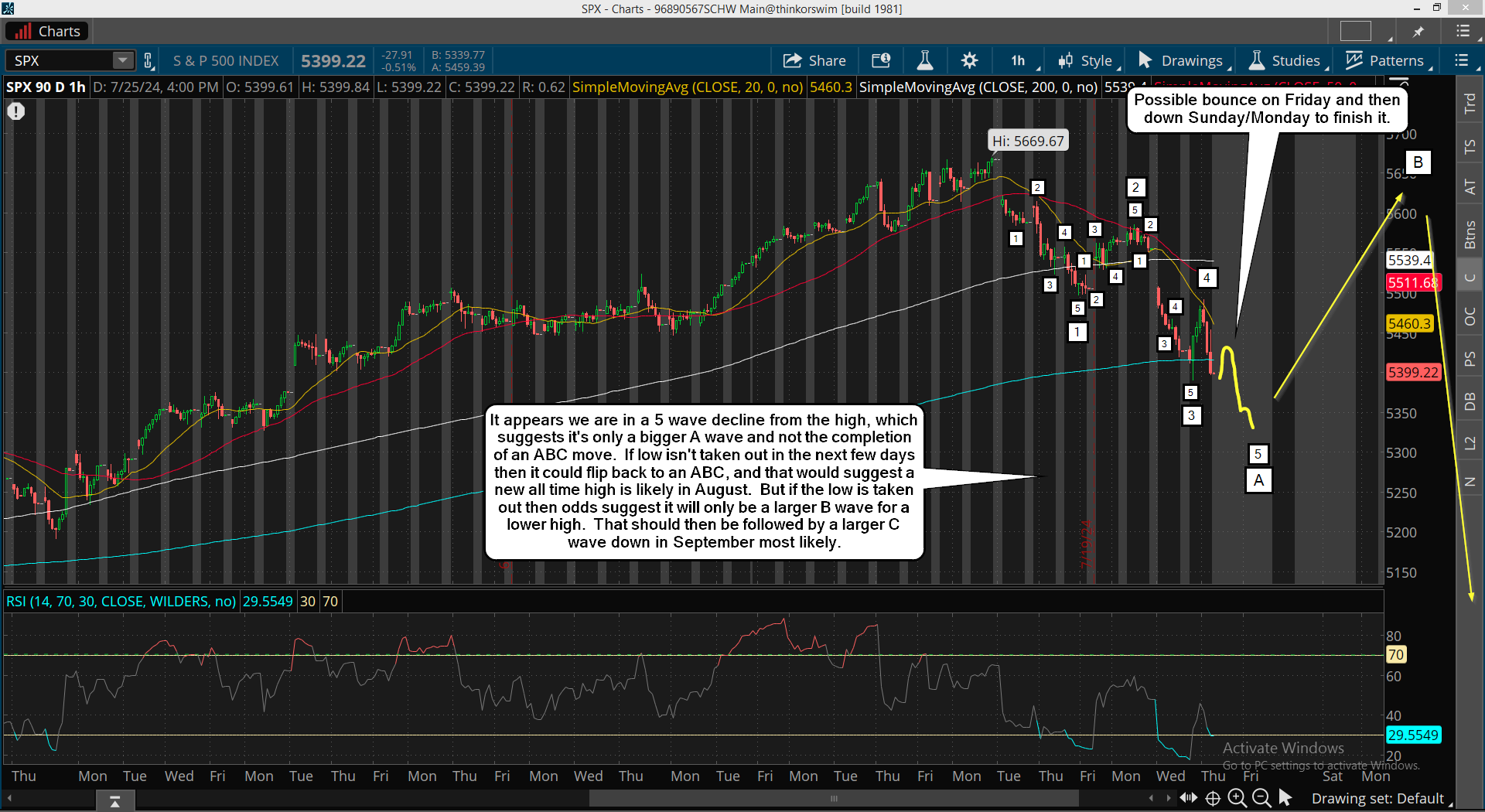

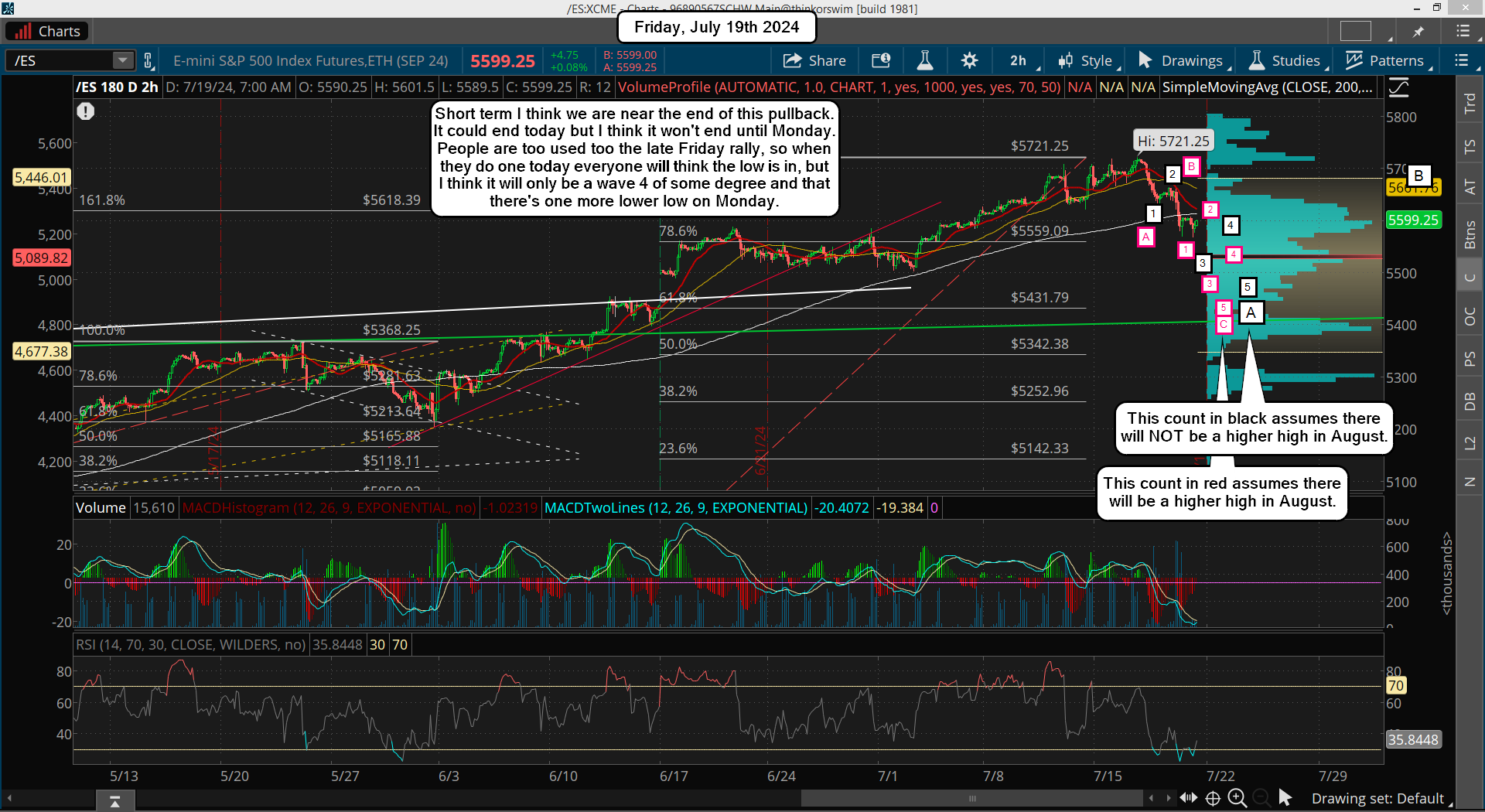

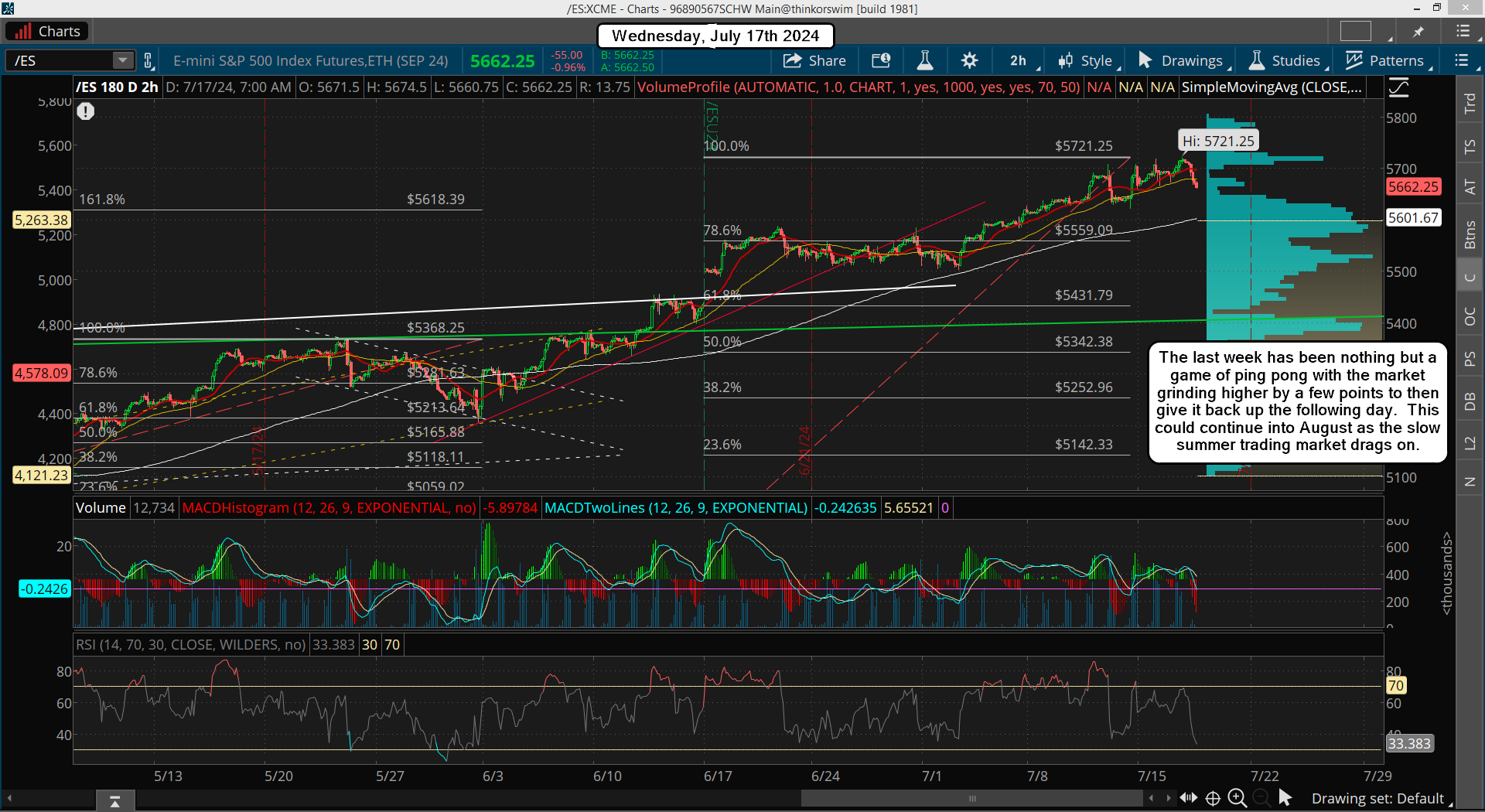

This week the market will be focused on the CPI out on Wednesday, which should do the typical wild swings to trap both sides before the next big move, which I think will be up. Meaning we should have one more move down this week for either a higher low or lower low, but don't know which one?

