It's seem that the Goldman Sachs news has been completely forgotten by the market, as the Bulls pushed it higher again today. Even into afterhours the Bulls kept buying up Apple, after they blew out earnings. Once again we are back to more of the same bullish crack high that the Bulls have been snorting for months now.

When will the market come down to it's senses and sell off to levels more reasonable... maybe never? Everyone is now expecting the 1228 spx level to be hit, before any pullback. The monthly 50ma is around 123.00 SPY, and the weekly 200ma is around 122.50 SPY. Those levels match up with the 61.8% fib at 1228 spx, which is what everyone is expecting now.

The question is... if everyone is expecting it, will it still happen? Remember, the market likes to take your money, not pay out money too you. That level is obvious to every trader out there, and that makes me believe that we will either fall short of it, and trap a lot of bulls, or pierce through it to a higher level, and trap all the bears that get short when 1228 is hit.

So which will it be? I don't know, but these charts tell me that it should fall short of that target, as they clearly show the bulls losing steam. Unless they turn around quickly, they won't have enough momentum left to get there.

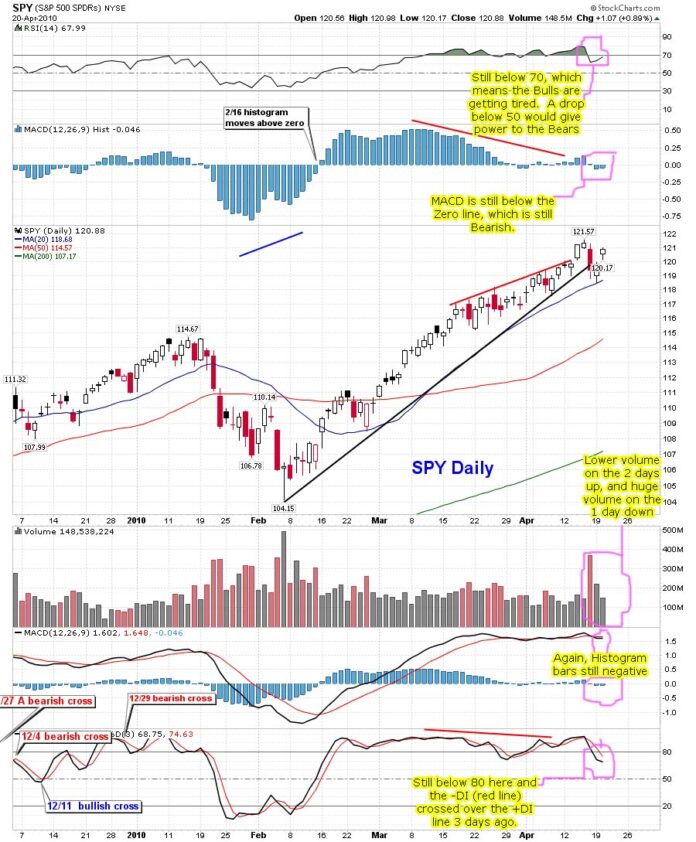

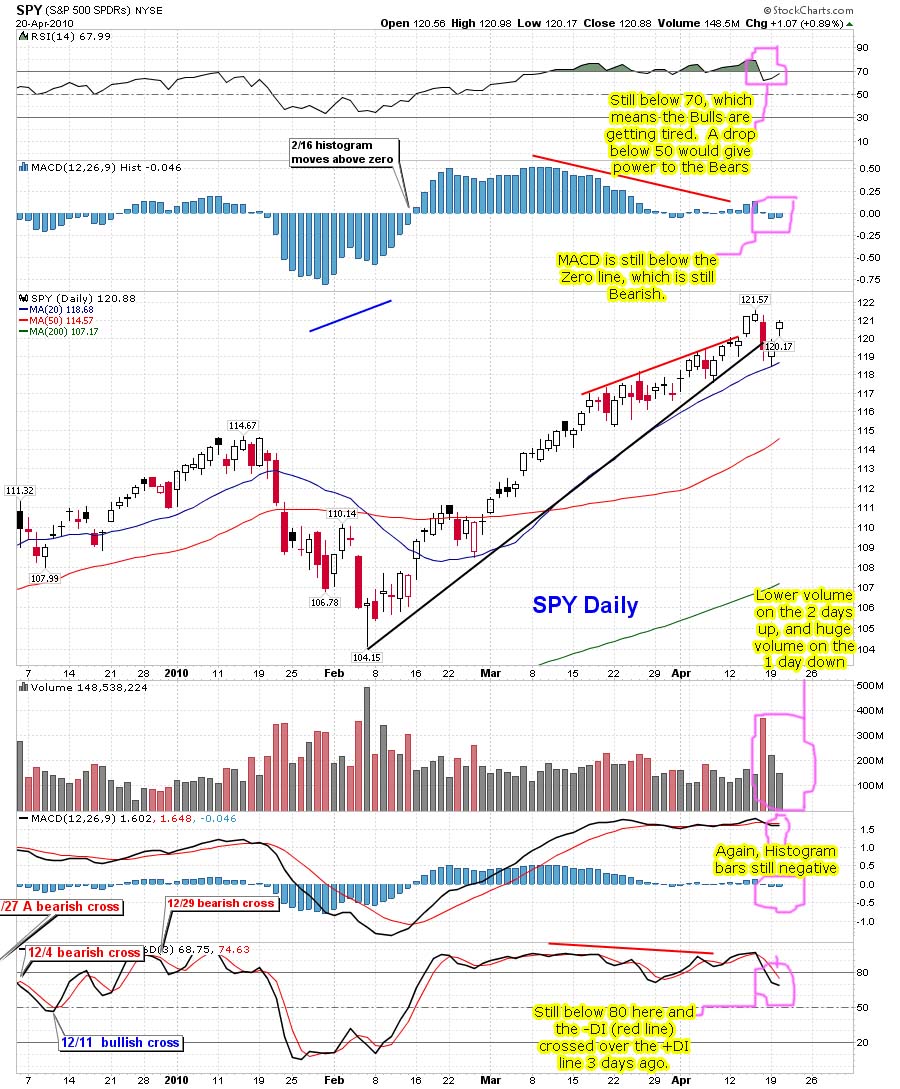

