I guess we are back to the "Shoulda' Woulda' Coulda'" forecasts for the market now. Yes, it should have already rolled over to the downside. And it would have done so if we had any real volume in the market. But, it also could still go higher? There... now I've covered it all! LOL!

As for next week... once again, it should roll over to the downside. Will it? Who knows? This market is so controlled it isn't even fun anymore. Any selling is quickly bought up by computer bot programs, and as long as the big institutions won't sell their shares, the little guys will never succeed in pushing this market back down.

It's truly up to the big institutions, as the selling will only stick when they start selling. When? I don't know, but we seem too be very close. Too many signs of this damn cracking are appearing now. Eventually one of those big boys will hit the panic button, and the rest will follow.

I heard somewhere that this last week ranked in the top 10 lightest volume weeks for the last 6-7 years. And it's March! WTF? I'd expect it in the summer, or around a major holiday, but not during the month of March. Man... when this market manipulation finally fails to work anymore... look out below, as this pit might be bottomless!

One of the signs that the market is cracking is the fact that both oil and gold sold off Friday, while the dollar was getting hammered. Good ol' Ben was out in force on Friday, the dollar got kicked in the groins again. The poor little dollar... you actually feel sorry for it. It's the governments' punching bag it seems...

Also notice that the market did not rise proportionally to the dollar being sold. The market actually ended down by a fraction. It should have been up 100 points or more on the Dow, with the dollar getting sold off so hard. It didn't... which clearly indicates that this inverse relationship between the two is struggling badly. Eventually, it will cease to work, and the market will sell off with the dollar. When? Unknown... but these current observations are clearly pointing to a top in the market.

The VIX has also inched it way up, which is another indicator that we are nearing a top, or already at one. Volume is all we need in the market. Give me volume, and I'll give you selling! It's really that simple! The pit bulls (big institutions) are currently on their leash and sitting still as their master (the government thugs - Timmy, Benny and Obama) have told them to do so. And for now, they are listening. Soon they will get hungry, and break that leash. Then the fun starts!

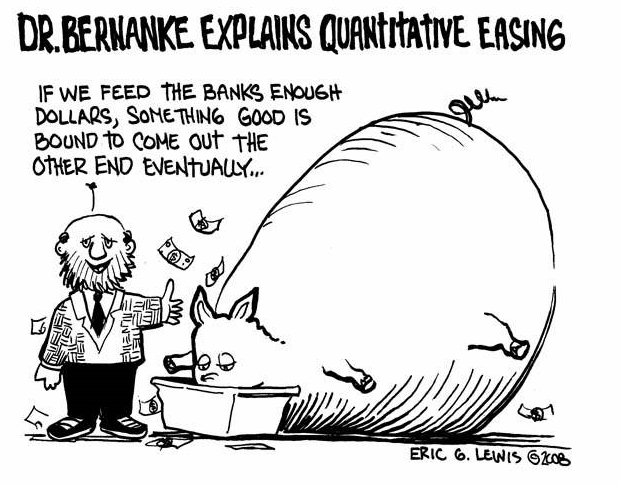

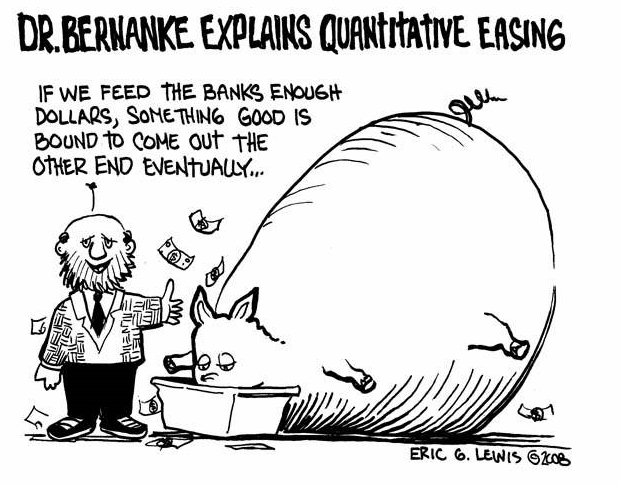

One more thing... let's also not forget that the Fed's are cutting back on their Quantitative Easing, as Obama stated recently that they will be trying to reel back in the money they've put out into the system. Good Luck on that Mr. Dreamer! Goldman already moved that money into the Cayman Islands...

