The bulls recaptured lost ground today, as the weekend allowed the media to spin the Goldman Sachs story as a non-event. We know differently, as where there is one roach... there's always more! Nothing is ever easy in trading, and you can bet that this coming correction is going to be full of bounces along the way.

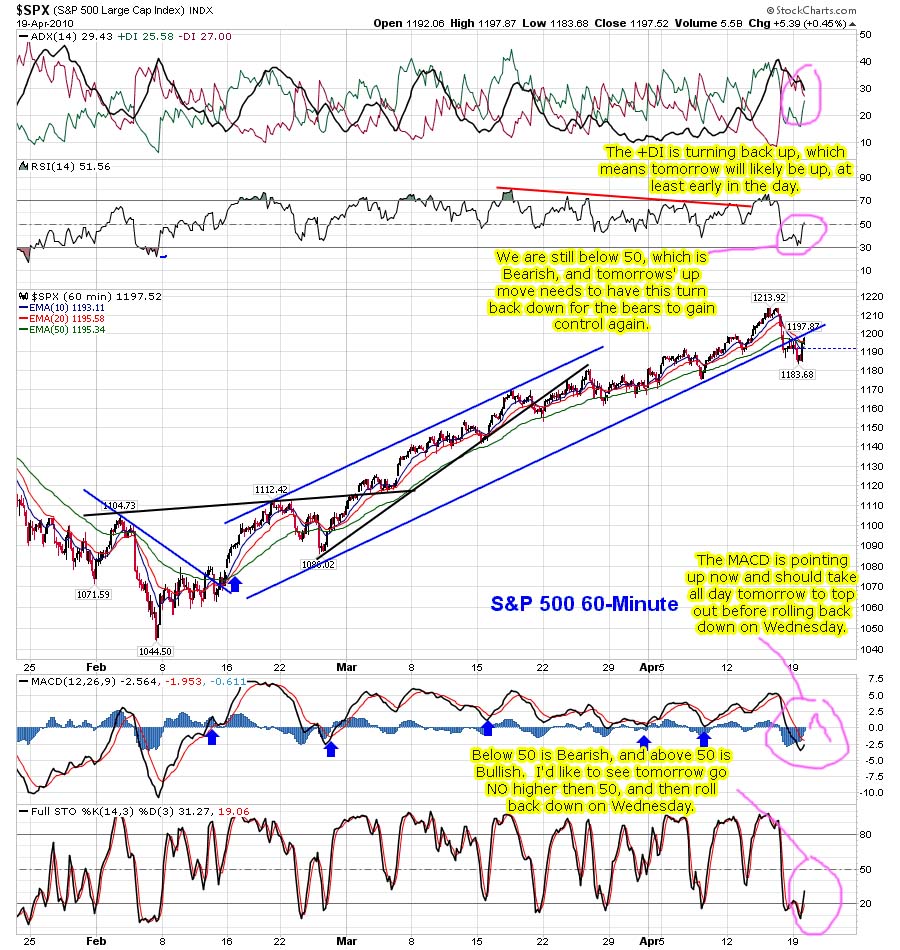

Looking at the 60 minute chart of the SPX, you can clearly see that we finally busted out of the trendline from the 1044.50 low. We are now in "backtest" mode, and will likely try to recapture the trendline tomorrow by closing inside it once again.

That doesn't mean it's over for the bears, as the daily chart tells a different story. Looking at it, you can see that the -DI line (in Red at the top of the chart) has clearly spiked higher from Friday's sell off. The +DI (in Green) is also losing power and pointing down. You can see that the RSI has dropped out of the "above 70" range, which means the up trend is losing steam. I'd like to see it fall below 50 for me to confirm that the bears are in control, but it's a start at least.

So, at this point, I'm not going to say that we aren't going back up and make a new high, as it still could happen, but the odds are slowly going down. We could have another sideways, wild swing, up and down movement similar to the November 9th to Mid-December time period.

