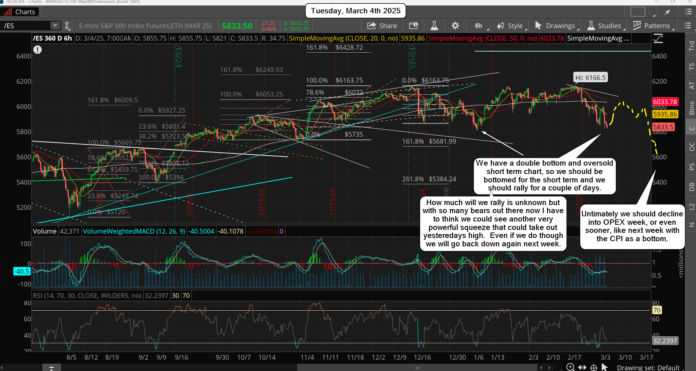

WOW! I wasn't expecting that drop yesterday as I thought we bottomed a day early on Friday and that this March 3rd expected low was hit early, but some how they flushed it hard yesterday and put in a new low. To me, this extends the rally until This Wednesday where we could make a lower high then yesterday or a higher high, like to my 6040-6060 zone on the ES.

I'm not sure what's going to happen here but the market nailed the lower low on March 3rd and should be in a rally mode for a couple of days before rolling over again. Since that lower low took out the bulls that were long from Fridays low there should only be bears left and they should take shorts on every move up today.

So, "if" we retrace most of the drop from yesterday, and fail to put in a higher high, I tend to think that Wednesday we'll see a move up above Mondays high to hit the stops on the bears this time. That would setup a nasty drop the rest of the week... if this happens? I'm really tore here as the market tricked me with that drop, but maybe it's my own fault as I said for a week or more that the expected low as on the turn date of March 3rd, so I have to assume that we will rally up to take out the stops on the bears before we drop again, and that means we should top on Wednesday.

The drop reminds me of the 5/20/2022 drop, which was followed by a rally that took out the prior highs of 5/17/2022 and then a nasty drop followed in the next two weeks. This would be the drop into OPEX and/or the FOMC meeting 3/19/25, and/or the CPI on March 12th, so that's the window I think for the low.

And that low should take out the 200 day SMA, but for this to play out I do think we need to make another higher high then the high yesterday so that those bears miss the drop. This means we need to squeeze hard today and tomorrow and if we run those stops on the bears the market will be free to start down again into the next two weeks.

Have a blessed day.