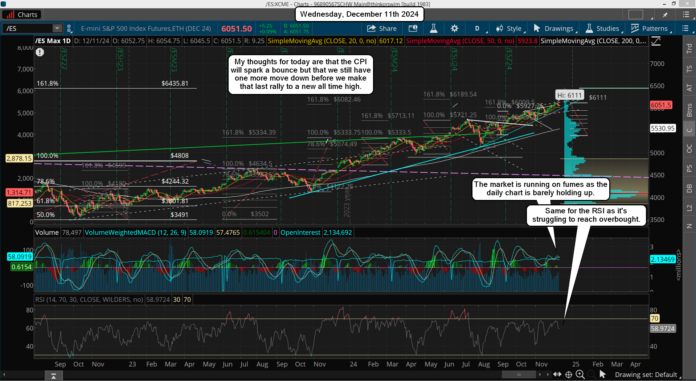

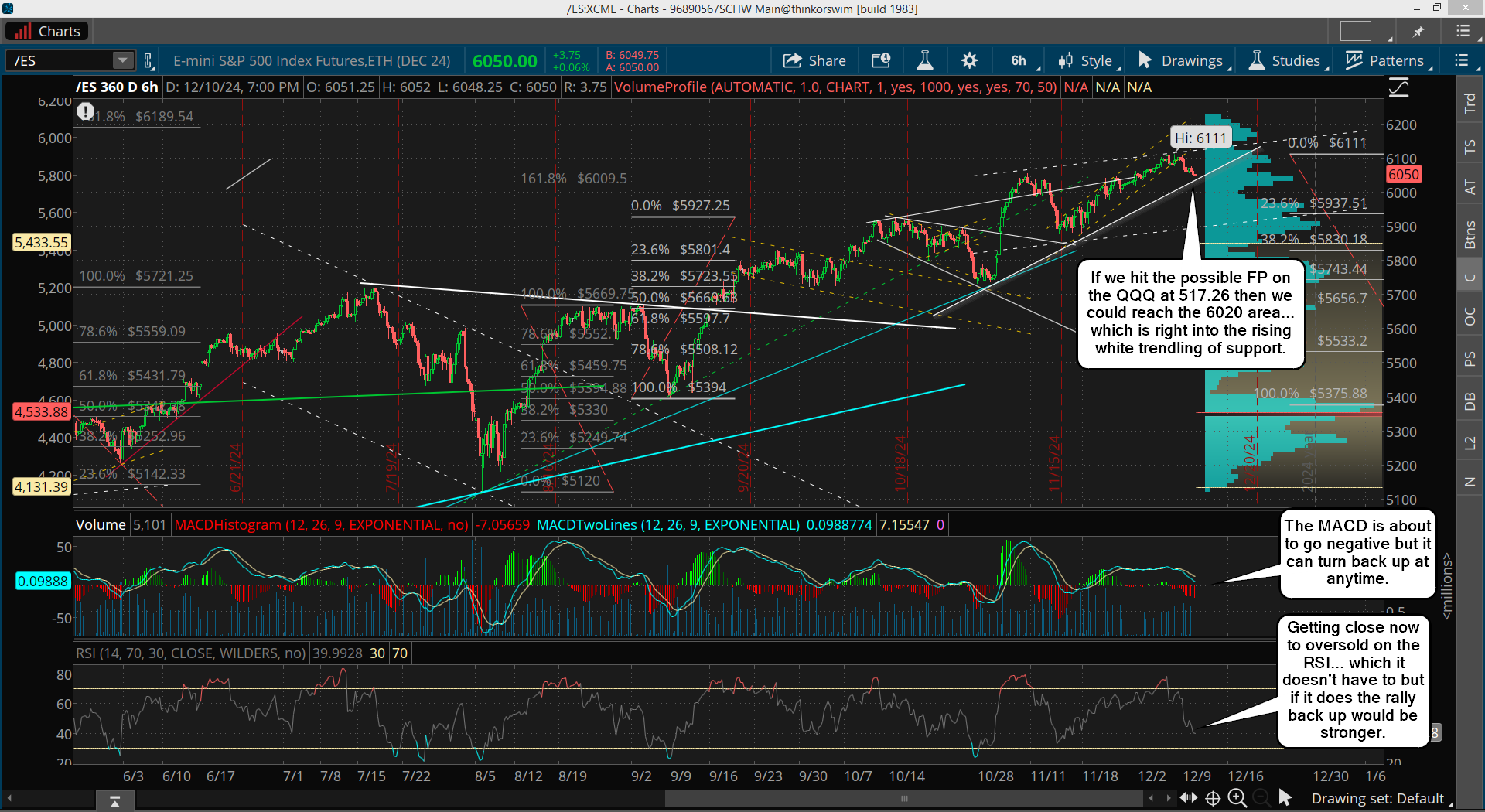

On the short term the market is close now to getting oversold on the RSI for the 6hr chart, which if we just look at it we should be bottoming soon. Now the daily is no where near done as it's pointing down but up near the top range on its' RSI... however, it could turn back up if the 6hr gets oversold enough and turns. The MACD is similar as well and could bottom today if we go lower.