Look at the top of the chart, and you can see that these last 2 days of rallying up has still produced negative Histogram Bars on the MACD. Notice at the bottom area, the volume still low, and dropping. Also, the bottom chart shows the bearish crossover already happened 3 days ago, and now both DI lines are below 80.

I know it feels like a bear trap, but it looks more like a bull trap too me. Many people will go short at the double top too, which makes it even tougher to go on up above the 122.50-123.00 level. Remember, it's not likely that they will hit that level and then reverse. They have to either fall short, or go above to the next level.

Either trap the bulls by falling short, or trap the bears by going above it. Both bears and bulls will be looking to go short at 1228, and/or close out there longs. The market isn't that giving. She wants to take everyone's money, so tricks must be played. I think they just tricked the bears with the Goldman Sachs news on Friday, and today they are tricking the bulls with the Apple news afterhours.

Maybe it's just my bias toward being bearish, or maybe I'm actually reading the charts correctly this time? I really don't know, as I've been burnt too many times to believe anything I see in the charts. Maybe I'm just seeing what I want to see? Possibly?

Or maybe I should just throw the charts out the window and call up Jim Cramer and ask him to hook me up with one of his Goldman contacts, so I'll really know what is going to happen next. Since he is so crooked and well connected with them, maybe we can use that too our advantage?

