Never Did I Want To See This Day, But...

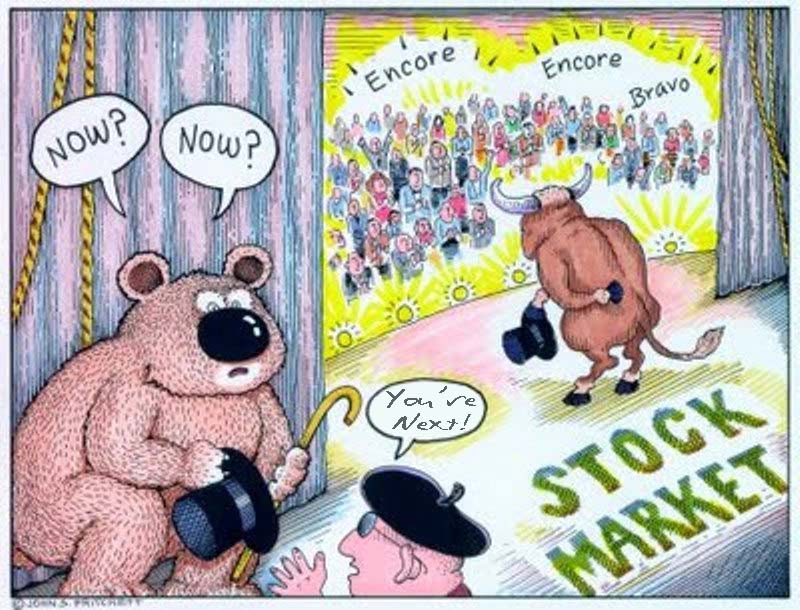

As I sat down to write this weekend update, I knew it wouldn't be like all the rest. In fact, I knew this update would be a "life changing" post for many of the readers of this blog. You see, I finally have enough pieces of the puzzle to see what is coming up next... and it scares the hell out of me!

