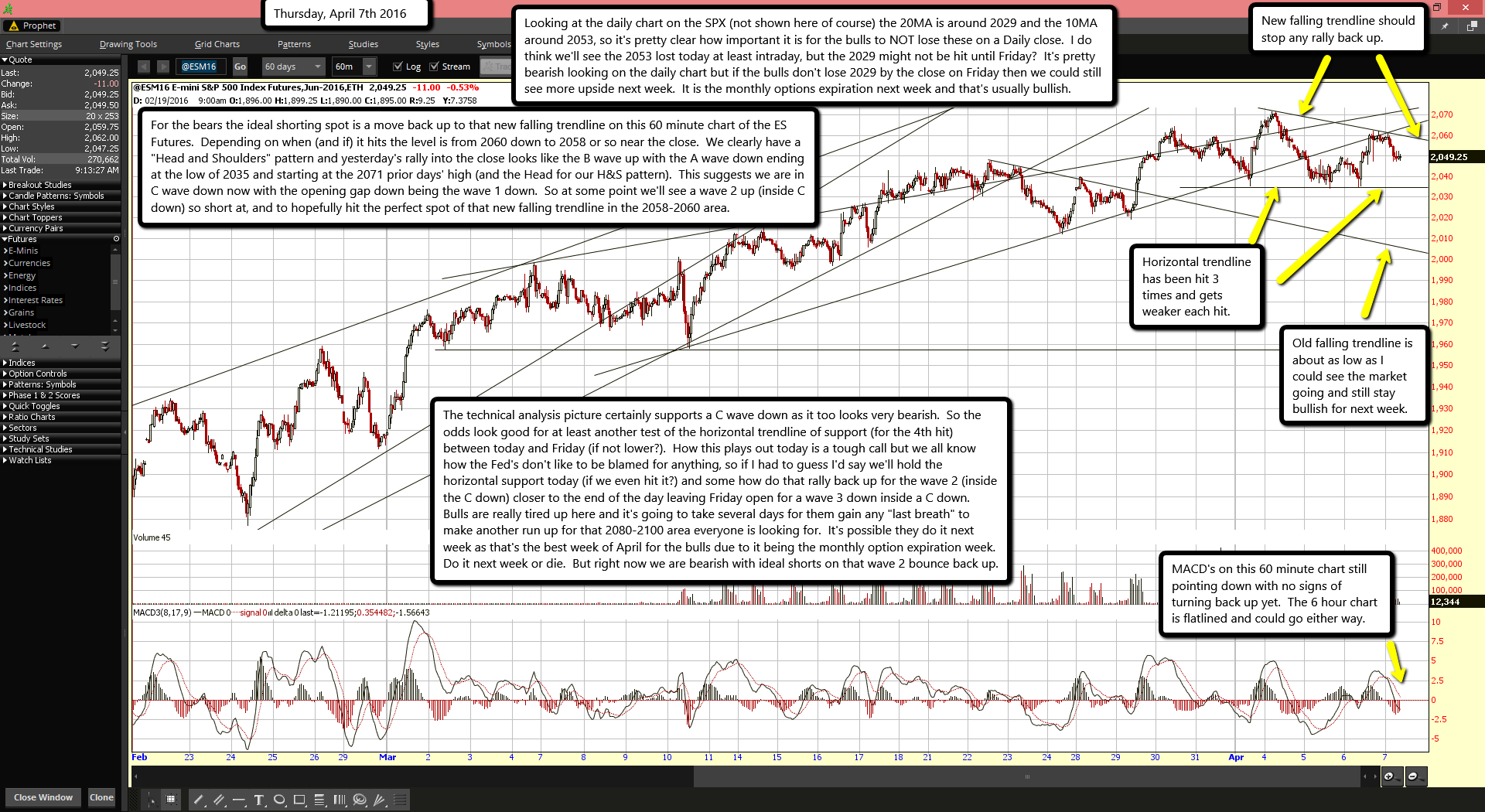

New falling trendline should stop any rally back up.

Horizontal trendline has been hit 3 times and gets weaker each hit.

Old falling trendline is about as low as I could see the market going and still stay bullish for next week.

MACD's on this 60 minute chart still pointing down with no signs of turning back up yet. The 6 hour chart is flatlined and could go either way.

Looking at the daily chart on the SPX (not shown here of course) the 20MA is around 2029 and the 10MA around 2053, so it's pretty clear how important it is for the bulls to NOT lose these on a Daily close. I do think we'll see the 2053 lost today at least intraday, but the 2029 might not be hit until Friday? It's pretty bearish looking on the daily chart but if the bulls don't lose 2029 by the close on Friday then we could still see more upside next week. It is the monthly options expiration next week and that's usually bullish.

For the bears the ideal shorting spot is a move back up to that new falling trendline on this 60 minute chart of the ES Futures. Depending on when (and if) it hits the level is from 2060 down to 2058 or so near the close. We clearly have a "Head and Shoulders" pattern and yesterday's rally into the close looks like the B wave up with the A wave down ending at the low of 2035 and starting at the 2071 prior days' high (and the Head for our H&S pattern). This suggests we are in C wave down now with the opening gap down being the wave 1 down. So at some point we'll see a wave 2 up (inside C down) so short at, and to hopefully hit the perfect spot of that new falling trendline in the 2058-2060 area.

The technical analysis picture certainly supports a C wave down as it too looks very bearish. So the odds look good for at least another test of the horizontal trendline of support (for the 4th hit) between today and Friday (if not lower?). How this plays out today is a tough call but we all know how the Fed's don't like to be blamed for anything, so if I had to guess I'd say we'll hold the horizontal support today (if we even hit it?) and some how do that rally back up for the wave 2 (inside the C down) closer to the end of the day leaving Friday open for a wave 3 down inside a C down. Bulls are really tired up here and it's going to take several days for them gain any "last breath" to make another run up for that 2080-2100 area everyone is looking for. It's possible they do it next week as that's the best week of April for the bulls due to it being the monthly option expiration week. Do it next week or die. But right now we are bearish with ideal shorts on that wave 2 bounce back up.