I'd post some charts, but what's the point... the market is going to continue up, until they want to sell it. Charts, Astrology, Moon Cycles, etc... don't affect a computer bot buying machine. All that is calculated based on real people... that have emotions. Machines don't have emotions, so a lot of the traditional ways to predict the market are history.

Welcome to the machine...

Let's hope that this isn't what happens to the stock market and the economy in the next few years...

Red

Sorry gang... I got really busy today, and didn't have time to do a Monday post. Doesn't look like I missed anything anyway... I'll get one up Tuesday. Meanwhile... make the market sell off, would you? LOL

Yeah the volume last week was shocking! (not really) But I agree with you, there is really nothing happening and the market lost all of its fun factor.

My account is hurting after anticipating a correction but hey… Welcome to the machine.

It just seems pointless to chart anymore, as the machines are in control, not humans. Humans do their buying and selling on emotions, so they can be somewhat predictable… but not machines.

I believe that's why all the turn dates based on the moon phases or astrology, don't work anymore. Frustrating isn't really a strong enough word to express how I really feel about this market.

Thanks Red – tomorrow should be an interesting day. Question is, if we gap down, what are they going to blame it on?

Carl just now:

June S&P E-mini Futures: Today's range estimate for the June contract is 1136 – 1148. I think a drop into the 1120-30 zone is imminent. Looking further ahead, look for the ES to reach the 1200 level by the end of May.

1142 -1150.25 actual yesterday (7.75 points)

1140.25 (last night's low)

1136-1148 estimate (June Expiry) for today (12 points)

1143.75 currently, so estimate is -5.75 to +4.25 from here

Earl, tZA above PP, Are you in?

Good Morning, Gcocks.

I haven't added yet, but I still have the TZA I bought last Friday.

If $RVX can close about the 20 MA today, you might want to buy TZA on the dip tomorrow. Sell TZA when $RUT touches the 20 day MA.

Dreadwin,

The last two times $RUT was in the area of it's 20 day MA, it blasted right through it like it wasn't there. Hard to see why it can be different this time, but I will be watching closely.

I think it will coincide with some other indicators. In general, $RUT could care less about the 20.

I see. Thanks!

You mean you don't think he should hold it forever like me?!

I totally admire your guts and conviction. You may yet be right. I'm still in cash for my trading account, waiting for things to make sense again.

Dreadwin, it's more like stupidity! I am stubborn as a mule and am sure I will pay a hefty price. I just think in the long term there are very few (you might be one of them) that can make money day trading.

Monica,

I will likely leap out of TZA on a whim. It has not been kind to me lately. But for sure, if AmericanBulls issues a sell signal on it, I'm out.

Just remember, something can't be mean or kind to you forever! The tides will change at some point. But if AmericanBulls has been accurate, by all means, follow them.

Accurate is not a word I would use to describe them, as a call at the end of a day can be as wrong as anything. I guess I'm just going to consider that they might be right.

Right now, it looks like AmericanBulls will have a BUY signal on TZA tonight, which will put me in TZA buy mode tomorrow. A dip then would be nice.

Man, GS looks like a great short. Wish I had the funds 🙁

SPY 60 min setup

http://www.flickr.com/photos/47091634@N04/44354…

SPY has very little room to move down on the 60 min as max contain is @ 113.41 now, consecutive closes below max contain on the 60 will lead to a trip down the 111.40 – 110.34 area where there is a knot of containment points

Gracias 🙂

$SPX terminal 2

11/21/2008 : 03/06/2009 : 3 month – 13 days

01/19/2010 : 03/12/2010 : 1 month – 21 days

Not sure I get this. My interpretation is that since it took around 102 days to get to new lows starting in 2008, and 51 days to get to new highs (half of 102), it will take only 26 days (1/2 of 51) to get to lows below those last seen on Feb 5th?

that's one way to look at it,

I'm interested in the relationship of the terminal 2 points of the bear mkt : bull mkt

I see – Nevermind my interpretation. I just realized that if my interpretation worked, it would have to be 26 days from Feb. 5th to make new lows and that didn't happen.