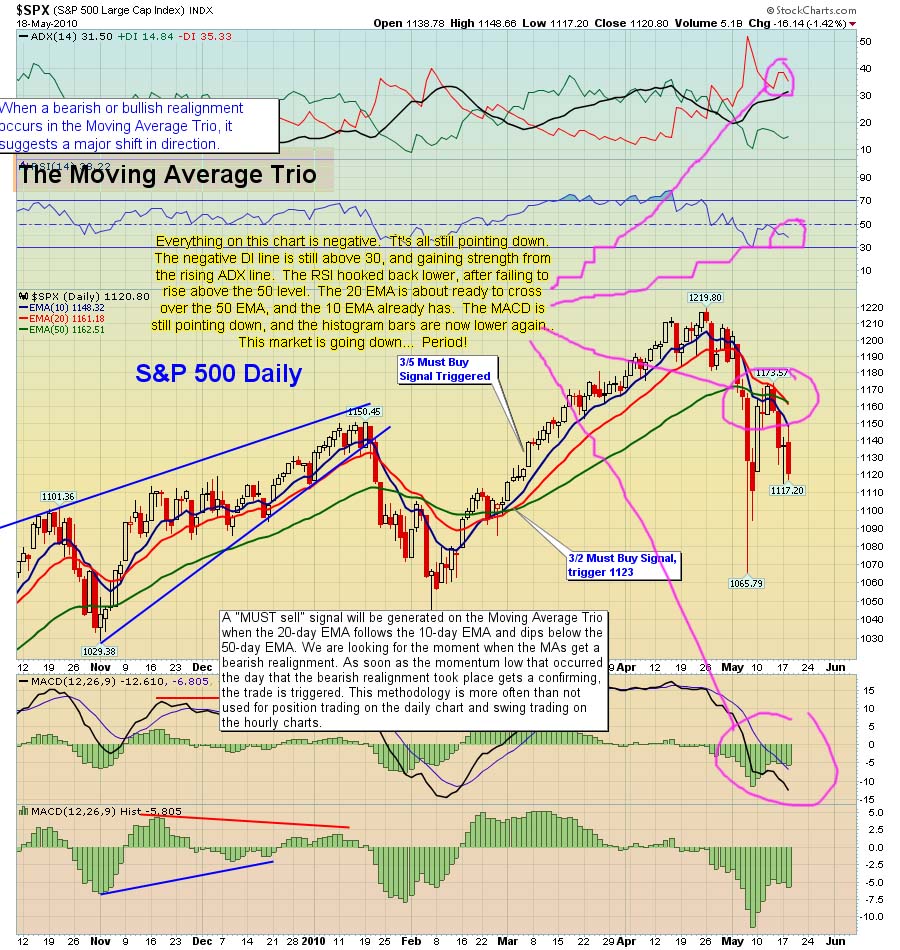

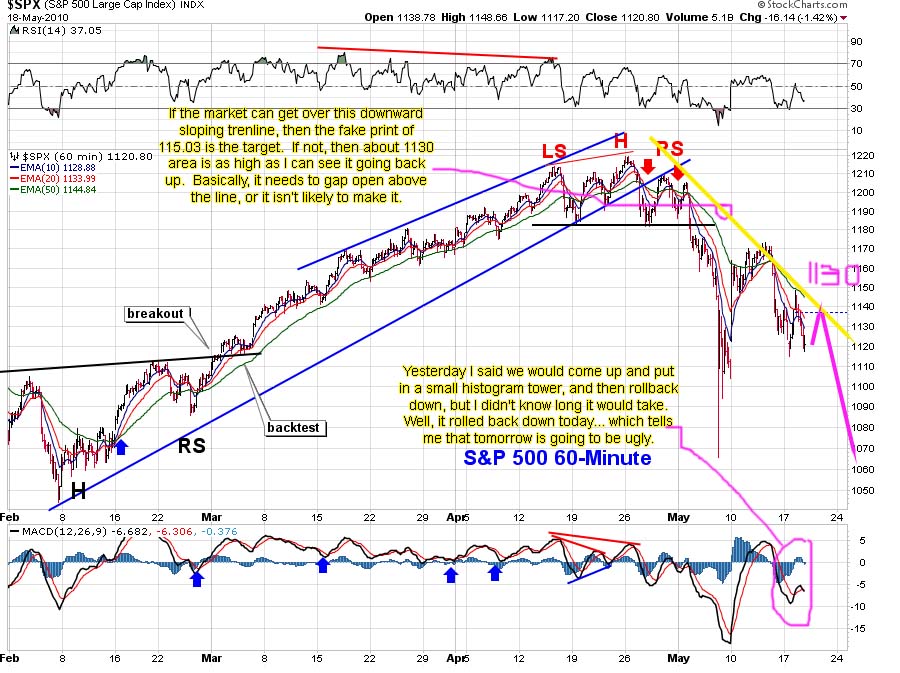

I've decided to do a video explaining everything, as it's much simpler, and will get the message across better. This is my first video post, and I don't have a script for it, so bare with me as I might jump around some. Once you watch the video, I encourage you to pass it around to your friends, as it might help save them from the coming disaster too. Just click on the image below and a new window will open with the video...

In the video, I quote some very intelligent people, that include investors, forecasters, and economists... to name a few. The link to the website is here... It was posted by Stock_Tech, a commenter on Thursday's post. (Many thanks for the link). I'm going to copy the post, and highlight the one's that really stand out to me, and post them below...

Economic Crash Forecast for 2010

3/24/10

Secular Voices

Bob Chapman

First 6 months of 2010, Americans will continue to live in the 'unreality'...the period between July and October is when the financial fireworks will begin. The Fed will act unilaterally for its own survival irrespective of any political implications ...(source is from insider at FED meetings). In the last quarter of the year we could even see Martial law, which is more likely for the first 6 months of 2011. The FDIC will collapse in September 2010. Commercial real estate is set to implode in 2010. Wall Street believes there is a 100% chance of crash in bond market, especially municipals sometime during 2010. The dollar will be devalued by the end of 2010.

Gerald Celente

Terrorist attacks and the "Crash of 2010". 40% devaluation at first = the greatest depression, worse than the Great Depression.

Igor Panarin

In the summer of 1998, based on classified data about the state of the U.S. economy and society supplied to him by fellow FAPSI analysts, Panarin forecast the probable disintegration of the USA into six parts in 2010 (at the end of June – start of July 2010, as he specified on 10 December 2008)

Neithercorps

Have projected that the third and final stage of the economic collapse will begin sometime in 2010. Barring some kind of financial miracle, or the complete dissolution of the Federal Reserve, a snowballing implosion should become visible by the end of this year. The behavior of the Fed, along with that of the IMF seems to suggest that they are preparing for a focused collapse, peaking within weeks or months instead of years, and the most certain fall of the dollar.

