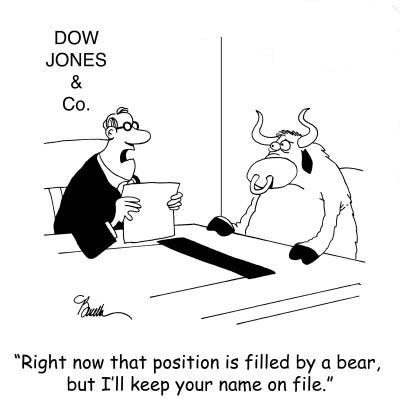

Does the Bull get his old job back?

The market closed the month of May out, as the worst it's seen in 70 years. Does that mean June is going to be just as bad? I doubt it, as I do expect a rebound to happen this month. From what level is the question? Is the current 1040 spx low the starting point, or do we still need another low first... before starting a serious rally?

In these video's, I'm going to explore both bullish and bearish counts, as both are possible at this point. From a technical point of view, the market is looking very bullish right now. The daily chart is starting to turn back up, the vix is overheated, and the dollar is looking like it needs to pullback some and give the euro a nice bounce.

But, we all know that looking only at the technical picture will get you burnt sometimes. You must also include other things, like the news for one. Markets can stay overbought or oversold for longer then you might expect them too. I'm going to cover the news factor too, as I think that will be a big mover of the market next week.

One thing to keep your eye on is the announcement that France is now warning on their credit rating. That, plus the ongoing oil disaster, in which the latest attempt to fix the problem failed over the weekend. There are still many things that can spook the market, causing another sell off to happen.

So yes, the technicals are pointing for a relief rally, but since everyone and their brother is now expecting the same thing... what's the likelihood that it's going to happen like that? Most chartists now have us going back up to either 1120 or 1140 on the spx, and then another wave down.

That's the part that makes me wonder if it's going to happen like that? The market usually doesn't allow the bulls and bears to profit, by entering and exiting their long and short positions at per-forecasted targets. It fact, it usually likes to trick them both, by trapping one in their position, and not allowing the other one a spot to get a position.

Regardless of whether you are bullish or bearish, both are usually taken to the cleaners in this wild casino game they call the stock market. I know that most bears were squeezed out on last weeks' 300 point up day. The bulls didn't see that coming either, and probably missed the ride up too. But, I think bulls are on board now, as they all see the Inverse Head and Shoulders pattern that should produce a nice 50 point up move, to about 1140 spx, should it play out?

The bears see the pattern too, and are probably sitting on the sidelines in cash... too afraid to short from the 1090 area that we are currently at. They are waiting to go short at 1140, at the same point the bulls will close out their longs. Seems a little too easy for me to believe that the market is going allow the bulls and bears to profit by a move up to 1140, or even 1120 spx, as others have as an upside target.

If I were the market maker, I'd gap it down on Tuesday, trap all the bulls, and keep going lower until I put in another lower low... not allowing the bears a good spot to get short on, or the bulls a bounce to get out on. But, I'm not the market maker, so I don't know what will happen on Tuesday?

I will say this... if the market really does want to go up to the 1120 or 1140 area first, it needs to gap up on Tuesday to get above the current resistance levels that are currently holding it back. It could very well do that, unless some worst then expect news comes out before Tuesday.

Most of the week doesn't have any really important data or earnings, until Friday's jobs data. That should be a market mover, but which way... up or down? If I am to think like most retail traders right now, I'd suspect that most people will think that the data will be bad and cause more selling.

But, we all know by now that the government always lies on the data anyway. So, a better then expected number could rally the market instead of causing it to sell off. I suspect that the market will be going down into the Friday data, and will turn back up and rally on the news... which would trap a lot of bears, should the market be dumping hard into that date.

This is all just guessing of course, but again... just think what is it that most people are expecting next week? Most are looking for a positive, bullish week. A gap down on Tuesday, and continued selling into the end of the week, would put a bearish taste in everyone's month. The bulls would become bears, and they would all be expecting an even bigger sell off on the jobs data.

