That ended up with a bearish reversal candle...

Looks like Monday decided to gap up instead of gap down... but in the end, the day still closed down. Days like these are tough on the bears, as there wasn't any news or volume supporting the move up. Just the typical Bullish Monday history pattern, and maybe just because they wanted to suck in more bulls, and squeeze out more bears.

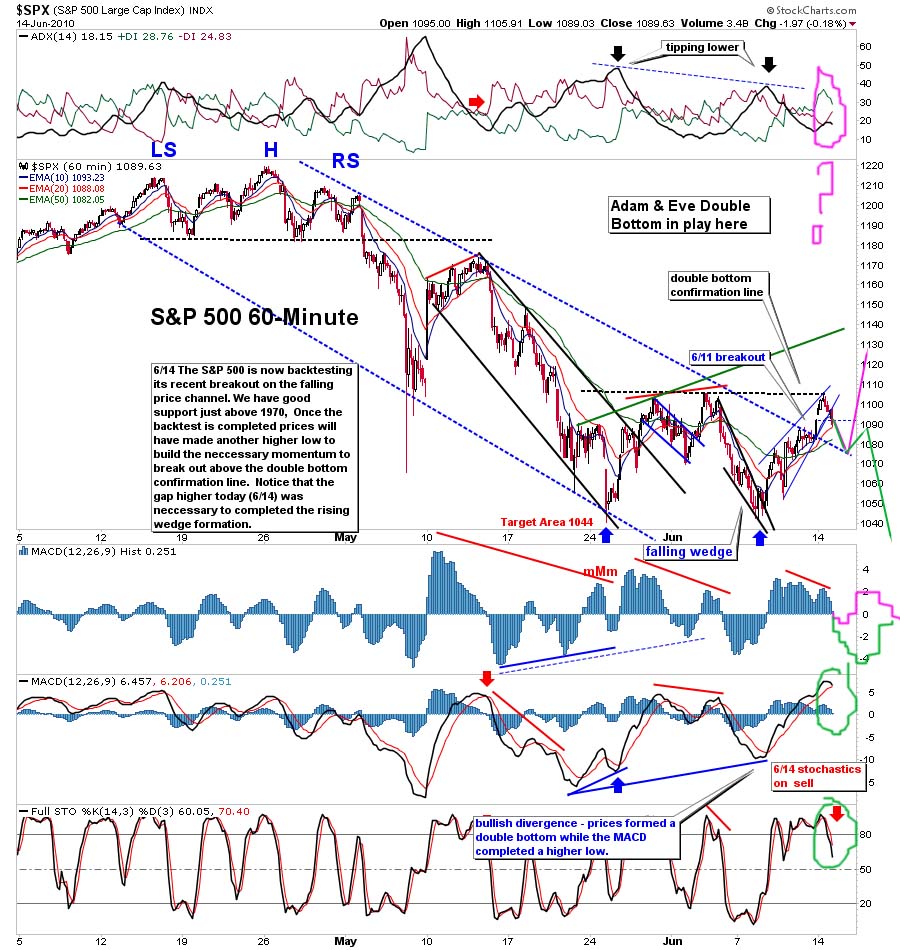

So now what? Well, I certainly don't see tomorrow as an UP day, as I think it's obvious to everyone that the 60 minute chart is massively overbought, and started to roll over into the close today. So, it's not a matter of "if" tomorrow will be a down day, but more about "how much"?

The first support going down will be around 1080, where the upper trendline will be back-tested (from the falling channel that the market just broke out of). From there, we can expect a bounce to occur... but how much?

Will that just be a smaller wave 4 down, with another wave 5 up still to go... pushing on up to 1120-1140? Or will the triple top put in today finish the wave up from the 1042 low, (most label it a wave 4), with a big wave 5 down still to come?

I wish I knew? But I don't. It's really up to the daily chart now. If the daily turns back down tomorrow, then we could see a big wave 5 down... probably to that fake print of 100.72 spy. However, if the daily doesn't roll over tomorrow, then it's likely only a backtest at the 1080 trendline, and will likely go back up for a final smaller wave 5... completing between 1120-1140 spx.

