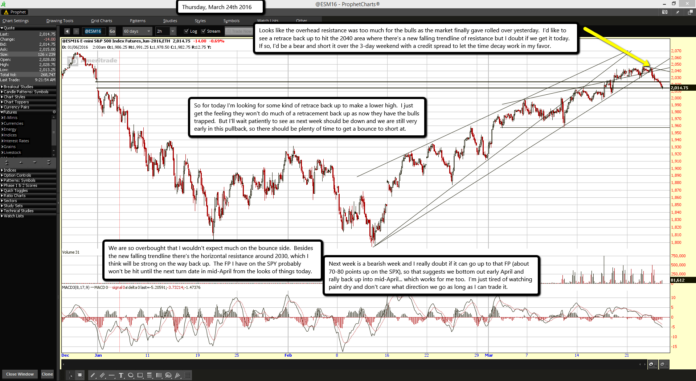

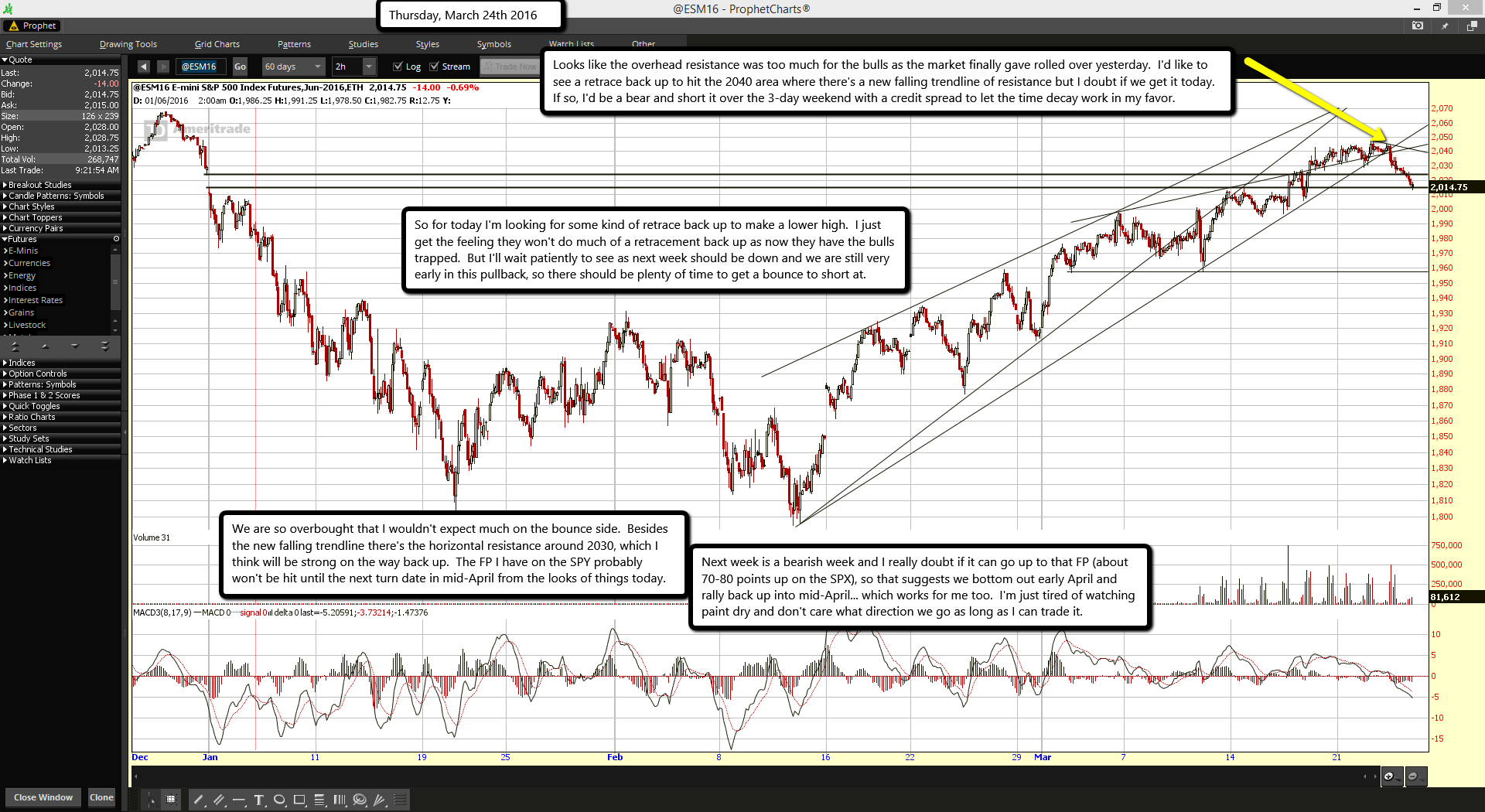

Looks like the overhead resistance was too much for the bulls as the market finally gave rolled over yesterday. I'd like to see a retrace back up to hit the 2040 area where there's a new falling trendline of resistance but I doubt if we get it today. If so, I'd be a bear and short it over the 3-day weekend with a credit spread to let the time decay work in my favor.

Looks like the overhead resistance was too much for the bulls as the market finally gave rolled over yesterday. I'd like to see a retrace back up to hit the 2040 area where there's a new falling trendline of resistance but I doubt if we get it today. If so, I'd be a bear and short it over the 3-day weekend with a credit spread to let the time decay work in my favor.

So for today I'm looking for some kind of retrace back up to make a lower high. I just get the feeling they won't do much of a retracement back up as now they have the bulls trapped. But I'll wait patiently to see as next week should be down and we are still very early in this pullback, so there should be plenty of time to get a bounce to short at.

We are so overbought that I wouldn't expect much on the bounce side. Besides the new falling trendline there's the horizontal resistance around 2030, which I think will be strong on the way back up. The FP I have on the SPY probably won't be hit until the next turn date in mid-April from the looks of things today.

Next week is a bearish week and I really doubt if it can go up to that FP (about 70-80 points up on the SPX), so that suggests we bottom out early April and rally back up into mid-April... which works for me too. I'm just tired of watching paint dry and don't care what direction we go as long as I can trade it.