Of course the opposite is also true, if we rally into Friday. At that point, I'd expect bad numbers and the market to sell off, after reaching the forecasted 1140 or 1120 area that everyone is now expecting. But again... how often does the market do what everyone expects? Just food for thought... for all you bullish folks out there.

Red

P.S. Here's a interesting audio from Larry Pesavento. Just click on his name to go to the website, or listen to just the audio right below.

Good thoughts. Indeed the market bias is for an up week to 1125 – 1135. However, my thoughts are like yours-namely the market is there to surprise; especially after reading this:

http://www.mmacycles.com/weekly-preview/mma-com…

I read that weekly preview too Phoevos…

It's likely to surprise everyone, as the market is prone to do that. Everywhere I looked, it seemed that everyone was expecting 1120 on the falling channel scenario, or 1140 on the inverse head and shoulders. I guess we'll see on Tuesday which one plays out….

US DOLLAR Index will face resistance

http://niftychartsandpatterns.blogspot.com/2010…

Thank you

San,

You sure do cover every chart. Keep up the good work, and try to join in on the conversation sometime, if you have the time.

Thanks

Since i am trying to post forex us and indian markets i am not able to give prompt reply to anyone.

Redster! nice lonnnnnnnnnnnnnnnnnnnnnnnnnng post LOL

same page and looks like a gap up tomorrow the EUR needs to work off a bit of oversold condtions

http://hotoptionbabe.com/blog/11-another-week-w…

Don't let it run up too far. Let's put a leash on the bull… OK?

I think if it can rally past 1100 then 1120 is in view, but won't be a very long rally

🙂

I'll take a nap when it's at 1120, and you call me when we hit 988… OK?

heheh come on over we are chatting in the hotoptionbabe.com chat room (everyone has withdrawals)

Hey Red, what up my friend? I know, we've only exchanged a few thoughts, and I'm already calling you my friend. LOL. I've been out of pocket for the last few weeks, as I've been in Vegas on business (no gambling for me, I do enough of it in the markets!). I haven't had time to follow the markets closely, but still profited from the slide, which was great. I'm still short, and hope to close my position soon. though futures are looking positive right now. oh well.

actually, the reason i'm writing this note is because a week or two ago, I remember reading (quickly) where you apologized to those who were upset at you for calling market crash. I know you felt bad about how a few actually put lock, stock and barrell on your words. well, first off, I think you do an exceptional job giving market summaries. EXCELLENT! with this being said, no one is perfect, and no one can call the market tops or bottoms to a 't.' and if they do, they're lucky. As for those who banked money on your words, well, as soon as they saw it wasn't working out in their favor they should have bailed, not blame you for their error. I know you felt bad, but you are here to simply give market commentary and analysis; and offer your opinion on which way the market will go based on your TA and other experience.

However, at the end of the day, we as traders and investors have to live and die by our decisions. We can't blame others for our losses. If we do, then I suggest those in the blame game should find something else to do besides investing, because they will get chewed up and spit out every damn time. Red, continue your great work my friend. And let the markets tank on Tues. 🙂 Take care sir.

Hey Red, what up my friend? I know, we've only exchanged a few thoughts, and I'm already calling you my friend. LOL. I've been out of pocket for the last few weeks, as I've been in Vegas on business (no gambling for me, I do enough of it in the markets!). I haven't had time to follow the markets closely, but still profited from the slide, which was great. I'm still short, and hope to close my position soon. though futures are looking positive right now. oh well.

actually, the reason i'm writing this note is because a week or two ago, I remember reading (quickly) where you apologized to those who were upset at you for calling market crash. I know you felt bad about how a few actually put lock, stock and barrell on your words. well, first off, I think you do an exceptional job giving market summaries. EXCELLENT! with this being said, no one is perfect, and no one can call the market tops or bottoms to a 't.' and if they do, they're lucky. As for those who banked money on your words, well, as soon as they saw it wasn't working out in their favor they should have bailed, not blame you for their error. I know you felt bad, but you are here to simply give market commentary and analysis; and offer your opinion on which way the market will go based on your TA and other experience.

