The market keeps on grinding it's way higher, as all the bears are gone (or dead), and the bulls aren't selling yet. When will they dump the market? When the last retail trader boards the bull train I guess? Could we go higher? Yes, of course we can. Wouldn't it be poetic to top out at 116.66 spy, just like we bottomed at 666 spx. Games people play... you got to love the irony.

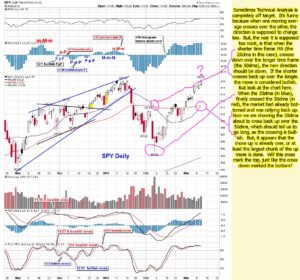

Here's something that's funny. Notice in the chart below that we actually bottomed out at 104.58 the same day the 20ma (blue line) crossed down over the 50ma (red line). Now we are about to see the 20ma cross back above the 50ma... which is considered bullish, just like the cross down was bearish. Yet, it seems to be too late when it crosses, as the down move was over by then. Will the up move met the same fate?

Of course I don't know the answer, but it seems too me that all this light volume slow grind higher, is designed to wear everyone out. Let me tell you... it's working! I'm worn out with all this crap. And, I'm tired of writing about doom and gloom too.

I'd write about something positive if I could find some, but all the news on the economy is still bad. Cisco is coming out with a router that's supposed too be 12 times faster then standard routers. Now that's exciting news! Maybe I should go long on the stock now? Yeah, and I'll long on BIDU too! This market is so overbought that it looks like a 1,000 pound fat man. How long can this last? Not too much longer, as the damn is cracking.

Notice how the dollar was down today and so was gold. Why? Don't they usually trade the opposite direction of each other? Yes, they do. But, gold is a safety play too. And when the people think that the market is safe now, and that they can make more money in stocks, they will sell gold and buy stocks... regardless of what the dollar is doing. Now that tells me that we are so close to a top, that it's not even funny.

Add the large VIX buy on Monday, with the large sell block of Goldman on Tuesday, and today's gold action... and you have many clues that the top is in, or just a hair away from it. Is it the final top? I doubt it, but it should be good for a nice 5-10% correction before moving higher. After that we could go up and tag the 50ma on the weekly chart. Summer time is slow in the market, and that's when I'd expect a move up to that level... if it happens?

Ok, that all I can think of to say. I'd complain some more about Goldman or how the market is extremely manipulated, but it wouldn't do any good. Plus, Goldman isn't doing anything right now. It's all the little retail traders that are pushing it up one dollar at a time. And since the bears are all hibernating (or dead), the only way the market is going to fall is if the institutional bulls decide to dump their longs. That's really what we are waiting for now. We need to see the first one sell, and then the others will join in too.

Unfortunately, we need some more bad news... really bad news, to get the selling started. It would be easy to start a fight between all the big boys if we were in school. We could just start a rumor about each of the baddest boys, and tell each of them that the other one said it. They would all turn on each other, and the fighting would begin. I remember girl's that used too do that all the time. They did it to make the boys jealous. Too funny it was, (and many year's ago). If life were only that simple today...

Red

P.S. Just for you Bear's out there...

Love your commentary – thank you Red.

Maybe I should have been a writer then… it probably pays better then this stock market does. LOL

Nah – your time will come Red. Don't worry and don't give up.

Refresh your page… and don't worry, I'll never give up.

nice write up Red, thanks for your feedback

Take care

Joe

Thanks Joe… it gets tiresome at times, but I try to throw something together. Mostly just my thoughts, and frustration about this market and life in general. Glad to see that people still enjoy it.

Your thoughts are what keep this boring market going…

Rock on Red

we'll have to prise their grubby fingers off this one by one

Red, we want good news, not bad news! Bad news is fueling this short squeezing machine. The good news is what will finally trigger the big sell-off. Keep sentiment bullish, even after a 10% drop. Buy the dips of a 15% drop. Triple down on a 30% drop…. that is what we want. Interesting that even you don't think it is possible we get a greater than 5-10% drop. I gotta admit, almost unanimously, all bears think this will fall “some other time… maybe in the summer or fall”. This was a blow off mania top, pure and simple. We fall hard starting tomorrow…. and bigger than anybody can imagine — like 25% big…. for starters. This gap tonight will grow to the downside and nobody will be able to short this thing!