So the last two low points of the bear market had 102 days in between them, and the last 2 high points of the so called “bull” market had 51 points between them.

Thought you might like…

http://www.futuresmag.com/News/2010/3/Pages/Fib…

link doesn't work, it says bad request

Sorry for the lengthy comment….

———————————

The stock market has done reasonably well since the cycle inverted on Feb. 5 as new highs confirm that cycle. Financials are doing reasonably well but what got my attention lately is the action in leisure sections like hotels, cruise lines and restaurants. What that means is people are starting to spend money again. When you see stocks like Carnival, Royal Caribbean, Starwood Hotels at new highs it means people are going on vacation. Other stocks that are at new highs are Cheesecake Factory, Darden and even Morton’s which is on a breakout means you have to take notice. Let’s face it; Morton’s is never going to be confused with Jack in the Box. Just so you know, J in the B is not even close to a new high.

What does that tell you?

On the other side of the coin there are literally hundreds of stocks that have given us V shape recoveries since February. I like to see stocks that break out of bases and there have not been enough of those. My concern is the multitude of stocks going straight up means there is some kind of a buying panic going on. Turn on the television and one of the themes is how many people are panicking because they’ve missed this move over the past year. The cheerleaders are exhorting the hordes to jump in and they are doing it! My take is if you didn’t get into the market when you were supposed to no point in doing it now. As traders, there are many different ways of entering a stock but we all know they are talking about the buy and hold crowd.

If you are a buy and holder now is not the time to be getting in. As a matter of fact it could be the WORST time to be getting in. Its time window time again and this is one of the bigger ones. We are 610 days off the top of the bear. But it’s not the only one this week. On Thursday the SPX will be 261 days off the bottom. On Friday, day 262 for the SPX the overall market will be at 615 which is another important number which very few of you know about. The 615 number is taken from the NASA tables as Venus (224.7 days) is .615 of a 365 day year. Don’t think that’s important? From the 87 crash low to the top, the low in the Dow last year is a .615 retracement. No, not .618, its .615 you got that right. Anyway you slice it we have a double dose of fun this week as markets hit new highs.

Of course, with the Spring Equinox this is the time of year when trends can change. In general terms if we do get a turn here because of the time windows and the change of season any potential turn here could be the turning point of the whole year. Of course there is no validation as I write this, but conditions are ripe that if a high is put in, it could be the high for the year. Consider the NASDAQ topped three weeks later back in 2007. So I’m not talking just about this week, I’m talking about the overall market conditions in the next month.

Over the years I’ve realized how important some balance of price and time is to the turn window. There have been many windows which have not validated. Why is that? This applies to a daily as much as it does to an hourly chart. What we are looking for is some squaring of price and time at the window to gain a more powerful pivot. The pivots come as a result of a universal price and time ratio as you’ve seen in my now famous Russell 2000 cracking the Fibonacci code webinar. If you haven’t seen it, I know it’s supposed to be up for 6 months and I think we are about 5 months into it. But we can get a change of direction based on time alone and if that’s all we get, the change of direction is usually short lived. Sometimes we get turns on some bizarre yet simple calculations. Take the Cocoa chart for instance. Over the last 30+ years, the Cocoa market was in a 280 month bear followed by a 109 month bull. Do the math, that adds up to 389 months. Now take 109/280 and what is the answer to that? Get your calculator…

It’s these kinds of symmetries we uncover in our weekend Futures update. But that calculation did throw the Cocoa chart into a new bear market. As we hit this new window the SOX chart is up .314 (Pi) for every hour since the low on February 5. The BKX is up 189.8% (rounds to geometric 190) since it bottomed out last year. It’s also up .1317 points a day and 1317 is 3.60 times a 365 day year. Want to read something strange?

