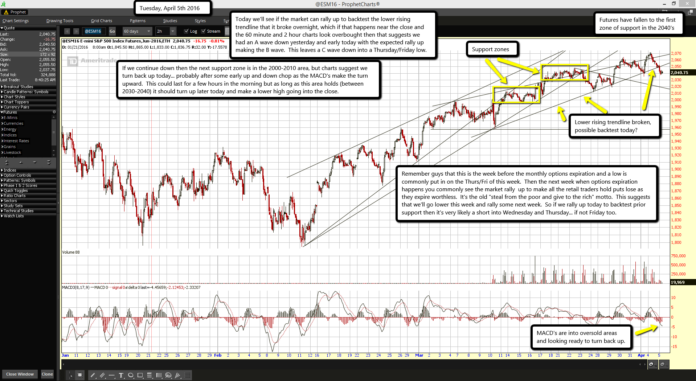

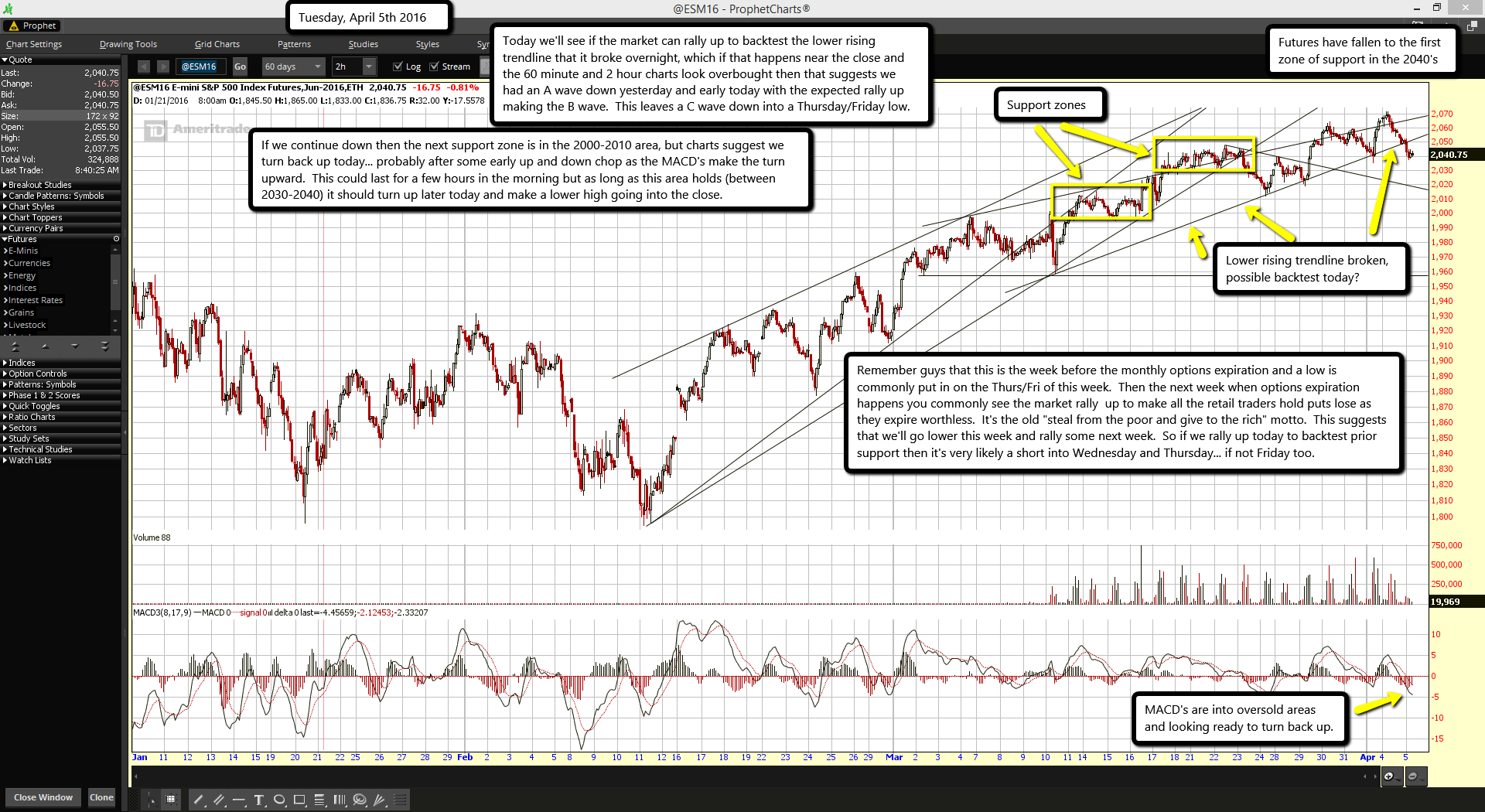

Futures have fallen to the first zone of support in the 2040's

MACD's are into oversold areas and looking ready to turn back up.

Today we'll see if the market can rally up to backtest the lower rising trendline that it broke overnight, which if that happens near the close and the 60 minute and 2 hour charts look overbought then that suggests we had an A wave down yesterday and early today with the expected rally up making the B wave. This leaves a C wave down into a Thursday/Friday low.

If we continue down then the next support zone is in the 2000-2010 area, but charts suggest we turn back up today... probably after some early up and down chop as the MACD's make the turn upward. This could last for a few hours in the morning but as long as this area holds (between 2030-2040) it should turn up later today and make a lower high going into the close.

Remember guys that this is the week before the monthly options expiration and a low is commonly put in on the Thurs/Fri of this week. Then the next week when options expiration happens you commonly see the market rally up to make all the retail traders hold puts lose as they expire worthless. It's the old "steal from the poor and give to the rich" motto. This suggests that we'll go lower this week and rally some next week. So if we rally up today to backtest prior support then it's very likely a short into Wednesday and Thursday... if not Friday too.