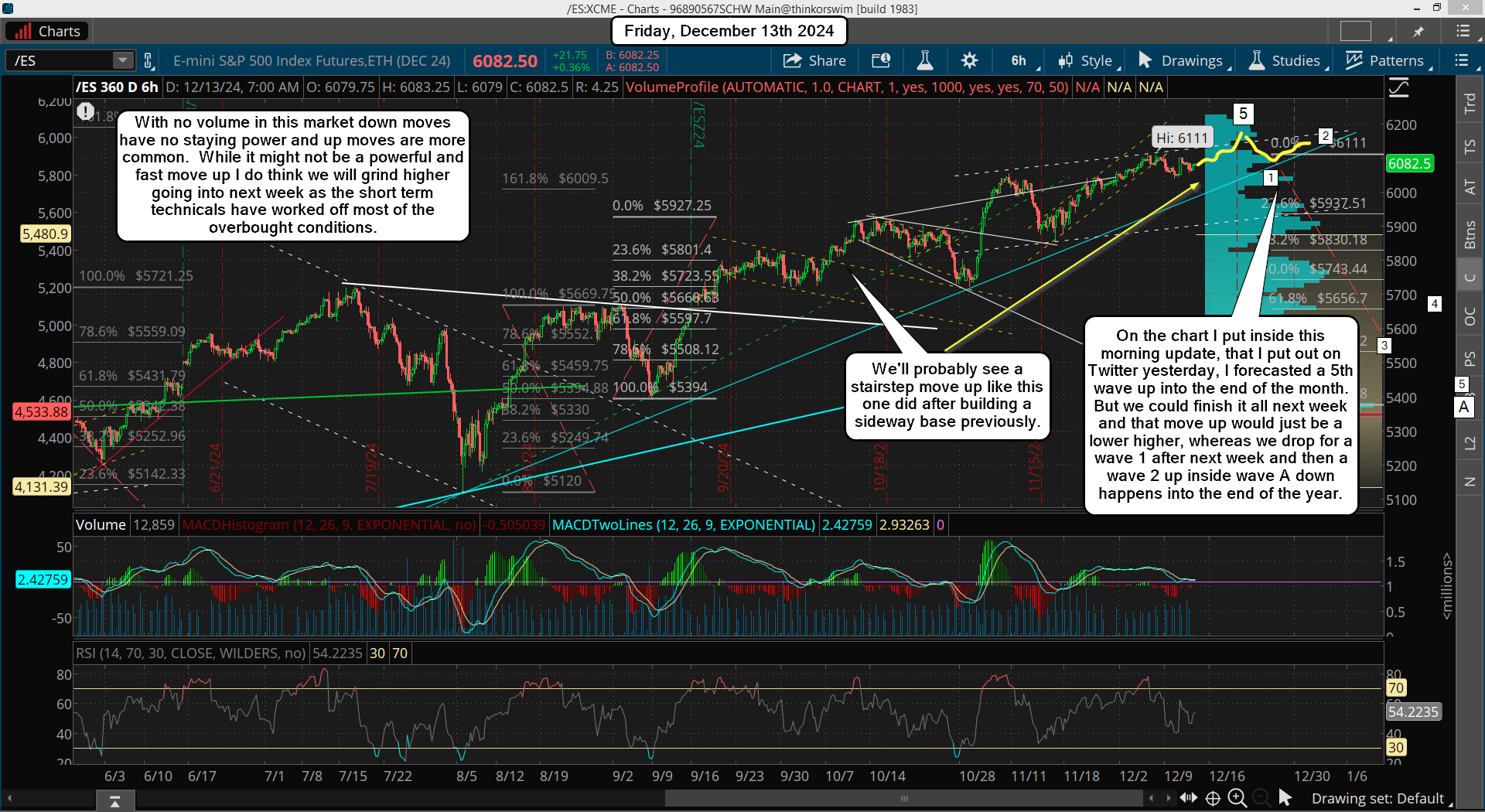

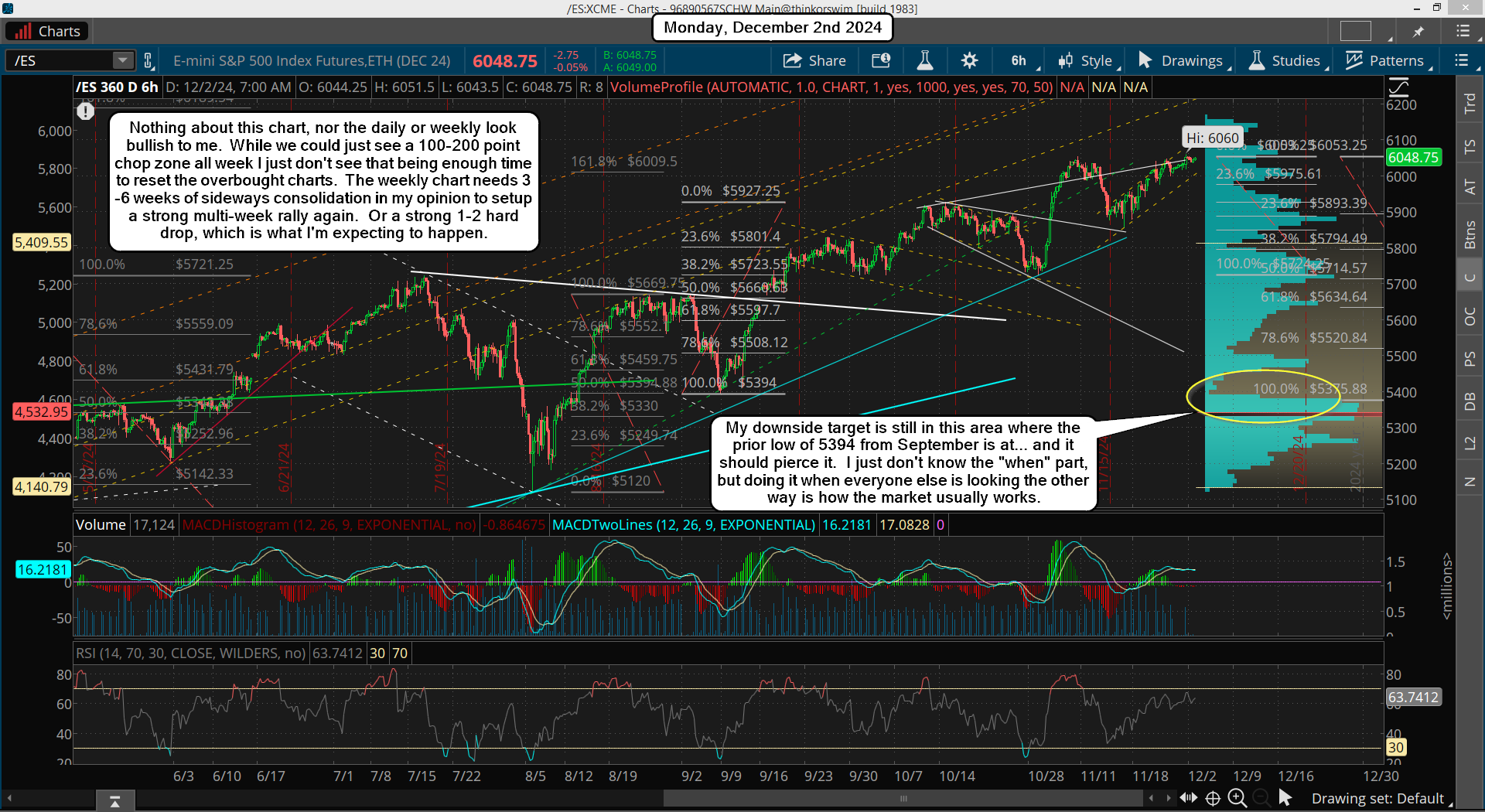

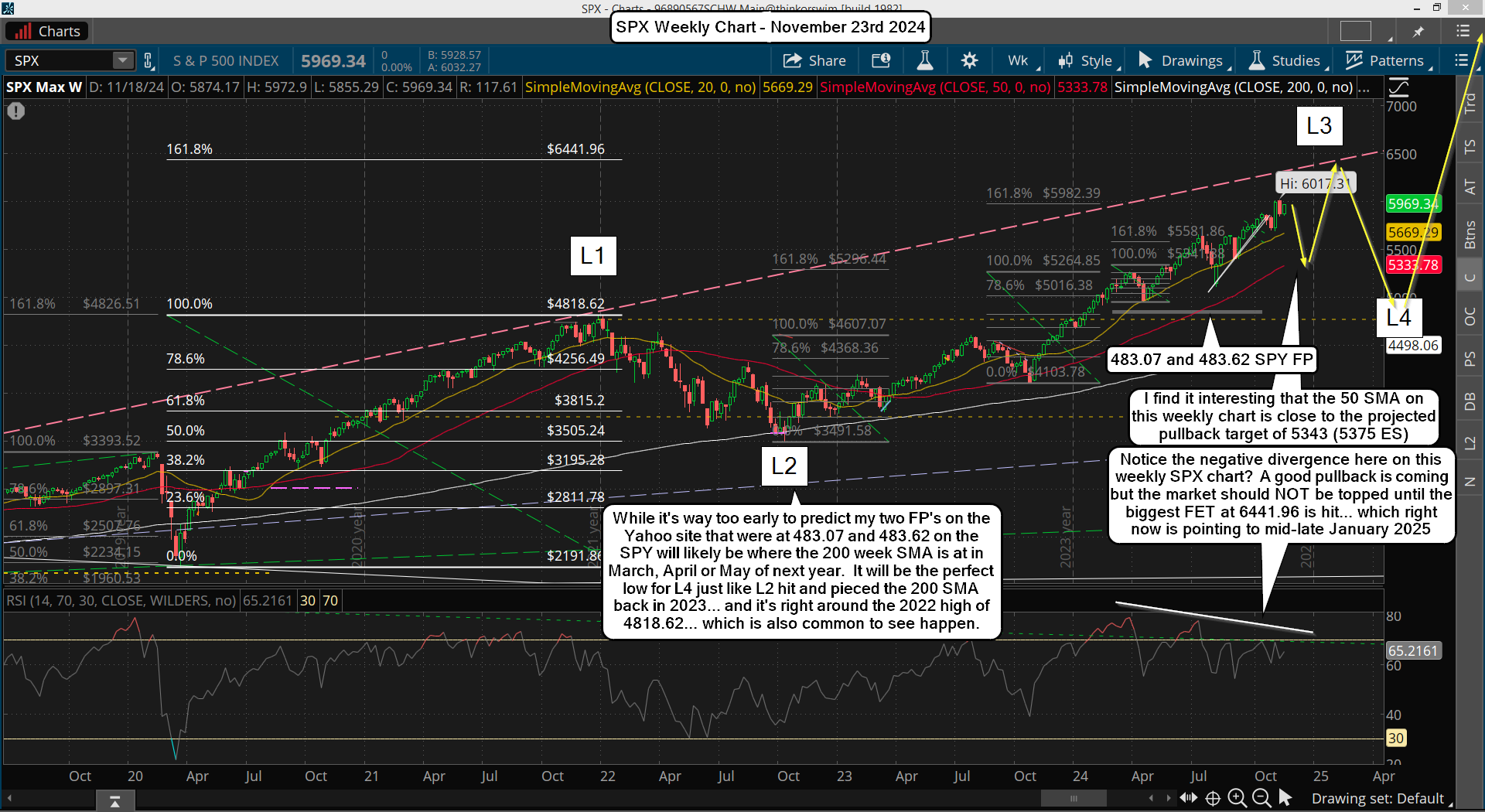

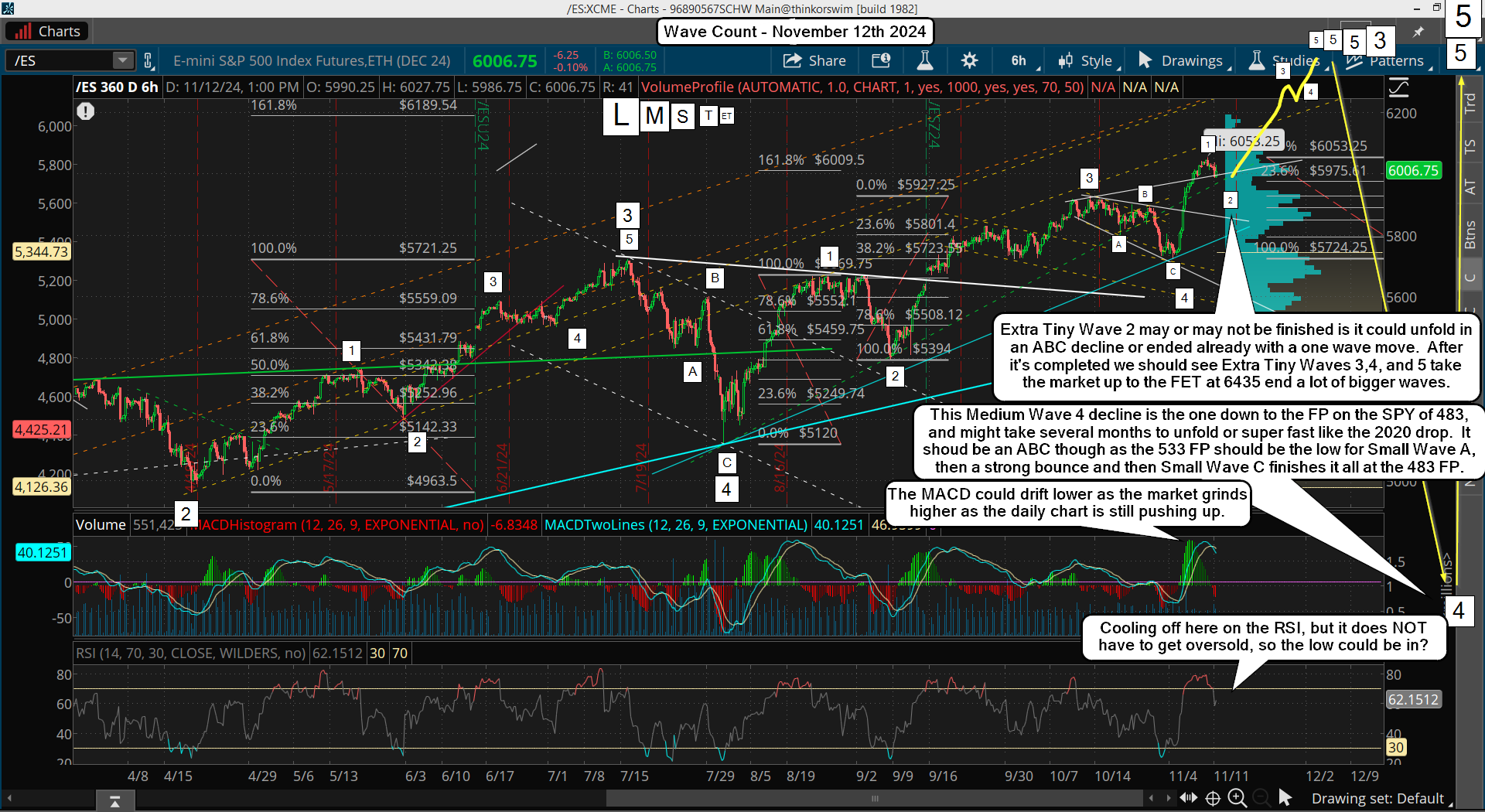

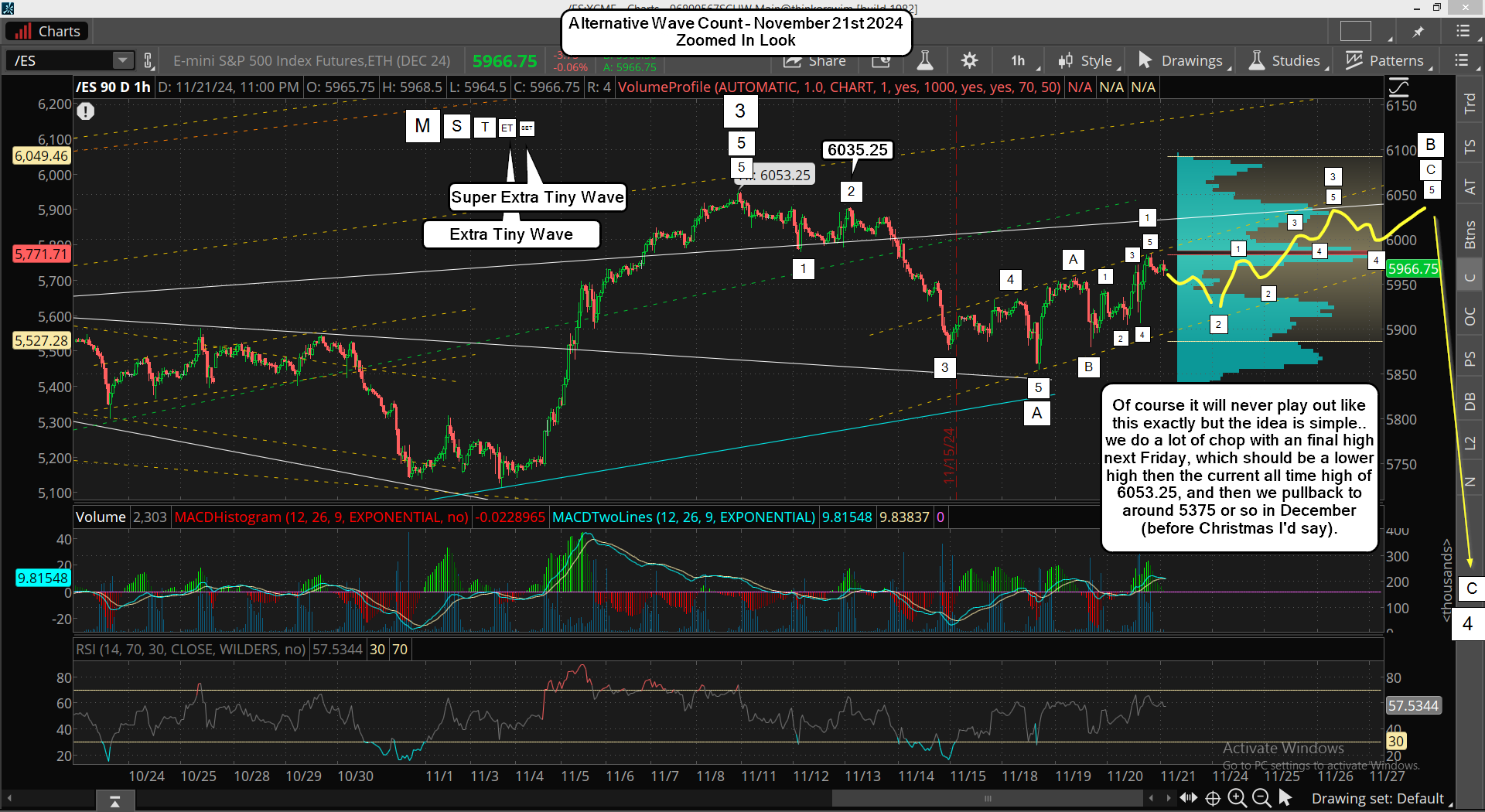

This week is the last week where we could possibly see a blow off top, I really don't think it's going to happen. Instead, I think we get a lower high and a pullback to the 533.01 FP on the SPY into mid-late December. Then we rally hard again into late January to hit my FET of 6441 and the FP on NVDA of 160.22, which I've covered on last Fridays' post in great detail. Would I like to see a rally to 6441 this week? Heck yeah! But the odds of that happening are super low in my opinion. The technicals are just too weak looking. The weekly chart looks ready to (finally) rollover, which you can see on the SPX below...