I don't think that will happen, but it is possible. It really depends on what the "powers that be" want to do at this point in time? Do they want to go straight down to the fake print around 10,000, or drag it out sideways, and run up to 11,816 first.

Personally, I believe that the release of the news on Goldman was just a start of the coming news to be released over the next few weeks. I can't be sure, but if I recall what was "in the news" during that sideways chop fest in November and December... it wasn't anything majorly negative.

That makes me lean more on a quick 3-4 week sell off, as they didn't just release this news on Goldman for a one day event... at least I don't think they did? I'm sure it's possible, but usually they toss a bunch of negative news out there when they want to sell it off, and then pump positive news when they want to rally it up.

Bottom line here... it's all about what news and earnings come out this week. If they make them positive, the market could chop sideways for weeks, until it finally pops out of the range and goes on up to 11,816. Or, they could dump all the bad news over these next few weeks, and cause the sell off.

I'm sure that Goldman wanted their stock to tank, so they could buy it back cheaper. Who knows how much phantom stock they sold to the public? If you read the story Matt Taibbi published, that I put up on yesterday's post, you will see how they borrowed shares that didn't exist, so they could bankrupt Lehman Brothers. I'm sure this is a common occurrence for them.

But, at some point, the phantom shares must be put back into the phantom vault. That's probably why they tanked their own stock, so everyone holding shares of it would sell them at the "now heavily discounted" price.

In a way, it reminds me of a friend of mine that owned a "buy here, pay here" car lot. People would buy the car at over inflated prices, (because they had bad credit), and then pay higher then normal interest rates, with payments on a weekly basis, instead of monthly. Once they missed a payment, he would repossess the car, which would then be sold again to another sucker.

He got the car back at a discount, because the person did pay some of the weekly payments, and of course some type of a down payment. He could re-sale the same car multiple times, and do the same thing every time. Some cars he re-sold 7-8 times! He made a good living that way. Of course the difference between his business and what wall street does to the average investor, is that the people that buy the car do know the risks, and the late payment results. Wall Street lies, cheats, manipulates, and does flat out fraud to steal peoples' money. Big difference there...

Anyway, I'm expecting an up day tomorrow... but hopefully not too far up.

Red

RDL, I posted bullish chart of chart, that surely means the end of the known universe. hehe

http://oahutrading.blogspot.com/2010/04/chart-o…

Great charts Red. This is so annoying!

Keeping an eye on GS daily setup is probably not a bad idea…

http://www.flickr.com/photos/47091634@N04/45378…

the 155 area on friday & yesterday was important because of yellow containment. GS first started dancing with yellow containment back on 8.5.2009.

You'll also notice @ the close yesterday that GS backtested light blue containment that held GS during the Jan/Feb low.

I'm not sure what that meant yesterday with the Dow closing at 11,092, and last week the spx closing at 1192, as I can't make out any 666 from it… but it's quite clear as 911.

The games they play are annoying…

Yes, and now up substantially in premarket. Thanks Sundancer.

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1195 – 1208. Yesterday's late rallied continued to the 1203 level early this morning. It was much bigger than I anticipated and was uncorrected. This leads me to conclude that yesterday's 1180 low ended the correction from 1180 and that a swing to 1270 is now underway.

1179.75–1194.50 actual yesterday (14.75 points)

1203 high last night

1195-1208 estimate for today (13 points)

1200 currently, so estimate is -5 to +8 from here (somewhat bullish)

You know Earl…

It's great that you post the bullish side from Carl, as everyone knows I'm primarily bearish. I will eventually go long, but I'll won't do so until I see a correction first.

So do continue to post, as I want give people both sides of the story. (I'm wrong most of time anyway! LOL).

I really haven't made up my mind about Carl yet. He does fairly well sometimes, but his trading lately, on the days that he takes a trade, has been not so great.

He also changes his mind a lot, which I think is a strength. I never thought of Carl as being opposite of you — or anyone — he is just Carl. Do let me know if it's bugs you seeing his stuff — not trying to do more than give people something to bounce off of.