Here's the thing to keep in your mind. Today was up on very light volume, with only about 80 million at 2pm on the SPY. The last 2 hours of the day moved the volume up to 207 million. That means the market still has a lot more sellers then buyers right now.

The market has hit the 1100-1105 area now 5 times since May 28th. Two choices are now in front of the market. It either has now weaken the resistance door enough that the next time it hits it, it will blasted through it to a much higher level (1120-1150?)... or, it's gave up for now as the door is too tough to breakdown at this current time.

Meaning, it will fall back down to a lower low to get more fuel (bears to squeeze) to go back up and test the door again at a later time period. The lack of news out this week leaves me guessing at to which scenario is accurate?

This truly is a "do or die" time for both the bulls and the bears. The line in the sand will be the 1080 backtest tomorrow. Of course I do expect a bounce off the trendline, but that bounce has too go back up and take out the 1100-1105 level, if the bulls want new highs.

For the bears, they want the bounce at the 1080 level to only go slightly back up to sideways, forming a bear flag, which will force the market to fall back into the falling channel again. If the bears can get the market back in the channel, then a wave 5 down will most likely be the path for the market. A new lower low would then happen.

Either way, a news event could spark heavy buying or selling? However, the lack of any news leans in favor of the bears, as they don't need large volume to fall, like the bulls new large volume to rise up and break through the door overhead.

In summary, I expect tomorrow to go down to at least 1080 spx, then bounce. From that point, we could continue down or make another run for the door overhead. The daily chart will give us clues, for if it rolls over tomorrow, then bears will likely control the tape. But if it continues moving higher, then it's likely just a backtest of the trendline, with more upside likely to follow.

Red

Great post Red, I'm recovering from a hangover from partying too much in Montreal. I'm glad BP took a hit today since I'm loaded up on BP puts but my SPY puts are getting killed so far. It will be interesting to see what tomorrow brings. Good luck to all.

I feel your pain my friend. It's do on die for the bears tomorrow. They need to get the market back in the falling channel, or else the bulls will just take out the 1100-1105 resistance on the next surge up.

is that a midnight full moon doji on caterpillar then?

Red, check out my new blog format, additional comments appreciated.

Hope all is well on your side….these fake waves are painful

http://stockcharts.com/h-sc/ui?s=$cpci

I don't mean to be an alarmist but recently I way a chart showing the correlation between high $cpci and market correction within a day or two. lat 4 out of 4 times it worked

$cpci is the big boys index put/call ratio- the smart money

$cpce is the dumb money -equity put/call ratio

I found it (I don't mean to get people all worked up, but rationally you should take a look at this)

To elaborate: the following comes from

http://www.patternprofits.net/2010/06/weekly-wr…

the charts didn't come thru. scroll about 3/4's down his post

Sentiment Indicators

Index option players (smart money) have also been a great indicator of late. I don't think it's a coincidence that the spikes in the $CPCI have preceded monster drops in the indexes by only a day or two. Check out the two charts below…

The 2-3% drops that have followed these spikes in the $CPCI means someone is betting big on the put side of the equation and quickly cashing in. Well worth keeping an eye on going forward.

Lastly, the equity option players (dumb money) continue to avoid put protection and I had to double and triple check this number on the CBOE. The complacency shown here is absolutely frightening given the session we saw on Friday. It's no wonder the bears can't wait for Monday's open. Nothing has me more scared for my longs than this…

Breadth & Sentiment Charts Courtesy of http://stockcharts.com

The point: The $cpci spike much higher yesterday. This is very bearish….see below

(I've said enough)

(I lied, here's another) Monday, June 14, 2010

Brief Update

The first thing I want to point out tonight is the $CPCI will be looking to go 5 for 5 in signaling short term swing tops over the past few months. I circled the readings near the 2.0 mark and showed how each instance was followed by significant weakness over the following 2 to 5 sessions. The smart money was loading up on index puts today and the ratio is once again in the range that we can expect prices to reverse and head lower…

OK, you guys know I am more bearish than anyone but Tim on SOH posted the NYSE Summation index and it has me concerned. Do you think it is relevant?

http://stockcharts.com/h-sc/ui?s=$NYSI&p=W&yr=2…

The summation is a key indicator of the money flow. its turning and it normally is very accurate at indicating tops and bottoms. It is a very strong reason to go long at this time.

