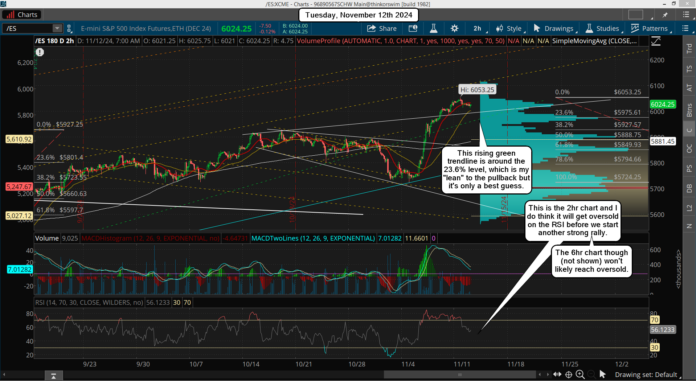

Yesterday we appear to have put in a short term high as a much overdue pullback should be starting now. I still don't know what level it's going to bottom at but the price points I'm looking for are at the 23.6% level of 5975.61, 38.2% at 5927.57 and at most, the 50% mark of 5888.75, which is close to the "possible" FP on the SPY of 483. I don't really think it will go that deep but with the CPI number out Wednesday before the open we could see some fast move down there I guess?

If it reaches it I think it's a strong buy for the last rally up into the end of this month or the first week of December. Again, I'm not leaning toward that deep of a move as that seems too far. My thoughts are that we get somewhere between 23.6% and 38.2&... like 5950 maybe? Something like that... a move below 5975 but not below 5900.

My focus will be on the RSI on the 2hr and 6hr chart and not so much about the points. I'm also going to be focused on whether or not we get a decent move down today, in front of the CPI, which then might put in a bottom and cause a move back up from the CPI. Or, if we don't pullback very much I'll have to think the CPI will cause a deeper pullback, but it should be fast and short lived.

It's more of a "feel" as I watch the RSI, which I think the 2hr chart will have it get oversold, but probably not on the 6hr chart. Whichever way it plays out the next move up should be a wave 3 of some degree with the pullback being a wave 2 and the wave 1 up being the rally after the election.

I will also add that "if" there is a really fast drop, and fast rally back up, it's likely a bull trap as too fast of a move in both directions. It would suggest an ABC move is in play and another drop to shake out those bulls (a C wave) will probably happen. Then we do the face ripper rally to the FET into the end of this month.

Have a blessed day.