No, no…

That's the point I'm telling you. Keep posting. I want this blog to be fair to both sides. Remember, the market makers don't care if you are bullish or bearish. They take money from both sides.

So it's good to hear the other side. People that read the blog are also trying to make money, besides just hearing me bitch about all the corruption. If that means they need to go long, then that side needs to be heard.

The blog is open to all posters… both bulls and bears. I do pick on the bulls a lot, but never a real person.

I remember a year ago, before I started this blog, how Mole would bitch people out, and even ban some, for posting bullish charts. I don't think he's as bad about that anymore.

But anyway, I don't want this blog to be unfair to anyone. Everyone can have their say. So do continue posting. I'm sure there are silent readers that gain some benefit from it.

I'm primarily here the for the entertainment… as my trading skills are not exactly great. LOL.

I think you just invoked the cosmic whammy un-jinx on Carl and now he will have a great trading day.

He is due for a good day, and he doubled up. Probably means we go higher.

gapped up above 120.30. Guess we are going to 121.03.

been out all morning, SPY almost tested 121.03

Do you think it still needs to?

GS selling hard though.

9:42est 158 print

Thanks Sundancer – I guess we are going lower.

3:21est

GS new LOD

Carl just went long one unit at 1199.50

aapl dropping

Alphahorn posted this on his blog. I'd advise that you don't watch if you're short from yesterday.

http://www.youtube.com/watch?v=RIfzVEreB_I&feat…

I watched it anyway 🙂

I think it is hilarious. It would be less so if I was losing money today.

Carl just went Long second unit at 1199.75

operators dumping the $VIX into expiration tomorrow

There must be too many calls that they want to expire worthless. That's probably why the market is rallying today.

Too bullish to me. Down tomorrow. imo

http://stockcharts.com/h-sc/ui?s=$NYUPV:$NYDNV

Some general observations:

1. 8 trading days left in the month, currently there are major violations given the current setup on $RUT/IWM & $DJI/DIA

2. $DJI is @ it's last daily containment pt. 11,137

3. large entity is suffocating the bid on GS

4. E-wavers think mkt. is going up, TA enthusiasts think mkt. is going up, Cycle gurus mkt. going up

5. the tape is being heavily painted

So what does all this tell me: keep an open mind to the market treading water in a tight range for a while should a large expansion in volatility not commence very soon.

the odds of a deep retracement are getting lower by the day, given the setups on the monthly

Thank goodness I carry around a large jar of Vaseline with me. It won't hurt as bad when they stick it too me again!

The bullish trend is still largely intact. Strong rally typically doesn't just roller overnight. A parabolic rise typically eperiences a stall. Rebounce. Failure. And resumption of decline.

Despite the Friday sell off, the damage has yet to establish a confirmed sell. What we have is more components turning bearish. What we need now, is a followthrough decline to move everything firmly into the “sell” territory. That will resolve all those overbought situations and reset the tone, and set up a nice buying opportunity, before the credit crisis raises its ugly head again. All of the banks are reporting fake profits based on reduced loss reserve. They are cooking the books, hoping that everything will turn out ok in time. The Audacity of Hope, indeed.

If there is no followthrough, then the intact bullish structure will just mean the melt up resumes to the cliff of madness. A possible but lower probability outcome.

In sum, waiting for the market to resolve itself.

Here's a monthly view of the triple knot the $SPX is currently running into:

2 containment pts. & the triple 21 ENV

http://www.flickr.com/photos/47091634@N04/45386…

Well gang, since the market is just boring me too tears, I'll post a video that Anna wanted me to put up for those in OBB to see. It's a new kitten that someone dropped off at her house that was abandon.

Anna takes care of lot's of animals, and of course took in another stray, as she couldn't bare the thought of an animal shelter not finding a home for him and having to put him to sleep.

