February 18th 2018

A Strange Pattern Is Developing and so far I don't see anyone talking about it...

It's been over a year, maybe several years, since I've done a weekend post and video but I feel compelled to share what I've discovered recently. It's something I hope doesn't play out but so far is tracking out day to day almost perfectly.

Of course there are just as many diehard bears out there that are still calling for a stock market crash today, tomorrow, or soon... just like they have been for many years now. And there's the mega-bulls that are looking for the DOW to hit 100,000 or some crazy number. Which one is right, or are they both right? So far the crash callers have been wrong time after time as the market just keeps on going up and up and up.

The market has changed a lot in the last 18 years I believe with computer algorithms making up 84% of the trading each day, and with the Fed's injecting trillions of dollars into the system with one Quantitative Easing program after another to keep the market going up. That's at least until recently as they are now slowly rising interest rates and attempting to reverse the money injection, which some say caused the recent 10.8% drop in late January into February.

Others say that it was caused because Jerome Powell replaced Janet Yellen as the new Federal Reserve Chairman and the deep state that runs the stock market didn't like it... therefore they decided to tank the market to punish Trump for his decision. Some say he isn't Jewish as well and that the deep state always put a Jew in office as they are "one of them" and can be controlled. I don't know what to believe about that issue but certainly the market was super overbought from a technical point of view and needed to pullback anyway. The timing of it was and still is suspicious.

Anyway, what I have to show you deals with "codes" and "numerology" that the deep state (the elite, illuminati, cabal, skull and bones society, free masons, or whatever name they hide under?), use to tell their buddies on the inside what's going to happen next in the market. Now a true member (which I'm NOT) could read these codes perfectly and know exactly what's coming next, when it's coming, and when it ends... but I have to just guess at it and use the knowledge I've discovered over the last 9 years while writing this blog.

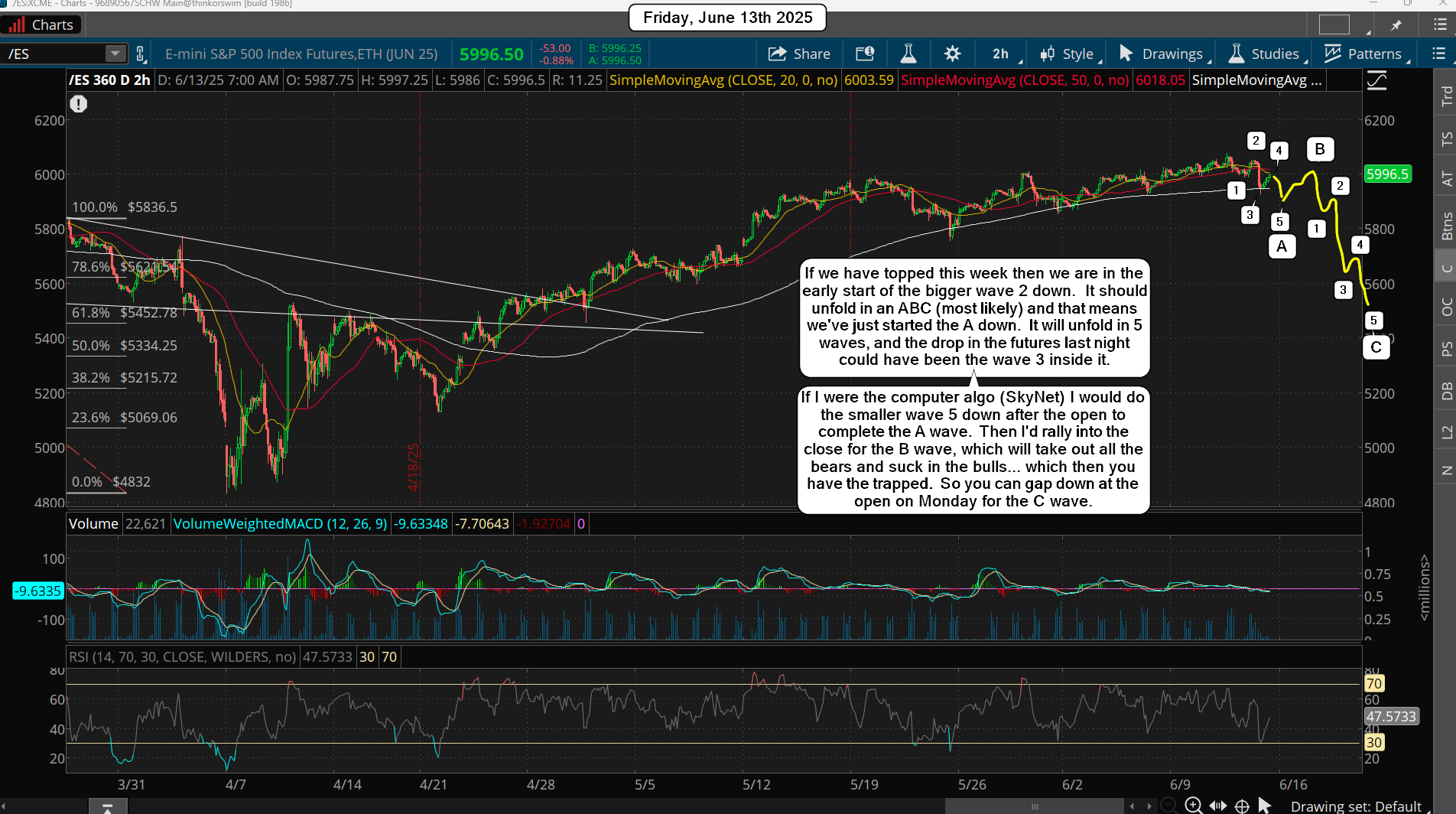

So, with that preface I must add that there is a super computer "AI" (artificial intelligence... I call it "SkyNet" from the Terminator movie) that reads every post, page, blog, website, tweet, chat, etc... on the internet and if certain things are said that "they" (the elite) don't like then it tends to get no traffic or worst the site gets attacked by "bot's" to slow it down to a point that no one can get it to load where they can read. In fact, SkyNet even watches youtube video's and converts them from speech to text so it can decide again if it gets traffic exposure or not.

Therefore I have to be careful on exposing this information to SkyNet as I only want to help a few fellow traders by giving them what I've discovered so they can be on the look out for it and not get caught on the wrong side of the trade should this actually happen? In order to keep this information away from SkyNet reading it I've decided to password protect it and require a real person to login to my site to get access to the password so they can read it. I apologize to those of you who think is too much trouble but I really must keep this information only in the hands of real people and NOT spread over the internet where SkyNet can read it easily. So I ask you NOT to copy the text or the video and repost it on the internet. It's free to view for all, so that's not too much to ask of you I think. I'm also putting the video up on Wistia instead of Youtube so hopefully it goes unnoticed by SkyNet.

To read the rest of this post and view the video you must create a new account and login to get access to the passworded page... which is located here:

Is 2018 Setting Up A Stock Market Crash Or Inflationary Based Mega Rally-Part 2

The password is: 1987