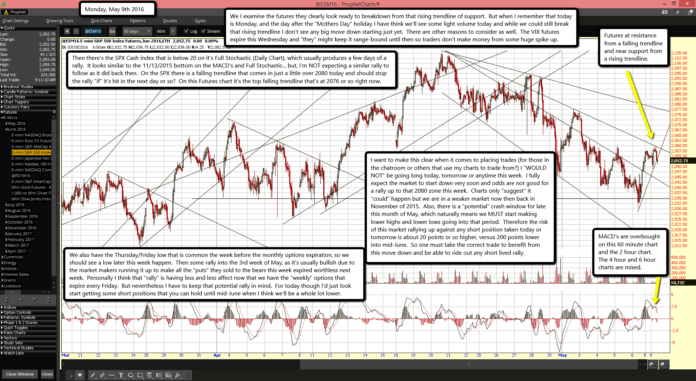

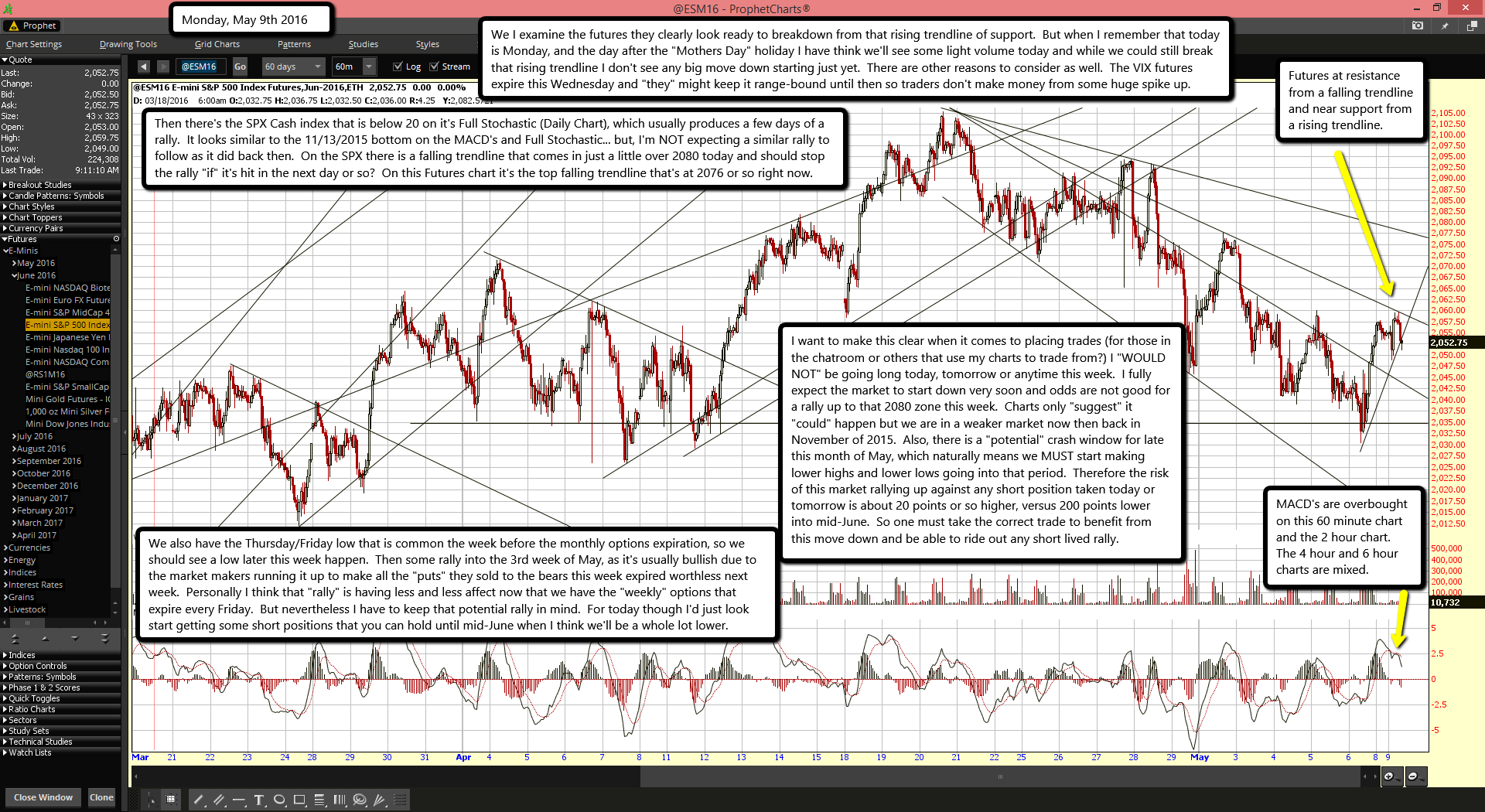

Futures at resistance from a falling trendline and near support from a rising trendline.

MACD's are overbought on this 60 minute chart and the 2 hour chart. The 4 hour and 6 hour charts are mixed.

We I examine the futures they clearly look ready to breakdown from that rising trendline of support. But when I remember that today is Monday, and the day after the "Mothers Day" holiday I have think we'll see some light volume today and while we could still break that rising trendline I don't see any big move down starting just yet. There are other reasons to consider as well. The VIX futures expire this Wednesday and "they" might keep it range-bound until then so traders don't make money from some huge spike up.

Then there's the SPX Cash index that is below 20 on it's Full Stochastic (Daily Chart), which usually produces a few days of a rally. It looks similar to the 11/13/2015 bottom on the MACD's and Full Stochastic... but, I'm NOT expecting a similar rally to follow as it did back then. On the SPX there is a falling trendline that comes in just a little over 2080 today and should stop the rally "if" it's hit in the next day or so? On this Futures chart it's the top falling trendline that's at 2076 or so right now.

I want to make this clear when it comes to placing trades (for those in the chatroom or others that use my charts to trade from?) I "WOULD NOT" be going long today, tomorrow or anytime this week. I fully expect the market to start down very soon and odds are not good for a rally up to that 2080 zone this week. Charts only "suggest" it "could" happen but we are in a weaker market now then back in November of 2015. Also, there is a "potential" crash window for late this month of May, which naturally means we MUST start making lower highs and lower lows going into that period. Therefore the risk of this market rallying up against any short position taken today or tomorrow is about 20 points or so higher, versus 200 points lower into mid-June. So one must take the correct trade to benefit from this move down and be able to ride out any short lived rally.

We also have the Thursday/Friday low that is common the week before the monthly options expiration, so we should see a low later this week happen. Then some rally into the 3rd week of May, as it's usually bullish due to the market makers running it up to make all the "puts" they sold to the bears this week expired worthless next week. Personally I think that "rally" is having less and less affect now that we have the "weekly" options that expire every Friday. But nevertheless I have to keep that potential rally in mind. For today though I'd just look start getting some short positions that you can hold until mid-June when I think we'll be a whole lot lower.