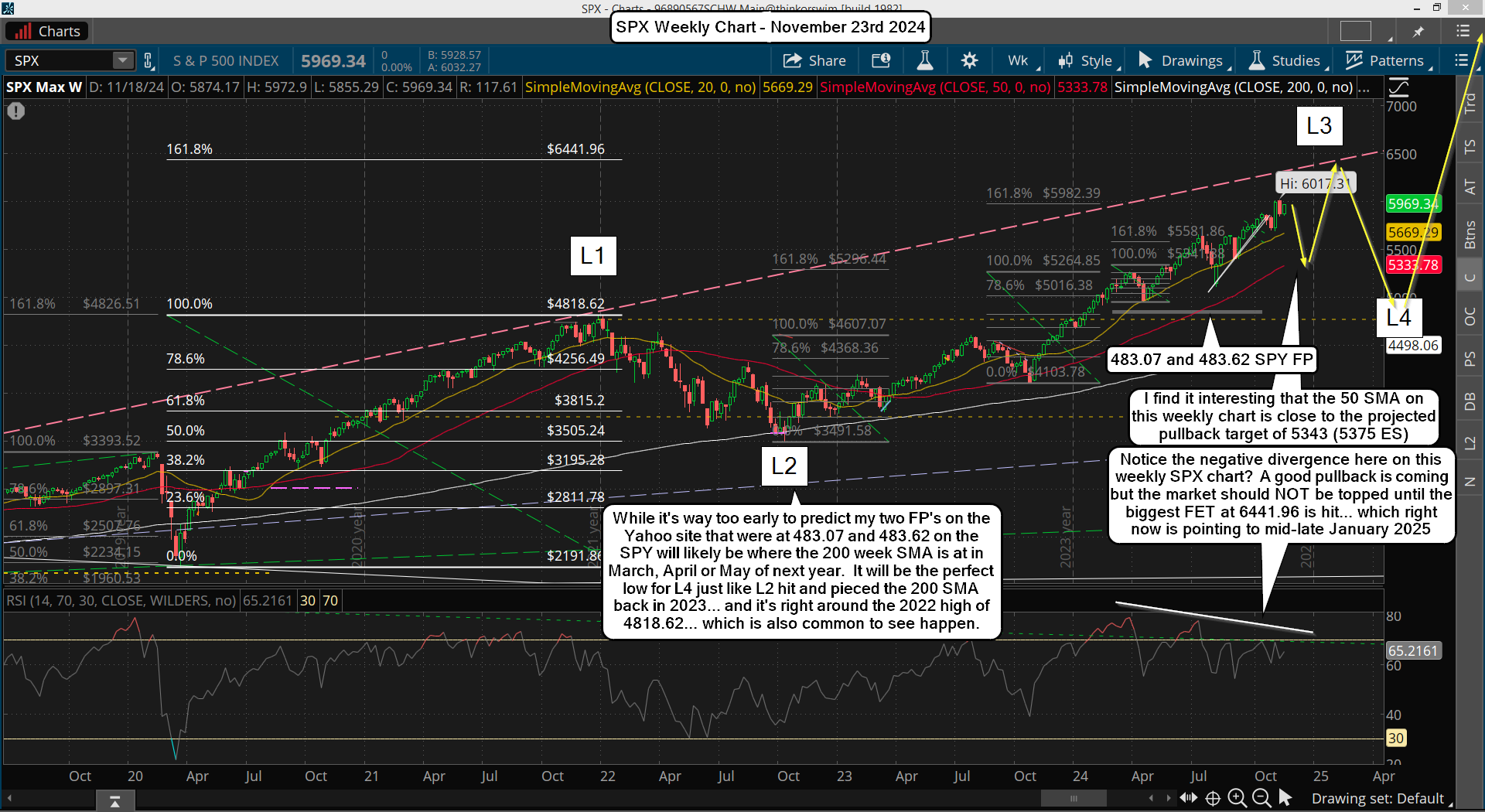

Besides the obvious triple (or quadruple) negative divergences on the RSI of that weekly chart notice all the different Fibonacci Extension Targets that have been hit. There are short, medium and longer term one's, just like there are small, medium and large waves. The biggest FET is the one connecting the 2020 low to the 2022 high, which points to 6441.96, and is my final high for this multi-year bull market before a really nasty correction happens.

All of the short and medium term FET's have been hit except the big one at 6441.96, so I just don't still this bull market ending until that one is reached. I do NOT see December as a bullish month where we will go up and hit it, as the technicals just don't support it. Now let's look at the daily chart of the SPX...

