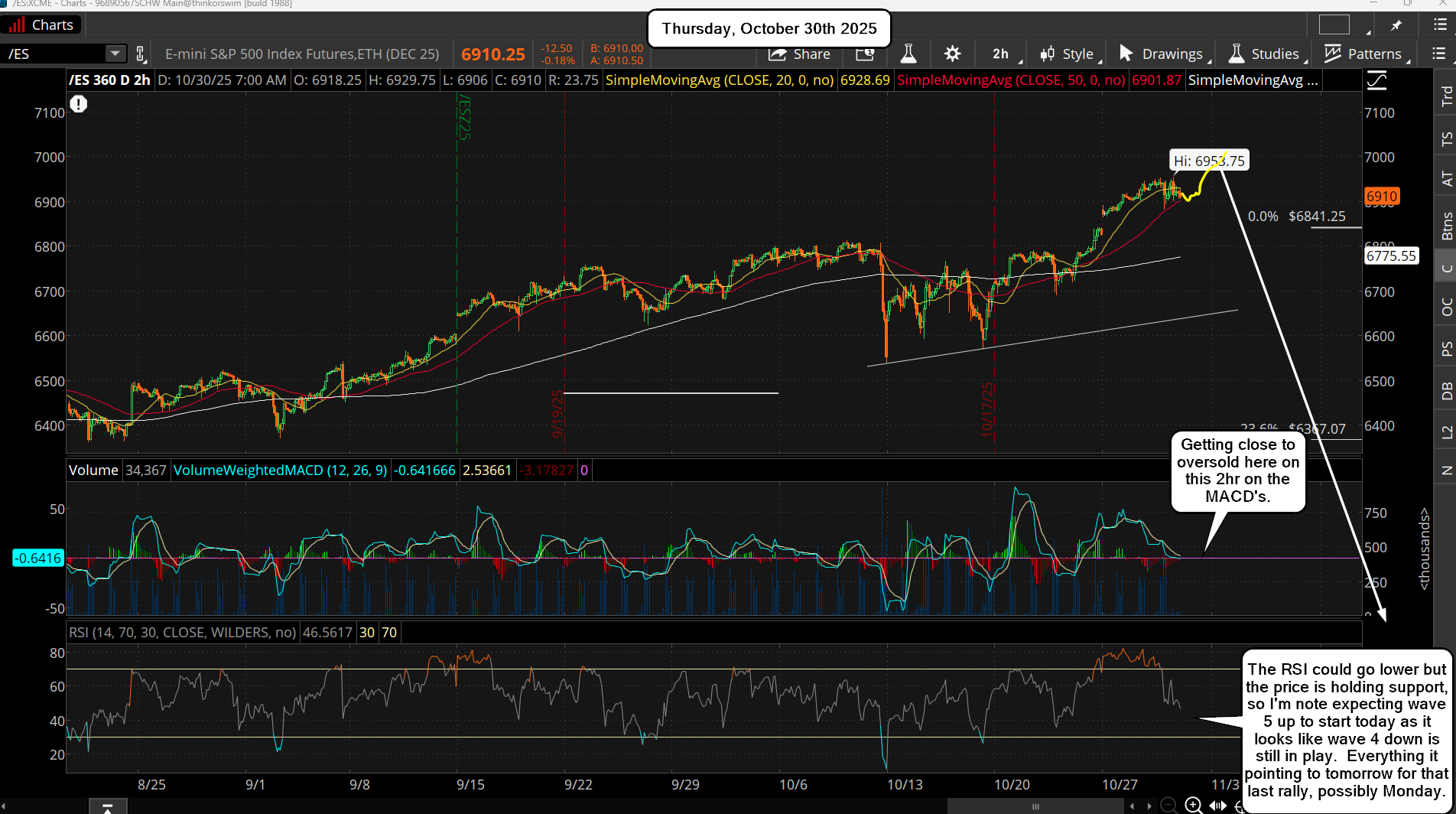

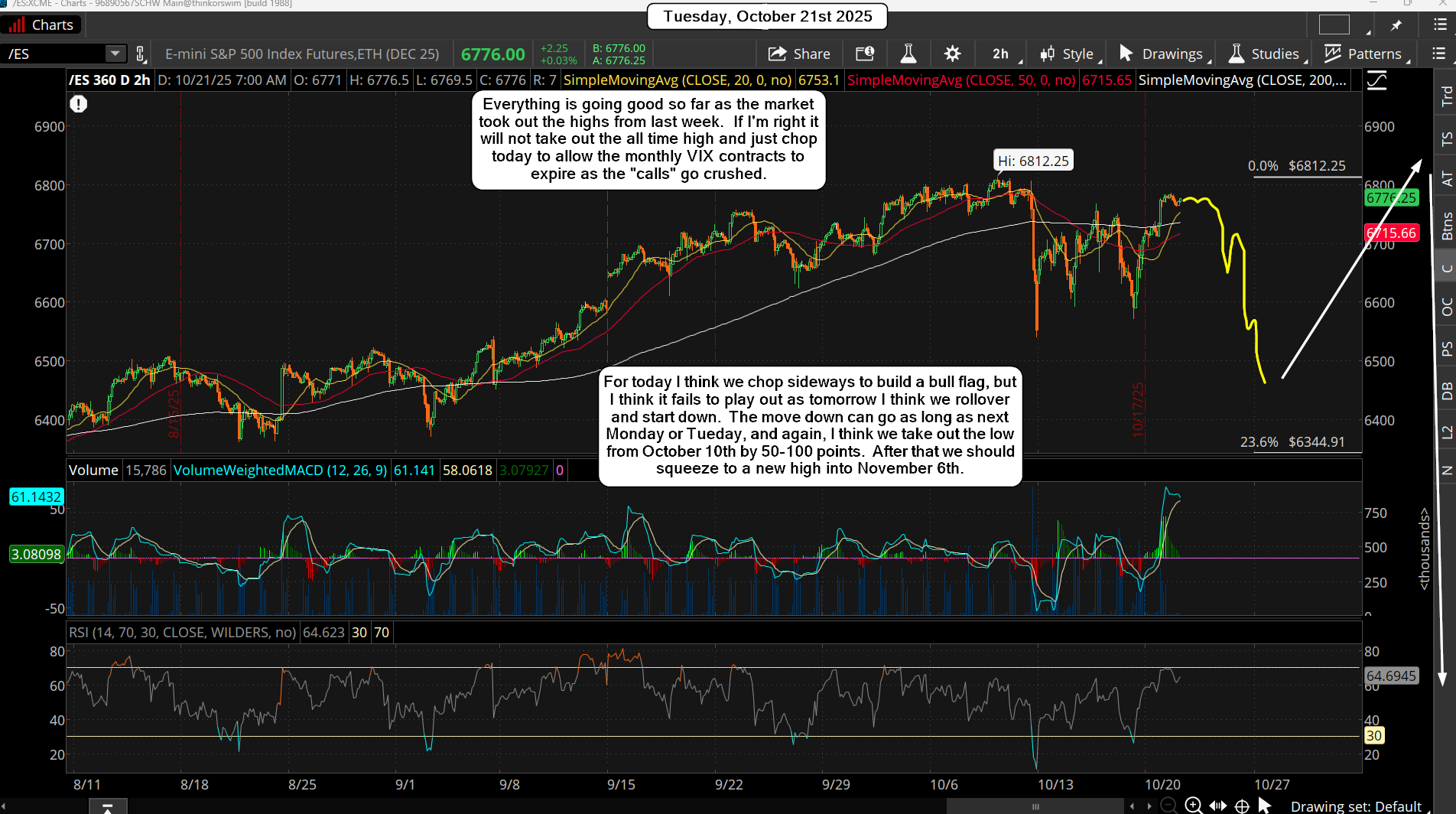

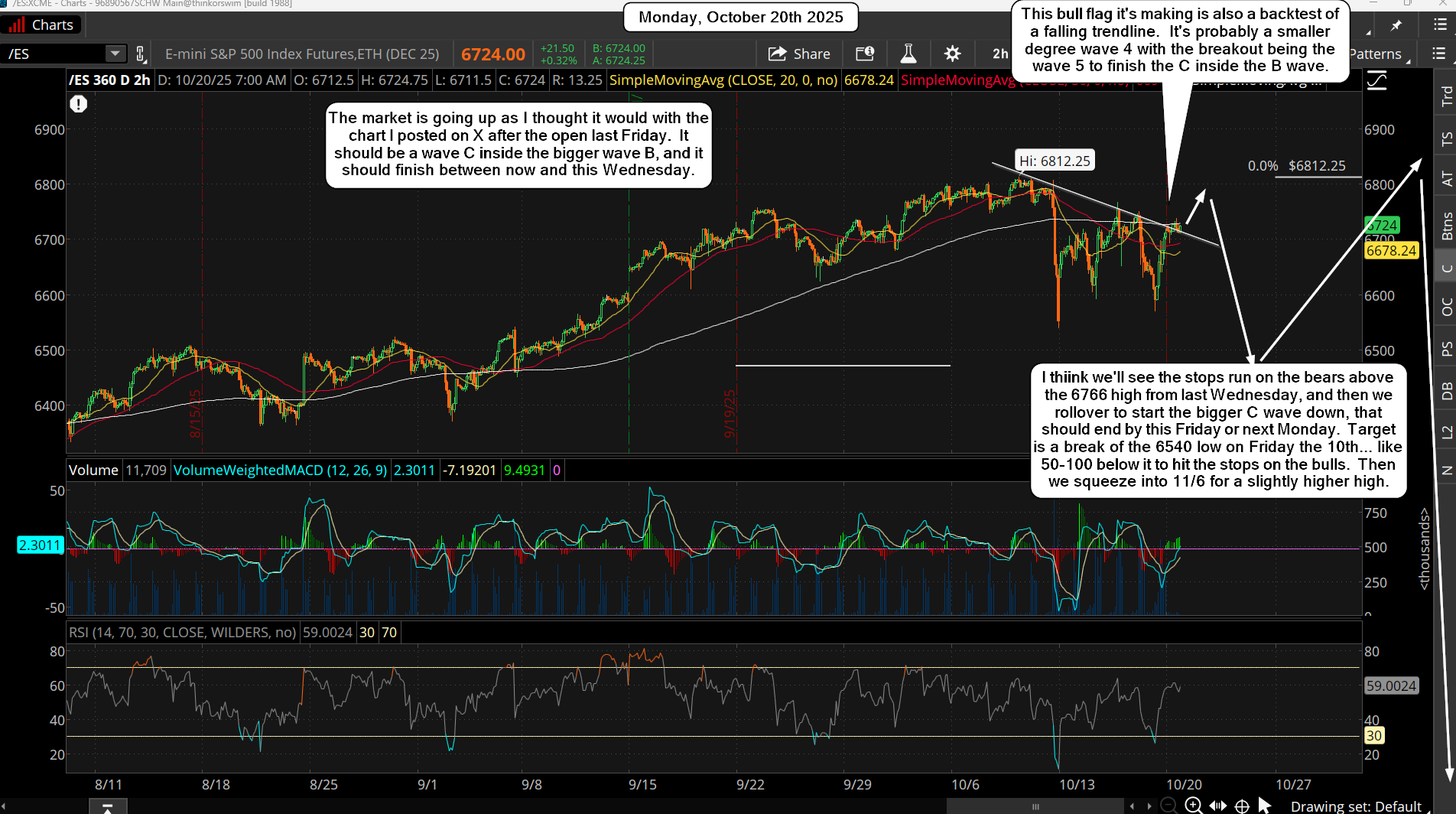

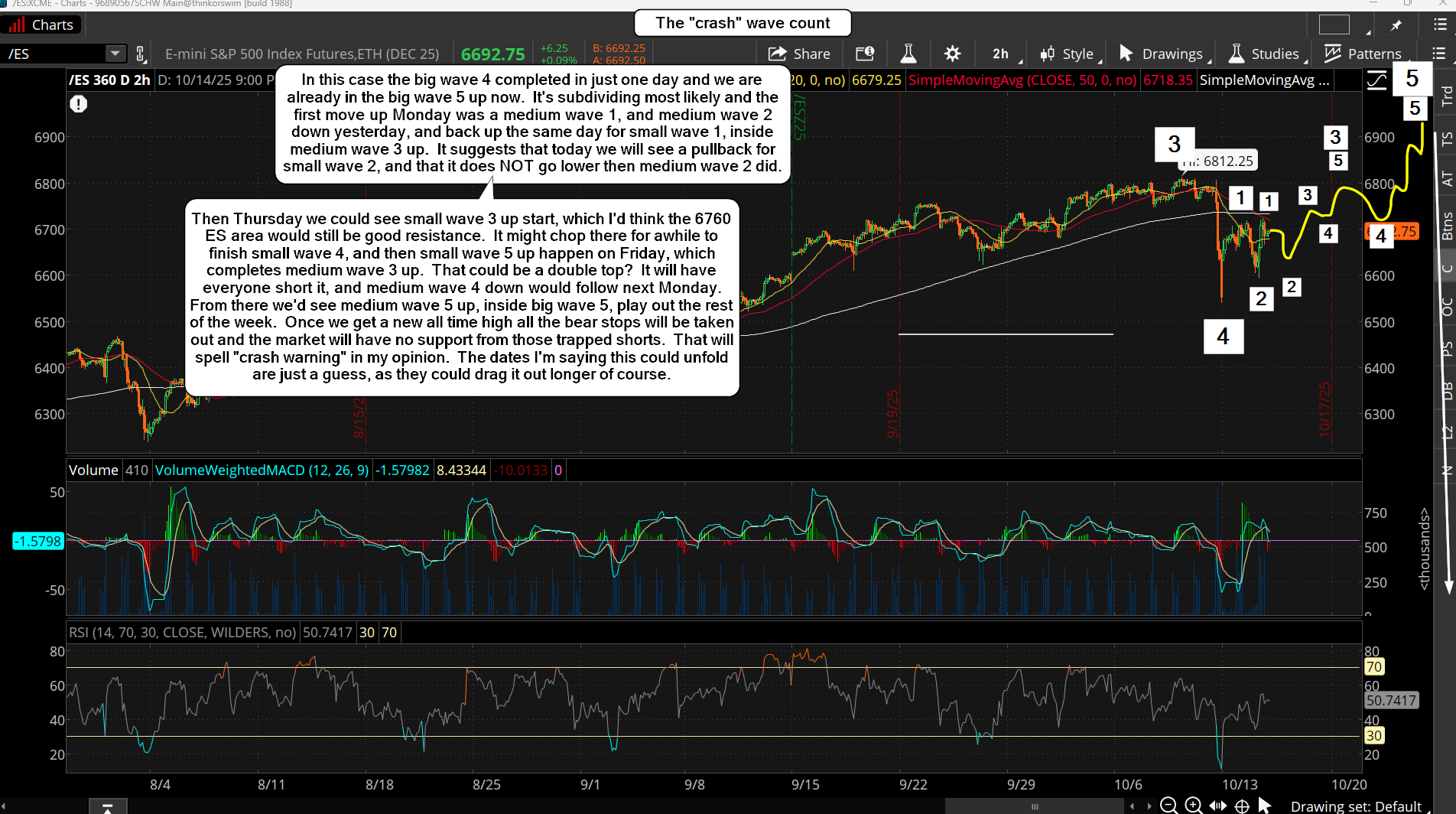

So far, it looks like we are still in the smaller A wave up inside the bigger B up from yesterdays chart. I'm still looking for smaller B down to happen in the next few days, which should not take out the lows from last Friday, but should take out yesterdays low. It should be just deep enough to take out the longs from yesterdays low, which should get the bears all short looking for Fridays low to get taken out... but should not be. The chart below is what I'm think...