The Russell is now up 336.31 points in 255 days equates to a move of 1.318 points a day. Banks are up .1317 and Russell 1.318. So we have symmetry on several of our important charts.

What does this mean? Conditions are very ripe for an important change of direction. Even the Dollar is ripe for a change. The daily Dollar is now down .1125 points a day off its high and the significance there is double 11.25 and you get 22.50 and again you get 45, all important Gann angle numbers. Given the fact the Greenback is at important median support it’s all lining up. I think these numbers might be a waste if the Dollar weren’t lining up as well. But it is.

On a lower probability there is a chance we don’t get a reversal but a breakaway gap. All of these calculations are designed to do is give us an important reaction point in the market. During the crisis, my windows led to acceleration points, both 233 day windows hitting either at the Lehman BK and the TARP event. We’ve covered that endlessly in this space. But the higher probability is a change of direction going south. Perhaps the lowest probability play here is having all of these time windows this time of year and have nothing happen at all.

thanks, I'll share some sequences later in the week

Carl just went Long one unit at 1139.25

Damn Carl – I hope one of these days he is proven wrong!

Some days he gets it wrong. Hopefully, today is one of those days.

TESTING for chickens

operators left a 3 min gap @ 1149.55 from the 9:51 candle

Carl must have noticed!

1149.55 gap filled

You may be smarted than me, but I am faster!

smarter that is 🙂

they left 4 gaps starting from the 14:33 candle

I'm having trouble seeing them but aren't gaps always left in the daily chart?

you'll need a 3 min chart, they just threw a tick on the SPY coinciding with the gap on the $SPX @ 14:33

OK. I'll check it out.

Oh my goodness – I see that tick they threw in. Why do they do that?

it coincides with the 14:33 $SPX gap

I know that it coincides with the 14:33 gap but does it mean then that they can take the $SPX higher now without having to “really” fill that Gap?

$vix weekly

http://www.flickr.com/photos/47091634@N04/44354…

UUP daily ***if*** scenario

http://www.flickr.com/photos/47091634@N04/44354…

We are oh so close on that UUP – argh!

GAP FILLED!

Carl at day’s end:

1136-1148 estimate today for /ES (12 points, June Expiry)

1136.50 -1146.50 actual today (10.0 points)

Pretty close.

Trades:

In /ES at 1139.25 hasn’t sold, currently 1145.50 (up 6.25)

Grade: B

Wow – think I would have sold. But Carl seems to be doing much better than I!

I would have sold also. Carl must be looking at different indicators.

TNA opened down 0.1%. TNA was up 0.4% at the high and closed down 0.7%.

The Full Moon Trade ends today.

After eleven days, this trade is up 23%.

Money is flowing back into the market. Not good for bears. Bears are fighting a setup with a historical record of 9 to 1 against them. Lousy odds.

On a side note, I wonder what has Mole done with all the March 10 puts he had been accumulating last year. I hope he doesnt get wiped out.

I remember that last year when Mole was buying all those March puts. I'd hope he sold them a long time ago. I'm sure they are worthless now.

TZA opened up 0.2%. Gap today was filled, and TZA was up 3.1% at the high. TZA closed up 0.8%.

We are in a New Moon Trade, which favors TZA, starting at the close today.

The plan is to wait for a BUY signal from AmericanBulls on TZA before starting this trade.

Volume for TZA was normal

$RVX (VIX for $RUT) closed 2.1% higher with TZA up 0.8%. Good for TZA.

TZA was slightly up today, up now for 2 days in a row. Before this, had been down 9 days in a row.

The low for TNA today was $7.28. The low yesterday was $7.16, the lowest low ever.