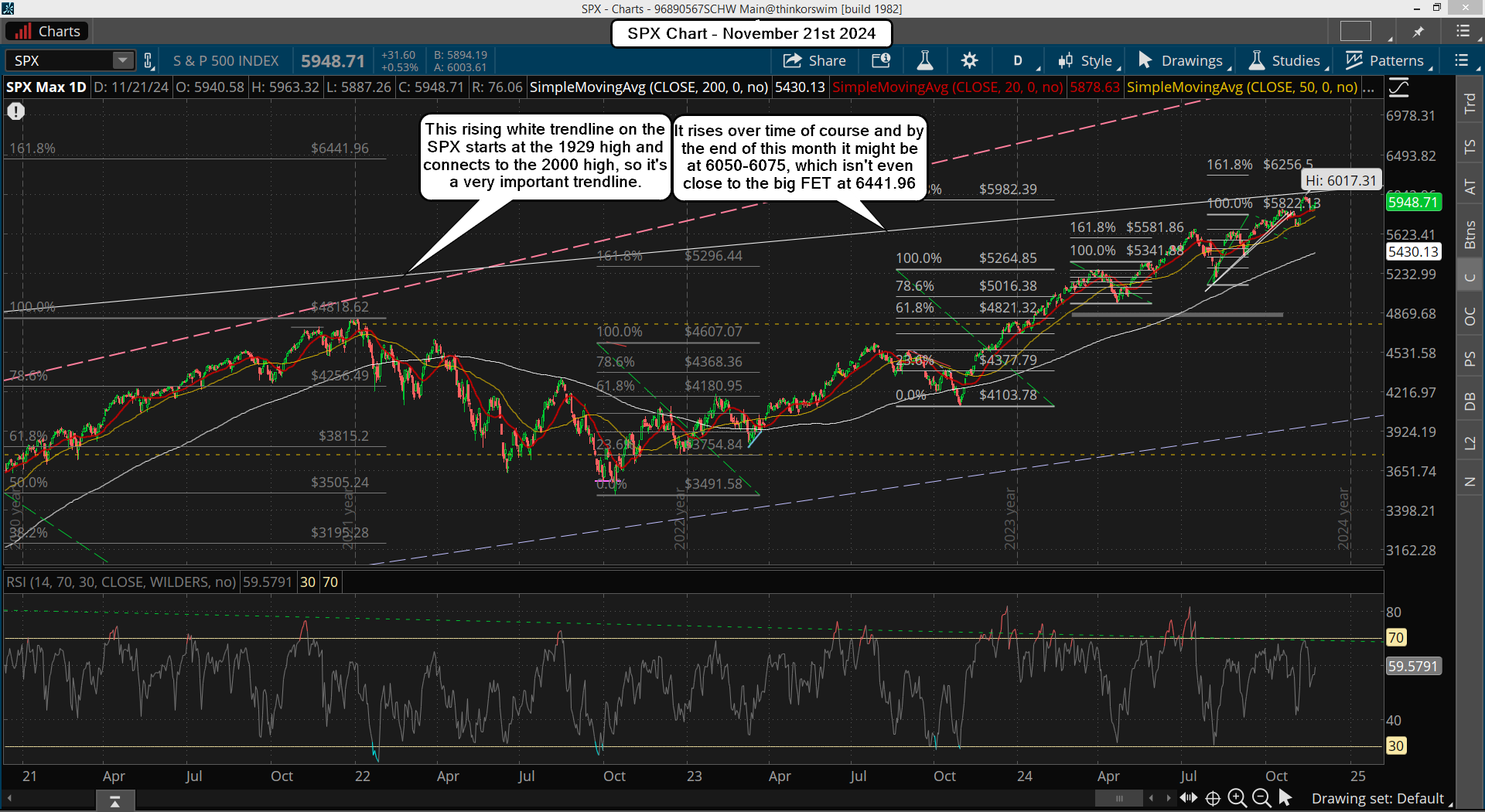

As you can see the RSI i pointing up on the daily chart but it clearly getting tired as it has made several tops on the RSI that never reached overbought before rolling over. We will likely see the same thing happen this week as while there should be light volume due to the Thanksgiving Holiday there's just no really big buying up here. I think we'll just chop and grind all week and top out by either Wednesday or the half day on Friday. By then the RSI will be exhausted and will likely rollover the first week of December.

Don't forgot about the common pattern that happens every month around the end of it and the start of the next month... which is "turns happen a lot". Some are small and some are big but never the less it's a common pattern every month and this month will be no different. Add in overbought weekly charts and you have a setup for a nice move down coming.

