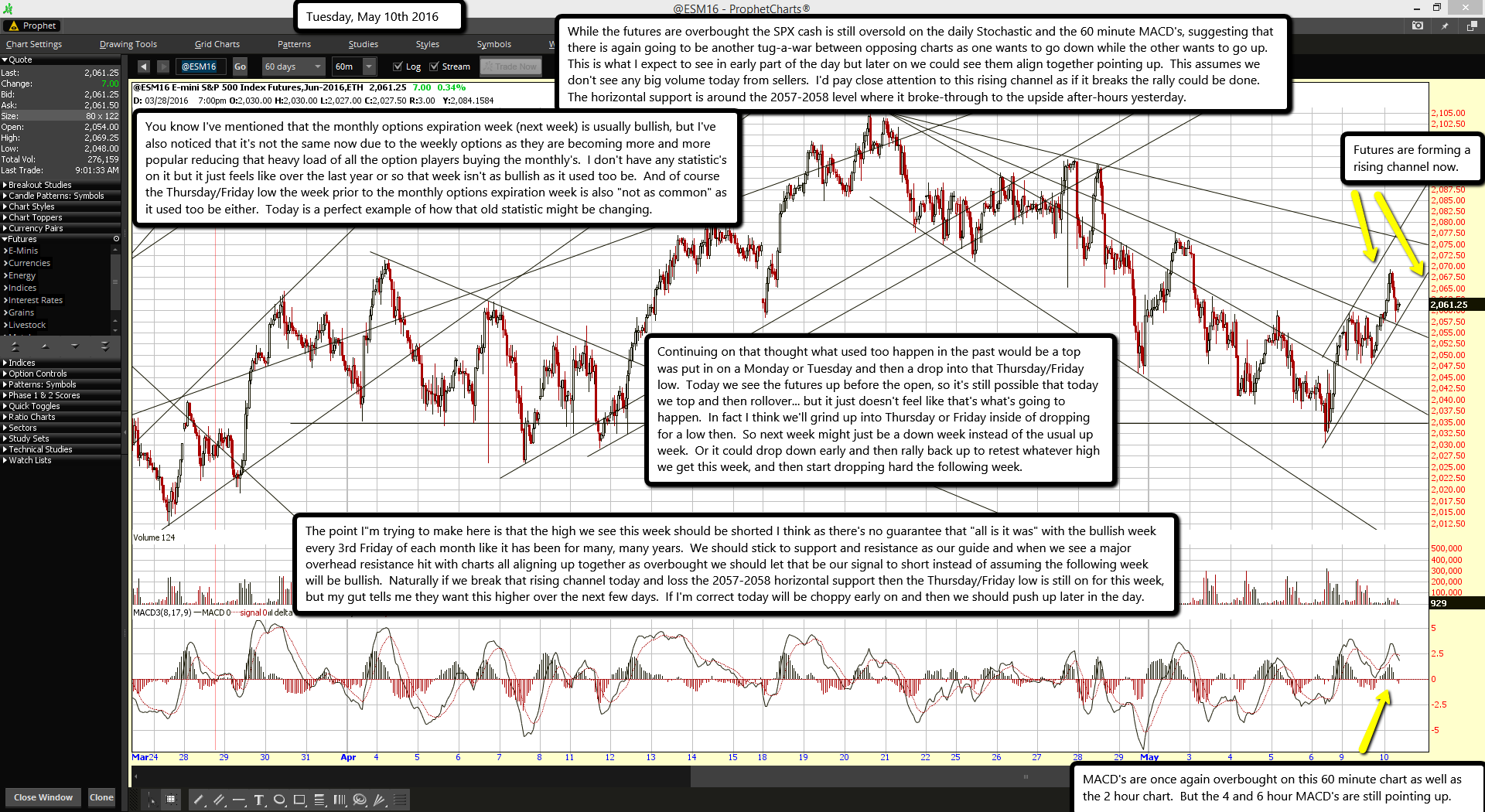

Futures are forming a rising channel now.

MACD's are once again overbought on this 60 minute chart as well as the 2 hour chart. But the 4 and 6 hour MACD's are still pointing up.

While the futures are overbought the SPX cash is still oversold on the daily Stochastic and the 60 minute MACD's, suggesting that there is again going to be another tug-a-war between opposing charts as one wants to go down while the other wants to go up. This is what I expect to see in early part of the day but later on we could see them align together pointing up. This assumes we don't see any big volume today from sellers. I'd pay close attention to this rising channel as if it breaks the rally could be done. The horizontal support is around the 2057-2058 level where it broke-through to the upside after-hours yesterday.

You know I've mentioned that the monthly options expiration week (next week) is usually bullish, but I've also noticed that it's not the same now due to the weekly options as they are becoming more and more popular reducing that heavy load of all the option players buying the monthly's. I don't have any statistic's on it but it just feels like over the last year or so that week isn't as bullish as it used too be. And of course the Thursday/Friday low the week prior to the monthly options expiration week is also "not as common" as it used too be either. Today is a perfect example of how that old statistic might be changing.

Continuing on that thought what used too happen in the past would be a top was put in on a Monday or Tuesday and then a drop into that Thursday/Friday low. Today we see the futures up before the open, so it's still possible that today we top and then rollover... but it just doesn't feel like that's what's going to happen. In fact I think we'll grind up into Thursday or Friday inside of dropping for a low then. So next week might just be a down week instead of the usual up week. Or it could drop down early and then rally back up to retest whatever high we get this week, and then start dropping hard the following week.

The point I"m trying to make here is that the high we see this week should be shorted I think as there's no guarantee that "all is it was" with the bullish week every 3rd Friday of each month like it has been for many, many years. We should stick to support and resistance as our guide and when we see a major overhead resistance hit with charts all aligning up together as overbought we should let that be our signal to short instead of assuming the following week will be bullish. Naturally if we break that rising channel today and loss the 2057-2058 horizontal support then the Thursday/Friday low is still on for this week, but my gut tells me they want this higher over the next few days. If I'm correct today will be choppy early on and then we should push up later in the day.