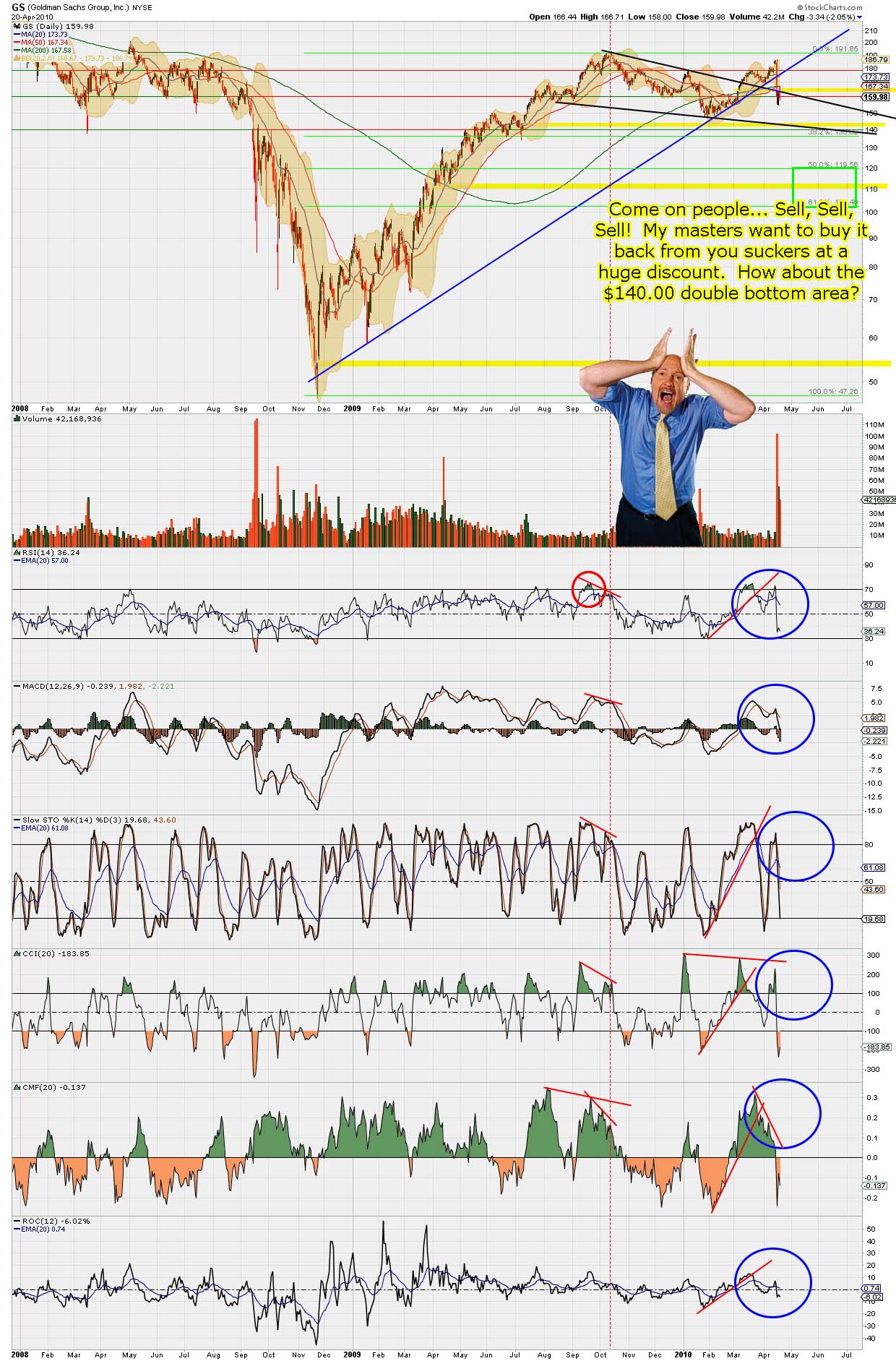

The last I heard, he was extremely bearish on Goldman, telling everyone to sell it. Why? I suspect that it's because Goldman sold all their shares (and some that don't exist too... you know "Phantom Shares"), and that they need to buy back those shares. So, if they push the market down hard, (or at least their stock), they can buy them back at a much cheaper price.

Now at some point, it will hit a level that Goldman will start buying them back at. Of course they will tell their puppet-man Cramer to continue telling everyone to sell it, so Goldman can continue loading up on every push down. Once they are fully loaded, and have bought back all the shares they want, they will pull Cramer's strings, and he will become Bullish again.