Here's a short video of Ziggy…

http://reddragonleo.com/wp-content/uploads/2010…

Red,

I was afraid to say anything about the cat, lest someone figure out where I live and mail it to me:)

You're bad Earl… too funny. 🙂

I can't adopt every animal I see like some people do, but I have compassion for helpless ones.

Anyway, I just thought I'd break up the boredom.

Ok gang, I used another program to remove the advertisement from the video, and add a frame with a start and stop button. I uploaded it to Anna's site too, (as it's her kitten).

I thought I'd get some type of response from you guys (and gals), but it seems you are all harden traders, and could care less about a helpless animal.

Come on gang… at least you could say “cute kitten”, or something? I know you all still have soft spots in your hearts. He would have died without Anna taking him in. Show Ziggy a little love guys.

Even the toughest men like pets. Here's a better video…

http://www.hotoptionbabe.com/ziggy

Carl just sold longs at 1202.50

Been out for most of this torturous day. It could go up, it could go down, it's impossible to tell!

Carl at day’s end:

1195-1208 estimate for today (13 points)

1197–1205 actual today (8 points)

Today stayed in Carl’s range by 2-3 points.

Trades:

In /ES at 1199.50, out at 1202.50 (gain of 3 points)

In /ES at 1199.75, out at 1202.50 (gain of 2.75 points)

Grade: B (made some money)

TZA opened down 1.4%. Today’s gap was not filled. TZA was down 0.1% at the high, and closed down 4.0%.

Unfilled gap: $6.14 – $6.15

We are now in a New Moon Trade, which tends to favor TZA

AmericanBulls had TZA with a BUY-IF signal for today. Under AmericanBull’s BUY-IF rules, TZA would not have been a buy today, so this trade remains in cash.

Volume for TZA today dropped from the two previous days, at normal levels today. Neutral for TZA.

$RVX (VIX for $RUT) closed down 8.3% with TZA down 4.0%. No divergence.

TZA was down for 6 days, up for 2 days, and down today. Bad for TZA.

The low for TZA 3 days ago was $5.80, the lowest TZA price ever. Today’s low was 9 cents higher. Good for TZA.

Ultimate Oscillator for TZA fell for 9 days to 23, then rose for 2 days to 29, then fell today to 28. Bad for TZA.

MACD on the monthly chart has been flat far below zero for days, and remains that way today. Bad for TZA.

Bollinger Bands for $RVX (VIX for $RUT): Today’s long black candle closed above the bottom Bollinger band. MACD seems to be heading back down. Looks like $RVX might rise tomorrow. Bad for TZA.

Bollinger Bands for $RUT: Today’s white candle for $RUT returns $RUT near its high, but away from the upper Bollinger band, which is rising. MACD might be topping. Bad for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s white candle rose to close below the upper Bollinger band. The upper Bollinger Band rose today. Two days after what appeared to be a successful 3-day sell signal, not so sure the sell signal worked. Bad for TZA.

TZA had a lower high, lower low and lower close – Bad for TZA.

Money flow for the Total Stock Market was $5,934 million flowing out of the market 2 days ago, $1,037 million flowing out yesterday, and $364 flowing in day. Bullish – Bad for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks bad for TZA.

AAPL reports 3.33 vs. 2.45

We also hit the 121.03 spy into the close. It was 121.06 at 4:00 pm est. Of course we are higher now on Apple news.

I saw that. I don't know what to make of any of this.

Yeah… it's seems everything is coming up roses now!

Seems like it has been since I started going short!

Do you know when it reopens for trading?

Did AAPL lower giudance?

Apple (AAPL): Q1 EPS of $3.33 beats by $0.88. Revenue of $13.5B vs. $12B. Sees Q2 EPS of $2.28-2.39 vs. $2.70, on revenue of $13B-13.4B vs. $12.97B. Sold 2.94M Macs (up 33%), 8.75M iPhones (up 131%), 10.89M iPods (down 1%). Shares halted just before release.

Yes but they always do.