However, at the end of the day, we as traders and investors have to live and die by our decisions. We can't blame others for our losses. If we do, then I suggest those in the blame game should find something else to do besides investing, because they will get chewed up and spit out every damn time. Red, continue your great work my friend. And let the markets tank on Tues. 🙂 Take care sir.

Hey Bob,

Glad you had fun in Vegas. I've been there 4 times myself, but never to gamble (I do enough of that in the stock market… LOL). I appreciate the complement too.

And yes… you are right, is it up to everyone else to make the decision to do their own trading. I can only present possible outcomes, and show which one I favor the most. Of course it doesn't always go in the direction I want it too… but that's life.

Tuesday is looking like it will try and gap up, to get over the current resistance that's holding it back. Maybe it will go up to 1120 or 1140, and then tank? To me, that seems to easy too forecast.

But, sometimes the market actually does exactly what you think it's going to do… go figure! LOL

oops, sorry for the double post

Hi Bob i fixed it for you 😉

wow…what a revelation…So the market will go either up or down..hmm

That's really really REALLY unusual 🙂 Oh..how about some sideway action ? Ok here it is, I bet the market will go up or down or sideways this week 🙂

What do you want… a crystal ball? Wish I had one…

Euro vs Usdollar moving in a channel with upside possibilities

http://niftychartsandpatterns.blogspot.com/2010…

Thank you

http://content.screencast.com/users/Annamall2/f…

Anna be nimble, Anna be quick; you are something else. 🙂

CPCI (index options put-call ratio) is rather high, which is bearish though we may have to sit through a Tuesday rally.

CPC (total put-call ratio) is crazy high, as not seen since July 2007 and February 2008.

Based on these, I think the low we are looking for is imminent though any Tuesday rally might be quite uncomfy. Good news is that German, French, and Asian markets rallied hearty today but are not looking so hot toward the close. Nikkei closing is a mystery; Yahoo is not showing it.

If the foreign markets fail backtesting Tuesday, then we can hope for a down day, possibly even a gap down at open.

If we do have a lower low soon, as in sub-1000, better liquidate immediately and buy anything long while we're down there, for a day trade. Though I expect a big rally to follow, possibly challenging 1220, it may take a couple of weeks to get it off the ground (following the patterns of '07 & '08). We may languish in the 1075-1100 area for awhile, so it may not be a good idea to buy call options right away. Around OEX might be better.

I'm with you Rip…

Not sure I want to go long yet, because of the vix working against you. Maybe a call spread?h

The VIX is still a long way away from hitting that false print of 24.

Yes Newbear,

The VIX is a long way from hitting that false print of 24, but we also have the false print of 1061 that hasn't been hit either? What if neither are accurate?

http://www.screencast.com/users/alphahorn/folde…

Maybe Anna can shed some light with her secret method.

LOL… There isn't any secret method to it. Some prints play out to the price level forecasted, and other prints only tell the direction the market is going.

Then there are also those prints that are simply late fills and mean absolutely nothing. Picking the real ones out is tougher then it looks.

So if Anna has a secret way to know which one's are the real one's, then she has a friend named Lloyd too. Maybe that's why she won't tell us how she's figuring it out? Hmmmm…

Never underestimate the power of a woman. She's a smart cookie, that's one thing I know for sure…

Smarts and her intuition are a deadly combo.

Stochastics indicate that VIX is due for an intermediate correction, but it can set another new high even if STO is disintegrating. That's what I'm thinking will happen the next 2-3 days.

Anything bought at sub-1000 ought to be a winner, but I expect a twilight period after the plunge and immediate recovery, while the market is trying to make up its mind which way to go. Calls bought at the beginning of that period will be likely to lose value and/or expire, IMO.

