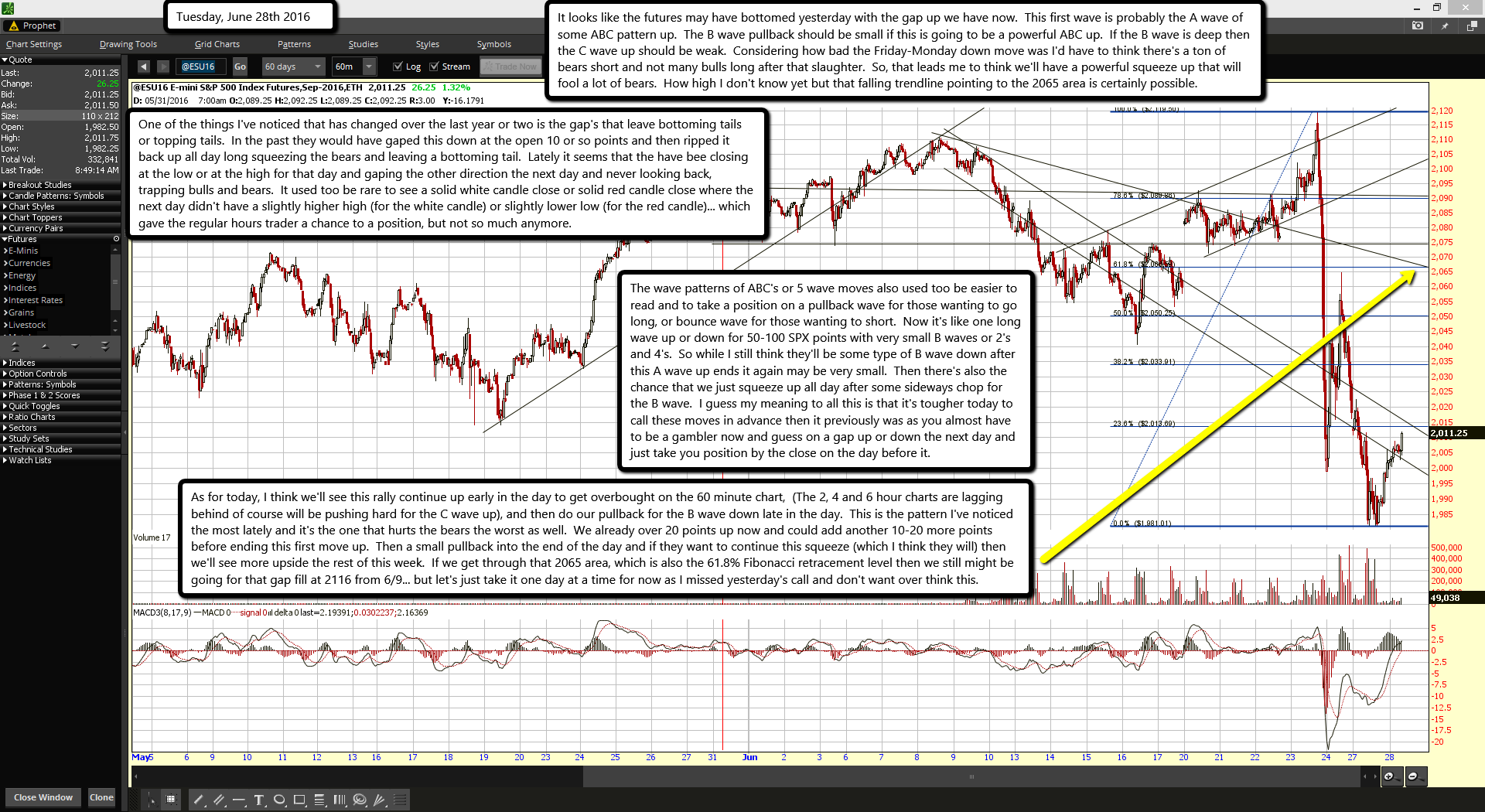

It looks like the futures may have bottomed yesterday with the gap up we have now. This first wave is probably the A wave of some ABC pattern up. The B wave pullback should be small if this is going to be a powerful ABC up. If the B wave is deep then the C wave up should be weak. Considering how bad the Friday-Monday down move was I'd have to think there's a ton of bears short and not many bulls long after that slaughter. So, that leads me to think we'll have a powerful squeeze up that will fool a lot of bears. How high I don't know yet but that falling trendline pointing to the 2065 area is certainly possible.

One of the things I've noticed that has changed over the last year or two is the gap's that leave bottoming tails or topping tails. In the past they would have gaped this down at the open 10 or so points and then ripped it back up all day long squeezing the bears and leaving a bottoming tail. Lately it seems that the have bee closing at the low or at the high for that day and gaping the other direction the next day and never looking back, trapping bulls and bears. It used too be rare to see a solid white candle close or solid red candle close where the next day didn't have a slightly higher high (for the white candle) or slightly lower low (for the red candle)... which gave the regular hours trader a chance to a position, but not so much anymore.

The wave patterns of ABC's or 5 wave moves also used too be easier to read and to take a position on a pullback wave for those wanting to go long, or bounce wave for those wanting to short. Now it's like one long wave up or down for 50-100 SPX points with very small B waves or 2's and 4's. So while I still think they'll be some type of B wave down after this A wave up ends it again may be very small. Then there's also the chance that we just squeeze up all day after some sideways chop for the B wave. I guess my meaning to all this is that it's tougher today to call these moves in advance then it previously was as you almost have to be a gambler now and guess on a gap up or down the next day and just take you position by the close on the day before it.

As for today, I think we'll see this rally continue up early in the day to get overbought on the 60 minute chart, (The 2, 4 and 6 hour charts are lagging behind of course will be pushing hard for the C wave up), and then do our pullback for the B wave down late in the day. This is the pattern I've noticed the most lately and it's the one that hurts the bears the worst as well. We already over 20 points up now and could add another 10-20 more points before ending this first move up. Then a small pullback into the end of the day and if they want to continue this squeeze (which I think they will) then we'll see more upside the rest of this week. If we get through that 2065 area, which is also the 61.8% Fibonacci retracement level then we still might be going for that gap fill at 2116 from 6/9... but let's just take it one day at a time for now as I missed yesterday's call and don't want over think this.