I still don't know why trading is halted?

the bulls are having a orgasm

Well the bears are having a heart attack then…

what else is new.

AAPL 260's LOL!!!!!

Do I hear 300

Do I hear 325

Do I hear 990!!!!!!!!!!!!!!!!

How about an even One Thousand for this gorgeous Red Tulip?

while the bulls are having orgasms over AAPL

“someone” continues to suffocate the bid on GS, walking it down AH to the low 159's.

Sounds like someone big is trying to get off the Titanic before she sinks…

how would you like to be a institutional investor with GS as one of your largest holdings

All those sucker hedge fund clowns thought GS was a ATM machine that only goes up

If that's who's holding Goldman down, then it could take weeks to unload all their shares (doing it a little at a time, so it doesn't tank on them).

That also means that they would like to see the overall market stay up, while they unload Goldman. If one of those clowns tries to unload too much on any given day, a technical sell level could be hit on Goldman and cause the bot's to kick in.

It's going to be very touchy for the next few days, and weeks. One mistake by a hedge fund could cause the sell off we've been looking for.

I think we hit it soon enough anyway. If we get over the previous SPY high tomorrow, the bots are going to get us to the next retracement level. Everyone and their mother is looking at the 1228 ish level, right?

Meaning that we either fall short of it, or blast above it… Which one is the question I'd like to know?

The last one was at 1120, and we hit 1150. Springheel jack has a great IHS chart on /ES:

http://www.screencast.com/users/springheel_jack…

Cramer $1000 target

Some of the moves I saw in the afternoon are making sense now — the entire market was holding its breath, waiting for AAPL to release earnings. Unlike GOOG, this does not seem to be a “sell the news” event. Even oil is going up.

Dreadwin,

Was you long on Apple? If so, you made a good call.

I don't touch AAPL. Been burned too many times. I forget sometimes that everyone else uses it as a barometer of the consumer economy.

But their guidance for future was down.

They're always super-conservative with guidance. That way everyone can pump their stock after earnings.

Seems like they are in a hurry to sell the shares as promised to their buddies. GS had BAC $20, JPM$50 still pending. Other than that AAPL price had a target $262. JPM had RUT to be 690 target price, the rest is short squeeze. Seems like top is imminent to me

How many of you remember the dry bulk stocks during 2006-2007?

Can't say I do? What happened?

http://www.flickr.com/photos/47091634@N04/45385…

$8.5 to $131 to $2.72

fund managers got completely destroyed

Hello. I am forex-cat.

Your blog is very interesting.

Thank you.

…my blog:

forex chart analysis and a cat

You should join in and chat with others Forex_Cat. Everyone is easy to get along with, so don't be shy.

Not that I care if you promote your blog, as I did add you to my blogroll, but it's considered rude by most bloggers to simply put your blog link on someone's site, without contributing something.

Since you are Japanesse, and maybe in a different time zone, I understand you not being here all day. But please do comment from time to time. I added a translate link for my blog for you. I don't know if you can translate these Disqus comments, but hopefully you can read everything OK.

The way to get traffic to your site is to post helpful charts and news events on other blogs while you chat with them. You probably know more about the Japanesse market then most of us do, so maybe you can keep us informed?

I'm expecting a black candle on AAPL tomoorow

You may be right but what makes you think that?

yhoo tanking now

The Daily view from Americanbulls

TNA had a SELL-IF signal today, and that signal expired without a SELL signal, so TNA is a Hold for tomorrow. The TNA buy was at $56.50. TNA closed at $65.10, up 15.2% since the buy. The candlestick today was a White Candlestick (normal buying pressure).

TZA had a highly reliable BUY-IF signal today, and that signal expired without a BUY signal, so TZA is a Wait (for a signal) for tomorrow. The TZA sell price was $6.51. TZA closed today at $5.91, down 9.2% since the sell. The candlestick for today was a Black Candlestick (normal selling pressure).