Ok then… here's some good news! Obama, Bernanke and Geithner just turned themselves in, and admitted that they are crooked and were stealing that Tax Payer's money!

Here's the bad news… the market rallies to all time highs! LOL.

Carl just now:

June S&P E-mini Futures: Trading activity moves to the June contract at the pit open. Today's range estimate is 1123-1139 for the June contract. I now think a 20-25 point break has started but I expect it to be brief and end near 1120. Look fort the market to reach 1200 by the end of May.

Carl is now using June expiry, which is 4.5 points lower than March expiry as I write this.

1123-1139 estimated range for today (June Expiry)

Current is 1136.25, so -13.5 to +2.75 from here

Wow, down once from Carl. Interesting! Actually think this would be bad for the bears. We need it to go lower than 1120. If it only gets there, it will alleviate some overbought conditions and could the resume upwards. Ugh.

Agreed. Carl remains bullish. I'm wondering if he goes short today or just waits for the downside to subside.

Looks like I get to trade TZA today. So long as it doesn't get below $7.39 (pivot line for today)

Earl, how do I pull up pivots on a chart?

They are called pivot points. Also Persons points.

If your software doesn't have them, you can go to http://www.nationalfutures.com/pivotcalculator.htm

enter yesterdays high,low & close and get them.

Thanks so much.

I've seen Carl try to short the market many times. He gets burned often, even when he's right. He stayed away from shorting the January to February down move, just waited for the right time to go long. I can't imagine he'll try to short a 20 point move.

Thanks Dreadwin

I'm in TZA — not loving it.

I think you're in the right ETF.

Unless we see some shenanigans very soon, I think this $RVX move is real. Needs to cross 50 with authority to confirm.

http://www.screencast.com/users/dreadwin/folder…

Looks like I may be selling my TZA shortly. Just not working today. It's above the pivot ($7.39) but has been sneaking under it. I suppose I could wait for the close to decide, but it could fall like a stone at days end. Bah.

The other possibility I see is one last mad upthrust in $RUT to 680ish.

FWIW, i tend to agree with Carl on this one. 1120-1125 (SPX) But I am not detecting any material money outflow yet. Data showing some minor outflow. It may turn into something more material. But nothing yet.

Everything looks ripe for a decline. The potential is there. Just waiting for 'the East wind', as the Chinese General in the movie Red Cliff says.

SC,

I really thought Carl was onto something with his lower range estimate, but then he went long.

Mental note: until Carl puts on a trade, don't take the estimates too seriously.

All sorts of signs that a decline is coming. Just need a real decline 🙂

Becareful in following Carl's trades. I have seen him getting stopped out trades after trades, day after day. This is not a demerit on him. Carl just does his things. lol Apparently he does it well, over time.

SC,

I don't exactly follow his trades. I have my own. When we disagree, I generally try to figure out if maybe I made a mistake.

This morning I was trading TZA, and he came out with lower estimates — a good match. Hasn't worked out well for either of us 🙂

The day is not over Earl. Think we will have a sell off eod.

It's been a sleepy day — could be a big move right before the close. Down would be good.

I don't know. I prefer up into Sundancer's containment points on the RUT and XLF and then a massive move down. But I don't think I'll get that lucky!

Thanks for the warning, SC.

