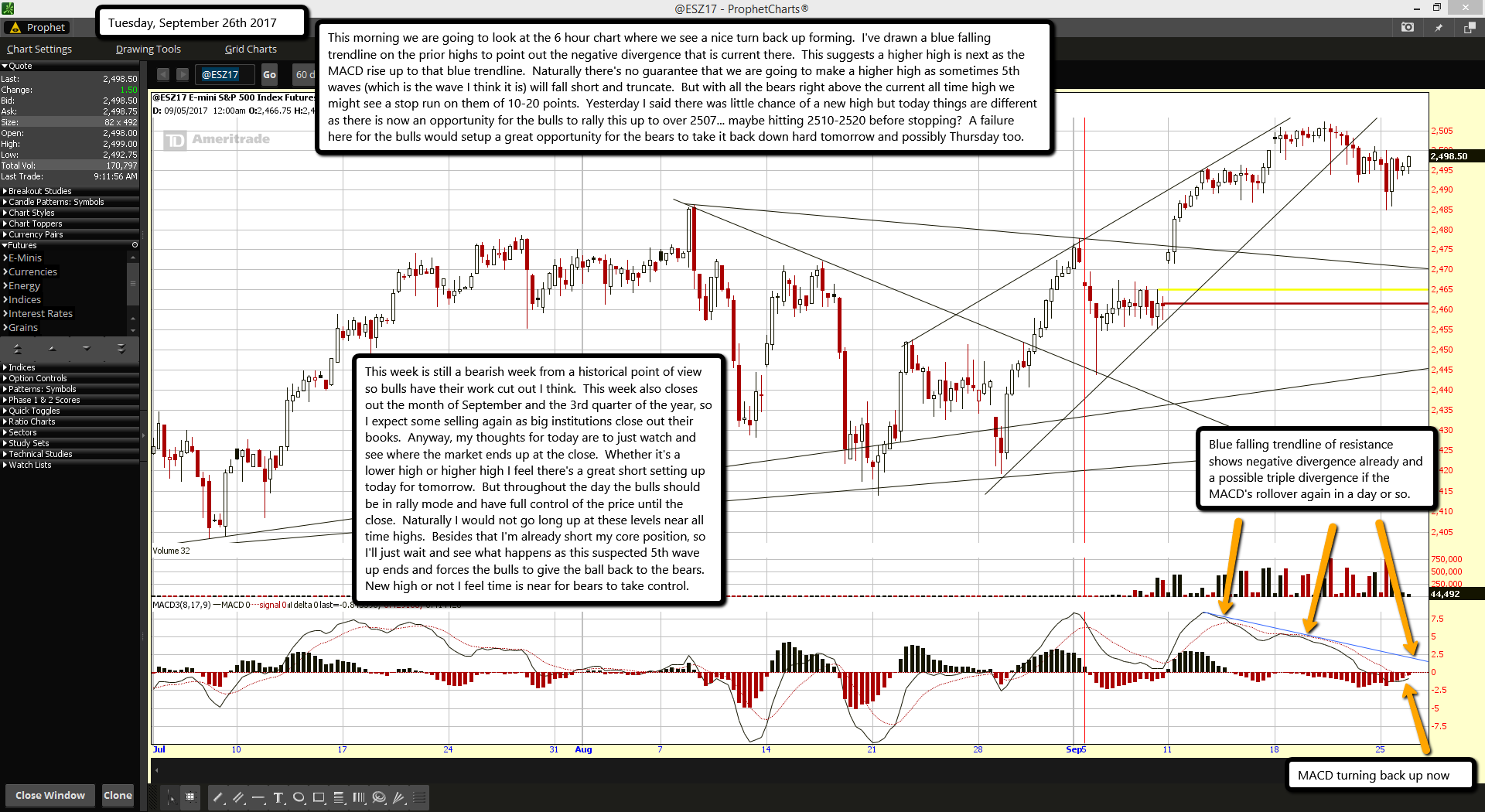

This morning we are going to look at the 6 hour chart where we see a nice turn back up forming. I've drawn a blue falling trendline on the prior highs to point out the negative divergence that is current there. This suggests a higher high is next as the MACD rise up to that blue trendline. Naturally there's no guarantee that we are going to make a higher high as sometimes 5th waves (which is the wave I think it is) will fall short and truncate. But with all the bears right above the current all time high we might see a stop run on them of 10-20 points. Yesterday I said there was little chance of a new high but today things are different as there is now an opportunity for the bulls to rally this up to over 2507... maybe hitting 2510-2520 before stopping? A failure here for the bulls would setup a great opportunity for the bears to take it back down hard tomorrow and possibly Thursday too.

This week is still a bearish week from a historical point of view so bulls have their work cut out I think. This week also closes out the month of September and the 3rd quarter of the year, so I expect some selling again as big institutions close out their books. Anyway, my thoughts for today are to just watch and see where the market ends up at the close. Whether it's a lower high or higher high I feel there's a great short setting up today for tomorrow. But throughout the day the bulls should be in rally mode and have full control of the price until the close. Naturally I would not go long up at these levels near all time highs. Besides that I'm already short my core position, so I'll just wait and see what happens as this suspected 5th wave up ends and forces the bulls to give the ball back to the bears. New high or not I feel time is near for bears to take control.