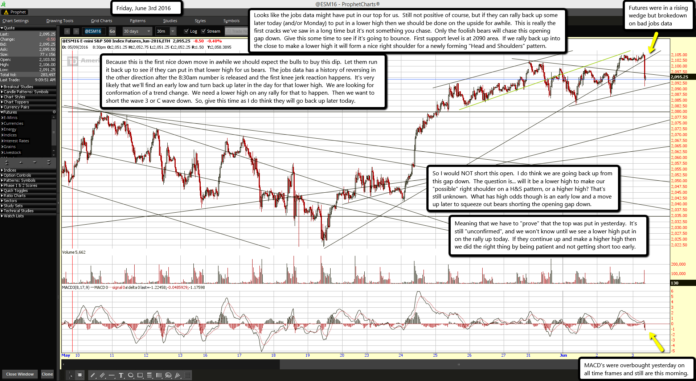

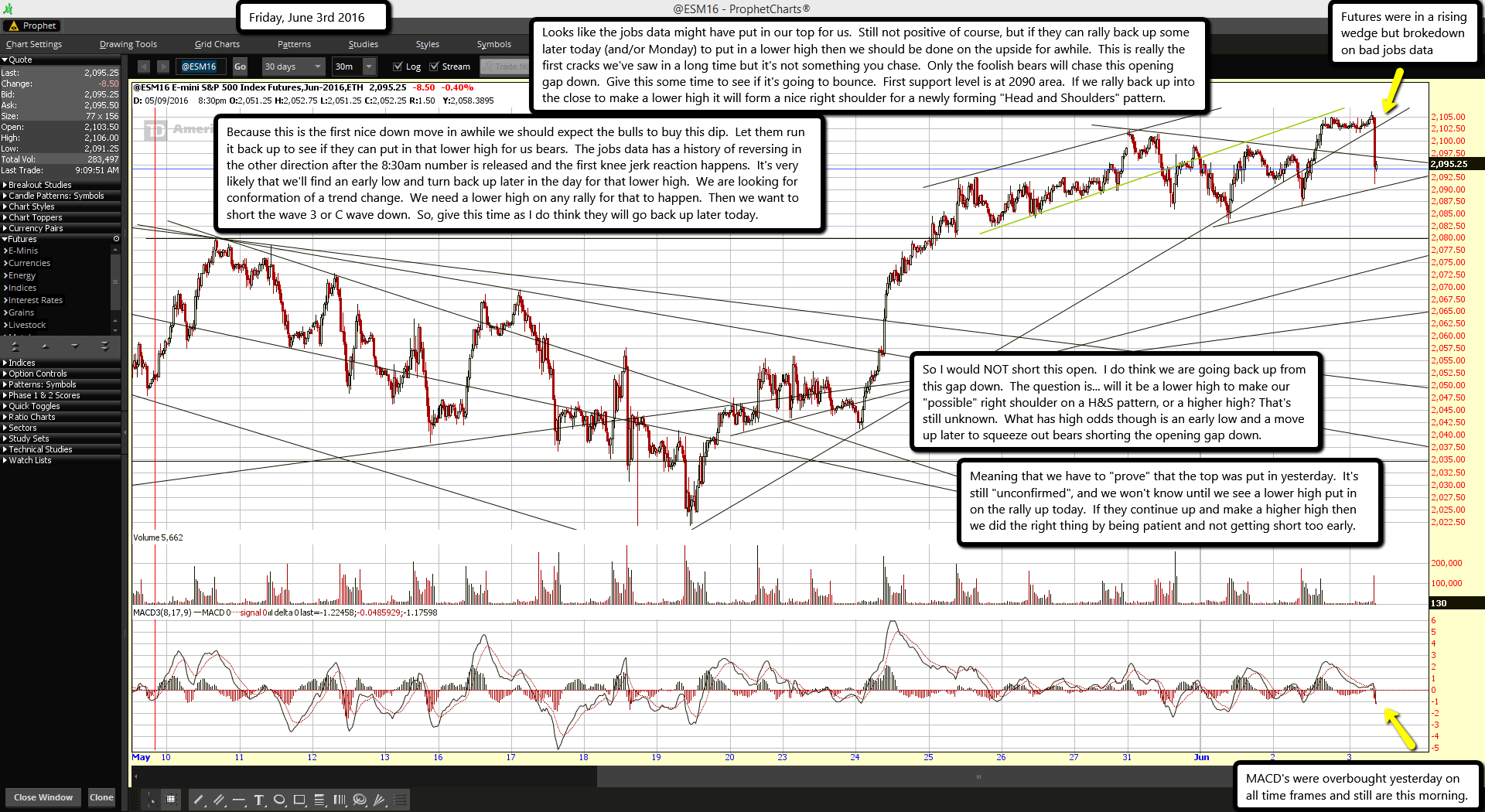

Futures were in a rising wedge but brokedown on bad jobs data

MACD's were overbought yesterday on all time frames and still are this morning.

Looks like the jobs data might have put in our top for us. Still not positive of course, but if they can rally back up some later today (and/or Monday) to put in a lower high then we should be done on the upside for awhile. This is really the first cracks we've saw in a long time but it's not something you chase. Only the foolish bears will chase this opening gap down. Give this some time to see if it's going to bounce. First support level is at 2090 area. If we rally back up into the close to make a lower high it will form a nice right shoulder for a newly forming "Head and Shoulders" pattern.

Because this is the first nice down move in awhile we should expect the bulls to buy this dip. Let them run it back up to see if they can put in that lower high for us bears. The jobs data has a history of reversing in the other direction after the 8:30am number is released and the first knee jerk reaction happens. It's very likely that we'll find an early low and turn back up later in the day for that lower high. We are looking for conformation of a trend change. We need a lower high on any rally for that to happen. Then we want to short the wave 3 or C wave down. So, give this time as I do think they will go back up later today.

So I would NOT short this open. I do think we are going back up from this gap down. The question is... will it be a lower high to make our "possible" right shoulder on a H&S pattern, or a higher high? That's still unknown. What has high odds though is an early low and a move up later to squeeze out bears shorting the opening gap down.

Meaning that we have to "prove" that the top was put in yesterday. It's still "unconfirmed", and we won't know until we see a lower high put in on the rally up today. If they continue up and make a higher high then we did the right thing by being patient and not getting short too early.