I haven't watched Carl enough to see him stumble and fall 🙂

for those with eagle eye's will notice a significant index gap on the $SPX this morning

And what does that gap suggest? Sundancer, do you think we have to get to your top numbers on $RUT and XLF before we can really head downwards?

significant $SPX index gap @ the open

past days with significant index gap:

3/5/2010

2/16/10

1/12/10

12/21/09

12/17/09

12/10/09

12/01/09

11/27/09

11/11/09

11/06/09

10/14/09

10/08/09

for those looking for ***the top*** then yes those numbers on the $RUT & XLF and a couple of other setups have to be fullfilled

Looks like in most of those gap cases, we rallied higher (minus about 3 of them)

the direction of the index gap is what is important, you'll find a high correlation between the direction of a significant index gap and resulting daily close

Thanks for laying it out in layman's terms 🙂

Looks like we closed in the direction of the gap. Assuming the same happens, that would mean we close down today.

yes,

if the $SPX happens to close over 1143.96($SPX open today) then the $SPX will have 6 consecutive higher closes than opens and in the last 12 months the $SPX hasn't had more than 6 consecutive higher closes than opens

Yes, that it will be interesting to watch.

Looks like we could be breaking a record here then!

Carl is long one unit at 1140.50 – going with the flow

Carl added Long second unit at 1139.75

Carl sold both units at 1137.50

Out of TZA

$DJI – DIA containment pt. dancing

http://www.flickr.com/photos/47091634@N04/44257…

$SPX 1148.76 printed, this setup is done

http://www.flickr.com/photos/47091634@N04/44221…

Sundancer, what does that mean?

the bullish setup triggered @ 1116.66 is completed, this was the last of bullish setups on the $SPX that i had

Basically, you are saying that the “short term top” is in, and now we are just looking for a reason to sell… some bad news to blame it on, right?

***if*** we are going to turn down then we're not far off from a turning point as we're running out of room to run,

remember this chart of the $SPX monthly

http://www.flickr.com/photos/47091634@N04/43590…

after they run the stops above 679.75, RUT is out of room if this is a backetest

http://www.flickr.com/photos/47091634@N04/44227…

“…..***if*** we are going to turn down …”

Bravo! That is a key point. A lot of market participants just go hogwild when their key points are reached, and forgot about there is a ” ***if**** ” clause. Damn the fine prints… LOL.

But, if the RUT runs to 690, won't it indicate that is no longer a back test and we won't turn down?

***if*** the $RUT closes the month above 679.75 then the bears worst nightmare will come true, but March 31st is a ways off

Yep – the tough part is figuring out what to do in the interim if it blows through that number. Thanks for all your info Sundancer.

I got ya… We might not be ready to go short yet, but going long is probably a bad idea at this level.

yeah going long now is like walking on fire

don't forget this indication last friday from the operators

http://www.flickr.com/photos/47091634@N04/44203…

I see that level being hit pretty quickly if some serious volume comes back into the market.

For the end of the month, if we close above 1115, then that is bullish, or bearish?

***if*** we close the month above 1115.10 then the setup is in place for a major monthly reversal, the same parameters were in place during 8/2000 & 10/2007

Sundancer,

What about this XLF

the XLF isn't there yet, creeping closer to $15.82

SPY containment pt. update

http://www.flickr.com/photos/47091634@N04/44249…

the bid from the algos has come the SPY opening above it's containment pt. the last two days, if there isn't a reaction here then the SPY chart is going to look like the IWM chart, the next containment pt. is up in the 118 area

JPM had a target of $690 on the RUT for 2010. Almost there.

Sundancer, do you think this is it or more up to go

$690 sounds good after they run the stops above 679.75 area

http://www.flickr.com/photos/47091634@N04/44227…

Carl at day’s end:

1123-1139 estimate today for /ES (16 points, June Expiry)

1134 -1145.50 actual today (11.5 points)

Missed by a mile.

Trades:

In /ES at 1140.50, out at 1137.50 (loss of 3 points)

In /ES at 1139.75, out at 1137.50 (loss of 2.25 points)

Grade: D – (could have been worse)

It's good to know Carl is human afterall!

some possible good news for the bears:

***if*** the capital capacity of AAPL's regulator has not changed, then the $229 area is nearing the end of the road for AAPL before it heads to it's de-leverage pt.