This scenario is based on my reading of CPC and how the market reacted in '07 and '08, could be totally wrong.

Israeli commandos attacked a Palestinian humanitarian aid mission today, which bodes ill for Tuesday. Not to imply that world political events have anything to do with the stock market, or vice versa, of course.

Here's an interesting article predicting the rise of the dollar until the end of June, and then a collapse on it. That would mean a big drop in the market too.

Could be that June will put in a bottom in the market, instead of a top, like I previously stated in my GD2 video?

http://seeker401.wordpress.com/2010/05/31/cnbc-…

It might go higher next week but I don't see conviction on the European front:

http://www.nytimes.com/2010/06/01/business/glob…

I guess the art here would be to second guess the market. Say, it opens circa SPX 1095 on Monday. Thinking that such might be a fake, do we have the guts to short at such point? (say buy VXX at $27.75 or whereabouts?)

What if wrong?

Leo made a good point in his commentary that this is hard to judge whether a bull or a bear. And a sideways action must be the worst…maybe coiling for some big action.

I don't know guys and for some reason a sense of fear is prevailing..or is it just me?

I am really uneasy. What if they come up with a European package to combine all sovereign debt from member countries and then reissue EU bonds at a combined rate lower than constituent states (except for Germany of course whose low rates are exceptional):

http://www.spiegel.de/international/europe/0,15…

Last resort will be to nuke the oil well..Obama sends nuclear experts to tackle BP’s Gulf of Mexico oil leak..40,000-100,000 barrels a day not 5000!!

http://seeker401.wordpress.com/2010/05/27/last-…

Earthquake watch is still in effect…

http://www.youtube.com/user/astrotometry#p/a/u/…

Re: earthquakes

http://www.google.com/search?q=earthquakes&rls=…

Also, Red Dragon Leo what do you make of this? (just found it – not sure of how to interpret it):

http://spiraldates.com/

Interesting…

I find that turn dates are very useful when combined with technical analysis too. Looks like they got the April high date pretty accurately.

I am still not clear of how to use. The author's commentary refers to a turning point during last(this) weekend and then the graph shows the first peak in June 6th (another turning point). So, the markets go down until the 6th? or rally until then?

BTW the futures turned a bit negative. So, say, market goes down tomorrow. When is the best time to short? opening or later? usually the first hour is dangerous but if it gaps down it might stay down for the day….

http://money.cnn.com/data/premarket/

As I said in my video, I'm very bearish right now. I said that the market could gap up on Tuesday and run up to 1120 or 1140? At this point it's looking more like it's going to open down.

That means that we will likely sell until this Friday, and turn back up for a bounce on Friday and into next week. That's the turn date that website is talking about.

You still have to do TA's to see what direction you are going in when you are coming up to a turn date. If we rally into the turn date, then we would likely sell off at it.

But again, it's looking to me like we are going down until the turn date, then up. I seen one around June 3rd and the June 6th. That would be down into the 3rd, turn back up into the 6th, and then fall back down or trade sideways until the next turn date.

They are helpful, but I still lean toward TA's first… and if a turn date lines up with it, then it's just that much more likely to happen.

Another tool in the arsenal to better our odds.

Red, I don't think we will have to worry about a move to 1120 or 1140 yet. Interesting link to earthquake prediction. Lot's of bad news “allowed' out this weekend. Oil spill, Israel “terrorist attack”. German president resigning, France credit issues. Seems like the end of the world is coming. . . . .

Yeah, I kind of thought that Friday might be the last up move before move selling. But, I tried to cover all possibilities in my video's. Looks like my gut wins out this time.

EURO VS USD MIGHT GET A BOUNCE FROM 1215000 AREA

http://niftychartsandpatterns.blogspot.com/2010…

Very encouraging morning on FTSE; last Thursday and Friday they were above their 'teal line' (12dma is what I use for very short term containment) and pressing 20dma, today are back below.