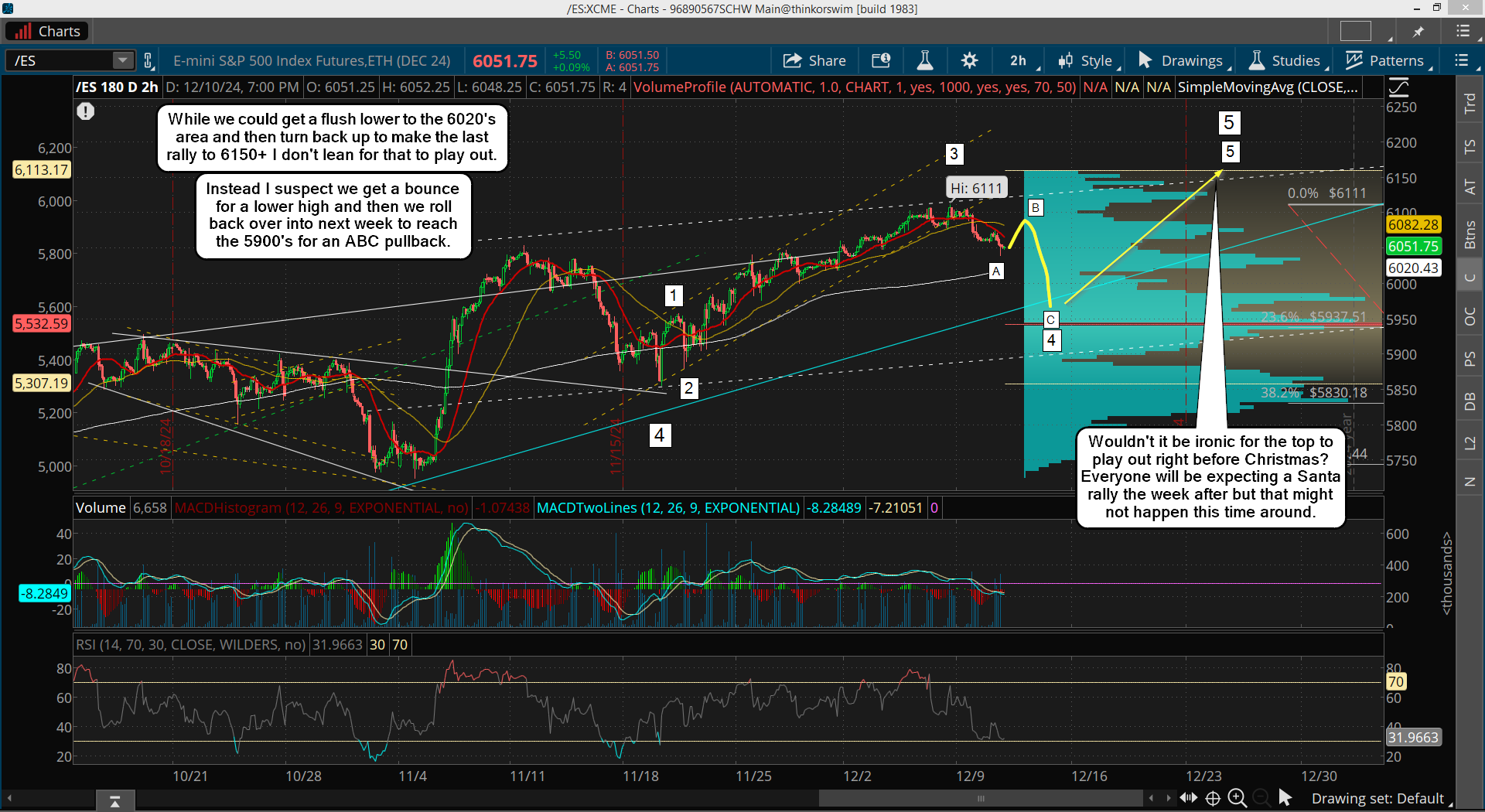

The CPI is out before the open so we could get a flush out lower to get oversold, or we could bounce from it and delay the RSI from reaching oversold and push it out into the future a few days from now. I'd then call the pullback an ABC move as I doubt if the CPI can be viewed so positive that it will just race off to 6150+, but I guess anything is possible?

I lean toward a little more downside to get nice and oversold on the RSI so that the squeeze back up can be stronger and therefore reach the 6150+ target... but I just don't think 6020-6030 will be enough. I think we need to go lower then that, which would suggest we get a move up after the CPI to stop the RSI from reaching oversold. Then another move down later (next week) into the low 5900's. Basically an ABC move, not a one wave decline. Below is that chart...

This is all based on the technicals of course and excludes anything crazy happening that shocks the market. I can see market rotation right now as Telsa was up nicely yesterday with the ES/SPX down, so it doesn't seem likely that the market has topped out yet, but I don't think the pullback is finished either.

While I'm still on guard for something happening to shock the market and cause the big drop to the FP on the SPY this current move down since Monday is not suggesting that "this" is it. The technicals suggest we will go back up soon but we might not reach another new high yet and still have one more move lower into OPEX or even drag it out into Christmas?

Have a blessed day.

We’re getting closer to a top. Nasdaq is on a different wavelength. My exhaustion indicator hasn’t triggered for the Nasdaq. It kept running in 2007 after the other indices topped.

Interest rates are going to start their next run higher. Homebuilders are tanking.

The cataclysm might be put off until the summer. I saw a trailer for the zombie apocalypse flick sequel 28 Years Later and it is being released next summer. It seems like some nice predictive topping sign indication. That doesn’t mean that the market isn’t topping soon.

The first two 28 Days Later franchise flicks came out in 2001,2007. Bear market years. I think the first one came out around 9-11 or was filmed around that time. The key warlike astrological configuration will be achieved next summer.

The advance decline line is now rolling over. We probably need a correction that is followed by a final high that isn’t confirmed by the advance decline line.

It doesn’t look like it’s going to be much of a pullback but I still think we get one before the finally rally up.