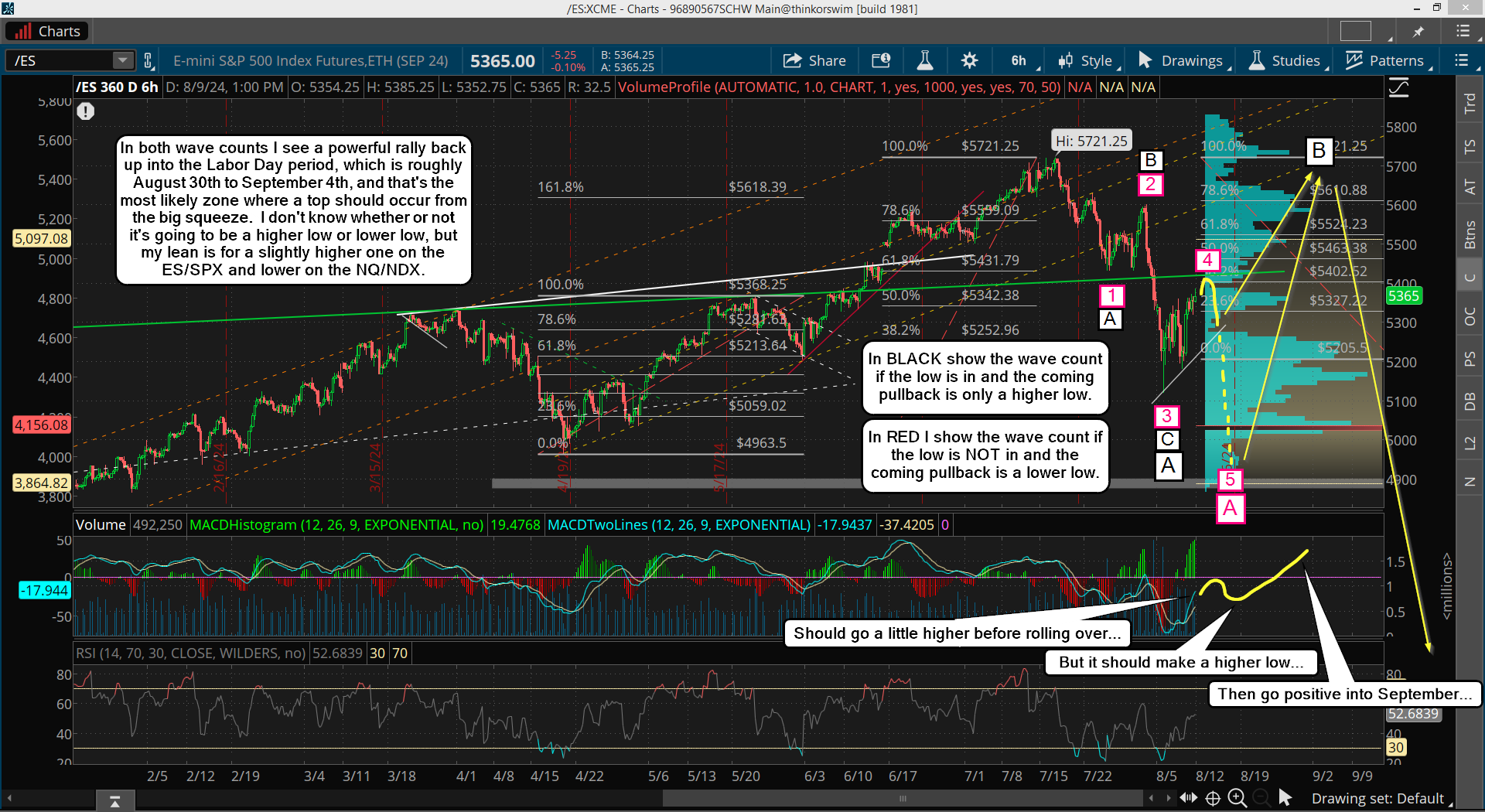

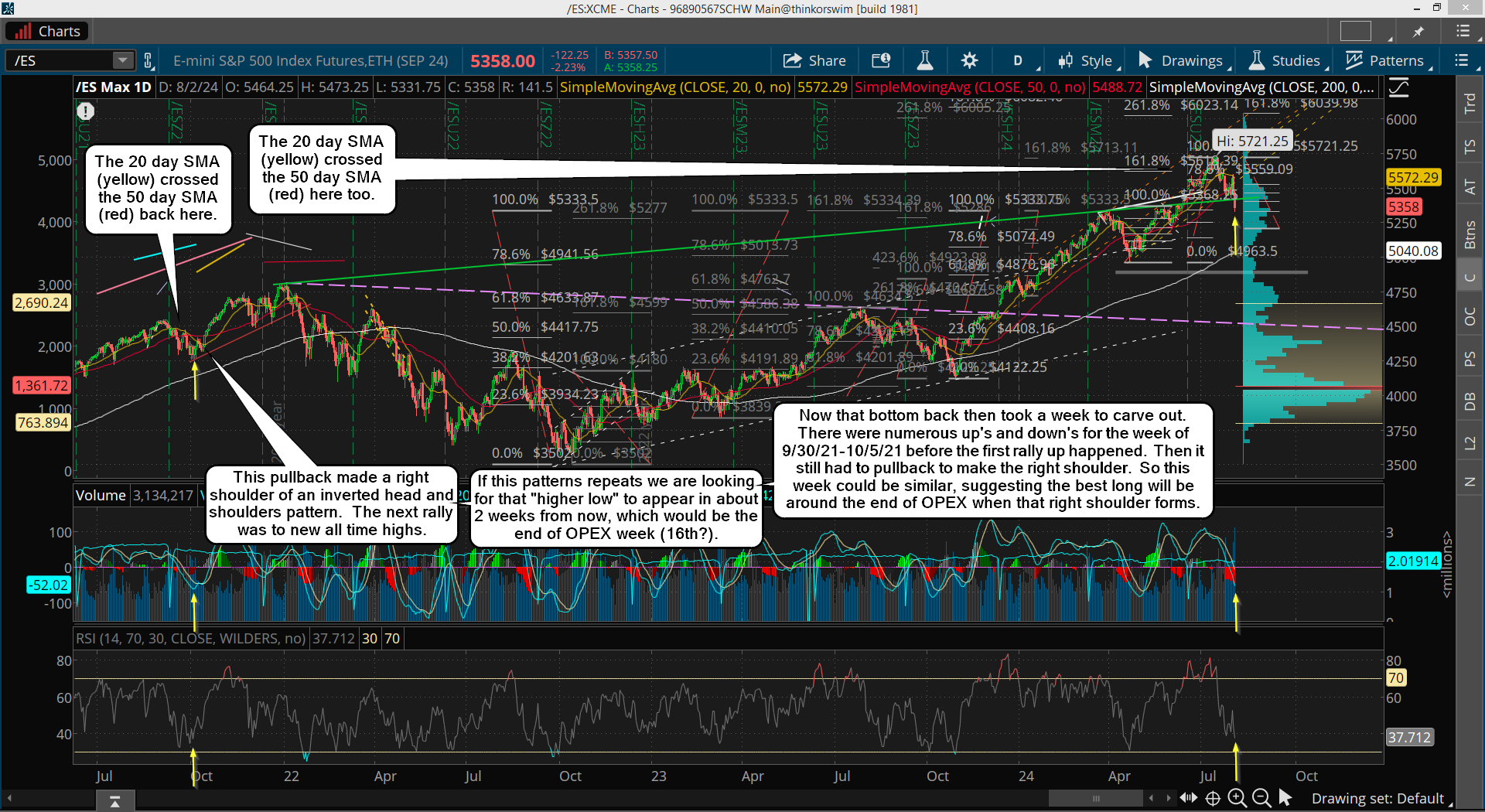

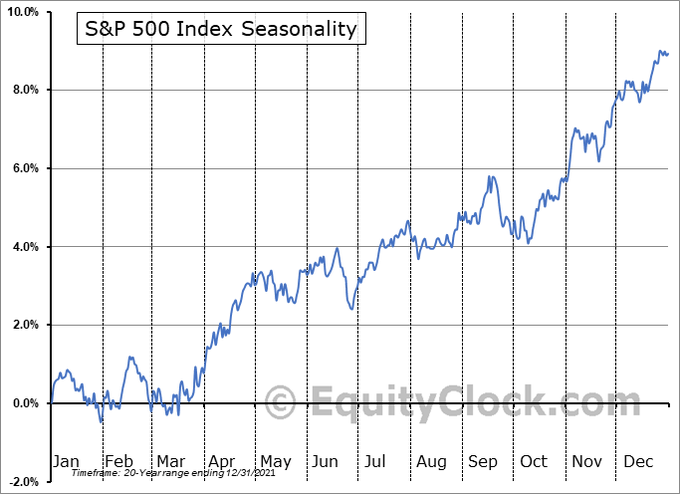

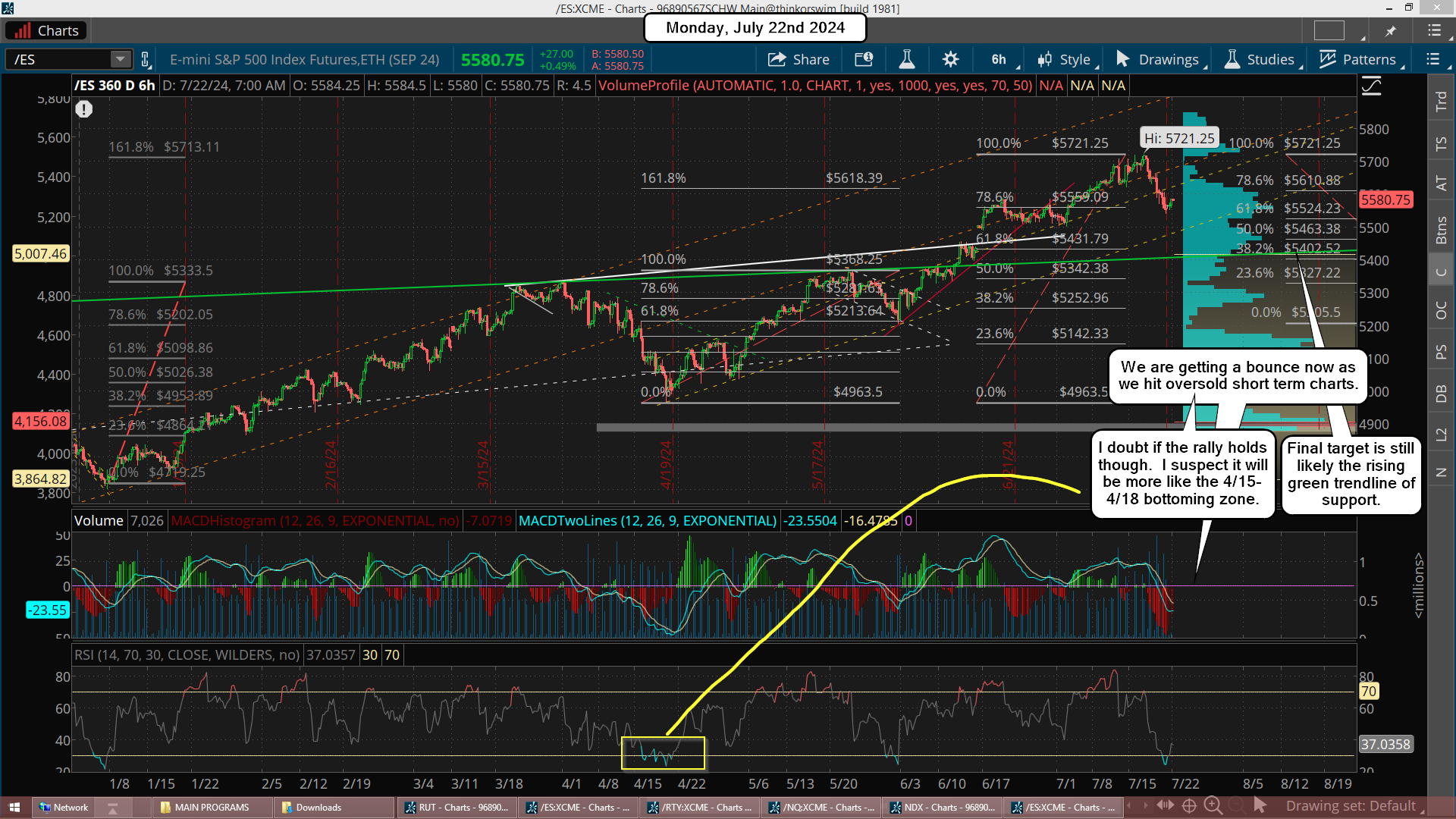

If we rally up toward the rising green trendline in front of the CPI then of course we'll pullback after it, but if we do that pullback in front of it then we should rally up after it. I've added a new rising white trendline on my chart, which will be support on any move down. I don't know how they will do it but I'll be looking for the pullback for a long entry, which should happen this week... either before or after the CPI. Once it's finished though I'll be looking for a strong rally into Labor Day around the end of this month, which could make a slightly higher high. Here's a chart...

