I don't have much to say this morning as all eyes will be focused on the election, and what the Fed does on Wednesday at the FOMC meeting. Keep in mind we probably won't have the final result the day of or day after the election as the deep state have clearly said it will take weeks to cheat, but most think Trump will win.

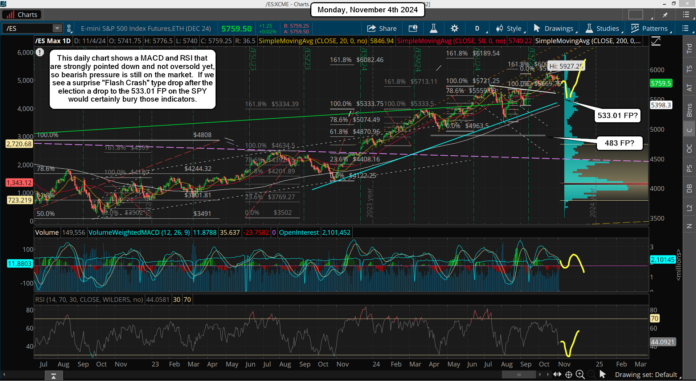

From a technical point of view the market is oversold on the short term chart and due another move up, but I don't know how high we go. In the end though we should reach 6100+ where my two FET targets are at (6082 and 6189), but we might not see it until December?

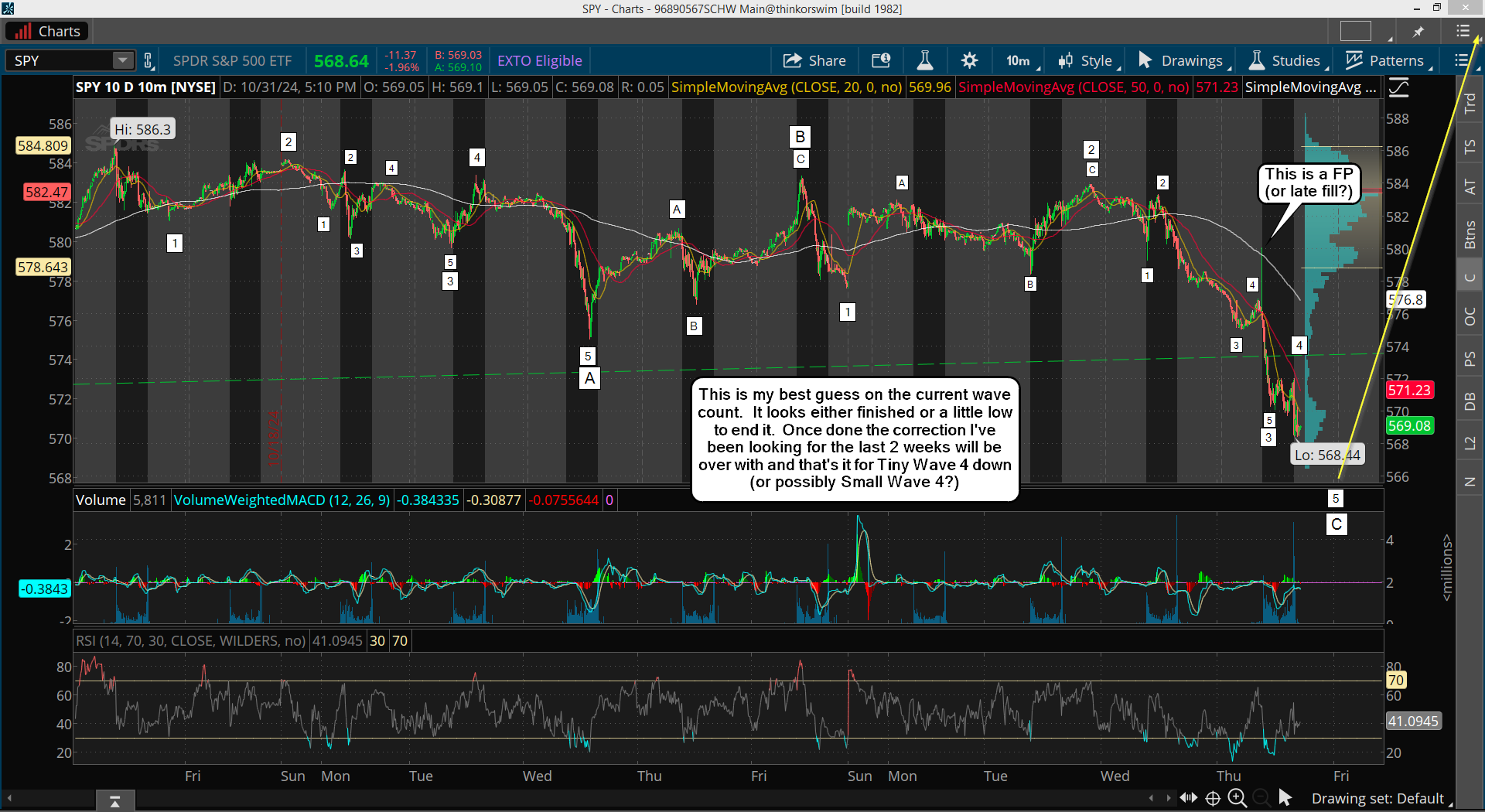

Possibly the intraday 'possibly" FP on the SPY from last Thursday at 580.01 might be the high for any move up prior to the dump? Here's that chart below, but forget the wave count as it will be wrong.

