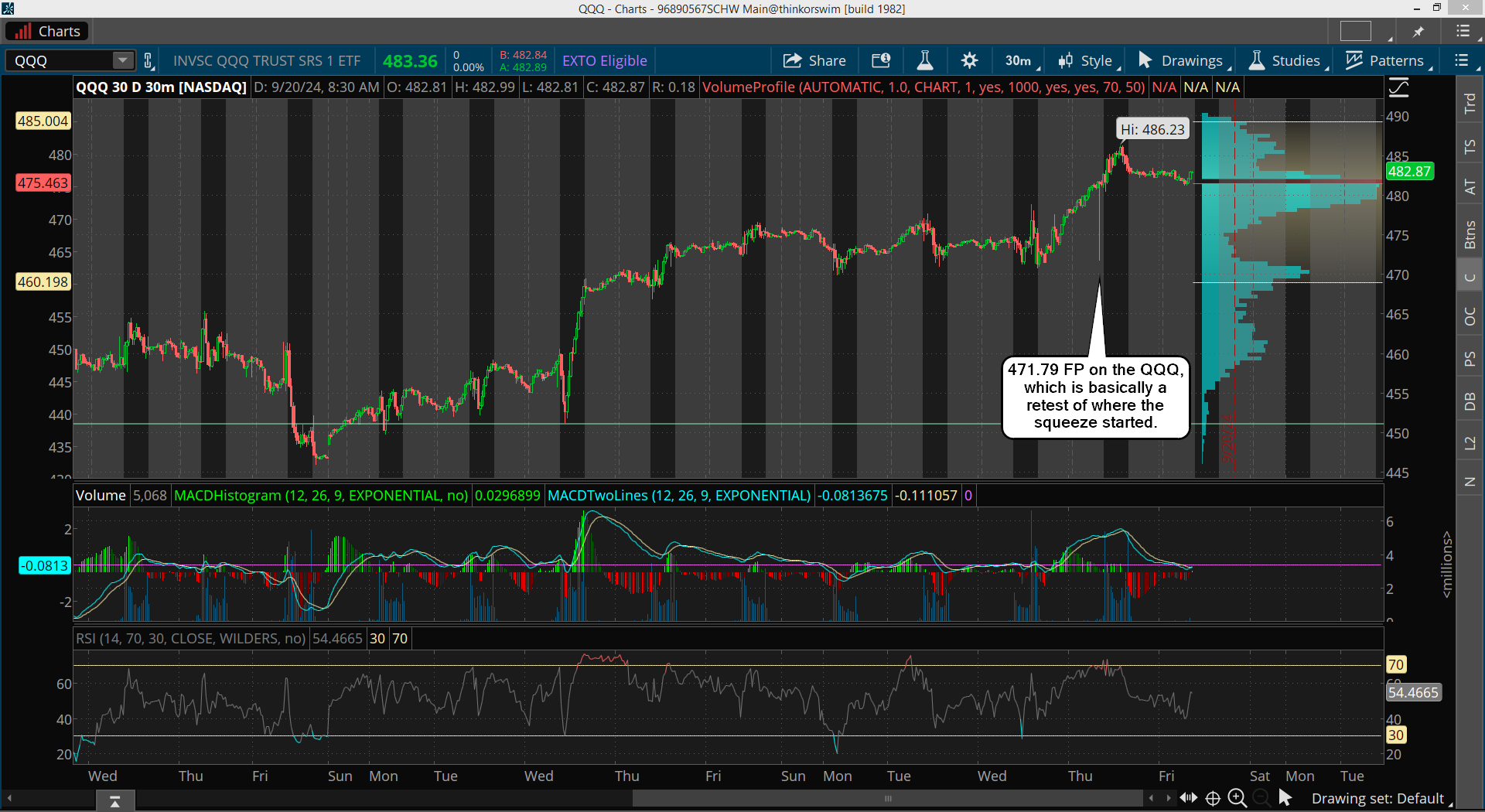

Lastly, on the very short term, there was an intraday FP on the QQQ that should be the target low for any pullback this week. That's an exit for trapped shorts I think, and I'd wait for the last squeeze to 5800+ into the end of this month before attempting to short again. Here is that FP, which is basically targeting the closing area last Wednesday.

Have a blessed day.