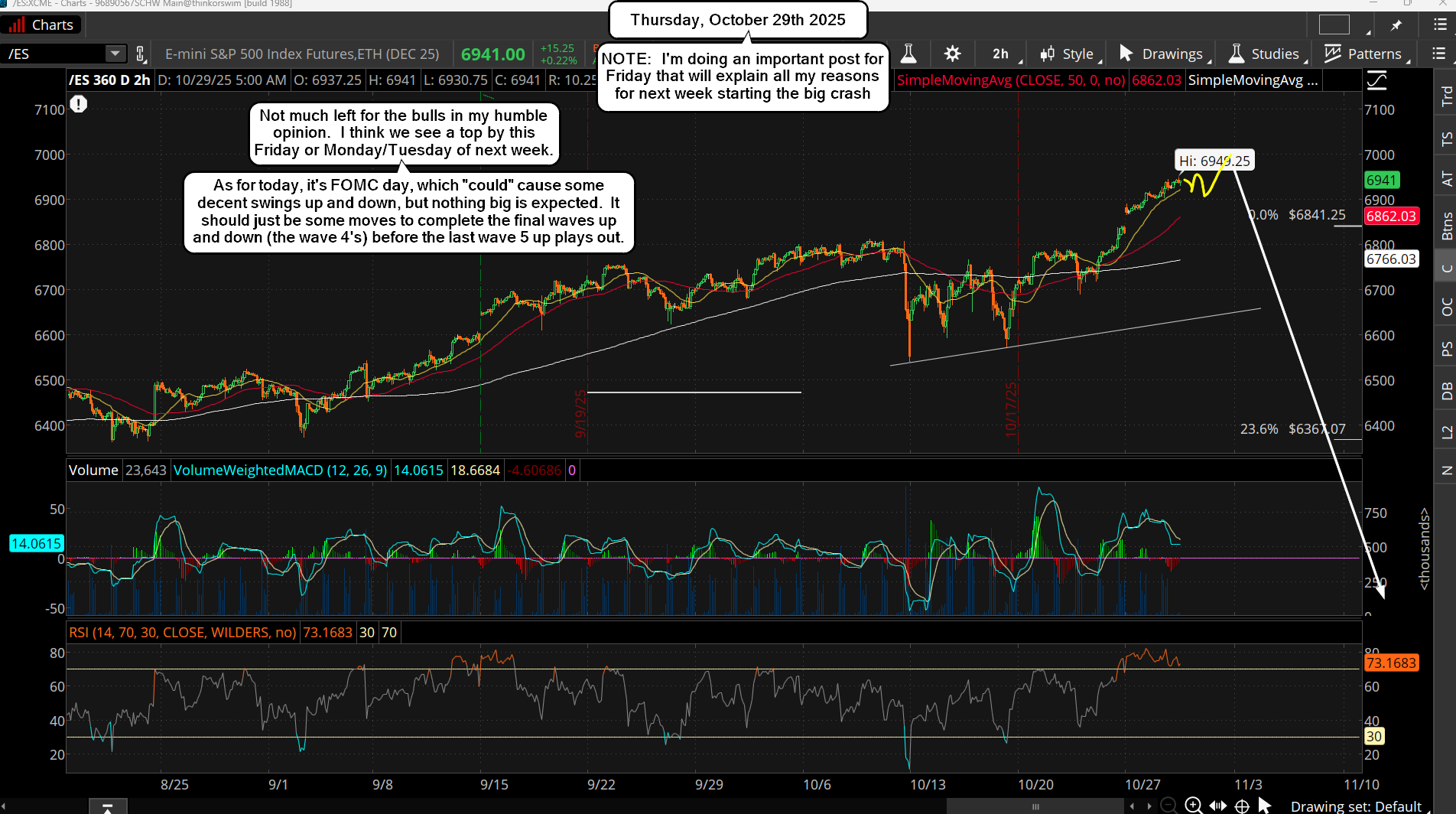

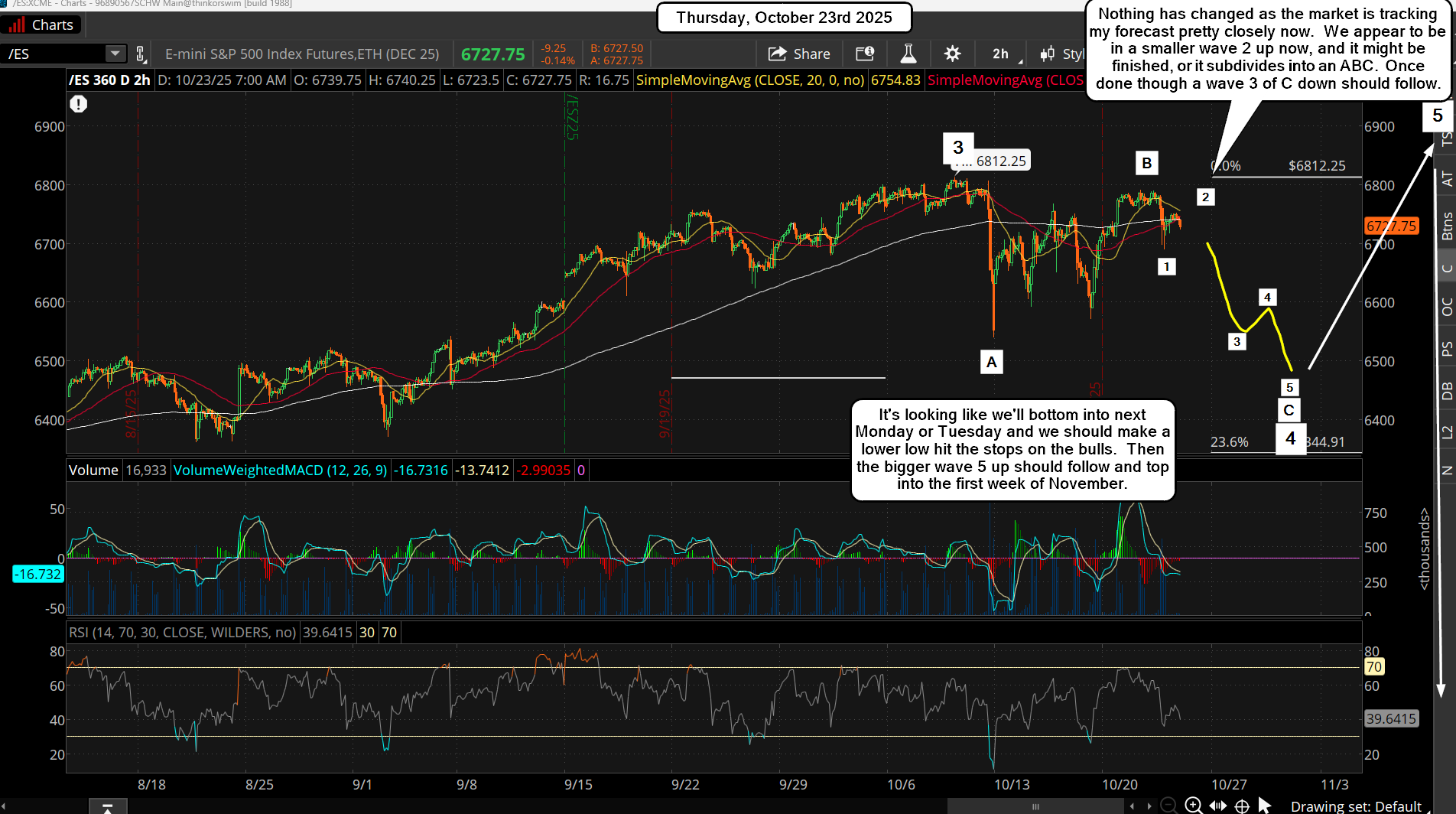

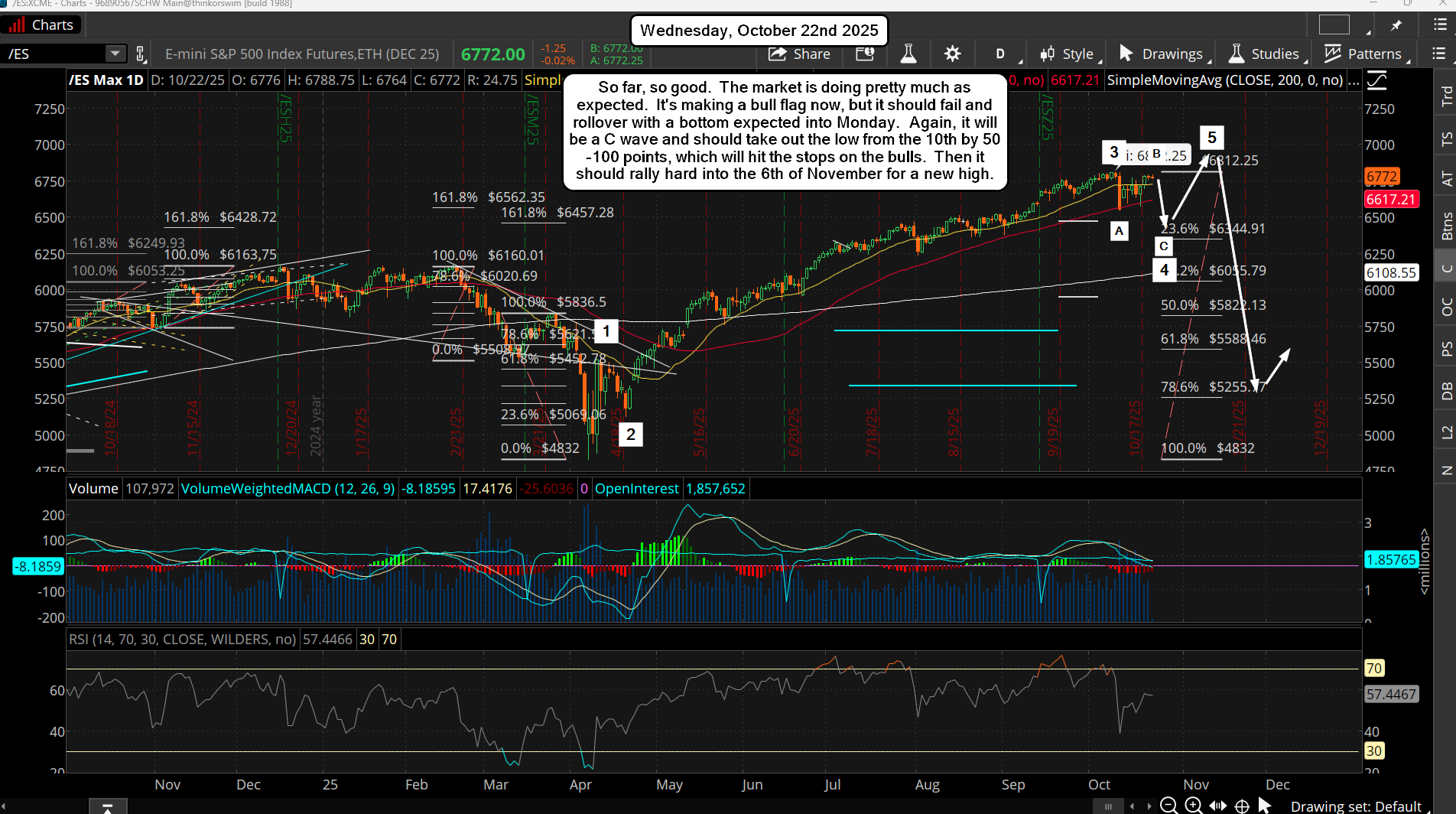

Next week is the tricky part, as if we only make a lower high for the smaller C way inside the bigger B wave up then we should have the bigger C wave down the following week to ideally the 6400 zone, and that will complete a bigger wave 4, and setup the market for a very large rally for the bigger wave 5 (like 7400+).

