We finally got the breakout late in the afterhour yesterday from the chop range we have been in for several days. As I said yesterday we have several news events coming up and any of them can give us the blow off top.

This morning we have the Jobless Claims, which could cause it? I do think we get a move up from it, but I don't know if it has enough to break through overhead resistance from the multiple tops we have. Plus there's a FP on the SPY afterhours yesterday pointing down to the chop zone, which is at 602.00, but that could also be a late fill and not a real fake print target.

However, the technicals will get overbought on the 2hr chart if we gap up and hit a quadruple top around the 6100-6120 zone. The 6hr chart isn't overbought though and it could push up more and allow the market to breakout. It's a flip of coin here as I don't know if it has enough strength to do it or not? I guess if the jobs number is super great then anything is possible. If we get past 6144 on the ES we could see a squeeze happen and we should run up to a new all time high to my target of 6235-6245.

But that's a big "if" as I just don't see it in the technicals or prior patterns. There is the 6163, 6162 and 6144 prior highs that will all be taken out in one big squeeze once the lowest one gives way. Prior patterns doesn't suggest it will happen today from the Jobs Number but if it does that's great as I'll be ready to short it. Odds though lean toward a gap up today to 6100-6120 and then a pullback to retest the breakout zone from the chop of the last several days.

And we have the possible FP on the SPY that would be the target. If that all happens today then possibly tomorrow with the Employment Situation we can get the squeeze for the blow off top? If that doesn't happen then it should be next Wednesday with the CPI number, and we've had CPI numbers in past put in big turns so that's a real possibility that it could happen again. If I remember correctly the 3502 bottom on 10/13/22 was a CPI day, and so was the 4180 top on 12/13/22, so that's the key date for the blow off top if today or tomorrow doesn't produce it.

For the short term though my lean is a gap up into the 6100-6120 zone and then a pullback to the 602 SPY FP, and more chop with an upward bias into the CPI next week with some decent odds that the blow off happens tomorrow instead, but I'd want to see a nice recover into the close today of any pullback so they can do another gap up tomorrow.

The "Wildcard" is if we gap up and keep going and that's certainly possible as I said. It's not my lean but there is a prior pattern that "if" it follows it we will indeed just keep going up and make a new all time high in a few days, like possibly by tomorrow or Monday?

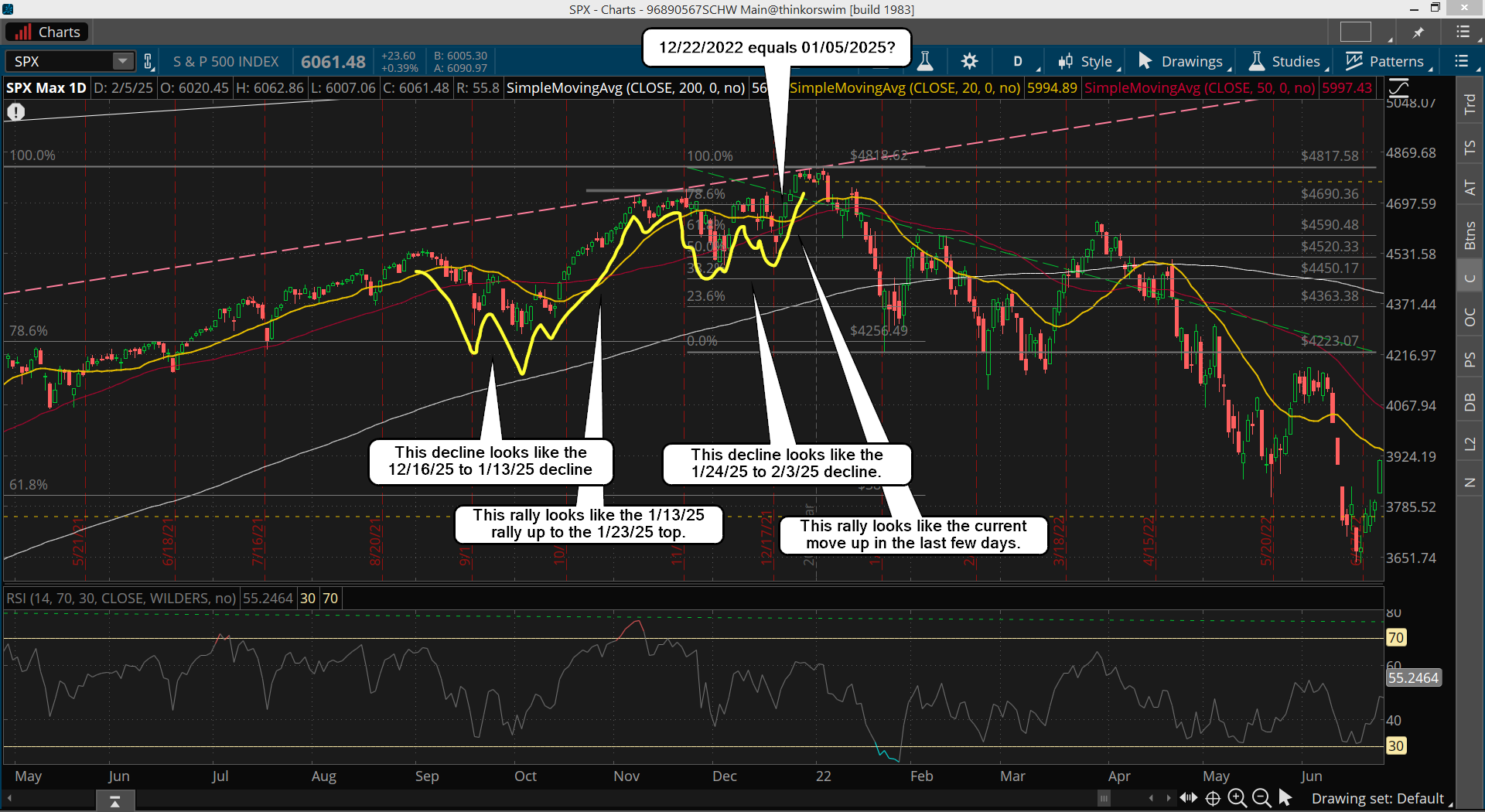

As you can see in the chart above yesterday looks a lot like 12/22/22, and it was followed by 2 strong days up with today being like 12/23/22, which then topped out the next trading day on the 27th, and that was of course the Santa rally but the pattern looks very similar to now.

Have a blessed day.