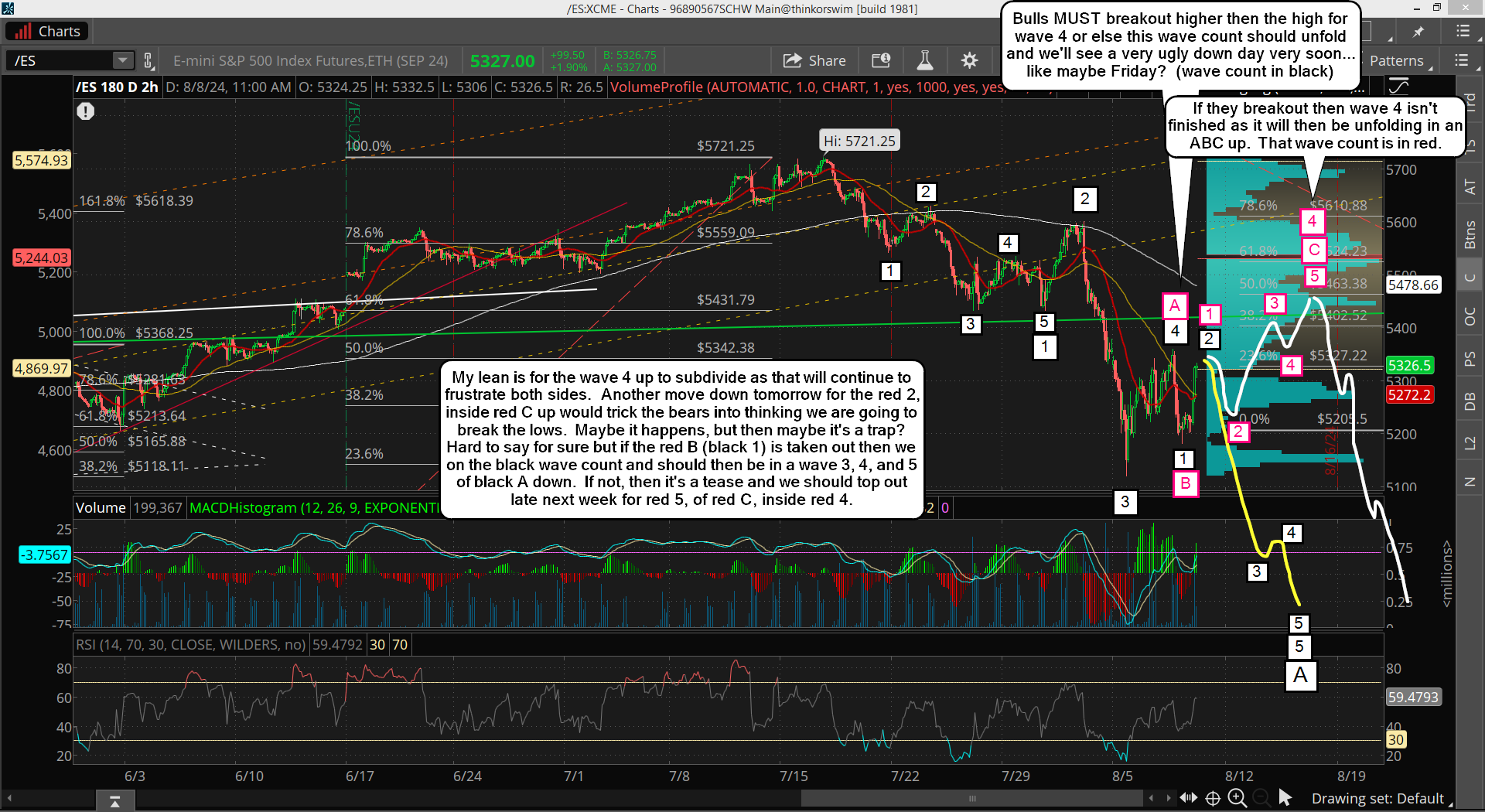

Now if the coming pullback is a higher low then I'll just mark the larger A wave completion at the 5120 current low on 8/5, which will be a 3 wave decline then. If we go lower then it will be a 5 wave decline for the larger A wave and that will mark the low. My lean is for a higher low with the larger A down having already ended, but that's just a guess. And looking at the technicals I lean toward a top in front of the CPI with the decline afterwards, but it could be a low in front of it too. Again, that's just a guess based on the technicals, which look like we will grind higher first and roll over around the CPI this Wednesday. Here's the daily chart...

In conclusion I think we go a little higher into the CPI and then pullback for a higher low Wednesday or Thursday. It could drag into Friday but I doubt if they close the weekly candle down... meaning we should see a late day squeeze on Friday if it starts off weak. The rally that should follow will likely last into the Labor Day period where a higher high could happen on the ES/SPX but I don't think we get one on the NQ/NDX.

Have a blessed day.