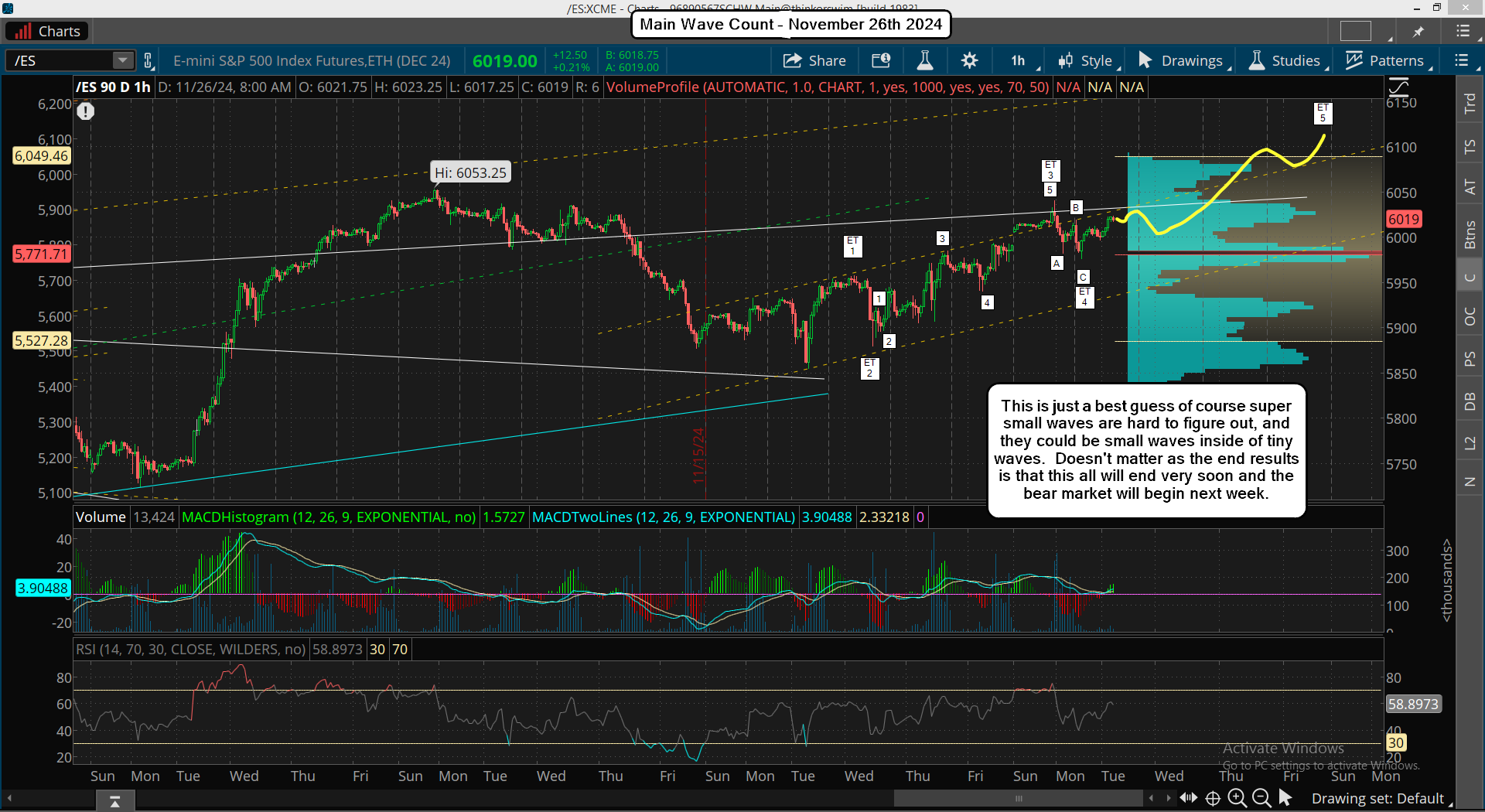

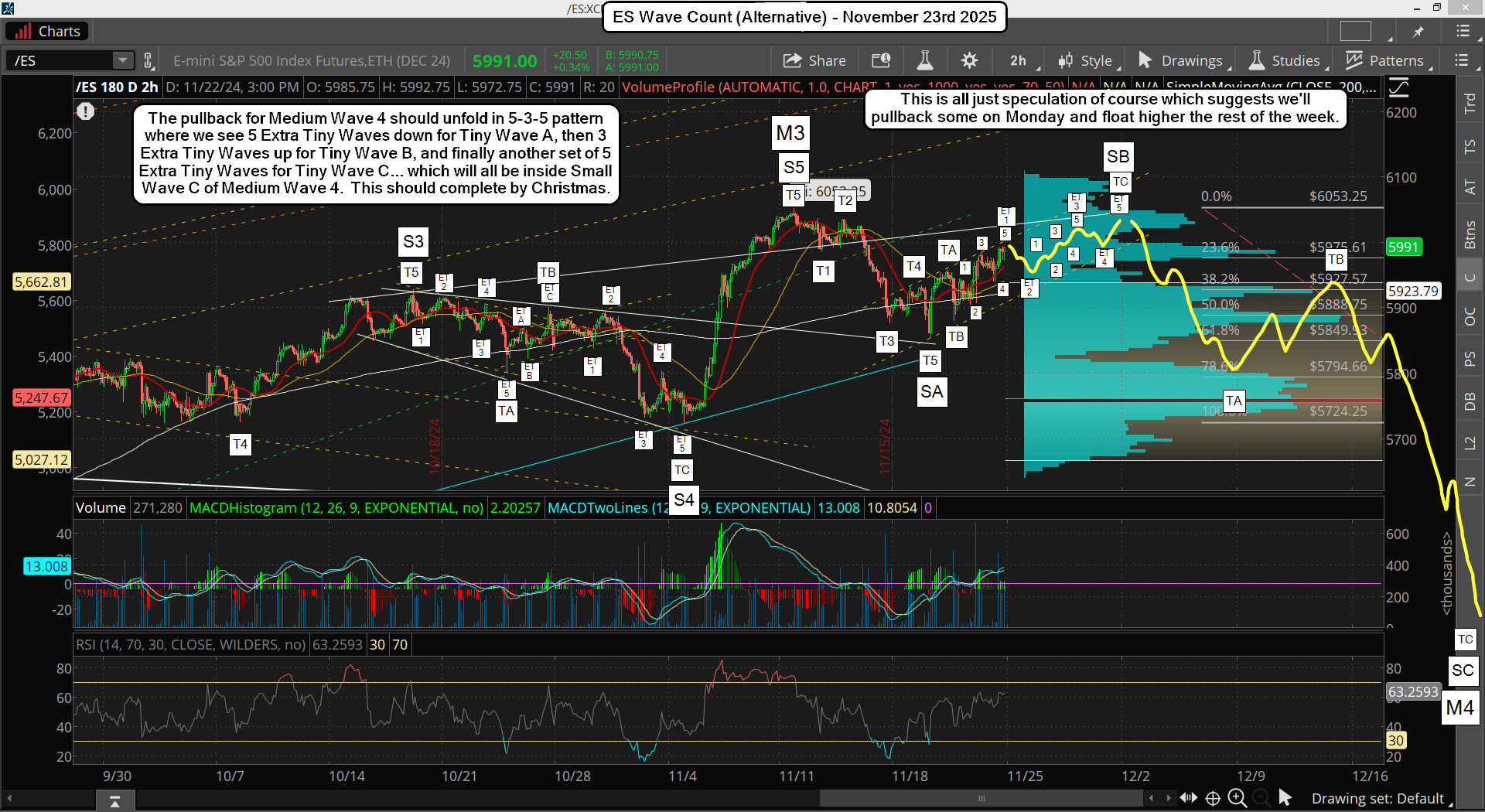

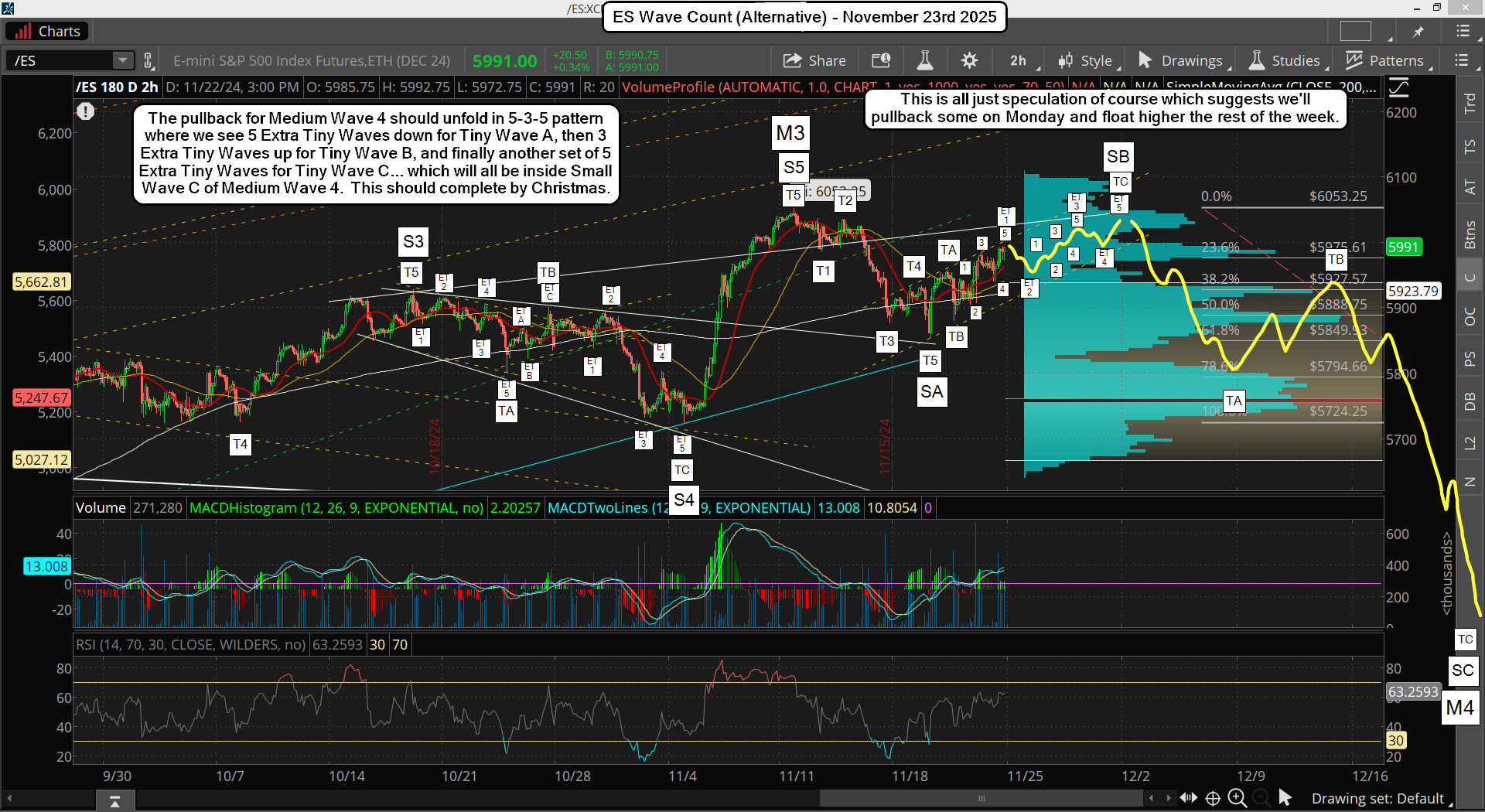

In this post I've covered the bigger picture here as we go into December and into the first quarter of 2025. As for the short term I don't have much to say. I just think we'll have light volume all week and that favors the bulls. Any pullbacks shouldn't be much and will likely be reversed back up into the half day on Friday. Next week is where the bears get to have some fun. Below is the "best guess" wave count (ES)...

Lastly let me point out some days that "events" are at, which could cause "turns" in the market. They are...

Next Non-Farm Payroll (NFP Dates): December 06, 2024...

Consumer Price Index Dec. 10, 2025 08:30 AM

... and the FOMC Meeting Two-day meeting, December 17-December 18

I'd have to guess that the FOMC date will be a low, maybe not "the low" but a low never the less. Possibly it bottoms there for some kind of wave 3, bounces for a few days, and does the wave 5 into Christmas where I suspect the "important" low will be at before a big rally starts for Medium Wave 5 into late January.

That Christmas area low could be a slightly lower low or slightly higher low then the FOMC low... I don't know? If we hit and pierce the 533.01 FP on the first low then I'd look for the second low to be a higher one. Then we'd have a wave 1 up (Small Wave 1 probably) from the first low, and a wave 2 down into Christmas for a slightly higher low. I lean toward this being the case as it will be the opposite of what happened in 2018... and you know how the market loves to fool the most traders.