Pretty simple to read really. So, that leads me to believe that a sell off is still coming... and very soon.

Red

Much appreciated Red. The $NYMO actually bounced today and got away from the 30 RSI level which means there is still room to go on the downside. But, I know it is all probably wishful thinking on my part.

I still think the week will be down. I think some selling will come in by Thursday and/or Friday.

Hopefully today Red. I am surprised that futures aren't higher given AAPL earnings.

Red, love your site. you might be right on this time.

You know… when the wolf finally does show up, no one will believe me.

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1197 – 1209. I think that the 1180 low ended the correction and that a swing to 1270 is now underway.

1197–1205 actual yesterday (8 points)

1201.75-1209.50 range last night

1197-1209 estimate for today (12 points)

1204 currently, so estimate is -7 to +5 from here (somewhat bearish)

Sundancer, just realized you said that AAPL wouldn't get 10% above it's Pi Ritual level. Seems we are just reaching that now. Will be interesting to see what happens from here.

AAPL's 10% threshold above regulatory limit is in the 251 region

Regulators will not allow more than 7-10% movement above limit if the regulators have plans to run it to new highs after the downside de-leverage pt. is hit. The action today confirms that this is the terminal move for AAPL.

I'll have to look this weekend but many of the regulated issues during 2000 ended 27-36% above regulatory limit and then they proceeded to lose 90% of it's value. AAPL will be no different. AAPL regulatory limit is 229 so you have a max range of $290 – $311.

Thanks for the response.

We need Obama to speak again about regulating the banks. That will get the selling started. Let me give him a call on my Bat Phone…

Hi Sundancer,

How do you know AAPL's 'regulatory limit' or any company's for that matter?

On a side note, can you suggest a good book/website that talks about regulators and pi rituals and the 'harvesting concepts' you write about?

Thanks in advance!

Regulatory limit of individual issues varies because the capital allocated to regulating an issue is not all equal

I first took a interest in AAPL during 2006 after I had enough data on the Regulator. A calculator & a abundance of data on a individual issue on all time frames will get you started on the path to figuring out that moves aren't so coincidental in individual issues & broader mkts.

I first started in this rodeo in 1998 and was more “lucky” than good to start with. I've always been a numbers person, so it wasn't long before I spent the majority of time looking @ % moves on all time frames co-relational to it's counter % move.

There isn't any website or books that I know of that talk about the regulatory aspect of the market. I refer to it as a self-discovery process. If you have an open mind, it wont take long for your eyes to open.

All the rituals you hear me talk about stems from this game (stock market) being a numbers game.

BlackJack (21) = 777

You ever get Lucky 7's (777)

Ever dialed a 1-888 number

Did you donate to the Haiti relief fund; text 90999 (60666)

I just noticed a BK commercial last night where the they showed the time being 3:14 am.

Ever shopped @ a 7-11 (7+11=18=666)

Where are the futures traded? Chi-cago : Home of the Chi-cago Bulls & Chi-cago Bears.

The rituals in the stock market run deep.

Now we've got this big Greek ritual. (Zeus : G-Zeus)(Son : Sun)

If you haven't figured out my avatar yet, take 666/Pi and you'll get 212 (boiling pt.)

Pi : Sun Ritual

Ok, I called up Obama and told him the deal. He's going to speak this Thursday for me, as I requested him too.

http://www.moneycontrol.com/news/world-news/us-…

I told him to go to CNBC with John Harwood at 2 pm. Hope that is fine with u.

Just as long as you told him to punish the banks… that's fine with me then.

Bears last stand : Bulls want to finally bust out of the corral

http://www.flickr.com/photos/47091634@N04/45403…

Reminder of the current weekly $DJI setup:

this week $DJI is in the 98 percentile for a close below it's open of 11,018.36

Meaning that it is very important to close below 11,018.36 to remain bearish? or above?

this is a consecutive close sequence

98% chance $DJI closes below 11,018.36

2% chance $DJI closes above 11,018.36

Speculative capital would be those who are net long the $DJI

I think you know what happens to speculative capital

LOL…

Yes… I am very aware of what happens to “speculative capital”… (unfortunately)

In the equity indexes, trends across all time frame are up. But weakness and divergence are showing. Foreign stocks are weakening. Nasdaq sans the big giants, are turning down. Healthcare took a hit today. But Finance is still strong.