Webbots

July and onward things get very strange. Revolution. Dollar dead by November 2010.

LEAP 20/20

2010 Outlook from a group of 25 European Economists with a 90% accuracy rating- We anticipate a sudden intensification of the crisis in the second half of 2010, caused by a double effect of a catching up of events which were temporarily « frozen » in the second half of 2009 and the impossibility of maintaining the palliative remedies of past years. There is a perfect (economic) storm coming within the global financial markets and inevitable pressure on interest rates in the U.S. The injection of zero-cost money into the Western banking system has failed to restart the economy. Despite zero-cost money, the system has stalled. It is slowly rolling over into the next big down wave, which in Elliott Wave terminology will be Super Cycle Wave Three, or in common language, "THE BIG ONE, WHERE WE ALL GO OVER THE FALLS TOGETHER."

Joseph Meyer

Forecasts on the economy. He sees the real estate market continuing to decline, and advised people to invest in precious metals and commodities, as well as keeping cash at home in a safe place in case of bank closures. The stock market, after peaking in March or April (around 10,850), will fall all the way down to somewhere between 2450 and 4125 during the next leg down.

Harry Dent (investor)

A very likely second crash by late 2010. The coming depression (starts around the summer of 2010). Dent sees the stock market--currently benefiting from upward momentum and peppier economic activity--headed for a very brief and pleasant run that could lift the Dow to the 10,700-11,500 range from its current level of about 10.090. But then, he sees the market running into a stone wall, which will be followed by a nasty stock market decline (starting in early March to late April) that could drive down the Dow later this year to 3,000-5,000, with his best guess about 3,800.

Richard Russell (Market Expert)

(from 2/3/10) says the bear market rally is in the process of breaking up and panic is on the way. He sees a full correction of the entire rise from the 2002 low of 7,286 to the bull market high of 14,164.53 set on October 9, 2007. The halfway level of retracement was 10,725. The total retracement was to 6,547.05 on March 9, 2009. He now sees the Dow falling to 7,286 and if that level does not hold, “I see it sinking to its 1980-82 area low of Dow 1,000.” The current action is the worst he has ever seen. (Bob Chapman says for Russell to make such a startling statement is unusual because he never cries wolf and is almost never wrong)

Niño Becerra (Professor of Economics)

Predicted in July 2007 that what was going to happen was that by mid 2010 there is going to be a crisis only comparable to the one in 1929. From October 2009 to May 2010 people will begin to see things are not working out the way the government thought. In May of 2010, the crisis starts with all its force and continues and strengthens throughout 2011. He accurately predicted the current recession and market crash to the month.

Lyndon Larouche

The crisis is accelerating and will become worse week by week until the whole system grinds into a collapse, likely sometime this year. And when it does, it will be the greatest collapse since the fall of the Roman Empire.

WALL STREET JOURNAL- (2/2010)

"You are witnessing a fundamental breakdown of the American dream, a systemic breakdown of our democracy and our capitalism, a breakdown driven by the blind insatiable greed of Wall Street: Dysfunctional government, insane markets, economy on the brink. Multiply that many times over and see a world in total disarray. Ignore it now, tomorrow will be too late."

Eric deCarbonnel

There is no precedence for the panic and chaos that will occur in 2010. The global food supply/demand picture has NEVER been so out of balance. The 2010 food crisis will rearrange economic, financial, and political order of the world, and those who aren’t prepared will suffer terrible losses…As the dollar loses most of its value, America's savings will be wiped out. The US service economy will disintegrate as consumer spending in real terms (ie: gold or other stable currencies) drops like a rock, bringing unemployment to levels exceeding the great depression. Public health services/programs will be cut back, as individuals will have no savings/credit/income to pay for medical care. Value of most investments will be wiped out.