The "clue" to tell us what is the plan will be whether the FP is hit on the first drop or not... and if there is a clean ABC drop with 5 waves inside the C wave down. This all assumes we don't make a higher high this week on all the indexes.

If we just make one on the ES, but not the NQ, or the YM, and maybe not even the cash indexes on the SPX, NDX and DOW... then I'll just say that Small Wave B up had an overshoot and the wave count is still valid. But if too many indexes make a higher high then I'll have to adjust the count and move the top for Medium Wave 3 to the new high. We'll cross that road "if" it happens.

For now the current wave count on this post is what I think is most likely, which is my Alternative Wave count that I covered on Friday. If a new all time high is reached (like early in the week, not on Friday) then we'll be back on the Main Wave count where my FET of 6441 is coming faster then I thought possible.

As of the close last Friday that blow off squeeze doesn't look possible as there's not even a full week left for it to happen into the turn window, which is why I put out the alternative wave count as then we'd pullback to the 533.01 FP first and then rally to the FET of 6435 into late January. But if we get a big squeeze this week, meaning over 6100, 6200+, then I'd say it's over the bulls and the first drop will be the 533.01 FP and then a strong rally into January for a lower high should follow.

My point here is that I can't get a 100% focused on the FET hitting as it's the last one, the really big one, which ends the bull market... so it could fall short of hitting. They have a perfect track record of hitting the medium and short term FET's but the large one, which again is calculated from the 2020 low to the 2022 high, will be the last one, and it might not reach it.

Looking back at a prior large FET, which connected the 2009 low of 666.79 (SPX) to the 2020 high of 3393.52, it projected a target high of 5078.64 to end the next multi-year bull market following the 2020 bottom. Well, all the medium and short term FET's from the 2020 low to the 2022 high played out just fine, but the final high in 2022 was 4818.62, which was short of the FET of 5078.64 by 5.1127%, and if you use that same percentage on the current FET of 6441.96 (SPX) you get 6112.14 as the final high. On the ES that would be about 31 points higher (roughly).

Again, there are many things to pay attention to this week as in the end it will be a "gut feel" using the technicals, the turn dates, the patterns, the fake prints, the fibonacci extension targets, and even some astrology. I just say that if we get a really big move up this week of several hundred point I have to start thinking it's topping now and any rally back up in January will be for a lower high. We shall see...

Have a blessed day.