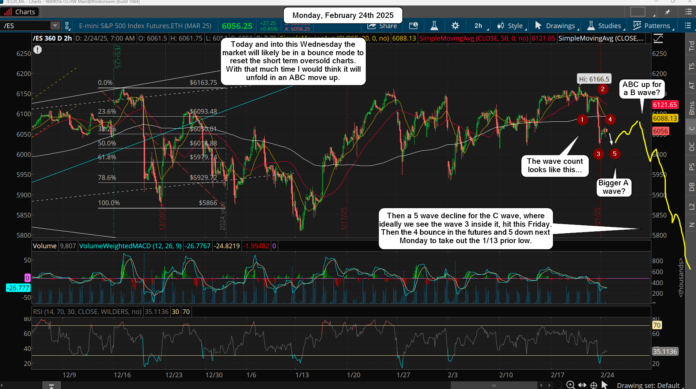

The market fell hard on Friday after topping on Wednesday with a tiny new high. I wanted a blow off but there must have been too many bulls long to make it happen? Nevertheless the turn date worked as the market topped and tanked. Support is a little lower around the 5970-5980 area on the ES, which might get hit today or tomorrow.

This Wednesday is another spot where we should see a high. I wouldn't really call it a turn date, but a bounce date would be more accurate I guess? The bottom dates are March 3rd, which should be the main "lowest low", but with another one on Friday March 7th or Monday March 10th it's possible that the later date makes a lower low.

Basically, the low on March 3rd should be followed by a 1=2 day bounce (maybe 100-200 points?) and then back down into the 7th/10th for either a higher low (a wave 2 pullback?) or a lower low (a wave 5 bottom?). From that low we should start a complex rally, but I don't expect to see some straight up, non-stop squeeze like in the past. Even if it turns out to be a wave 3 it will subdivide into 5 smaller waves and those waves will likely subdivide too. It should be a choppy mess for the next few months before we see all the various degrees of wave 1's up and wave 2's down finish, and setup a powerful, long lasting, multilayered wave 3 up. The big cycles say this will happen from a low in May and last into August where we finally see a huge blow off top. I posted on X the following..

https://x.com/reddragonleo/status/1892204496500965533

https://x.com/reddragonleo/status/1892558260890120377

It turned out that it went lower then I expected and dropped faster. The bounce into the 26th is still likely but I don't know how much? If everyone is still bullish and buying the drop the bounce might be weak, and that will keep the bulls trapped with no way to get out.

Plus it will keep bears from getting a good spot to go short at, and by the time we finally bottom next week they will have missed it all. While the fact remains that we saw a slightly higher high last Wednesday it was still likely a B wave with the A down happening from December to January. That means this current move down we are in is likely a C wave, and they don't usually bounce that much... which is why I lean toward a weak bounce into this Wednesday. Either way though more downside is likely.

I still think we will see the prior low take out, which could easily get flushed by a 100+ points, and that means we "might" even reach the 5600's? I wouldn't count on it, but the 5700's seems very likely at this point. The "when" part is either on March 3rd or the 7th/10th. For example, if we double bottom on March 3rd at the 5800 zone then I'll look for the March 7th/10th low to be a lower low that take out that double bottom and probably pierces the 200 day SMA, and of course that would be a final wave 5 down.

Or, if we take out the 5800's cleanly and drop deep into the 5700's on March 3rd I'd then think that the 1-2 day bounce will be a wave 1 of some degree and a wave 2 down for a higher low into the 7th/10th will follow.

One way or the other we should see the double bottom taken out to hit all the stops on the bulls and to reach and pierce the 200 day simple moving average. After that the bottom should be in and we will see higher highs and higher lows going forward the rest of the month.

Have a blessed day.