Money continues to flow into finance and general equity indexes, while pulling out of other speculative 3x.

I made some mistakes lately by letting my market expectation impair my judgement of the prevailing trend. My donation to the betting pool was my punishment. I am reformed now.

Based on the moves in oil today, I think we do move up to new highs before going back down.

food for thought

tradingperspective.blogspot.com

Interesting chart… It could indeed play out that way? I'm not sure whether we will go up first and make new highs, or sell off first, and later make new highs?

We should know by the end of the week though, as this week must close down to sell off first, or else we are going up to new highs first.

I guess it depends on what Obama says about regulating the banks more. Does he push off his threats to a later date, or fry them now while the fire is hot?

Carl just went long one unit at 1201.50

There is your speculative capital, Red. lol

SPY 119.95 area is where it's favorite TL is today

We need that to break, as I have 119.80 as support, then 119.20 next. Push Sundancer Push… Help us out here gang. Push the Bull over the cliff…

LOL

no need to push, the bull will collapse under it's own weight

the exit door is single file, and speculative capital is lined up 100 wide

in the mean time, the operators may tease some more speculative capital in

Die Market Die!

Carl just sold one unit at 1197.00

Thanks. We are at a crossroads here.

Carl sold at his projected low of the day. That only makes sense if he saw something that changed his view of just how low we might go today.

Doesn't mean we go lower though. Tricky market.

he did it because we pressed through crucial support at ES 1196.75 but now we've bounce back above it.

for the daytraders out there, this is a 3 min $SPX chart, where I have white circles is where the operator left a gap (de-leverage pt.) for the VST operator

current open gap 1205.74

http://www.flickr.com/photos/47091634@N04/45415…

$SPX 1205.74 gap filled, if you were watching the 3 min $SPX chart you got next hours move this hour

Folks I hope you see there is no secret to this game

Speculative capital got harvested, those that traded against the trend got paid

This sequence gets repeated on every time frame

Then can we go down now that the gap has been filled?! PLEASE!

maybe, but would it be more profitable if we sucked in some more speculative capital?

another tip for the daytraders: when there is a large move going into the 11:36 cst (11:36 = 11:9) 3 min candle & volume shows up, fading it usually pays well; it's the start of a sun ritual

for those that want to follow ritual timing sequences intra-day remember futures are traded in Chi-cago which is CST

http://www.biblegateway.com/passage/?search=Dan…

you're a smart one, I like those who critically think

Now have you figured out why I have 390 in my handle? 390 is how many minutes there are in a trading day

390 = 3*9=27=999=666

There's the daily sun ritual

11:45 cst (11:9) is the half way point of the trading day, 15(555) minutes before HigH noon.

for those with eagle eyes will notice the current co-relational high on the $NDX/QQQQ

$NDX 2040.49 : 2040.83

QQQQ 50.19 : 50.19

Fake print in GS again today at 157? Looks like LOD to me was 157.50

remember the 158 print yesterday I alerted people too, the VST operator harvested the crops today

Sure do.

Gap filled on the SPX

These up and down moves all day are a clear sign too me, that they are sweeping the floor of bulls and bears, just before they lay down the new tile.

What color will it be… Red or Green?

the TA enthusiasts say this is a “pennant” & have some target in the stratosphere once this pattern completes

I see a H&S on the 60 minute chart…

http://stockcharts.com/def/servlet/Favorites.CS…

bears need a gap below it's favorite TL & then the harvest may begin

given the 4:15 close, it's less than 4.5 pts

Carl at day’s end:

1197-1209 estimate for today (12 points)

1195–1207.50 actual today (8 points)

Reality was just 1.5 to 2 points below Carl’s range.