Ultimate Oscillator for TZA bottomed at 20 sixteen trading days ago and has generally risen since then but has remained below 50 and is currently 31. Indicating continued weakness for TZA. There are many days in the last sixteen trading days with divergences, it really is a mess to figure out.

Bollinger Bands for $RVX (VIX for $RUT): today’s candle touched the Bollinger Mid Line (20 day MA) and fell back (3rd day in a row). Closed higher today but seems to in an area of congestion. The lower Bollinger band is rising. Looks like $RVX might be rising, which is good for TZA.

Bollinger Bands for $RUT: The black candle for $RUT moved down today, farther from the upper Bollinger Band, indicating that $RUT might pause here or continue falling. Good for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s candle fell into an area of congestion, away from the flat upper Bollinger band. Perhaps indicating that TZA will continue to rise.

TZA had a higher high, higher low and higher close – good for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks like TZA might rise tomorrow.

I went in and out of TZA twice. I am holding some overnight. How about you.

I got stopped out when TZA dipped below the pivot line, but got back in when it bounced. Am holding mine over night.

Much more fun if TZA would stay away from the pivot line.

AmericanBulls gave a BUY on TZA just now. I would have done as well waiting for this signal as I did getting a jump on it last Friday.

The New Moon Trade, which favors TZA, starts now, as AmericanBulls has issued a BUY signal.

TZA is available now in the after hours session for $7.37, so that becomes the buy price for this trade.

I may add some more tonight.

Carrying what I now have overnight is thrill enough for me.

The view from Americanbulls

TNA is a SELL (Sell confirmed today). The candlestick of today was a High Wave (loss of a sense of direction and much indecision in the market).

TNA was up 46% since the buy signal on Feb 9th. TNA was $36.69 at the time, and closed today at $53.65.

TZA is a BUY (Buy confirmed today). The candlestick of today was White Spinning Top (complete indecision between the Bulls & Bears).

TZA was down 33% since the sell signal on Feb 9th. TZA was $11.04 at the time, and closed today at $7.38.

Summary: Sell TNA, Buy TZA.

$SPX

High Close : Low Close : High Close

1/19/2010 HC 1150.39

2/08/2010 LC 1056.62

3/15/2010 HC 1150.51

http://www.flickr.com/photos/47091634@N04/44359…

Are you implying that you think 04/0820/10 will have a LC at 1056.62?

I should have specified this isn't a sequence rather a setup,

this is what i call a Bermuda triangle formation

You have a way with words. I hope the hole is deep and wide.

“Bermuda Triangles are typically seen as wave fours. Once complete, prices typically move in the same direction they were headed before the triangle started. The downside targets are usually at a minimum the distance of the widest portion of the triangle from the level the triangle ends.” Bermuda triangles are also known as devil triangles 🙂 Question I have is weren't we headed up before this whole triangle started meaning that we would be going up from here?

The market is at a very tricky situation here. On one hand, money is flowing in, not out. That can change over a few days, but until that changes, it is going to stay strong. Furthermore, the March OpEx week has a 9 to 1 odds of being an up week. So basically for this week, bears are fighting against bad odds.

On the other hand, the current market conditions of being overbought, over valued, and facing interest rate pressure, has in the past experienced a -10% over the coming several weeks.

As soon as I detect money flowing out, I will start going short. Expecting a 10% drop. But will then be looking to load up more growth stocks with full margin. Expecting to ride the last stage of the cyclical bull market to the summer peak. P3 will come this summer when the Alt A reset hit the fan. This thermonuclear catastrophy will start going off from mid 2010 to mid 2011. The Alt A reset will be the trigger for the P3 everyone has been looking for since march 09.

Nice Post. Makes sense.

Carl's morning call:

June S&P E-mini Futures: Today's range estimate for the June contract is 1143 – 1158. The ES should reach the 1200 level by the end of May.

1136.50 -1146.50 range yesterday (10.0 points)

1144.50-1149 range overnight

1143-1158 todays range

1147.75 currently, so -4.75 to +10.25 from here

Thanks Earl. Hope he is wrong today. Still short I am.