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 15.2%

Summary of Positive $RUT based ETFs & a few popular ETFs & stocks (Market positive): +13

Hold: IYR(1x RE, up 0.4%), URE(2x RE, up 0.5%), DRN(3x RE, up 5.8%), QQQQ(up 2.87%), DIA(up 1.9%), UCO (2x oil, down 3.1%), AMZN(down 0.2%), IWM(1x, up 5.3%), UWM(2x, up 11.1%), SPY(up 1.5%), ERX(3x energy, up 9.8%), TNA(3x, up 15.2%),

New Confirmed Buy: GOOG

Transition to Market Positive: none

Transition to Market Negative: none

Market Negative: -3

Wait: USO(oil), GS

New Confirmed Sell: AAPL

Comment: Bullish overall, Bearish Oil, Bullish $RUT, Bullish Real Estate

Action for TNA or TZA for tomorrow: none

Red, how are the same indicators you posted yesterday looking tonight?

Just put up a new post Monica….

Red, how are the same indicators you posted yesterday looking tonight?

Just put up a new post Monica….

The Daily view from Americanbulls

TNA had a SELL-IF signal today, and that signal expired without a SELL signal, so TNA is a Hold for tomorrow. The TNA buy was at $56.50. TNA closed at $65.10, up 15.2% since the buy. The candlestick today was a White Candlestick (normal buying pressure).

TZA had a highly reliable BUY-IF signal today, and that signal expired without a BUY signal, so TZA is a Wait (for a signal) for tomorrow. The TZA sell price was $6.51. TZA closed today at $5.91, down 9.2% since the sell. The candlestick for today was a Black Candlestick (normal selling pressure).

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 15.2%

Summary of Positive $RUT based ETFs & a few popular ETFs & stocks (Market positive): +13

Hold: IYR(1x RE, up 0.4%), URE(2x RE, up 0.5%), DRN(3x RE, up 5.8%), QQQQ(up 2.87%), DIA(up 1.9%), UCO (2x oil, down 3.1%), AMZN(down 0.2%), IWM(1x, up 5.3%), UWM(2x, up 11.1%), SPY(up 1.5%), ERX(3x energy, up 9.8%), TNA(3x, up 15.2%),

New Confirmed Buy: GOOG

Transition to Market Positive: none

Transition to Market Negative: none

Market Negative: -3

Wait: USO(oil), GS

New Confirmed Sell: AAPL

Comment: Bullish overall, Bearish Oil, Bullish $RUT, Bullish Real Estate

Action for TNA or TZA for tomorrow: none

yhoo tanking now

I'm expecting a black candle on AAPL tomoorow

You may be right but what makes you think that?

Hello. I am forex-cat.

Your blog is very interesting.

Thank you.

…my blog:

forex chart analysis and a cat

You should join in and chat with others Forex_Cat. Everyone is easy to get along with, so don't be shy.

Not that I care if you promote your blog, as I did add you to my blogroll, but it's considered rude by most bloggers to simply put your blog link on someone's site, without contributing something.

Since you are Japanesse, and maybe in a different time zone, I understand you not being here all day. But please do comment from time to time. I added a translate link for my blog for you. I don't know if you can translate these Disqus comments, but hopefully you can read everything OK.

The way to get traffic to your site is to post helpful charts and news events on other blogs while you chat with them. You probably know more about the Japanesse market then most of us do, so maybe you can keep us informed?

How many of you remember the dry bulk stocks during 2006-2007?

Can't say I do? What happened?

http://www.flickr.com/photos/47091634@N04/45385…

$8.5 to $131 to $2.72

fund managers got completely destroyed

I think we hit it soon enough anyway. If we get over the previous SPY high tomorrow, the bots are going to get us to the next retracement level. Everyone and their mother is looking at the 1228 ish level, right?

Meaning that we either fall short of it, or blast above it… Which one is the question I'd like to know?

The last one was at 1120, and we hit 1150. Springheel jack has a great IHS chart on /ES:

http://www.screencast.com/users/springheel_jack…