I like the EW charts posted above but they are missing this short term. IMO. This short term will allow pros to sell out and suck in the retail. might as well play it until summation reaches top and go hard short again.

i still have some short positions also but much lighter.

sorry I ment to say CAN'T

breakpoint trades uses this all the time (it works) but this does not mean we can have short term whipsaws.

breakpoint trades uses this all the time (it works) but this does not mean we can have short term whipsaws.

As it was “about to” give a buy signal they cautioned that the market can still go down for another two weeks. As the chart indicated NOW it is on a buy.

Can't mean we have a heavy spike down for a day. Which is what I'm looking for.

Like this site and analysis:

http://stockcharts.com/def/servlet/Favorites.CS…

This guy seems hellbent on bearishness. two days ago he posted a “diamond” formation and forcasted a 57 drop monday.

then monday he says a 67 pt drop. Now he drops the diamond and doesn't mention the 57 or 67 pt drop

I'm not saying he's full of it. but maybe a little so…

Something I'm keeping an eye on:

2008

http://screencast.com/t/NjgxMmI2ZjA

now-(minus yesterday)

http://screencast.com/t/N2QwODA3ZDYt

great charts, Thank you

I don't like how UK market went up today after ours fell yesterday afternoon.

I smell a trap.

This kind of trading is tough on all. I got stopped out of a great TNA trade but not sso and tyh.

Like i said before this week and into next will be bull. iam mid to long term bear but right now markets are telling us something else.

Some how I don't think 1100 is going to hold the market back today gang. The market is too strong right now (aka… manipulated in the light volume environment).

If breaks, 1120 minimum is up next, 1150 even being possible. However, if it fails again it will likely go down.

this is probably the bounce that Anna was talking about yesterday

we should come down soon, still looking for 1070-1080

I'd have to agree. $TICK is not confirming today's gap up.

SP 500 Channel with resistance levels

http://niftychartsandpatterns.blogspot.com/2010…

Is the third time the charm??

Obviously this market has been baffling and frustrating to us as bears and to very many other sites and posters in the same boat. Despite charts, experience and what-have-you we all still remain clueless and powerless as to what the market will do on any given day or series of days in the future. We can only make the best percentage call we can and hope for the best. Most importantly, we don't want to be out of the game if things do move in our favor so we have to position ourselves to be able to take advantage. To continue to hold while this moves opposite out intent is foolish. Take your loss, get out and wait to fight another day. No field commander worth his salt would allow his troops to suffer uneccessary casulties when things are clearly stacked against him. Retreat can be strategic. The old axiom of cutting your losses is very apt and true. When this turns and it will there will always be time to get back in and profit.

In addition let the market dictate to you not you instead of you trying to tell the market what to do.

no matter your sentiment.

powershares qqq trust series I fibonacci levesl

http://niftychartsandpatterns.blogspot.com/2010…

They might just hold the market here until opx is over, as in this extremely light volume, they can 100% control the market.

I'm sick of this guess guess bullshit

Me too Ben…

Let's go arrest Obama, Geithner, Bernanke, and the rest of the thugs for crimes against humanity. Opps! Better not, as that would cause one be celebration… and new Bull market! LOL

Remember that fake vix print at 24? I guess we are going there.

Looks of fake prints Monica. When it the real question?

Do or die time for Bears. VIX is hitting its 50 SMA

SP 500 and cci similarity in price action

http://niftychartsandpatterns.blogspot.com/2010…

Nice… let's see if it repeats itself again.

Chances are there till yesterday's high is not taken out

Today's volume is so low I can't hardly see it on my charts. I believe they could have easily taken out the current resistance zone around 1100-1105… so why haven't they?

waiting to trap some more bulls

We are trying to turn toward the VWAP but it is lunch time in the Big Apple. Anyone heard from Rick Santelli lately?

Good point! We are at major resistance on the 60's. First the hidden div that took us down yesterday now the reg divergence is setting up.

This makes sense when you look at the daily. It is setting up a hidden divergence.