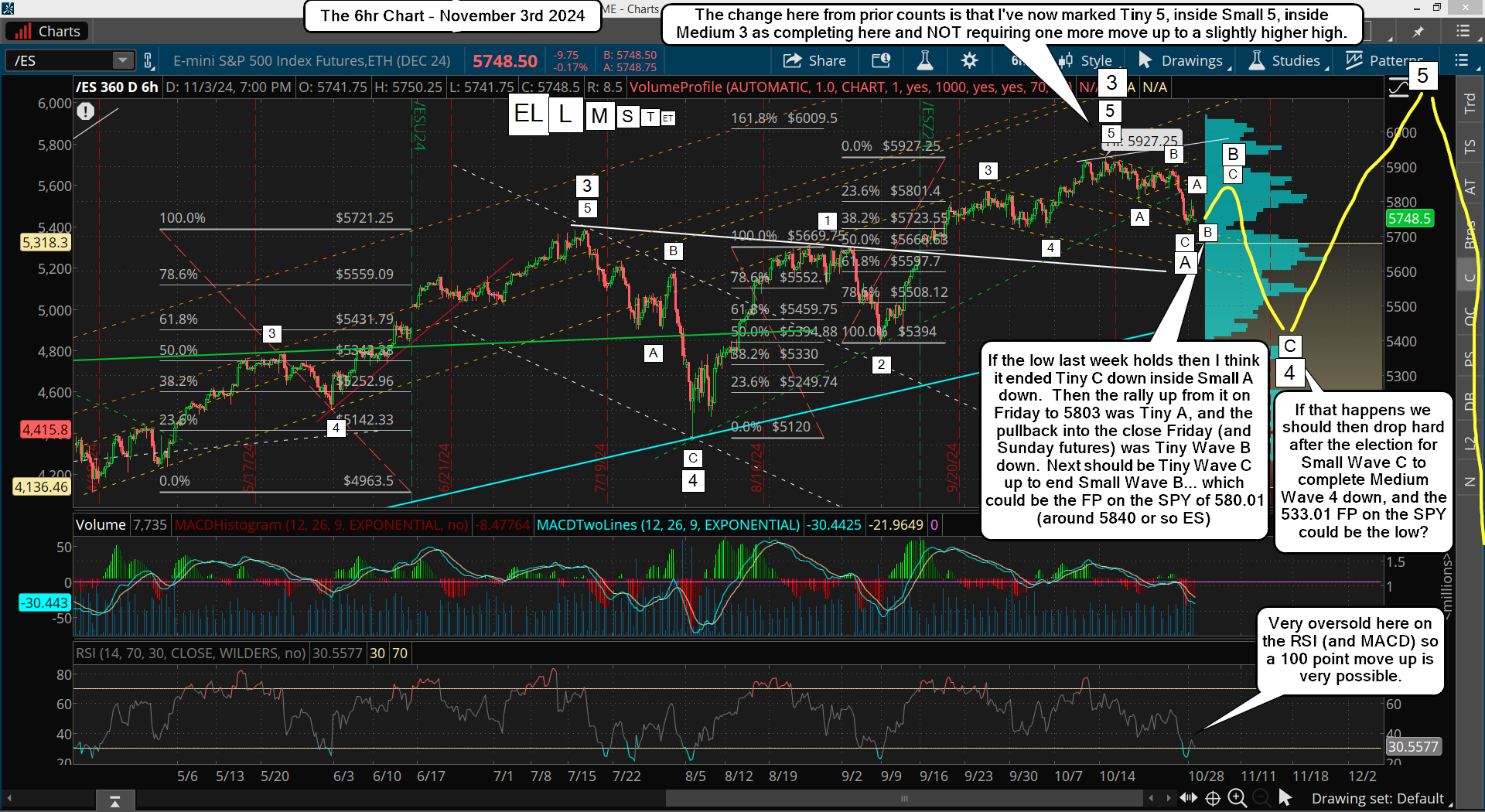

Meaning we might still make some knee jerk move up on Tuesday from early poll results showing Trump is ahead, and then start down hard Wednesday if those results aren't accepted and final. If so, I think will be going to my FP's on the SPY of 533 and 483, but I don't know which one or when. I still lean toward the 533 one though as it makes the most sense with my wave count.

As crazy as this sounds it's very possible that we don't those big upside levels until December, as that's the month that has the most bearish events in it from Astrology, and it would have everyone bullish into the end of the year looking for the Christmas rally... especially if we do a fast drop to 533 first, as everyone will think that's the low for the year we we hit a new all time high the following month.

That's kind of what happened on election day in 2016, but back then it was a one day "limit down" move that recovered by the open the next day and then the market rallied for many months afterwards, so the low was put in back then. This time around though we'll see a surprise drop in December that very few will catch.

Anyway, I'll end it here and I've covered everything already in prior posts. For the short term I think we start going up but it might have some wild moves with the unknown events this week. If we rally on Tuesday to the possibly FP on the SPY and get overbought short term I might risk a short with the thoughts that Wednesday we'll tank from not knowing who won.

Don't forget that Wednesday the Fed might lower rates again with another .50 basis points instead of the .25 that most are expecting. Combine that with no clear winner with the election and panic could set in.

And lastly here's my latest possible wave count...

Have a blessed day.