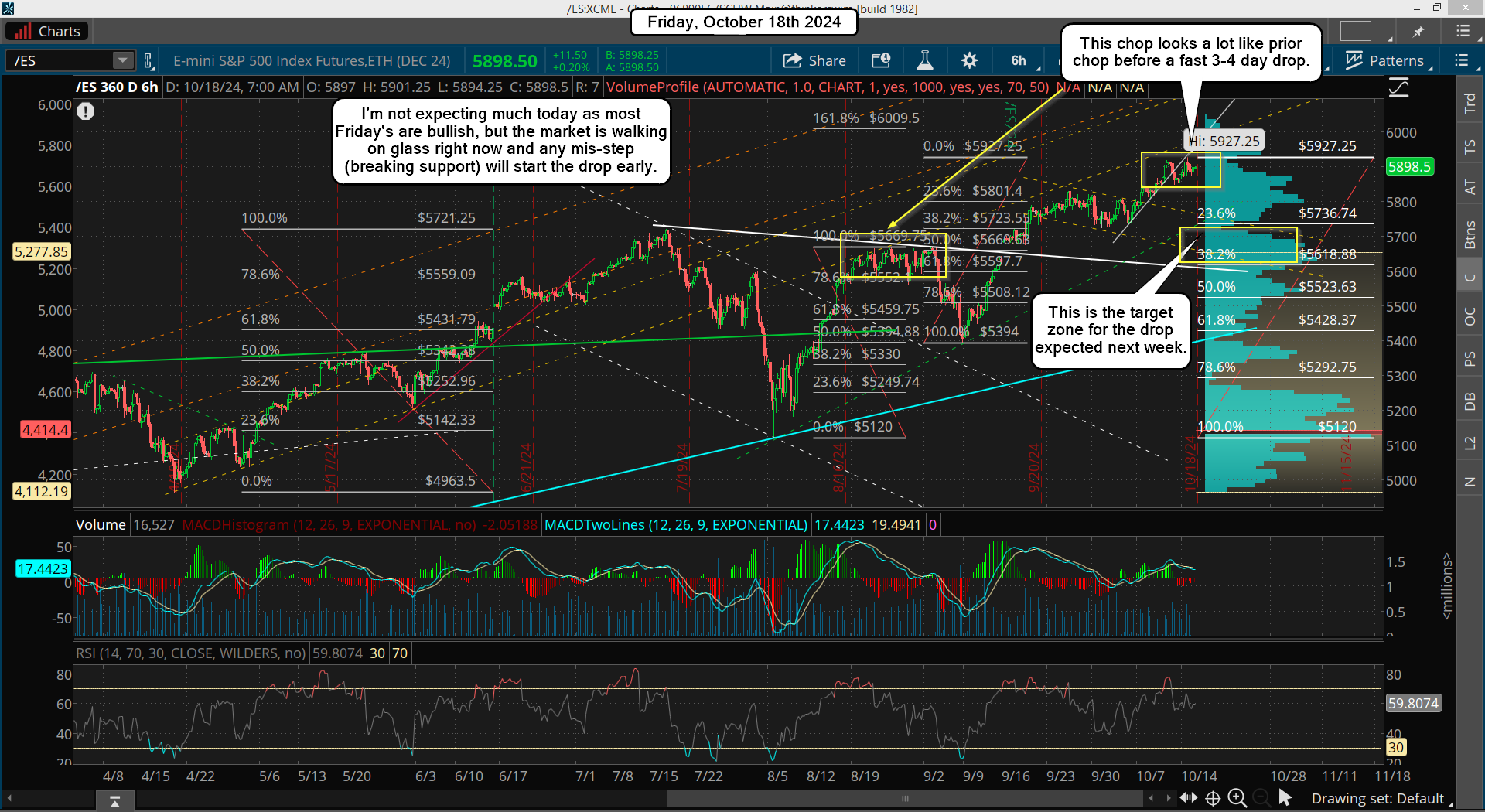

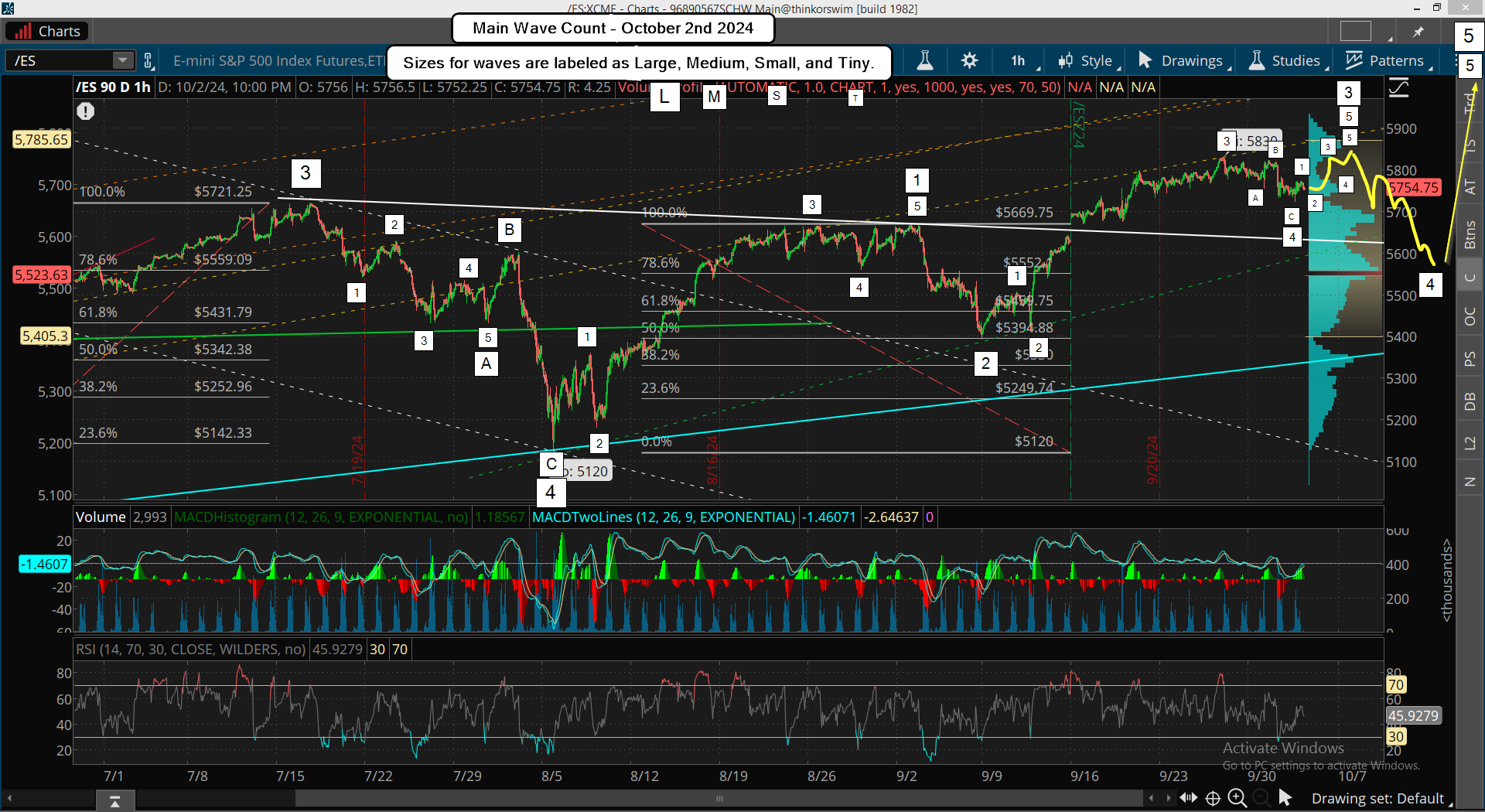

Last Friday's update played out fairly well as the market did rally early in the day to hit the top of the falling channel, and actually pierce through it. However, it failed to hold into the close and rolled over instead and erased that entire move up from the open. I had thought it would hold into Sunday futures and that's where we'd see that drop, but the market was weaker then expected and dropped early.