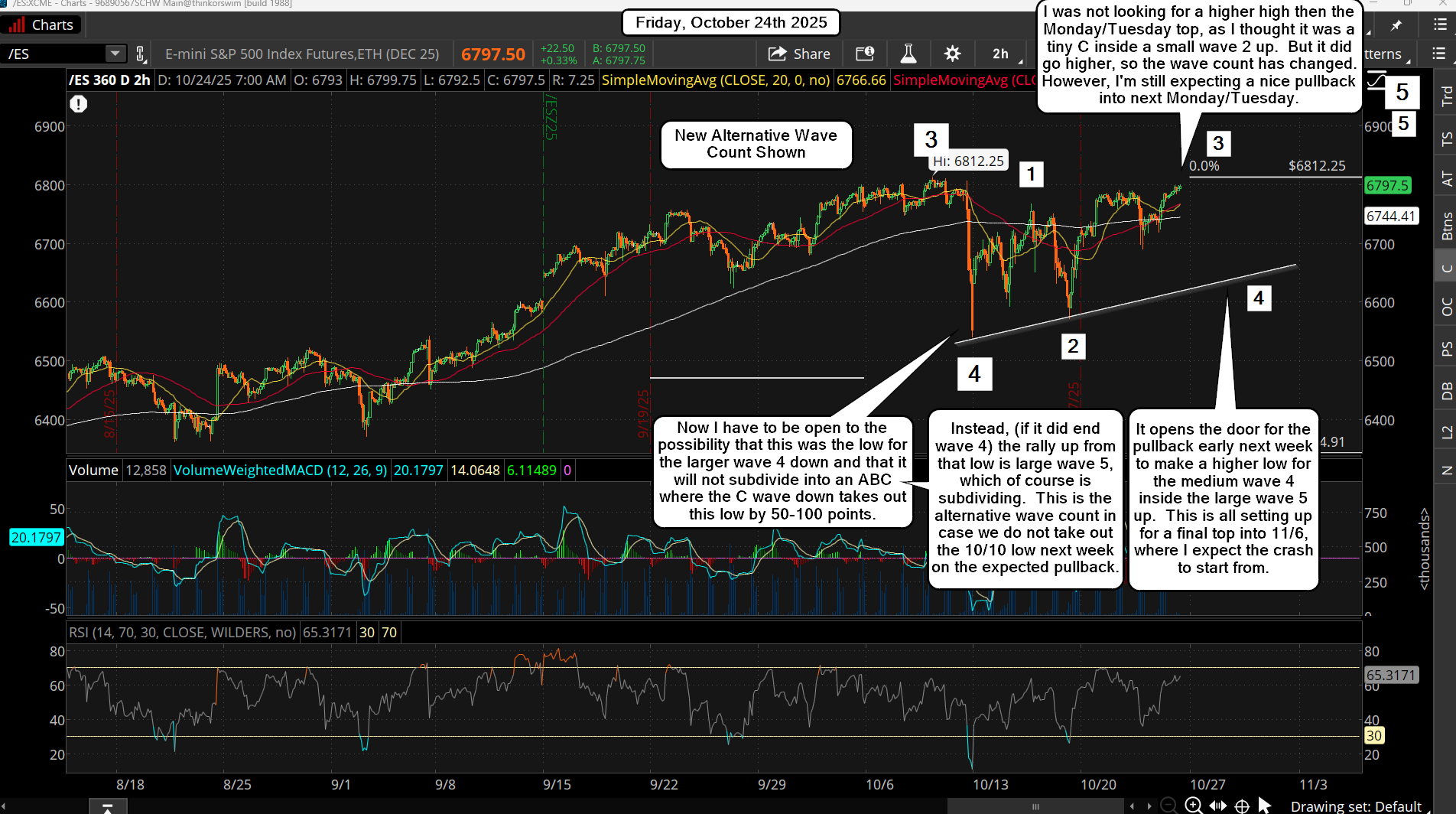

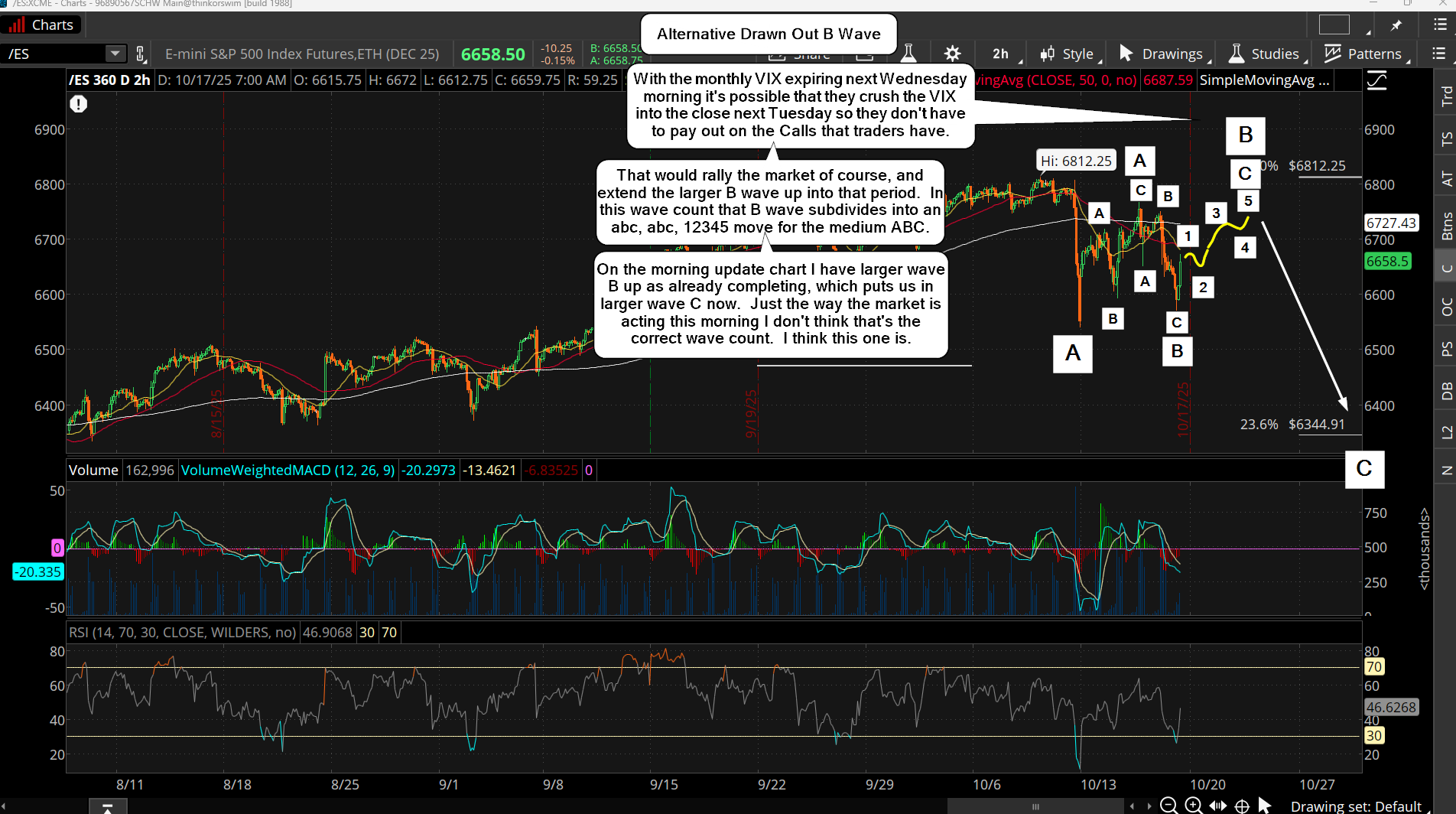

But, if instead the rally up next week makes a higher high (like between the 20th-22nd or so) then there's another wave count in play. That wave count is below...