If we break the intermediate high. all bets are off. My only concern is breath. The triple MAC pattern is 80% reliable and it hit yesterday. Summation, BP and MACD.

It is my hope that the low volume will cause a whipsaw. Personally, I think that it is related to tonite speach by the Bomster.

What can he say that is not known? Meanwhile Toyota has not figured out what went wrong but they are off the front pages.

http://www.screencast.com/users/has001u/folders…

May be waiting to trap some more bulls

I think we are clinging to to the Bear case and trying to find points to validate our thesis instead of looking at the actual writing on the wall. Volume may be low, there my not be new, but PRICE is king. We went up the entire Feb-April Run on pathetic volume, so all this needs to be considered.

Look at SPY on a 4-Hour chart. It's about to close over the 50 SMA on that chart. Hasn't done so since the April top and was even rejected yesterday. It's getting very close for the bears to toss in the towel for now and jump on the Bull Train. Waiting myself. If SPY closes above 110.33 at end of this hour, I'm closing out shorts and going long.

i agree. We are on the cusp. I think that they will headfake it above the 200d just becuase everyone watches it.

Long Gold thank god!!

bears are done.

It sure looks that way…

SPY is now oversold in EVERY timeframe. But I believe the tide has shifted. I would buy the dips now, instead of selling the pops.

Huh? Oversold? You mean OVERBOUGHT!

Sorry, OVERBOUGHT!

LOL Just try not to drink the bulls' kool-aid. It's laced with bullshit.

All the “proffesional” I've been listening to in Feb May and now June were all full of it. This really gets me down.

I have to trade off the chart only and forget this guru bullshit

It certainly makes you wonder if they are listening to what is being said on the blogsphere, and manipulating the market to make sure it doesn't happen.

chartpattern trader was right. He kicked out asses

He's very good Ben. I have to agree with you. But, he's been wrong before too. No one is alway right.

Dow jones Breaks out shown in hourchart. The hour should close above the line for bullishness to sustain

http://niftychartsandpatterns.blogspot.com/2010…

Now wouldn't a late day crash surprise everyone!!! hehehe

Make it happen Anna… tease them bulls into walking off a cliff for us… would you?

eheheh nothing should surprise you 🙂

I think it's housing starts tomorrow. ??Maybe a crappy number and we get a sell off to get out of our puts, then buy a call for a rally to top BB??

sounds desprite?

wouldn't it be “typical” for them to spike down to the Middle BB 20dma just to screw the bulls?

It's times like these, when confusion is rampant, that we all are trying to find our way out of here….

http://www.youtube.com/watch?v=mZTPsrcfQSE&feat…

I'm grinding paint off a house (I'm a house painter) built in 1890. I look at my computer during the job and find my money getting toasted.

Welcome to Purgatory

Don't feel too bad Ben… I'm a slave too, only right now I'm jobless… or at least I don't have enough work to be working right now. It seems my masters (the Illuminati) stole so many peoples' last dime, that no one has any extra to spend on the services I provide.

Just looked at the tape for the first time this afternoon. Feel sick. Oh well. Nothing I can do at this point.

I think it's time to short SLB, 60 lows recent past, look like the resistance. use a 61 stop

VIX 24. then we reverse. My best guess. so another ramp job tomorrow I suppose.

the latest from mole. I could resurect. Need a sizable sell off and catch a big rally tomorrow???

Mole postulates Euro/jpy to 115 correlates with s&p to 1125

“How high we go is mainly up to the EUR/JPY – so let’s keep watching that. I reckon that the 115 mark on the EUR/JPY would nicely correlate with a 1125 reading on the SPX. No guarantees but a reasonable target at this stage. And yes, we could push much further than that – Minor 2 waves can theoretically correct a significant portion of their prior down wave – just so you know. But let’s all agree not to panic and let at least Soylent Orange unfold as proposed.”

Unbelievably! Did Obama resign and turn himself in or something? What other reason could there be to rally like this?

CAN WE SAY SHORT SQUEEZE? Of course, I am still short. Just wish we would print 24 on the VIX today but I am afraid it will take another day of this. BUmmer.

The $VIX is more tail than dog, imo, though it has shown a willingness to bounce when it crashes its lower Bollinger band, now at 24.70.