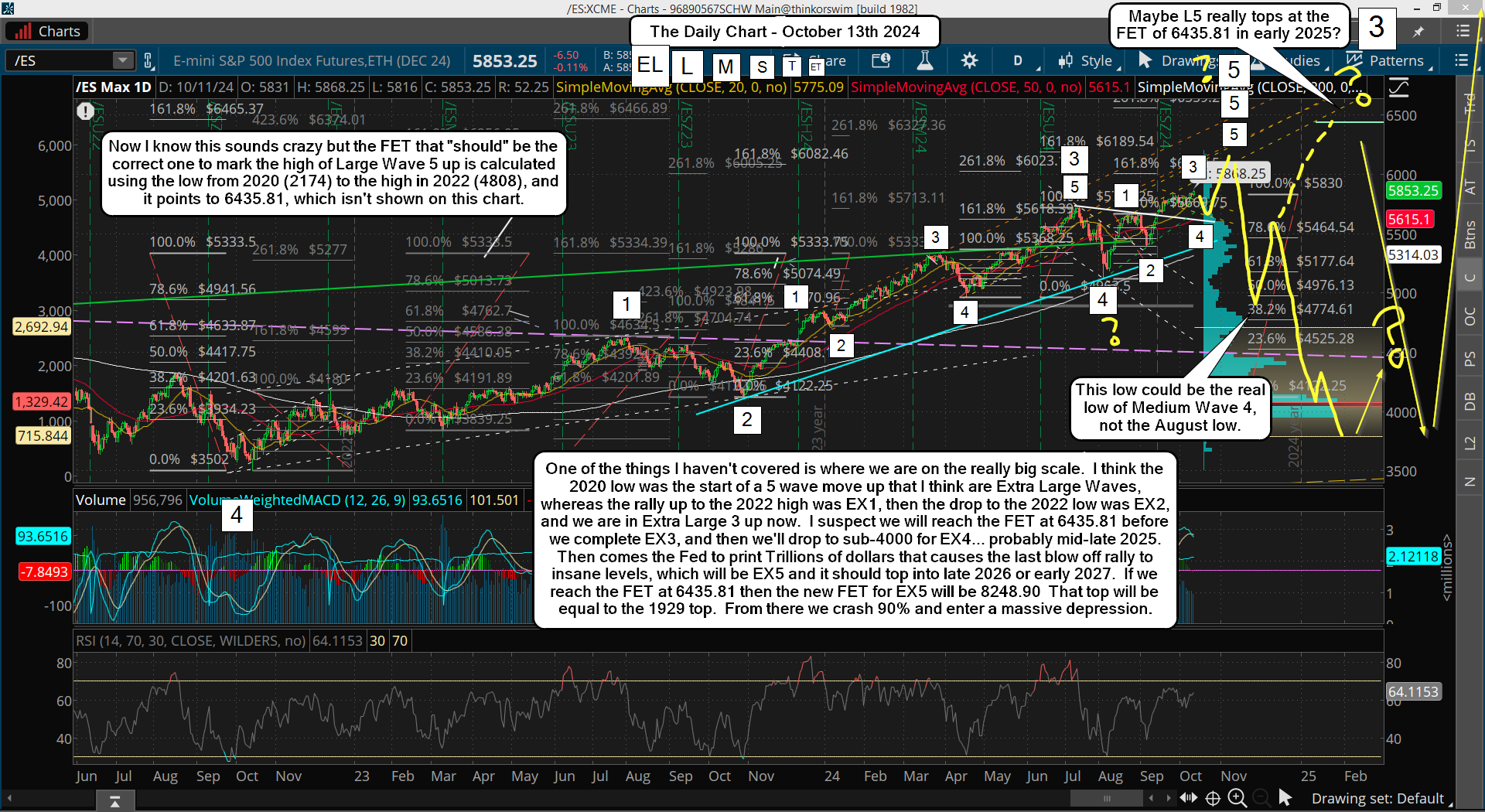

This makes me think it's diverging from the prior pattern back on 10/4-10/6 that I compared the current period when I cover it in Fridays post. To me, this weakness suggests that the up move expected from today isn't going to be strong enough to make a new high with my FET of 6009 being ideal price target. Instead I think we are going to remain in a choppy period from now until the election and neither make a new higher high or go much below 5800 (possibly 5750?), which really makes the most sense with traders being uncertain about who's going to win. While I would love to see another higher high to short I just think that's less likely now. Below is last Fridays Daily Chart Wave Count...