Carl just went long second unit at 1147.75

His first buy was 1139.25 yesterday

Carl just sold both units at 1150.75

Out of TZA

Wow – Carl is good. I'm glad I wasn't home for the huge run up. My stomach probably could not have taken it. Still haven't busted through my projections though. Hanging on.

I suggested (yesterday) that you'd have an opportunity to buy TZA on the dip today. Did you take it?

You did suggest that. I didn't take it, as I didn't want to add more TZA while underwater on the trade.

I'm out of TZA now, and that price might just come back.

The bullish candlestick pattern in TZA is still intact, and the bullish candlestick pattern in $RVX is still intact (did a gap fill of the gap created yesterday). $RUT is lagging the $SPX today, which is a bad sign for $SPX.

thanks dread.

Looks like TZA might hit it's low at the end of day.

7.16 is the low from last Friday. 7.15 is clearly the stop, but I'm not sure what the buy price is.

Back in TZA at the close.

Looks from below that he sold it.

Sundancer, thoughts?

Carl just Repurchased one unit at 1151.25

Oh lovely.

AAPL still hasn't broken the 227 number.

AAPL is out of room to run if the capital capacity of it's regulator hasn't changed, friday's high came within .6% of it's regulatory limit

AAPL is showing positive money flow. Buyers are more aggressive than sellers.

all I know is numbers, AAPL's regulator has not changed since I started crunching it's numbers back in the summer of 2006

AAPL is dancing with it's weekly controlling TL

http://www.flickr.com/photos/47091634@N04/44391…

But UUP hasn't broken through containment either.

Time Time Time… dilutes peoples perspective relative to price level

We're 6 months into going nowhere and it's worn many traders out, but this behavior isn't anything new to the $SPX. I've put together a weekly chart illustrating the markets tendency to rest over time.

http://www.flickr.com/photos/47091634@N04/44390…

moving day comes when the market has put to sleep everybody and then before traders realize it, the market is at it's next destination.

Yes, true. When you have a position, waiting any time is torture. I personally can't handle another 3 months of this.

most people can't handle the Time element in the market, with the compression in volatility it's taken many people out of the game. Since March 5th the S&P is up a whooping 20 handles. To people that are holding bearish positions it probably feels like it's up 100 handles, it's just another dynamic of the Time element playing mind games on people. The S&P is 7 handles higher than it was 64 days ago, daily gyrations to weekly gyrations turn out to net nothing and in the process, parting people with their money.

That's why I don't day trade because I can't get it right but at the same time, even though the S&P hasn't moved much, individual stocks and leveraged ETFs have moved more substantially. I guess it's better just to short the indexes straight out if you are bearish.

XLF is creeping closer to 15.82, where it will terminate it's bullish setup.

http://www.flickr.com/photos/47091634@N04/44234…

it may be worth pointing out that termination of a bullish setup is not equivalent to the beginning of a bearish setup.

But, if I am understanding you correctly, we also need UUP to close above 23.75. $RUT looks like it closed at containment, no?

$RUT closed pennies away from the $679.75 level

The UUP setup is a long term setup and will tell market participants when there is a top in equities, last year on May 19,20 the UUP broke through all containment pts signaling to market participants that any downward movement would be corrective. Right now it would need closes above the 24.25 level.

***the XLF can print prices higher than 15.82, that price just terminates my setup

Carl just sold long unit at 1154.75

Man he is good. And good buy at the close Earl.

Carl at day’s end:

1143-1158 estimate today for /ES (15 points, June contract)

1145.50 -1155.75 actual today (10.25 points)

Pretty close.

Trades:

In /ES at 1139.25 yesterday, sold today at 1150.75 (gain of 11.50)

In /ES at 1147.75 today, sold at 1150.75 (gain of 3.00)

In /ES at 1151.25 today, sold at 1154.75 (gain of 3.50)

Grade A

I HATE YOU CARL!!! J/K 🙂 I think Carl must work at GS!