May be some relief in sight, if you look at this one

http://carolan.org/wp-content/uploads/2010/02/0…

TNA opened down 1.8%. 2nd down opening in 9 days. Gaps of today and yesterday were filled, and TNA was up 1.3% at the high. TNA closed up 0.9%, but did not make a new high today.

We are in a Full Moon Trade, which favors TNA.

After nine days, this trade is up 25%.

Volume for TNA was fairly high (2nd highest in 21 trading days, yesterday was the highest in 21 trading days)

$RVX (VIX for $RUT) closed 1.4% lower with TNA up 0.9%. After 3 days with divergence, no divergence today. Good for TNA.

TNA has been up 20 of the past 22 days.

The high for TNA today was $54.40, 16 cents lower than yesterday (which was the highest high since November of 2008)

Ultimate Oscillator for TNA peaked at 78 thirteen trading days ago and has generally fallen since then but has remained above 50 and is currently 69. Indicating continued strength for TNA. After 3 days with divergence, no divergence today. Good for TNA.

Bollinger Bands for $RVX (VIX for $RUT): today’s candle touched the Bollinger Mid Line and fell back. The lower Bollinger band is **off the chart** but seems to be falling. Hard to read, but looks like $RVX might no longer be rising, which is good for TNA.

Bollinger Bands for $RUT: The white candle for $RUT rose as did the rising upper Bollinger Band, indicating that $RUT might continue rising. Good for TNA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s candle rose after 3 days of dropping, and sits mid way between the mid line and the upper Bollinger band.

Hard to read, but perhaps indicating that TNA will continue to rise.

A lower high and a lower low are signs of possible TNA weakness.

Overall, it looks like TNA might continue rising tomorrow.

for those with eagle eye's will also notice the $SPX closed .01 above it's jan. 19 high, even more important the 4:00 tick wasn't 1150.24, it was 1150.07, so the invisible hand came in couple minutes after the close pinned it @ 1150.24, now if they want to be cute on the weekly, a close tomorrow of 1144.99 wouldn't surprise me

Now the $SPX currently has 6 consecutive higher closes than opens and in the last 12 months, no consecutive sequence has made it past 6.

Also important is the $VIX weekly setup that I talked about on Monday, a close below 17.95 tomorrow and the probability increases for a melt up next week as the $VIX since the week of 8/13/07 hasn't ever broke it's consecutive close sequence @ 5.

the operators did this charade to the QQQQ's during the 08' top

week of 5/12/08 50.01

week of 5/26/08 50.01

“a melt up next week”… in the VIX or the market?

in the market ***if*** the $VIX closes below 17.95, but i don't think that's going to happen given the operators actions in the $VIX all week

remember on Monday when the operators gapped the vix up 3.5% while the markets opened flat, well that wasn't a coincidence, while the $SPX has climbed higher all week the $VIX hasn't even come close to taking out it's lows since last friday

Thanks

melt down. in market

Oh boy Sundancer, I fear that we may close the vix below 17.95 today which means a melt up in the SPY next week, correct? What if we close on 17.95?

The view from Americanbulls

TNA is a HOLD (wait for a possible SELL-IF signal after the close on Friday, for a possible sell at some point Monday). Today was a White Candlestick, indicating a normal up day.

TNA is now up 47% since the buy signal on Feb 9th. TNA was $36.69 at the time, and closed today at $54.20.

TZA is a WAIT (wait for a possible BUY-IF signal after the close on Friday, for a possible buy at some point Monday). Today was a Black Candlestick, indicating a normal down day.

TZA is now down 34% since the sell signal on Feb 9th. TZA was $11.04 at the time, and closed today at $7.29.

Summary: The candles today changed nothing.

One thing you may have missed:

$RUT:$RVX upper bollinger band is now (as of today) sloping down. Time will tell how significant that is.

Dreadwin,

I saw the beginning of the down slope, but the most recent candlestick was up today, and I really struggle with the subtleties of $RUT:$RVX, so I closed my eyes and moved on 🙂

Oh boy Sundancer, I fear that we may close the vix below 17.95 today which means a melt up in the SPY next week, correct? What if we close on 17.95?