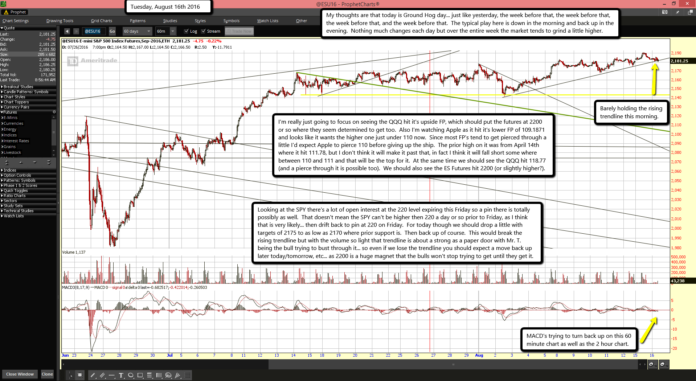

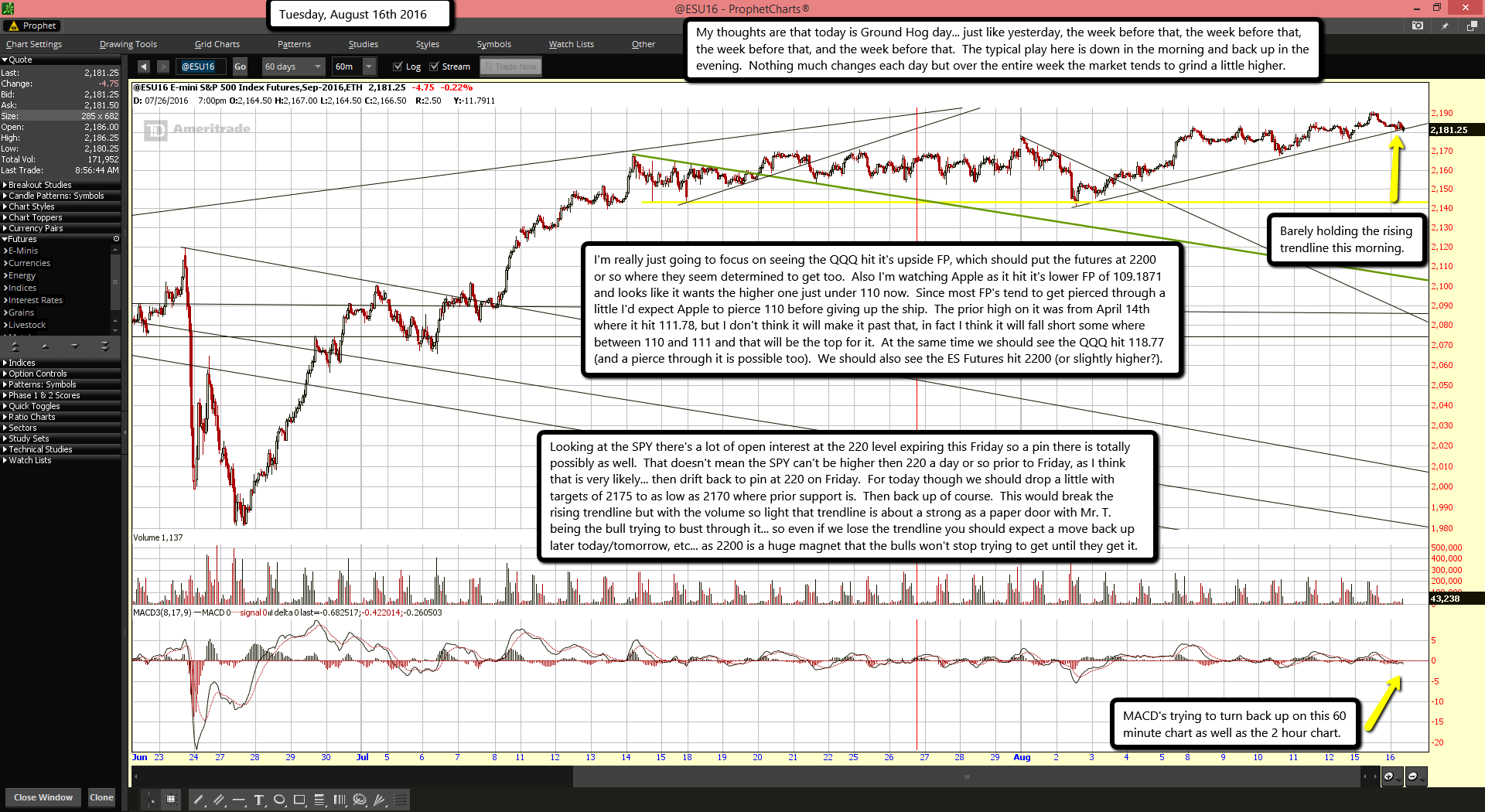

Barely holding the rising trendline this morning.

MACD's trying to turn back up on this 60 minute chart as well as the 2 hour chart.

My thoughts are that today is Ground Hog day... just like yesterday, the week before that, the week before that, the week before that, and the week before that. The typical play here is down in the morning and back up in the evening. Nothing much changes each day but over the entire week the market tends to grind a little higher.

I'm really just going to focus on seeing the QQQ hit it's upside FP, which should put the futures at 2200 or so where they seem determined to get too. Also I'm watching Apple as it hit it's lower FP of 109.1871 and looks like it wants the higher one just under 110 now. Since most FP's tend to get pierced through a little I'd expect Apple to pierce 110 before giving up the ship. The prior high on it was from April 14th where it hit 111.78, but I don't think it will make it past that, in fact I think it will fall short some where between 110 and 111 and that will be the top for it. At the same time we should see the QQQ hit 118.77 (and a pierce through it is possible too). We should also see the ES Futures hit 2200 (or slightly higher?).

Looking at the SPY there's a lot of open interest at the 220 level expiring this Friday so a pin there is totally possibly as well. That doesn't mean the SPY can't be higher then 220 a day or so prior to Friday, as I think that is very likely... then drift back to pin at 220 on Friday. For today though we should drop a little with targets of 2175 to as low as 2170 where prior support is. Then back up of course. This would break the rising trendline but with the volume so light that trendline is about a strong as a paper door with Mr. T. being the bull trying to bust through it... so even if we lose the trendline you should expect a move back up later today/tomorrow, etc... as 2200 is a huge magnet that the bulls won't stop trying to get until they get it.