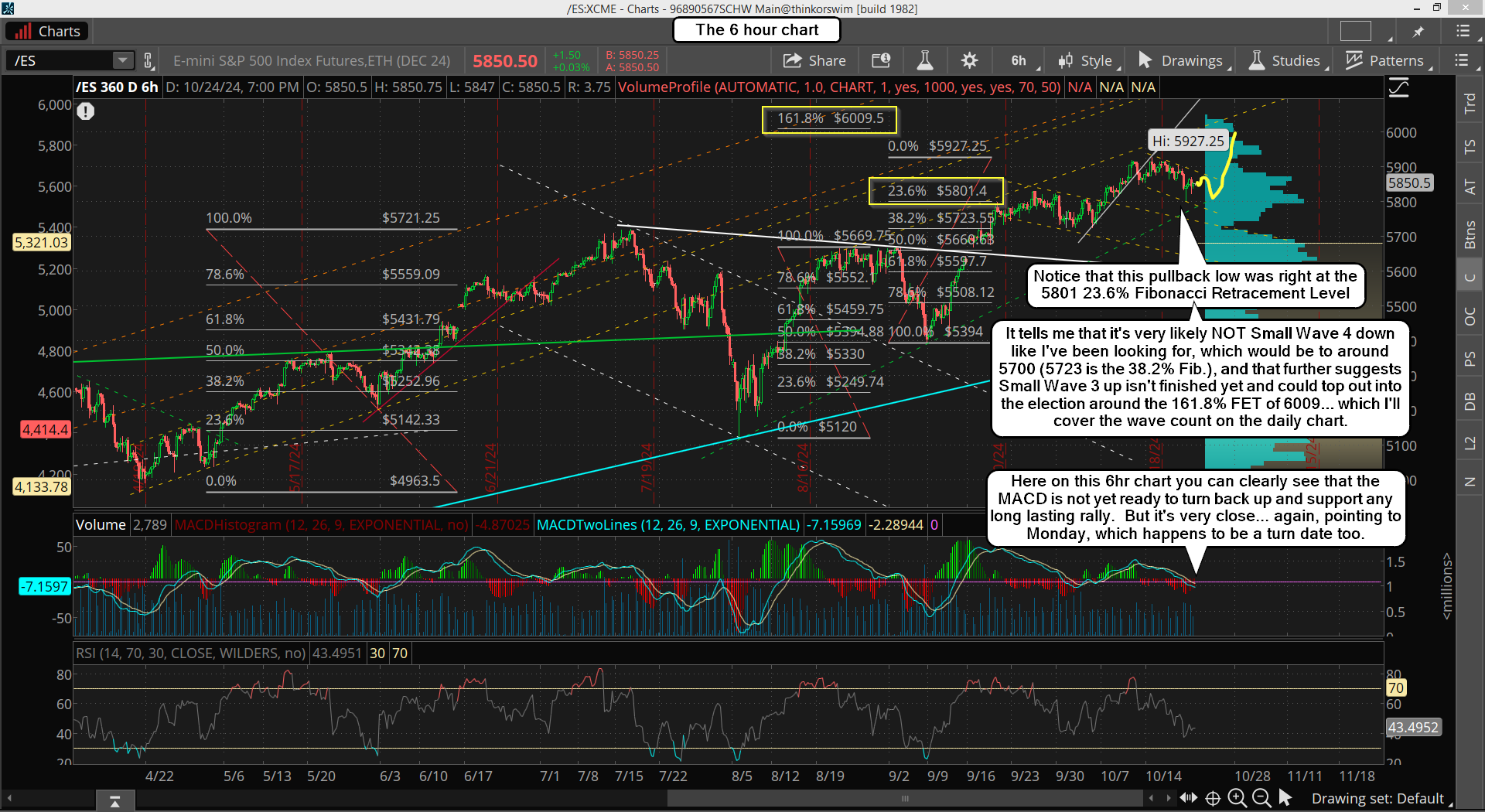

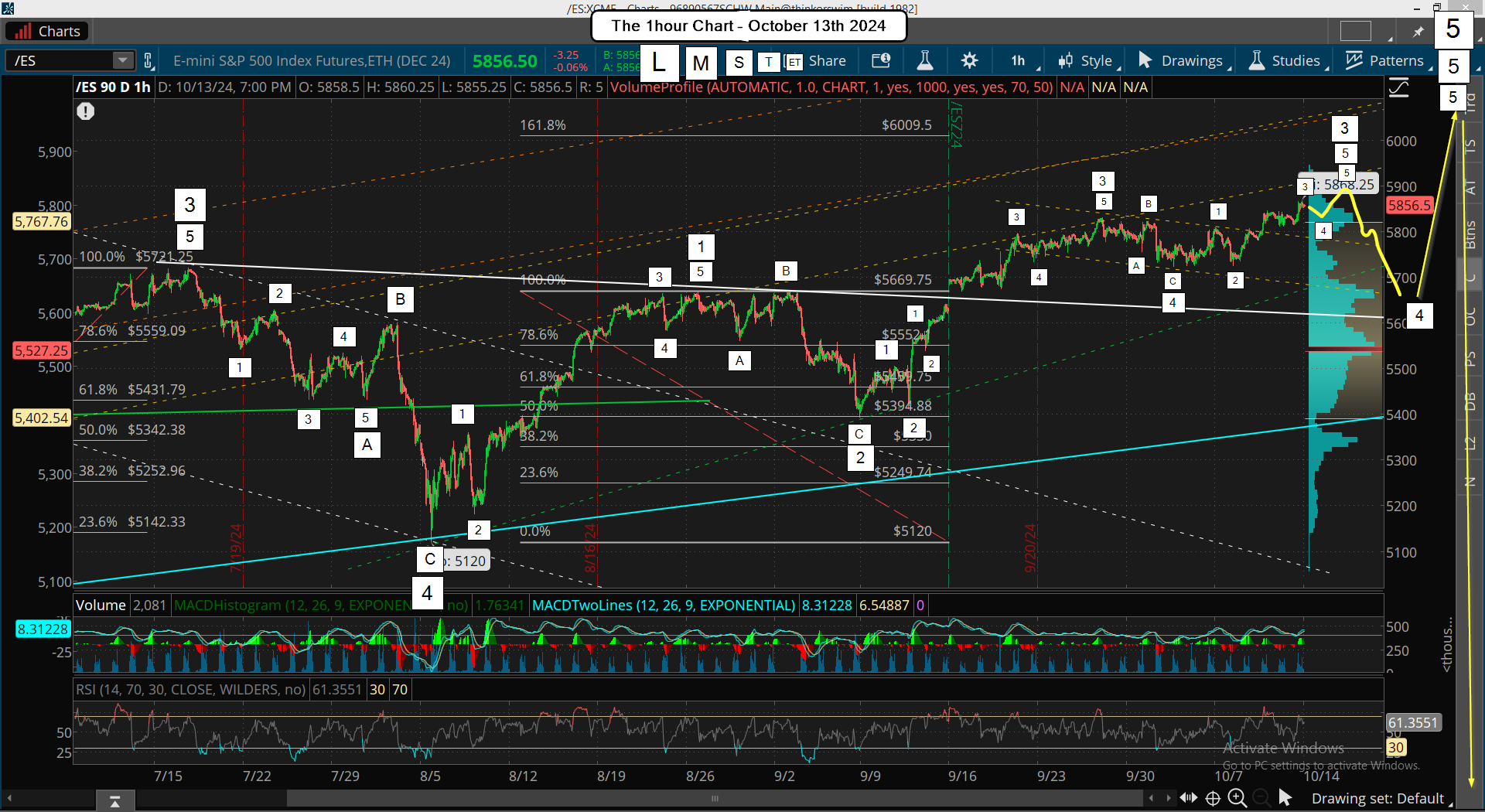

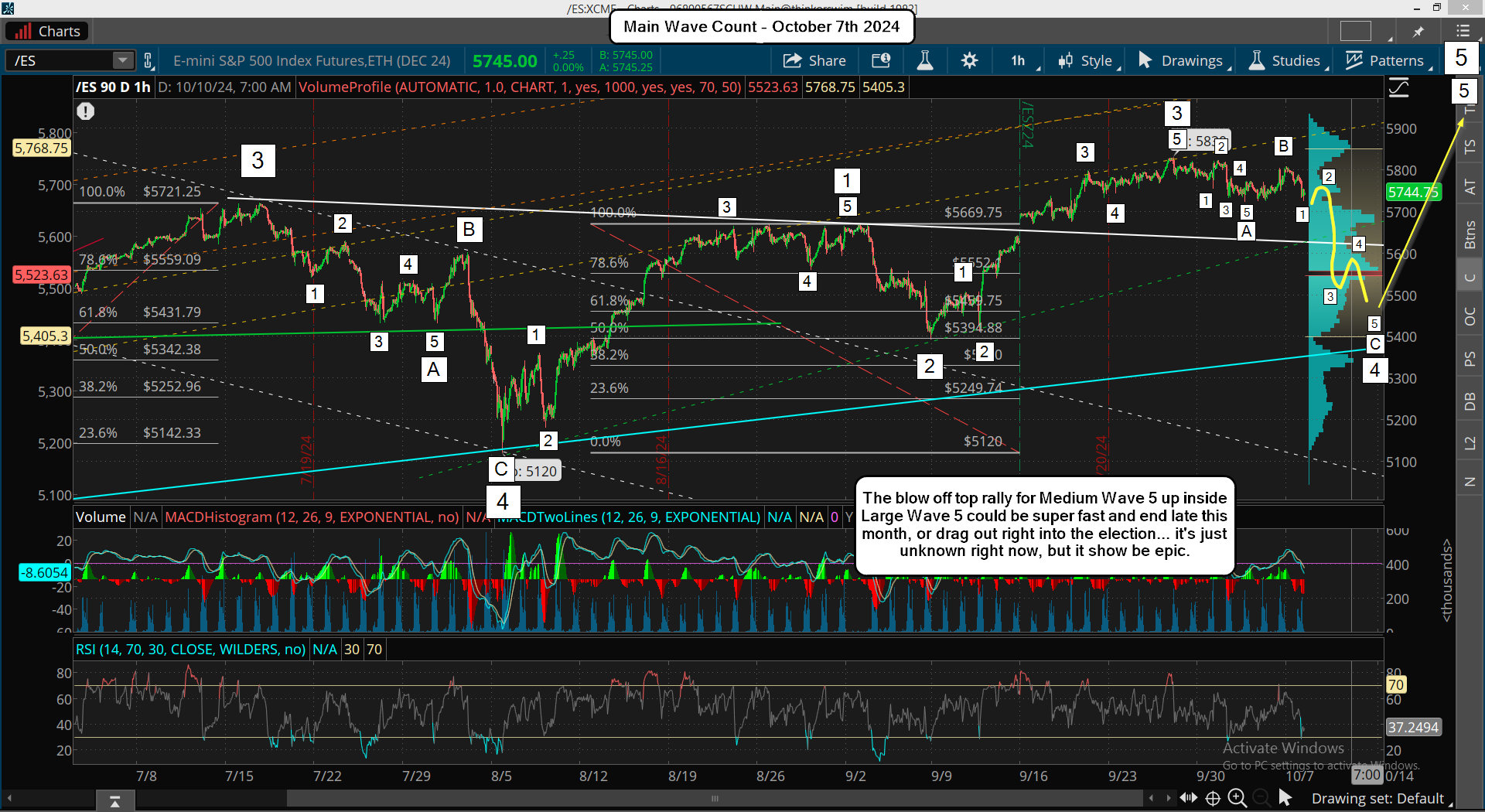

If the market does not make a higher high in the coming week or so then the wave count will updated to mark the ending point for Tiny Wave 5, inside Small Wave 5, inside Medium Wave 3 at the 5927.25 high on 10/17 and the pullback I have shown on that chart as Tiny Wave 4 will actually be Small Wave A down inside Medium Wave 4. That means that all the chop we get from that low will be part of Small Wave B up. This assumes Small Wave A already ended a the 5801 low last week, but it could be retested and a slightly lower low first.