The US debt markets will freeze again, this time permanently. There will be no buyers except at the most drastic of fire sale prices, and inflation will wipe away value before credit markets have any chance at recovery. The panic in 2010 will see the majority of derivatives end up worthless. Since global derivatives markets operate on the assumption of the continued stable value of the dollar and short term US debt, using derivatives to bet against the dollar is NOT a good idea. The panic in 2010 will see the majority of derivatives end up worthless. The dollar's collapse will rob US consumers of all purchasing power, and any investment depend on US consumption will lose most of its value.

Robin Landry (Market Expert)

I believe we are headed to new market highs between 10780-11241 over the next few months. The most likely time frame for the top is the April-May area. Remember the evidence IMHO still says we are in a bear market rally with a major decline to follow once this rally ends.

John P. Hussman, Ph.D.

In my estimation, there is still close to an 80% probability (Bayes' Rule) that a second market plunge and economic downturn will unfold during 2010.

Robert Prechter

Founder of Elliott Wave International, implores retail investors stay away from the markets… for now. Prechter, who was bullish near the lows in March 2009, now says the stock market “is in a topping area", predicting another crash in 2010 that will bring stocks below the 2009 low. His word to the wise, “be patient, don’t rush it” keep your money in cash and cash equivalents.

Richard Mogey

Current Research Director at the Foundation for the Study of Cycles- Because of a convergence of numerous cycles all at once, the stock market may go up for a little while, but will crash in 2010 and reach all-time lows late 2012. Mogey says that the 2008 crash was nothing compared to the coming crash. Gold may correct in 2009, but will go up in 2010 and peak in 2011. Silver will follow gold.

James Howard Kunstler (January 2010)

The economy as we’ve known it simply can’t go on, which James Howard Kunstler has been saying all along. The shenanigans with stimulus and bailouts will just compound the central problem with debt. There’s not much longer to go before the whole thing collapses and dies. Six Months to Live- The economy that is. Especially the part that consists of swapping paper certificates. That’s the buzz I’ve gotten the first two weeks of 2010.

Peter Schiff (3/13/2010)

"In my opinion, the market is now perfectly positioned for a massive dollar sell-off. The fundamentals for the dollar in 2010 are so much worse than they were in 2008 that it is hard to imagine a reason for people to keep buying once a modicum of political and monetary stability can be restored in Europe. In fact, the euro has recently stabilized. My gut is that the dollar sell-off will be sharp and swift. Once the dollar decisively breaks below last year's lows, many of the traders who jumped ship in the recent rally will look to re-establish their positions.

This will accelerate the dollar's descent and refocus everyone's attention back on the financial train-wreck unfolding in the United States. Any doubts about the future of the U.S. dollar should be laid to rest by today's announcement that San Francisco Federal Reserve President Janet Yellen has been nominated to be Vice Chair of the Fed's Board of Governors, and thereby a voter on the interest rate-setting, seven-member Open Markets Committee. Ms. Yellen has earned a reputation for being one of the biggest inflation doves among the Fed's top players." Schiff is famous for his accurate predictions of the economic events of 2008.

Lindsey Williams

Dollar devalued 30-50% by end of year. It will become very difficult for the average American to afford to buy even food. This was revealed to him through an Illuminati insider.

Unnamed Economist working for US Gov't (GLP)

What we have experienced the last two years is nothing to what we are going to experience this year. If you have a job now...you may not have it in three to six months. (by August 2010). Stock market will fall = great depression. Foreign investors stop financing debt = collapse. 6.2 million are about to lose their unemployment.

Jimmy "Doomsday"

DOW will fall below 7,000 before mid summer 2010- Dollar will rise above 95 on the dollar index before mid summer 2010- Gold will bottom out below $800 before mid summer 2010- Silver will bottom out below $10 before mid summer 2010- CA debt implosion will start its major downturn by mid summer and hit crisis mode before Q4 2010- Dollar index will plunge below 65 between Q3 and Q4 2010. Commercial real estate will hit crisis mode in Q4 2010- Over 35 states will be bailed out by end of Q4 2010 by the US tax payer End of Q4 2010 gold will hit $1,600 and silver jump to $35 an oz.

George Ure

Markets up until mid-to-late-summer. Then "all hell breaks lose" from then on through the rest of the year.

Prophetic Voices

Neville Johnson

As I thought and prayed about the past year I felt the Lord say to me that 2010 was a year of labor pains, with the contractions getting closer and closer together towards the end of the year.