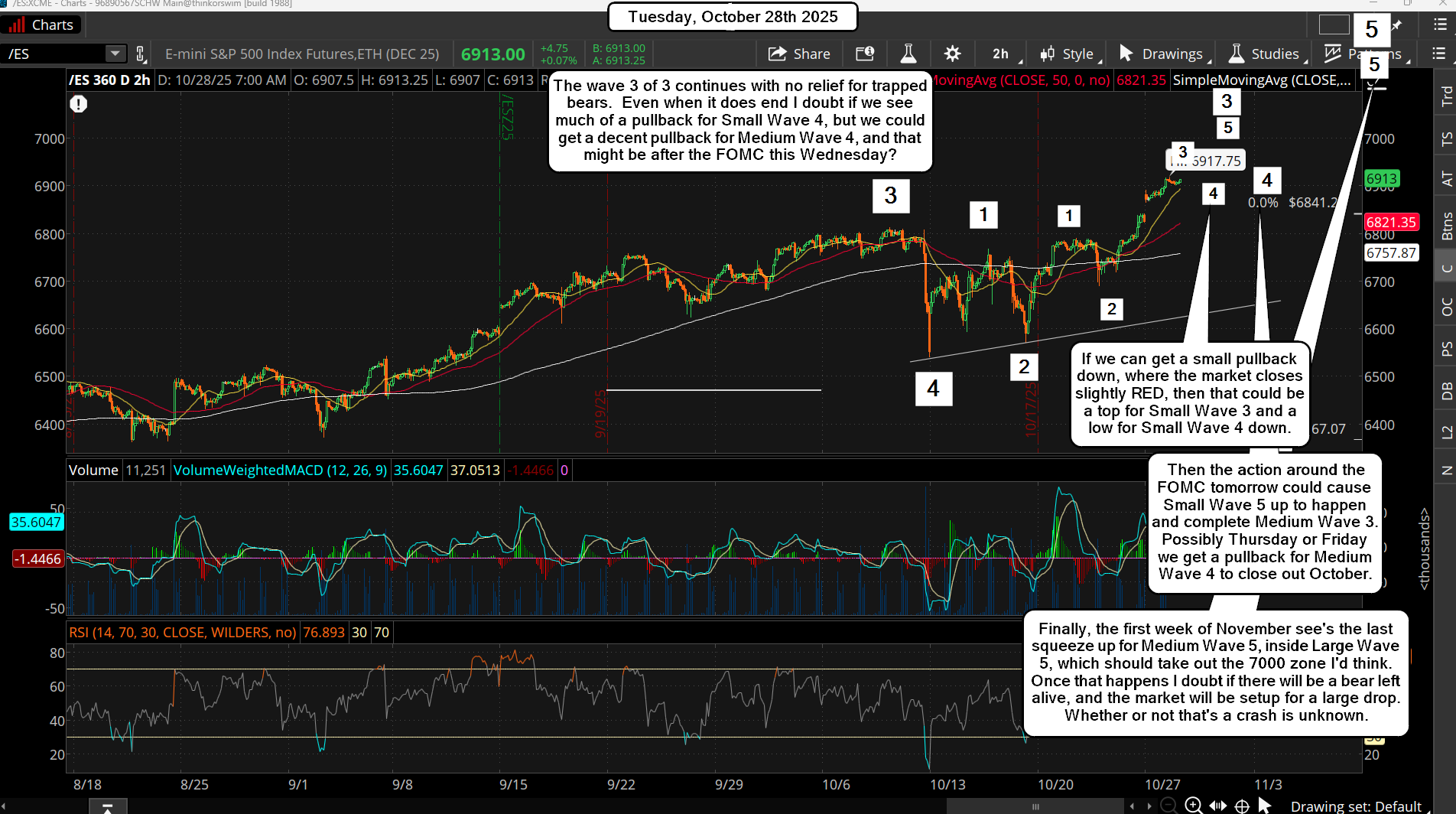

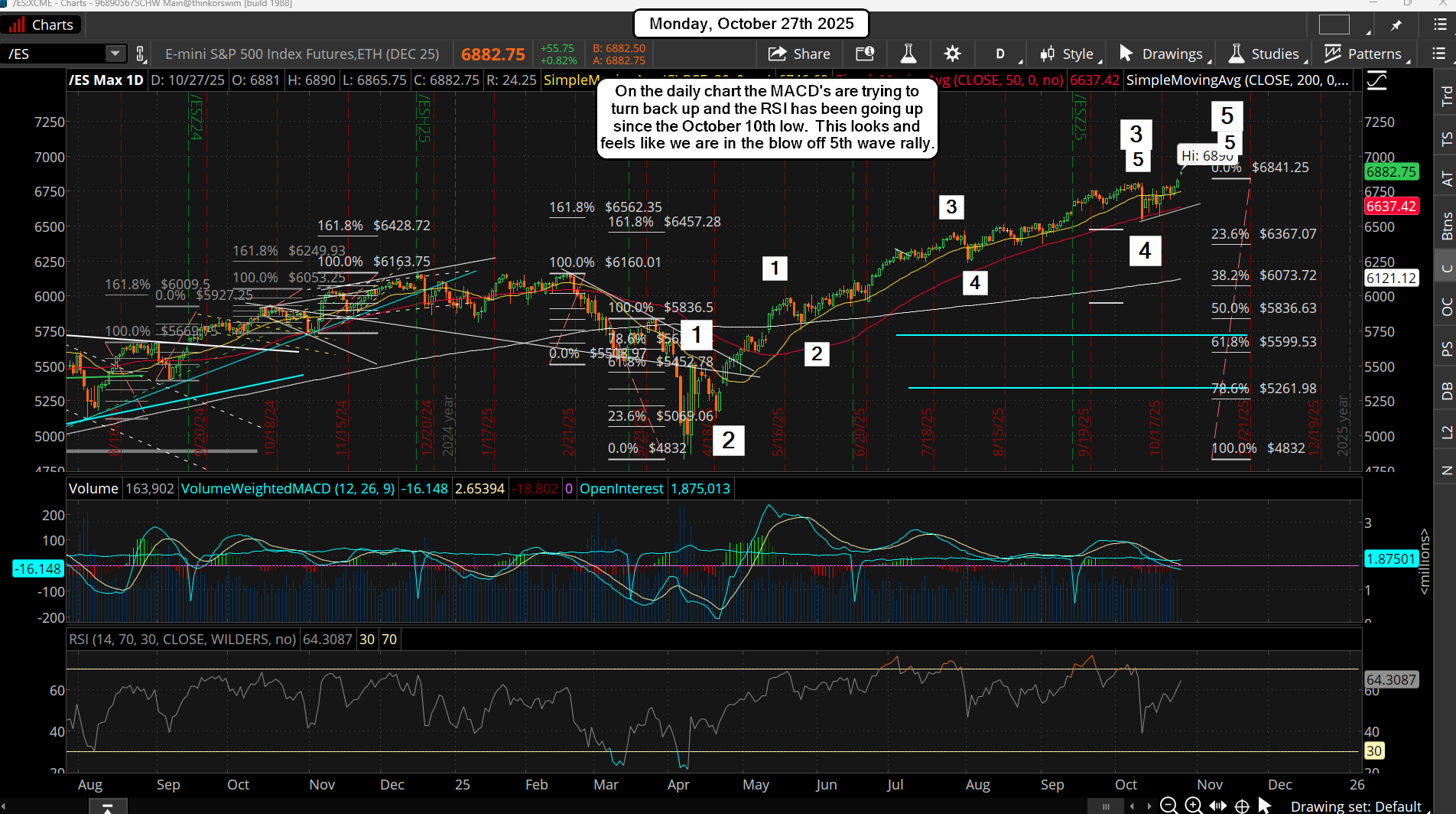

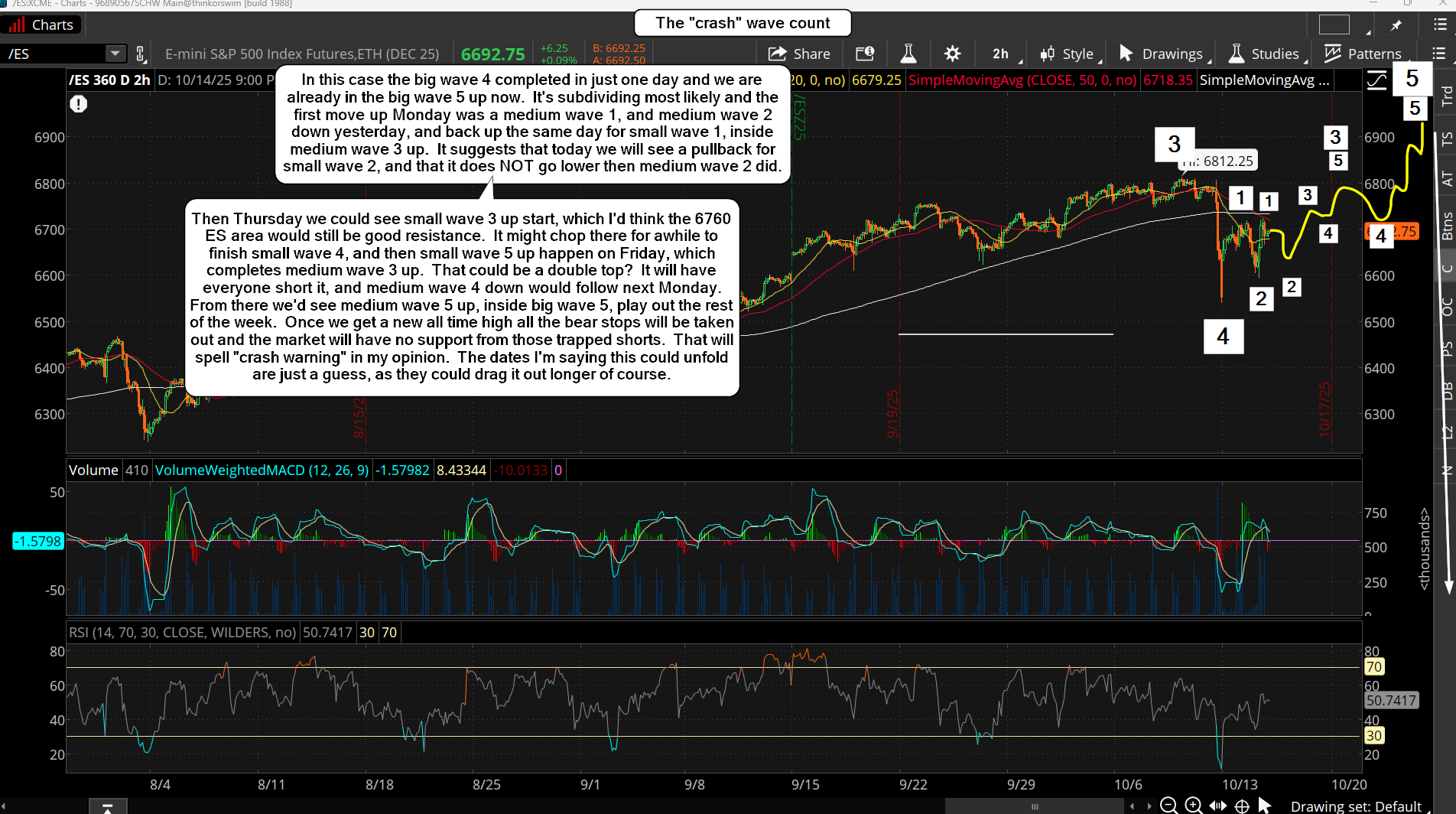

As you can see it's much more bearish as that last rally up will then become the final 5th wave, instead of one that takes the market to 7400+, which should happen if the prior chart plays out. Why? Because if the wave 4 down takes more time to form and bottoms around 6400 or so, like into the end of the month, there will have been enough "time" pass by to allow the overbought charts to get reset enough to start a powerful, long lasting rally. But if you shorten the time for the bigger wave 4 down, by making it complete in one day last Friday at that low, and then you go make a higher high into mid next week to complete the bigger wave 5 up, there won't be enough "time" passed to reset the overbought charts.

So the market will then be ripe for scary crash drop to happen with some "event" that happens and it gets the blame for the crash, but it will be all in the technicals and cycles. Again, the cycles are bullish the second half of October and bearish as we go into November. They are only a "guideline" an to where the pressure it at. Meaning, it can go up in a bearish cycle or down in a bullish one, but when they are at odds neither move will be large. However, if you are in a bullish cycle, with the market going up, and techincals support it, the move can be explosive. Same thing during a bearish cycle, as if the market is in one, and it's going down, and it has bearish technicals, you can see very large drops.