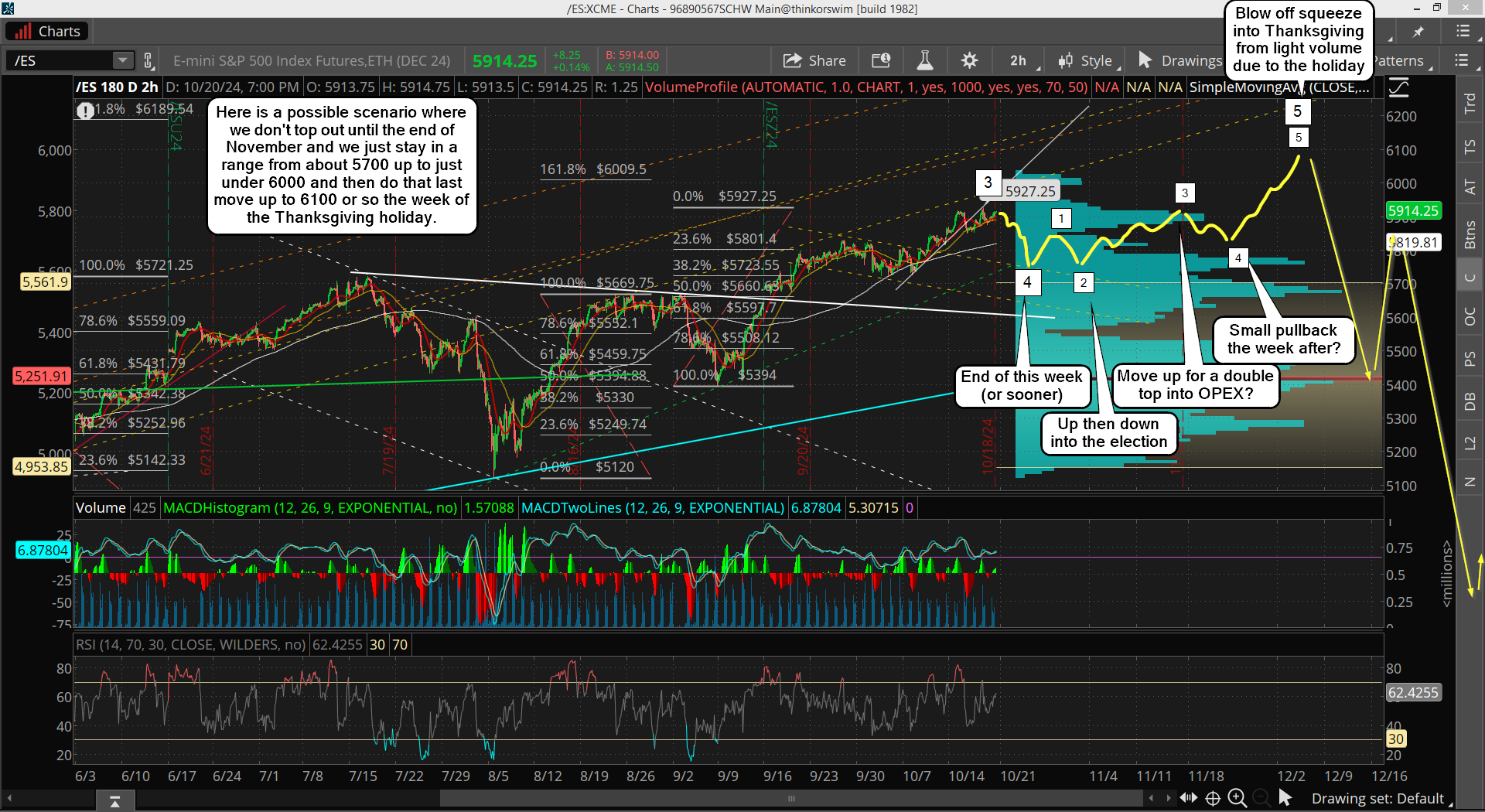

If that happens then the move up from there, which I don't see as much lower (maybe 5750?), will start Small Wave B, but I lean toward the market already being in Small Wave B now and that it will end as we go into the election. It sets up days following to have a large and fast drop for Small Wave C inside Medium Wave 4, and I still lean toward it reaching my Fake Print of 533.01 on the SPY, which is roughly 5388 on the ES. That's basically a double bottom with the 9/6 low of 5394, and that will be big support for a strong move back up. Below is that undated wave count...

Keep in mind that wave counts are not really that important and need to be adjusted all the time. Whether we make a slightly higher high like the wave count on Fridays update, or a lower high, like the wave count above, doesn't matter. The technicals on all the different time frames are more important, as well as turn dates and Fibonacci's... and let's not forgot how accurate the FP's have been over the past 14 years since I first discovered them. I just never know the "when" part on them, but they always hit at some point and with technicals current suggesting we are in a pullback period for awhile, and the "shock factor" with the election, I have to think that mid-late November we'll see the 533.01 FP hit.