TZA opened down 1.3%. Gap today was quickly filled, and TZA was up 0.6% at the high. TZA closed down 2.3%.

We are in a New Moon Trade, which favors TZA.

After one day, this trade is down 2.3%. Should AmericanBulls issue a sell signal, the TZA will be sold. First possible sell signal would be tomorrow.

Volume for TZA was lower than normal (only 3 lower days in the last 16 days).

$RVX (VIX for $RUT) closed down 3.3% with TZA down 2.3%. No divergence.

TZA has now been down 8 of the last 10 days.

The low for TNA today was $7.18. The low last Friday was $7.16, the lowest low since the dawn of civilization.

Ultimate Oscillator for TZA bottomed at 20 seventeen trading days ago and has generally risen since then but has remained below 50 and is currently 32. Indicating continued weakness for TZA. Today’s value was the highest of the last 4 days, so there is a mild Ultimate Oscillator up trend – mildly good for TZA.

Bollinger Bands for $RVX (VIX for $RUT): today’s candle touched the Bollinger Mid Line (20 day MA) and fell back (4th day in a row). Lowest close of the last 6 days. Seems to be in an area of congestion. The lower Bollinger band is rising. MACD has crossed from below. Really hard to read.

Bollinger Bands for $RUT: The white candle for $RUT moved up today, along with the upper Bollinger Band, indicating that $RUT might rise tomorrow. $RUT hit a new high today. Bad for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s candle rose to the top of the congestion area. The upper Bollinger band remains flat. Perhaps indicating that TZA will fall.

TZA had a lower high, lower low and lower close – all bad for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks like TZA might fall tomorrow.

IYR arrived @ it's next containment pt. @ the close

http://www.flickr.com/photos/47091634@N04/44385…

We almost made it too 116.66 spy today. With all the games they play, I can't imagine them not tagging that level intraday or on a closing print. Then maybe a little selling?

yeah a lot of rituals coming up, tomorrow is the St. Patricks ritual, Saturday is the Equinox co-relational to the sacrifice ritual 2.5 weeks later

tomorrow is also 888 days from 10/11/2007 $SPX all time high

666 days from 10/11/2007 gave us the 8/7/2009 high

777 days from 10/11/2007 gave us the dubai ritual on 11/26/2009

222 gave us the 5/19/2008 major high

333 gave us the 9/8/2008 major high

444 gave us the 12/29/2008 low

555 gave us the 4/17/2008 high

after tomorrows 888 sequence, the 999 (666) gives us july 6, 2010

Hi, I went back and looked at these inflection points and they don't seem always to be tops or bottoms although they generally fall in the vicinity.

Open $SPX 3 min gaps from the past 2 days

1143.52

1145.10

1148.54

1149.63

1152.14

It's funny how they stick by all those silly rituals. I guess you have too when you worship the devil, or else he's but a little fire under your ass! LOL!

Now that I'm thinking outside the box (way outside the box!), it makes me think about another odd coincidence between Lincoln and Kennedy. You can go here if you don't already know about it:

http://www.school-for-champions.com/history/lin…

Most people are already aware of the odd similarities between them. But what if they were the same person? Not in the physical form of course, but the spiritual form.

Yes, I do believe that my soul or spirit has lived many lives. Everyone's has actually. You should watch this video of David Wilcock, who was most likely Edgar Cayce in his past life. The similarities are amazing.

http://www.youtube.com/watch?v=scym0WH3Jww

But back to the market. The “controller's” of this market… whoever they are (the Illuminati are certainly involved), have clearly told the big institution NOT to sell. If this was a normal market, those guy's would have already bailed out.

But, they apparently owe some favors to the government for the free money the stole. So, I think the government has told them not to sell until “something” happens?

Is it Obamas' health care plan? I don't know, but they are clearly holding off on hitting the sell button. Since they seem to love those ritual games, whenever the selling does start… I'm sure it will be a some key point.