Trades:

In /ES at 1201.50, out at 1197.00 (loss of 4.5 points)

Grade: D (lost some money)

We are now in a New Moon Trade, which tends to favor TZA

AmericanBulls had TZA with a Wait signal for today, with this trade in cash. Under AmericanBull’s Wait rules, nothing could have triggered a BUY, so this trade remains in cash tonight.

Volume for TZA today was in the high side of normal. Neutral for TZA.

$RVX (VIX for $RUT) closed down 1.35% with TZA down 2.2%. No divergence.

TZA was down for 6 days, up for 2 days, and down 2 days. Bad for TZA.

The low for TZA 4 days ago was $5.80, the lowest TZA price ever. Today hit a new low at $5.75. Bad for TZA.

Ultimate Oscillator for TZA fell for 9 days to 23, then rose for 2 days to 29, then fell 2 days to 25. Todays close is 6 cents lower and has an Ultimate Oscillator 2 points higher than 4 days ago, which forms a divergence. Good for TZA at some point, perhaps not tomorrow.

MACD on the monthly chart has been flat far below zero for days, and remains that way today. Bad for TZA.

Bollinger Bands for $RVX (VIX for $RUT): Today’s small black candle closed near yesterday’s close, a bit above the bottom Bollinger band. MACD seems to be flat. Looks like $RVX might fall tomorrow. Bad for TZA.

Bollinger Bands for $RUT: Today’s white candle for $RUT is a new high, headed towards the rising upper Bollinger Band. MACD seems to be rising. Bad for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): yesterday’s white candle rose to close below the upper Bollinger band, and today’s tiny candle is right there as well. The upper Bollinger Band rose today. Three days after what appeared to be a successful 3-day sell signal, not at all sure the sell signal worked. Bad for TZA.

TZA had a lower high, lower low and lower close – Bad for TZA.

Money flow for the Total Stock Market:

$1,037 million flowing out of the market 2 days ago

$ 364 million flowing in yesterday.

$1,144 million flowing in day.

Bullish – Bad for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks bad for TZA. However, futures are lower after hours.

QCOM is getting pancaked after-hours.

Thanks — that might explain it. QCOM used to be a big deal, maybe it still is.

TZA is up 10 cents (1.7%) since the close.

Very nice blog. I will start following it. See mine.

http://midasfinancialmarkets.blogspot.com/2010/…

That was a nice chart of the Nasdaq you put up. We are clearly at some tough overhead resistance on it.

The Daily view from Americanbulls

TNA had a Hold signal today, and was up today, remaining a Hold for tomorrow. The TNA buy was at $56.50. TNA closed at $66.51, up 17.7% since the buy. The candlestick today was a White Candlestick (normal buying pressure).

TZA had a Wait (for a signal) today, and was down today, remaining a Wait for tomorrow. The TZA sell price was $6.51. TZA closed today at $5.78, down 11.2% since the sell. The candlestick for today was a Black Candlestick (normal selling pressure).

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, sell at $6.51

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 17.7%

Summary of Positive $RUT based ETFs & a few popular ETFs & stocks (Market positive): +11

Hold: IYR(1x RE, up 2.3%), URE(2x RE, up 4.1%), DRN(3x RE, up 11.1%), QQQQ(up 3.45%), DIA(up 1.9%), UCO (2x oil, down 2.1%), AMZN(up 1.3%), ERX(3x energy, up 9.2%), IWM(1x, up 6.0%), UWM(2x, up 12.6%), TNA(3x, up 17.7%)

Transition to Market Positive: +1

Highly Reliable BUY-IF: AAPL

Transition to Market Negative: -2

Highly Reliable SELL-IF: SPY, GOOG

Market Negative: -2

Wait: USO(oil), GS

Comment: Bullish overall, Bearish Oil, Bullish $RUT, Bullish Real Estate

Action for TNA or TZA for tomorrow: none

Looks like we could gap below the trendline this morning but of course things could change.

Looks like we could gap below the trendline this morning but of course things could change.