The market went basically flat today, closing slightly lower. This was the consolidation day that I was looking for yesterday. So, I was off a day... nobody's perfect I guess. Regardless, I'm looking for the swing trade play, and I'm just sitting in cash for now.

I think tomorrow could be another consolidation day, just like today. Slightly up or down, but no big move yet. Everyone seems to be waiting on the jobs numbers on Friday. I think it will fool everyone and be viewed as positive... which will push the market higher again.

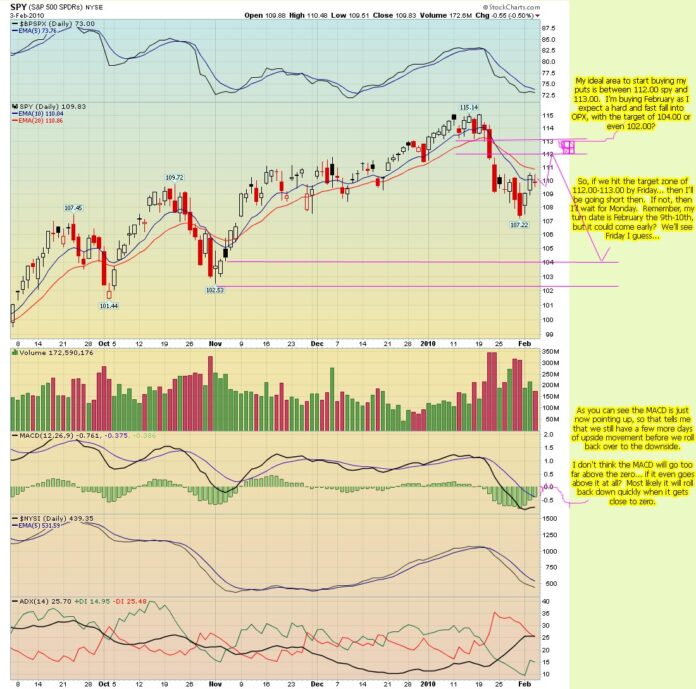

I'm really looking for a move to 112.00 spy or better. I'd love for it to reach 113.00, which was the major lower level of support during the 2 week battle between the bulls and bears, while inside a sideways channel. The 115.14 was the high, and the low was just a hair above 113.00 (spy).

The ideal plan to happen is for the market to pullback a little tomorrow and then rally one more time on the fake jobs numbers Friday, as you know the government is going to lie again. Let's just hope they do a good job of it this time.

Here a chart of what I'm looking for...

The trades you decide to take shouldn't be based on what I'm taking. I'm very confident of this wave 3 down coming, and that's why my risk tolerance is high. Buying short term February puts could make you a ton of money or you could lose it all too? My indicators tell me it's going to fall, so I'll be taking higher risks. Choose wisely....

Red

Red, what will you do if we just remain relatively flat or dribble slightly down before Feb 9th/10th? Will you still short into that?

Once that chart starts to show signs of rolling back down (look at the MACD) I'll be going short at whatever level it's at. Either this Friday or Monday… I'll be short! It will roll by Tuesday… I'm betting the farm on it!

I believe you. I am still short.

You short now?

No, I miss this one Monica. I'm glad your short though. I'll have to wait for a bounce now to get short. Arrrgggh!

Don't worry Red – it's never too late and I'm sure you will get your chance. I think the only thing I have learned from the stock market is to expect the unexpected!

Ain't that the truth girl? Stay short if you're already there. I'll look for a bounce tomorrow to join you.

Red, I'm in it for the long haul and will stay short. That's why I didn't try to catch the top. I have been losing money for months but I truly believed I would be OK and hopefully now I will be.

Cash is a position, agreed on the fake job numbers….every Gov contract requires businesses to increase their overhead by reports on job creation by specific monies. Really a bunch of bull – so to speak.

I'm a 100% cash now Steveo… I'm just waiting for the finally push higher on Friday or Monday. Target is 112-113 spy. I'll be going 100% short at that area. Yes, I'm that confident that the market will fall. My target is 104 by OPX.

Red ….

Wait just getting my coat (and helmet), I'm coming with you ………….!

Crash

Glad to have you join me Crash. This Friday or Monday will be the time to go short. We just have too wait for another push higher first. Patience….

He Red, Looks like we may need to change the game plan. I did not see this drop coming and I am not short, sitting mostly in cash at this time. Do you still see things playing out with a leg down in the markets starting sometime next week?

Thanks again for all of your research and analysis.

I'm sitting in cash too Captain. I didn't see this one coming. I'll have too wait for a bounce… hopefully tomorrow.

looks like the shorts got the jump on us. Right when I thought “we” had it figured out the “cartel” steps ahead of us and sells. On what news? Rueters states Jobless claims (weekly) and soviergn debt problems, see yahoofincancial

I've read the revisions to the monthly employment data for the previous YEAR will come out tomorrow and the bad news is that it's thought the revisions could be 100K more each of the 12 months unemployed than reported (according to larry levin). This bad news for 2009 will overshadow the NFP tomorrow. So they sold the bad news today.

I'm hoping for a bounce tomorrow ben… I totally didn't see this one coming.

Another reason for the sell of could be due to a hedge fund that imploded. One of my associates heard some speculation of this going around the pits today.

I will post if a get any additional info on the story.

Please do… (and let's just hope for a small bounce tomorrow to get short on)

Hey Leo

What if the market placed a bottom (V) either today or tomorrow/overnight and then bounces for a couple of days making wave 2. And then the beautiful 3 down the tubes?

The wave 2 that is coming is a smaller wave 2 inside a larger wave 3, which should have 5 smaller waves inside it. I think the larger wave 2 is over, and we just had a smaller wave 1 inside a larger wave 3.

Hey Leo

What if the market placed a bottom (V) either today or tomorrow/overnight and then bounces for a couple of days making wave 2. And then the beautiful 3 down the tubes?

The wave 2 that is coming is a smaller wave 2 inside a larger wave 3, which should have 5 smaller waves inside it. I think the larger wave 2 is over, and we just had a smaller wave 1 inside a larger wave 3.

Another reason for the sell of could be due to a hedge fund that imploded. One of my associates heard some speculation of this going around the pits today.

I will post if a get any additional info on the story.

Please do… (and let's just hope for a small bounce tomorrow to get short on)

Don't worry Red – it's never too late and I'm sure you will get your chance. I think the only thing I have learned from the stock market is to expect the unexpected!

Ain't that the truth girl? Stay short if you're already there. I'll look for a bounce tomorrow to join you.

Red, I'm in it for the long haul and will stay short. That's why I didn't try to catch the top. I have been losing money for months but I truly believed I would be OK and hopefully now I will be.