Sadhu Sundar Selvaraj

Starvation and famine/financial problems will develop. Terrorist attacks. Banks close. Tsunami. 7 new diseases worse than swine flu.

Amos Scaggs

The ultra-rich will go broke. I don’t mean go bankrupt I mean go broke, no money. I saw ultra rich people working for food because they were broke. This will happen by mid-February 2011.

Andrey Rasshivaev

The world is going to face the total and complete economical and financial collapse in August-September of this new 2010 year.

Greg Evensen

Economic meltdown and possible martial law in the mid summer 2010.

Larry Randolph

... there is yet a seven-fold shaking of greater magnitude coming that will produce enormous and perhaps catastrophic disruptions on economic, political, geophysical, atmospheric, and spiritual levels.

Weather Bill

Huge earthquake on the west coast in early September 2010. This earthquake to come is going to start the swift downfall of America.

Harold Eatmon (1998)

I had a vision of the stock market soar and then crash. After the crash, many big business corporations and private parties bought up stocks because of the low cost to buy in. Then I saw the market begin to climb again in a short period of time. Then it crashed again bringing tremendous loss, ruin and devastation to all who bought in the first time. This is what I have labeled "Two Black Mondays" . The time period between the Two Black Mondays was very close together. I could not tell exactly how close. There are some tell tale signs indicating the season and the setting. I saw the season to be when *"the leaves fall to the ground"* then the first crash would occur."Like Joseph in Genesis, I believe America will have fat years of financial blessing. I also believe there are coming lean years of financial difficulty for America. [Note: while this doesn't give an exact date, this prophecy was dead on accurate-the markets crashed -777 points on MONDAY 9/29/08, roughly 1 week into the FALL (leaves fall to the ground.) The markets then rebounded OVER A SHORT PERIOD OF TIME (from April 2009 to October 2009 the markets rallied nearly 4000 points!) and everyone bought back in. According to this prophecy, the next huge crash will happen on a Monday. Eatmon even accurately predicted the coming 'fat years' and the now present 'lean years']

Robert Holmes

On October 21, 2008 the Lord said to me (of the global economic crisis): “It will be a dead cat bounce,” meaning it will go down fast, bounce back then fall again. In April 2009, after some growth had taken place, the Lord affirmed, “Don’t get too excited about the market news, it will crash again.” In September 2009, He commented on stock market prices (as measured by the Dow Jones), “It will be a W curve”. Though it will improve through to mid 2010, it will crash again under “the weight of debt”.

Deryn Johnstone (1/25/2010)

"We will experience a worldwide economic upheaval resulting in the collapse of our monetary system. This economic crash will come suddenly, sending shockwaves throughout the world. It will be the opening of the establishment of a new one-world monetary system under a new one-world government. When this worldwide economic disaster hits, it will be unlike anything we have ever experienced. The world will be thrown into a state of shock. Panic and fear will grip the hearts of the people everywhere. They will be confused, not knowing what to do or where to go. During this time, the people of God will be clearly distinguished from the world by God's supernatural provision in their lives. It will not be the absence of problems and adversity among God's people that will be a witness to the world, but in the midst of this financial crisis the world will see God's strong arm of provision for His people.

Robert L

What is going to happen this year? 1. The stock market in America will not only crash, it will no longer exist 2. The President of the USA will foolishly bring sanctions on the nation of Israel 3. There will be a great earthquake that stretches from the Atlantic Ocean to the Pacific 4. The greatest fear will be none of these things; it will be the lack of food men will fear most. The sad truth is that even after all these things have taken place in 2010, most will not repent and turn back to God, most will become even more corrupt as we speedily rush toward the end of time.

--------------------------------------------------------------------------------------------------------------------

Needless to say, what lies ahead of us spells DISASTER! It's not going to be fun, even though all of you reading this post will have the chance too profit hugely from it. But many lives will be ruined in the process. There will be countless people go homeless, as they lose everything they have every worked for.

I encourage you all to reach out and spread this message to all that you know. I also ask that you help those that will be needing your help in the not so distant future. If you position yourself correctly, you can become filthy rich from this coming crash. If not, then you will go broke like all the others who didn't listen.

Choose wisely...

Red