The market imbalance has shifted from sellers to buyers is all. It happened last year when the news was just as lousy or worse. Can't say how long it will last, but if you're going to trade on technicals, the news is secondary, often seemingly irrelevant.

News is driving today. IDC call on Computer sales and Boeing's uping thier guidance. This is not a short squeeze….yet.

IMO, that's not the sort of news that spurs the market into 2+ percent trend days. The market was simply ready to rally, or rather continue the rally from last week.

I agree because at the same time Best Buy misses earnings both on Revenues and EPS and German Confidence was lower.

Indeed. That's the way it usually is: The news flow is mixed, some good, some bad, some days better than others. The market reaction to the news of the day is often pretty weakly correlated, or seems so.

BB makes its money in Q4 no one cares until then. The Boeing story is big as they have had so many problems.

To each their own.

If it gives you all any solace, massive amounts of money coming out of the Ishares SPX Fund, QQQQ and IWM. Look at the block trades down. But I'm not sure that's shorting going on, versus profit taking. If you look at the buying in on weakness, not much money flowing into the short funds.

IF that is from the WSJ site it is often wrong.

It could also be hedging, i.e., going long a stock and hedging by shorting an index.

http://online.wsj.com/mdc/public/page/2_3022-mf…

Dow jones is moving towards resistance around 10400

http://niftychartsandpatterns.blogspot.com/2010…

i wish would rally another 100 pts today and get this over with.

I would be happy to give back a percent into the close. We are still OK unless we take out that high.

trust me, the best thing for the bears would be a rally higher today. but they never make it easy. if we could get to around 10400-10450 that would be key. then everyone will be on the bull horn and they can take it down.

Monica,

What was the exact level on that fake print of the VIX from last week… I forgot it.

shoot. I don't remember – I thought it was 24 but maybe it was 24.70? Let me go back and look at my comments on your old posts.

They are already on the Bull Horn. Just wait for the pattern to play out. The VIX filling a gap means nothing. The operators laugh at that kind of thinking.

Have the courage of your convictions and the conviction to concur!

I know it's triple witching this week, but do all the indexes close out this month on Friday, or are they on separate days?

I FOUND MY COMMENT BACK ON YOUR MAY 25TH POST. VIX FAKE PRINT AT 24.10.

Well, there's nothing stating that it will be hit today or tomorrow, as you never know when they will they will be hit?

I still have the 100.72 spy sell that went through in afterhours from last week. When will it be hit?

http://reddragonleo.com/wp-content/uploads/2010…

thanks for the reminder.

Friday but uses Thurs VIX.

for emini s&p last TRADING day in thurs. then the value is determined by “the open” of the cash s&P friday am usually in the 1st half hour

if held over night the market could theortetically wail against you

Market wail against me… LOL! I think it's already done that.

VIX Fake Print was 24.1 on 5/26

I wonder where the market will be at if this print is hit… Dow 20,000?

http://reddragonleo.com/wp-content/uploads/2010…

Don't know if I posted this already today but I love his analysis.

http://blog.afraidtotrade.com/

There is also the “10 point” un-spoken rule (that Keirsten reminded me of), that says that the market will exceed or fall short of a known point of interest, when everyone is expecting that level too be tagged.

Most people are now expecting two different levels to be hit. One is the 1120 area as it where the 50ema is on the daily. The other is the 1140-1150 area as that where the right shoulder would be for the huge H&S pattern forming on the daily chart.

So, it is likely that the market will either fall short or rise above either of those targets to fool both the bulls and bears alike. Where? Of course I don't know? Let me call Tim Geithner up on my Bat phone, and I'll tell you…. LOL

I say between DJIA 10400-10450. That should be enough to get the vix to 24.10. And, that will be above the 200 MA so all bulls will get long and all bears will have covered.

23.40-23.60

why there?

I use median lines and that is where I have support. Many time frames. Could be a little rip before that. Lots of put selling near the bottom and that dumped the VIX and moved the market up.

Personally I don't think the market is going anywhere for years, It's in a range. The range is big.

never before have i wanted them to take it up so badly.

gs looks like sludge.