“I've fallen and I can't get up”?

Futures are surprising.

You may see your gap down.

But my bet is the bulls pull it out today.

Carl’s morning call:

June S&P E-mini Futures: Today's range estimate is 1065-1085. I think the low at 1036.75 ended the drop from 1216. I had thought that the “base building” process was over, but instead we have seen another break of more than thirty points. I believe the drop from Friday's early high at 1107 will end above the low at 1055.50 made late on May 26. Once the market stabilizes a move to 1300 will start.

1069 – 1096 range last 2 nights (27 points)

For the past 8 days, the over night range has averaged 24 points.

1065-1085 estimate for today (20 points)

1074 currently, so estimate is -9 to +11 from here (neutral)

“Looks like I picked the wrong week to quit sniffing glue” — Airplane the movie

Pez,

Are you long? I hope not, as I'm not expecting any large bounce to get out on.

Staying long term bearish until ~SPX 920 and short term trying to play potential bounces. However, I just got stopped out of some of the bounce play 🙁

This morning on CNBC a commentary talked about moving averages and how anyone that pays attention to them is bound to lose,

It was surprising as i believe the 50 is the only true trend for mid to long term

Reading Dr. Elder – when the 13ema is sloped downward play the short side. Dr. Elder combines the trend (13ema) with the MACD (momentum). Although, I probably just violated his rule w/ trying to play any bounce

I wonder if he'll be saying the same thing when the moving averages put in a death cross, and the market tanks? LOL What a smuck!

BREAKOUT STOCK XINYUAN REAL ESTATE CO

http://niftychartsandpatterns.blogspot.com/2010…

Are we going to fill the gap? Macd fell much harder than I expected along w/ RSi but prices are not showing a follow???

They certainly have been trying awful hard to fill the gap. They have been tanking the dollar to do it.

I take back what I said about god. There is a god and I'm being punished for being a money-changer

We are at a double top on the ES at around 1087, from 2am, and we have gap filled the SPY… now it's time to turn back down.

That last stick on spy 5 minute is pretty strong fill.

Nice job on the videos. i tend to think we are moving down based on long term charts.

Chart trader sees a stage 1 developing and still believes a run to 1150. hard to say. i am still short but holding off on adds.

AAPL Is on fire.

No question about it Jim… if they want to take it up to 1120, or 1140, they can. However, I think this mornings' gap down is a sign that today will be the high for the week.

Volatility is turning. This sis gaining strength. Go figure.

I think we all knew that this tape would turn back down soon. Lots of whipsaw action going on right now, but I still see another lower low coming… and probably by the end of the week.

Jim, did you say you are a vet? Can you email me, DCSmartCoin at G mail ? Thanks

I tried via DCSmartCoin@gmail.com.

Is that correct?

yes but can you remove that? Don't want net crawlers to snatch that and spam my email. My yahoo email gets 250 mails in the spam folders and another 300 in the inbox every few days. Don't want to repeat that with this one. lol

I fixed it for you SC… and I agree, always spell it out so spam bot can't pick it up when they crawl the net. I don't mind real people knowing my email, and sending me stuff, but I too get hundreds of spam emails regularly.

thanks red.

I read that you said today HOD is the top for the week.. I really wish you don't look at it that way. That tends to cause your mind to freeze into a particular frame and has a tendency to cause you to ignore new signals. The HOD may be the HOWeek, or it may not. Best to have no forecast/prediction, and just follow the teal lines on the hourly and follow the market, whereever it leads to. Stress free and bias free… 🙂 Hope that helps. I learned that the hardway. It is true when they say we are our worst enemies. I know I am my worst enemy. lol

Well SC,

There is nothing to say we couldn't go higher tomorrow, but I'm just looking at past history. We seem to have the high early in the week, and sell off into the end of the week.

But, I will admit that the daily chart is now turning back up, and could continue pushing the market up again tomorrow? However, I will remain short (I must like pain or something?)

Ok. gotcha.

