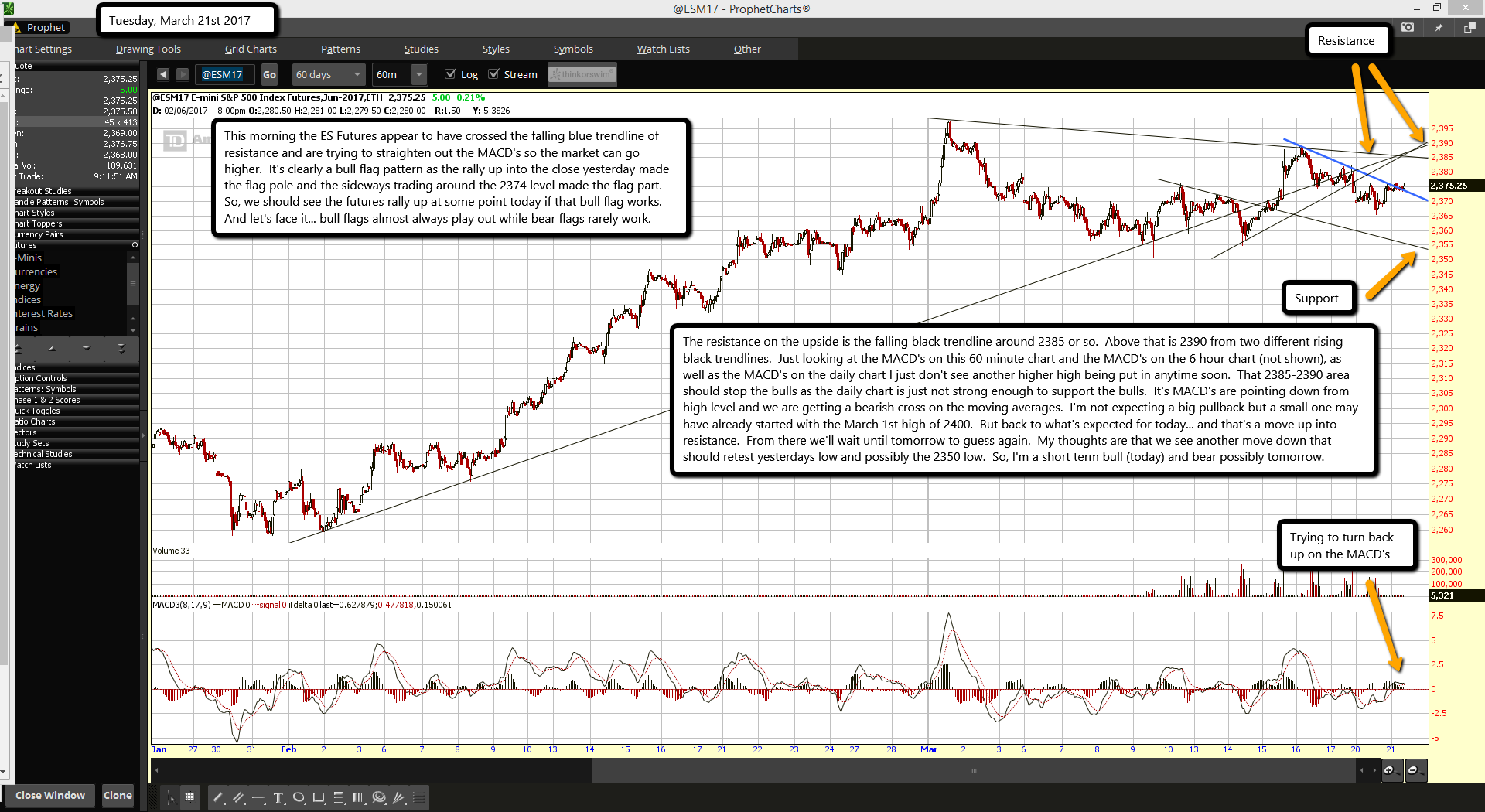

This morning the ES Futures appear to have crossed the falling blue trendline of resistance and are trying to straighten out the MACD's so the market can go higher. It's clearly a bull flag pattern as the rally up into the close yesterday made the flag pole and the sideways trading around the 2374 level made the flag part. So, we should see the futures rally up at some point today if that bull flag works. And let's face it... bull flags almost always play out while bear flags rarely work.

The resistance on the upside is the falling black trendline around 2385 or so. Above that is 2390 from two different rising black trendlines. Just looking at the MACD's on this 60 minute chart and the MACD's on the 6 hour chart (not shown), as well as the MACD's on the daily chart I just don't see another higher high being put in anytime soon. That 2385-2390 area should stop the bulls as the daily chart is just not strong enough to support the bulls. It's MACD's are pointing down from high level and we are getting a bearish cross on the moving averages. I'm not expecting a big pullback but a small one may have already started with the March 1st high of 2400. But back to what's expected for today... and that's a move up into resistance. From there we'll wait until tomorrow to guess again. My thoughts are that we see another move down that should retest yesterdays low and possibly the 2350 low. So, I'm a short term bull (today) and bear possibly tomorrow.