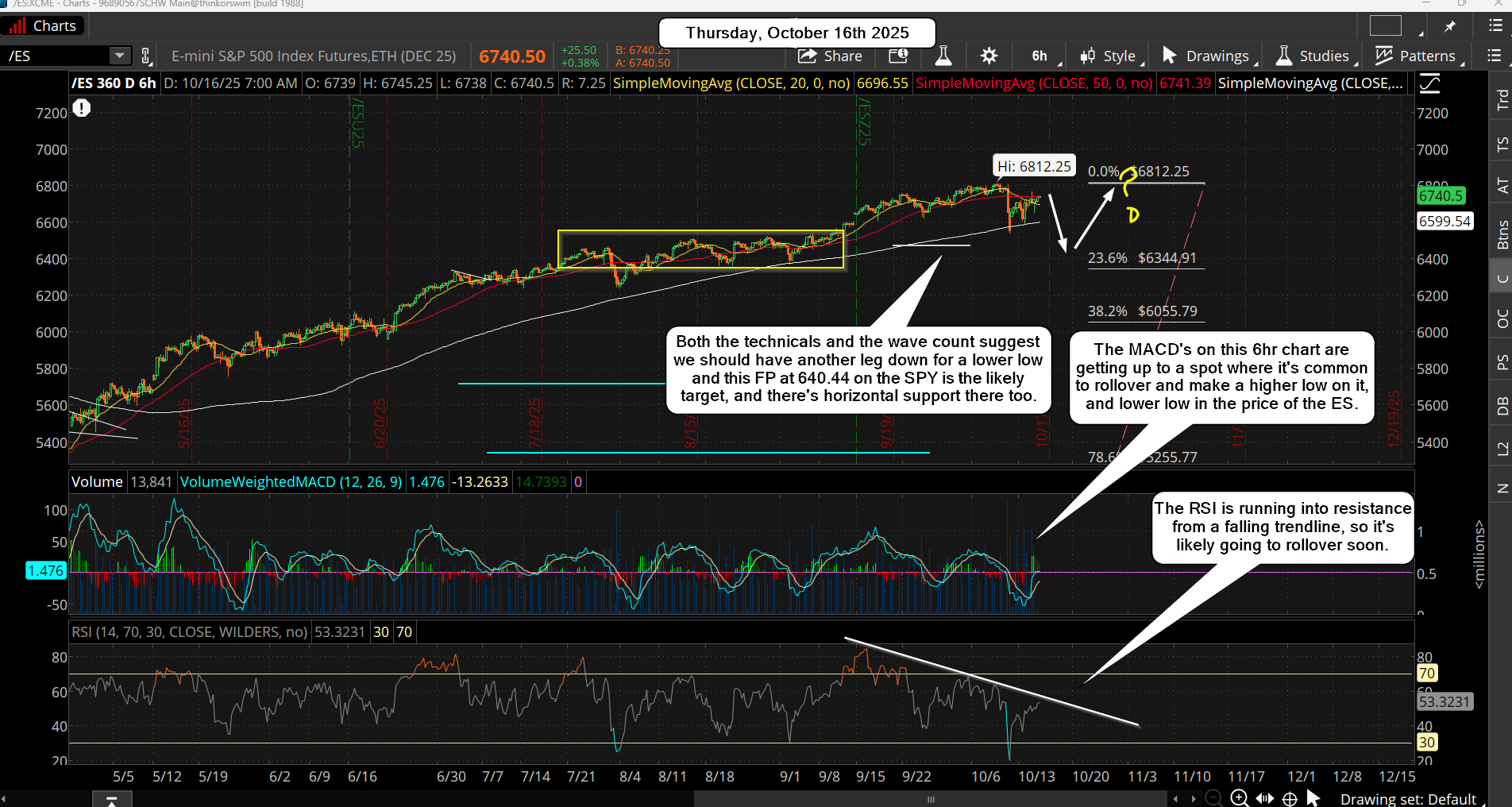

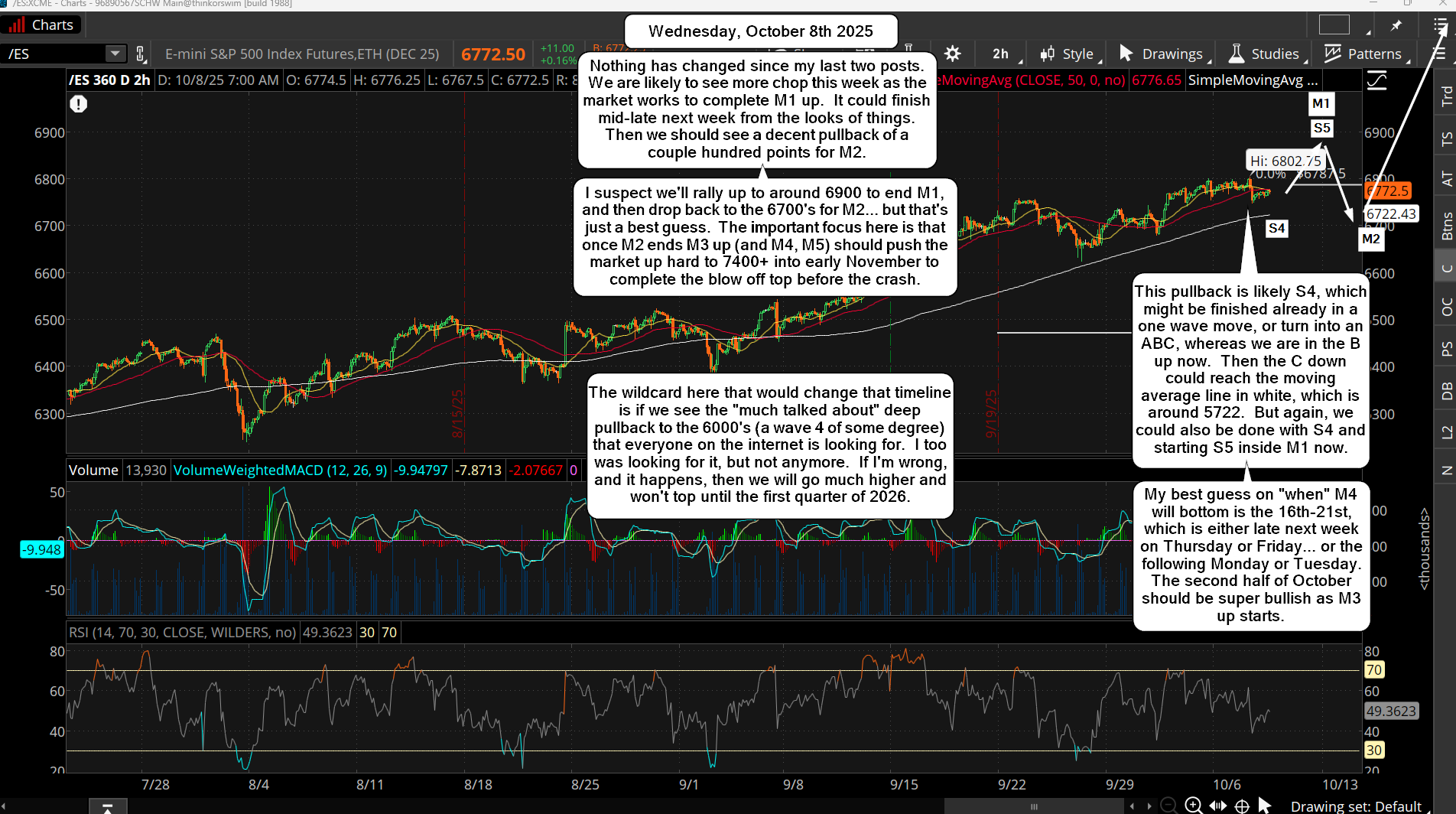

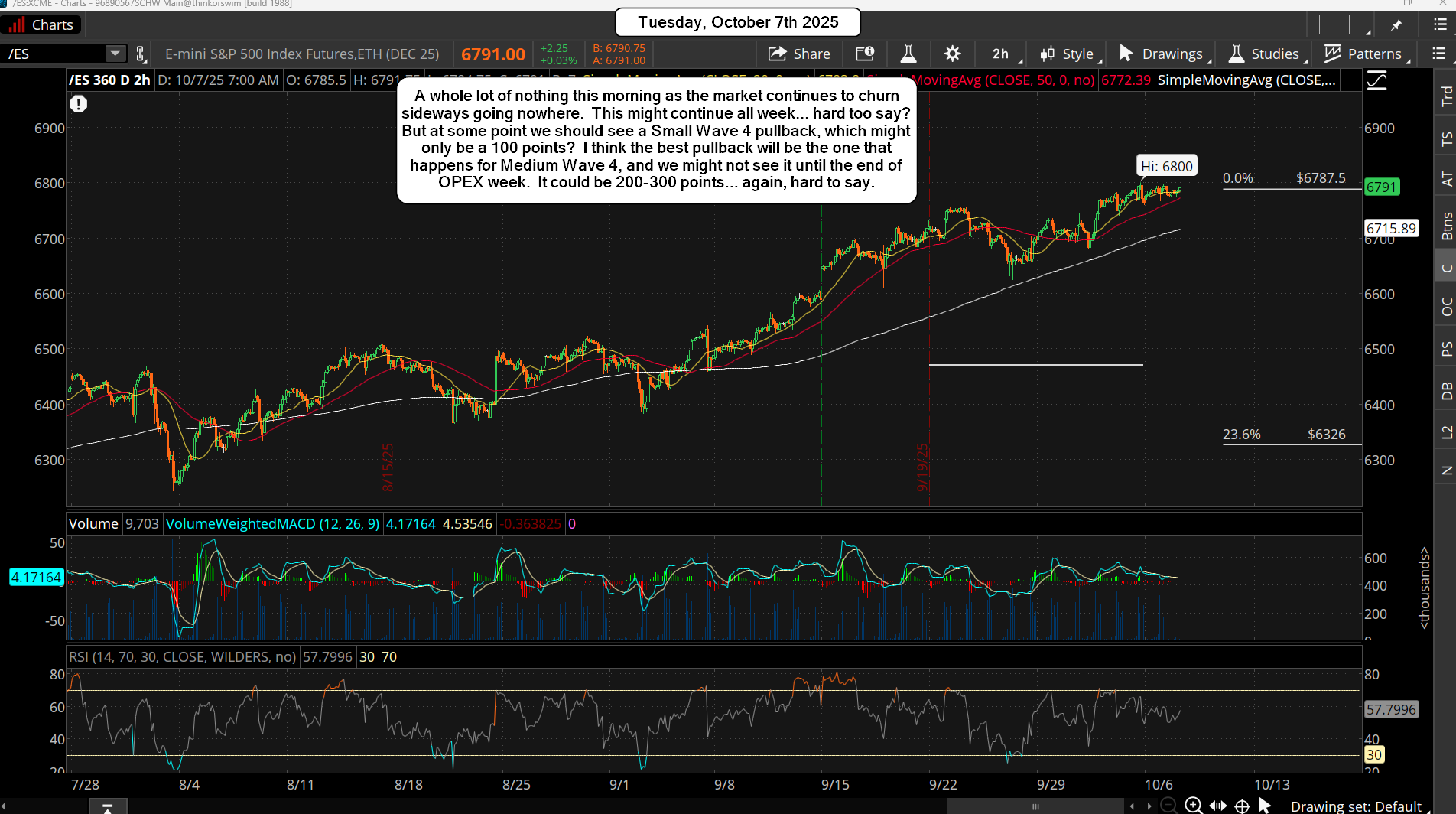

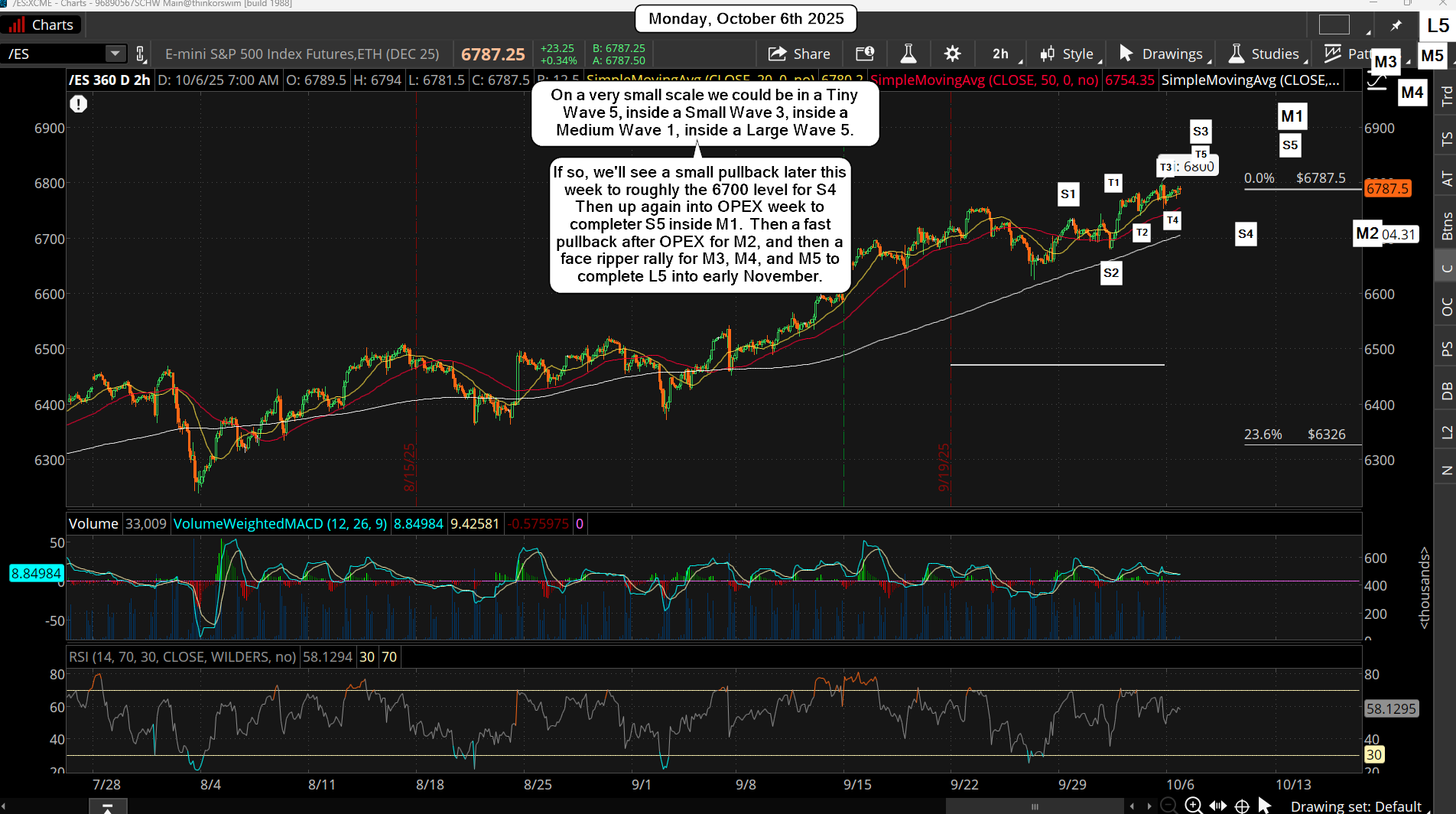

So where are we now? We are a neutral cycle this week, but next week and the week after it bullish, and then late October, into late November is a bearish cycle. What about the technicals? I think everyone knows we are super overbought on the bigger time frames, like the daily and weekly, but short term we are oversold. This suggests chop this week as short term and long term cycles oppose each other, and the cycles are neutral now as the are leaving the bearish period and entering the bullish period.

To me, this suggests a strong rally next week to a new higher high is possible as we enter the bullish cycle and technicals will probably setup some kind of positive divergence on their shorter term MACD's and RSI's to support a strong move. Basically, a wave 3 or C up has the best odds of playing out next week, but problem the bulls have is that if they go too fast (meaning they make a new higher high) they will exhaust themselves right as they go into the end of the month, where the bullish cycle starts to end and the bearish cycle comes back again as November rolls around. That's not good for the bulls as they really should take more time to reset overbought charts by breaking the wave 4 down into an ABC pattern that puts in a lower low into the last week of this month around the 6400 zone.

If they do that they can get the short term charts oversold enough to go into the bearish cycle of November as already reset enough... meaning they will avoid a crash. They will fight to go up in November against that bearish cycle, but they could carve out a wave 1 up and 2 down inside a bigger wave 5 up, which the wave 3 up could happen in December and be supported by the bullish period in the last half the month.

In summery, the bulls should NOT put in a new high in the next week or so as that will take out all the shorts that they need right now to keep the market from crashing. If you see a new high happen I'll be looking for a much bigger drop to play out. If they keep the shorts in the market by NOT making a higher high, the bulls can control the decline and support in the 6400 zone should hold.

Have an blessed day.