Pain is good. But moolah is better. LOL

Sorry iam not used to this stuff,

No prob, jim.

Carl has just revised his projected high of the day from 1085 to 1097.

To quote him: “This is very bullish action.”

We will be going back and forth…. up and down….. for the next few weeks.

Buy pullbacks. Then off to a new high.

The following week………HUGH plunge.

The next following week…..a 50% recovery bounce.

If the SPX gets the death cross of the moving averages… there won't be a new high. They'll be bounces along the way, but the new trend will be down. Just keep that in mind.

The market is struggling at the teal line. Odds favour a breakout to the upside, and subsequently a retest of the April highs. But if it fails at the teal line, then it is going down. The market will do what it wants to do, all the models and predictions not withstanding. I hope the market would follow the models and make life easier for us. But I have learned my lesson. There is only one rule in this game: The market will do what it wants to do, and your best bet to survival is to follow its lead.

In short, my forecast models say we are going up, short term, and die when the snow comes. My trend models say the market is still deciding.

Sorry if this doesn't help anyone. I suck.

where is the teal line now? emini s&p

109.75

1093.5

TZA looks like it is breaking out, just set a new HOD including pre-market.

Whoa.

Its interesting that r2k is leading the down move in a substantial manner. Is this the beginning of a flight from the little guys?

Mmm, very possible. That would demonstrate that the fabled breadth is coming apart.

My short ETFs are taking off prior to any breakout in SPX. I am tempted to cover, lol.

VIX is up today, despite the markets' attempt to rally. What does that tell you?

They are only marginally up compared to a real trend change and can swing from these levels quickly. i do not get excited until they are above 12%.on way other the other.

OIH is getting pummeled. BHI go long, use a 36.2 stop.

Lunch is over here we go again

Money flow indicators today will be very interesting. Who will be selling into this ??

Very indecisive right now. The market can't seem to make up it's mind which way it want's to go? The different time frames are fighting each other as well. Regardless, I still see another move down coming by the end of the week.

Mr TopStep…

http://www.youtube.com/watch?v=fAkDDZmHkLg

Nice snapshot

i THINK WE GET TO 1093.

Dow jones hourly chart in a diamond

http://niftychartsandpatterns.blogspot.com/2010…

good chart, thanks

one observation, I just checked the other country's index, looks like that germany's DAX, Britain's FTSE and HK's HSI, they all tested their respective 20 day EMA yesterday.

SPX has not done that yet so far

Thanks for your comments. I saw the 20 EMA in daily chart. It will take a nice reversal pattern for SPX to cross the 20 day EMA

Hi Red.

You have a neat assessment for June

The month is setting up as a typical tricky corrective pattern

see my blog for the Monthly graph

Primarily it shows;

3rd low

7th low

16-17 HIGH

25th & 30 LOWS

this should set the stage for a decent rebound in JULY till late in the month near the Full Moon

1040 COULD give way on WED AM, but rebound off like on a trampoline

7th might just close on that value.

Any rebound should be limited to 1100

EOM could be the MOST telling for DOW theory enthusiasts

Bes Wsihes

Jay

Thanks Jay,

I'm still looking for one more lower low, going into this Friday, and then a rise up all of next week. And finally another sell off into the end of the month, and around the June 25th date.

After that, I do see a rally up in July and August too. But late September looks to me to be the last major top, before a huge sell off the following months.

So it seems we are pretty close to thinking along the same lines. That's nice to know, as I've seen that you guys have been on top it lately. Glad to be on the same side.

Thanks for stopping by…

Red

Hi all – hope you are all doing well. I am still short but have vowed not to look this thing so closely – sort of a memorial day resolution!

Hey Monica,

We are all just watching the market sweep up and down, until she decides which way she wants too go?

this day seems impossible to call. A sell off now may not be very good for the week.

I was thinking of a few long positions but now i am backing off. but not adding shorts either. Which i may regret

It really odd Jim, as the charts look bullish, but the mood feels bearish. Which do you pick? The charts, or the mood?