The view from Americanbulls

TNA is a BUY-IF (Buy tomorrow if conditions are right). The candlestick of today was a White Candlestick (normal buying pressure). The last two candlesticks form a Bullish Kicking Pattern. A highly reliable bullish reversal pattern. The last three candlesticks form a Bullish Morning Star Pattern. Another highly reliable bullish reversal pattern. Confirmation (tomorrow) is still recommended.

TNA was up 2.5% since the sell signal yesterday. TNA was $53.65 at the time, and closed today at $54.96.

TZA is a SELL-IF (Sell tomorrow if conditions are right). The candlestick of today was Black Spinning Top (complete indecision between the Bulls & Bears). The last two candlesticks for a Bearish Kicking Pattern. A highly reliable bearish reversal pattern. Confirmation (tomorrow) is still recommended.

TZA was down 2.7% since the buy signal yesterday. TZA was $7.37 at the time, and closed today at $7.20.

Summary:

Mostly likely: Sell TZA, Buy TNA tomorrow morning.

Also possible: no action

If carl comes out bullish tomorrow, then I will sell my tza quickly.

Agreed. Owning TZA while he is long one or two units hasn't worked lately.

This blog is getting more interesting by the minute. Please note Springheel Jack's latest post on Hot Option Babe. Updated chart of $BPNYA. We hit the top trendline of the declining channel today. We are at or very close to the top now:

http://content.screencast.com/users/springheel_…

Now, what I have noticed from this chart is that the market usually hits a top two or so days after the high on this chart which looks like it was today. That means we may have to wait until Thursday or so for a sell off. Maybe that would give us time to get UUP above 24.25 and XLF to 15.82 since we have hit most of the other containments?! But of course, that would put us beyond the 888 number Sundancer mentions. We shall see – perhaps it could be tomorrow.

Actually – the 888 theory might hold with SHJ bullish sentiment chart. Tomorrow (the 888 day) should be a new high with the sell off on Thursday. Note to self – leave the house and don't watch the tape tomorrow.

This blog is getting more interesting by the minute. Please note Springheel Jack's latest post on Hot Option Babe. Updated chart of $BPNYA. We hit the top trendline of the declining channel today. We are at or very close to the top now:

http://content.screencast.com/users/springheel_…

Now, what I have noticed from this chart is that the market usually hits a top two or so days after the high on this chart which looks like it was today. That means we may have to wait until Thursday or so for a sell off. Maybe that would give us time to get UUP above 24.25 and XLF to 15.82 since we have hit most of the other containments?! But of course, that would put us beyond the 888 number Sundancer mentions. We shall see – perhaps it could be tomorrow.

Actually – the 888 theory might hold with SHJ bullish sentiment chart. Tomorrow (the 888 day) should be a new high with the sell off on Thursday. Note to self – leave the house and don't watch the tape tomorrow.

The view from Americanbulls

TNA is a BUY-IF (Buy tomorrow if conditions are right). The candlestick of today was a White Candlestick (normal buying pressure). The last two candlesticks form a Bullish Kicking Pattern. A highly reliable bullish reversal pattern. The last three candlesticks form a Bullish Morning Star Pattern. Another highly reliable bullish reversal pattern. Confirmation (tomorrow) is still recommended.

TNA was up 2.5% since the sell signal yesterday. TNA was $53.65 at the time, and closed today at $54.96.

TZA is a SELL-IF (Sell tomorrow if conditions are right). The candlestick of today was Black Spinning Top (complete indecision between the Bulls & Bears). The last two candlesticks for a Bearish Kicking Pattern. A highly reliable bearish reversal pattern. Confirmation (tomorrow) is still recommended.

TZA was down 2.7% since the buy signal yesterday. TZA was $7.37 at the time, and closed today at $7.20.

Summary:

Mostly likely: Sell TZA, Buy TNA tomorrow morning.

Also possible: no action

If carl comes out bullish tomorrow, then I will sell my tza quickly.

Agreed. Owning TZA while he is long one or two units hasn't worked lately.

Hi, I went back and looked at these inflection points and they don't seem always to be tops or bottoms although they generally fall in the vicinity.