If this happens we should rally hard afterwards and it should last into early December where a new all time high is hit. We should reach either my Fibonacci Extension Target of 6082 or 6189 at that time, and every bear will become bullish thinking the low is in and it's off to the races for 7000, 8000, whatever.

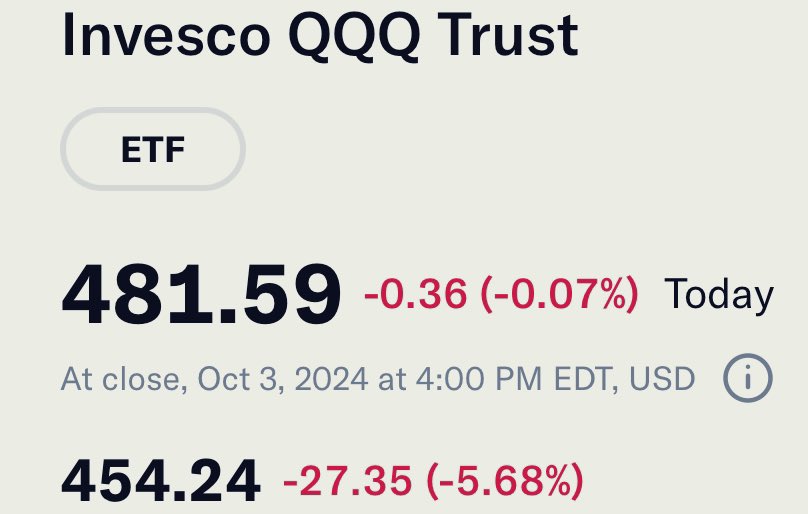

Let's face it, for years December is rarely super bearish and there's always a late month Santa Rally on top of that. But I think this December is going to shock everyone with surprise bigger drop to hit my FP's on the SPY of 483.07 and 483.62, which I rarely get two fake prints around the level, but I did this year. It's double conformation to me that we will that zone this year before it's over, and doing it in December will take everyone by surprise. Isn't that what the market always does anyway?

I mean, if it was easy to figure out everyone would rich from trading it, but not how it works. December of 2018 is a perfect example of traders being caught off guard. I think that's coming again, the rally up after it will make many more all time highs. I think 2025 could setup just like 1987 did... a blow off top before a crash!

Have a blessed day.