Agreed. i guess when volume at price spreads are this tight its just nothing. A flat day that is weak on any indication.

Finally… we broke that triple bottom! Can we get below 1077, as Mr. TopStep say's is the key support… which if broken will cause another round of selling to put in a lower low.

He called it but can the last 1/2 hour fend of the dip buyers??

Does not look like it.

Anoopsan did not post much today. Hope everything is ok

I think his has a day job too, which prevents him from hanging out all day like us.

Should bounce at the double bottom on the spy at 108.20 though… then fail, hopefully. And, the over night low was at 1069 on the ES. Could be a target in the afterhours or tomorrow?

r2k is leading the drop. TZA busting out

I just do not think there is enough happening here to give a good window.

its pure crap shoot.

Just remember what the TopStep guys said (which I agree with)… if we get below 1077, we will but in another lower low.

Well we are breaking hard below that. Question is what is the next low cause I am light on my shorts.

I don't know Jim? They may not let any bulls out, or bears in tomorrow?

Notice the RVIX is playing near the 12% area. Vix is lagging so this may not carry tomorrow.

These time frames are just blowing me away. The market continues to be the last 15 minutes of the day. i need to take a lesson from Monica and stay away.

unfortunately the weather sucks so i can't play.

I'm in cash now gang. I took advantage of that nice sell off into the close. I will reload short on a bounce tomorrow.

Congrats Red!

Thanks girl… you're doing the right thing. Stay put until we hit a new low.

Thanks Red. One thing I have learned is that there is no one right way to do it!

Another fun day! Still holding my shorts.

We Monica,

Don't worry, I still think we will put in another lower low this week. I'm just swing trading a little. I'll be back short again tomorrow, on any bounce up. I seen a false print to 108.60 going into the close. Could be the target back up tomorrow?

I wouldn't be surprised Red. For some reason I think tomorrow will be up but I stayed with my position because I don't have time to trade.

Carl at day’s end:

1065-1085 estimate for today (20 points)

1068.50–1094.50 actual range today (26 points )

Market was 3-9 points above Carl’s range.

For the past 10 days, average actual range is 26.7 points

Trades: No Trades today

Grade: C (lost no money)

In the past 10 trading days, Carl has taken just two trades, a loss of 12 points total.

Look at this giant hole gang… it reminds me of the national debt.

http://news.taume.com/World-Business/World/brea…

reminds me of my pocketbook!

Looks scary…

FYI

Nenner update this weekend I forgot to post earlier.

S&P/Nasdaq

As mentioned before, cycles only project a low later in Jun

A close for the S&P below 1074, Nasdaq below 1830, and Dow Jones below 10100 will probably lead to a test of the lows

When our downside price target on the S&P was reached, we bought a few stocks

We have very strict sell stops in order to break even

The stops are closing price only

However, investors who do not want to risk any loss should keep them intraday

The stops are:

Cat 60

Apple 248

Intel 21.20

GS 142.50 (we are long call spreads so we are not in a hurry to close those)

The sell stop for GS is for those who are long the stock only

FYI

Nenner update this weekend I forgot to post earlier.

S&P/Nasdaq

As mentioned before, cycles only project a low later in Jun

A close for the S&P below 1074, Nasdaq below 1830, and Dow Jones below 10100 will probably lead to a test of the lows

When our downside price target on the S&P was reached, we bought a few stocks

We have very strict sell stops in order to break even

The stops are closing price only

However, investors who do not want to risk any loss should keep them intraday

The stops are:

Cat 60

Apple 248

Intel 21.20

GS 142.50 (we are long call spreads so we are not in a hurry to close those)

The sell stop for GS is for those who are long the stock only

BTW his Nasdaq is the NDX

the 5minute, 15, are in sink. the 60 19 day and 20 are still above 50. Close of 107.54 is out of bb on 60, 15 etc.

This could be a bloody week.