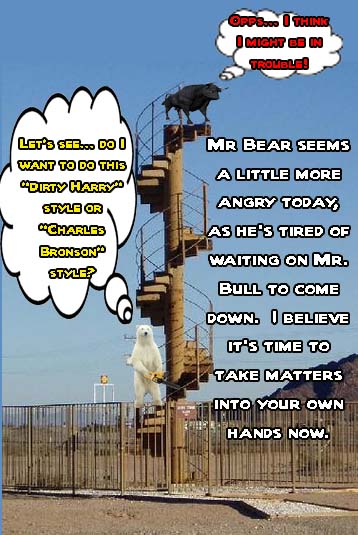

Will the bull ever come down?

Clearly this is being done to kill all the June Puts, as it has nothing to do with the news. If it did, we'd be at Dow 7,000 right now, and that would only be our first leg down. But again, the market lives in wonderland, and the rest of us live in hell. (It seems that way sometimes).

As for tomorrow, I'd tell you that I think it should crash 500 points or more, but that's about as likely as me flying to the moon at this point. We'll be lucky to get a 50 point drop (on the Dow), as this Skynet controlled market isn't going to move until next week. That's because of OPX of course... and you know those crooks aren't going to pay out any money to the bears this month.

So, with the 60 minute chart being mostly reset today, and tomorrow it will likely move back into positive territory, I'd stay we are going higher next week (wink wink). Are you reading this post Skynet? I'm uber bullish now... Dow 12,000 next week! Come on and give it too me you f@%king Bit@h from Hell...

Well, I guess I made my point on how I feel right now. No big long post, as what can I say that hasn't already been said? We all feel the same way... stunned, amazed, confused, upset, angry... did I leave anything out?

My forecast for tomorrow... more of the same B.S.

Red

P.S. I would like to see at least 50 different peoples' opinion the polls I put up. Please take the time to vote. Thanks...

Yes red, let's all go bullish, my lunch company certainly was in their view they see the prices from March lows compared to now so it's logical to assume that prices will continue up and the worst is behind us.

Every time I go bullish, the market turns within a few days. But it's still not likely to turn down tomorrow… with opx and all. So, that still doesn't help my June puts. I should be used too this by now though, as it's this way every opx week. Same shit, different month.

It really is the definition of insanity. I guess we are both certifiable.

Misery loves company I guess. The markets have always been manipulated as Levre pointed out in his classic Rem. Of a Stk Operator.

Its so blatant and apparent now.

Maybe thats the master plan.

Make us all dependent on the government.

Yes, it's always be manipulated… but not a 100% control, as it is now. The “turning on” of the printing press last March of 2009, changed the game tremendously.

The funds available to the PPT were limited prior to the first stimulus package. Now, they completely control the market. Skynet has been activated…

Hi Red,

Any thoughts on the massive volume in SPY June 110 calls. Almost 1.3 million calls traded. Were they bought or sold? Never seen such a huge volume! Hmmm………

Great question? I don't know if they were bought or sold. But since they were calls, it could have simply been some large player closing out calls that he bought earlier. Probably Goldman closing them out… they know every thing ahead of time.

http://www.screencast.com/users/dreadwin/folder…

This is an update of a chart I posted yesterday. Treasuries (TLT) are breaking out to the upside out of the triangle. GLD was also up today. This is absolutely a flight to safety.

I expect $vix will follow.

looking at this

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&…

I have been watching that, closely. $TNX and TLT tell us that another panic is coming, probably soon. I would suspect that we're going to set a new low, but have no idea on the timeframe.

You know Dread… I gotta hand it too “The Chart Pattern Trader”. He's been long this entire move up. Even though all the news is extremely negative, he just follows what he see's in the charts.

That's a great trader for you, as I certainly can't tune out the negative news, and just go long. My emotions get in the way, and stop me from taking any long position… for fear that another flash crash is going to happen just at that time.

I shifted my retirement account to 66% long on June 8th, 33% “safe”. I'm using DRV in my trading account as a hedge. So far, so good.

A “flash crash” is absolutely possible, but I think it is more likely well have a June 7th type day — big gap down, selling follow-through. Just don't know when 🙂

If it makes you feel any better, the CPT has been a a tear lately but that has not always been the case. I have reviewed his YouTube postings and he has had his share of large drawdowns. Not criticizing as no one is perfect and he has been of late.

Its cyclical.

Yeah, I've seen him has a bad run too. It's just the nature of the beast I guess.

He has been dead on. I did get nervous and sold all longs yesterday. where he kept a smaller position.

The two doji have me thinking we take a breather down possibly Monday Tuesday after a wild day today.

Red! Love this line: Come on and give it too me you f@%king Bit@h from Hell…

You tell 'em!

Well Rati… sometimes you just gotta air it out!

SPX Chart for you guys and girls …

Hope this helps…is all i see for now..

http://s657.photobucket.com/albums/uu293/bigelk…

Now go nuts and go make some nice green….ALL OF YOU!!!

happy trading 😉

I think today could be “the” day. Unfortunately, won't be home – busy with the kids and fam until next week.

Nenner Friday Update:

S&P/Nasdaq

No change in outlook

We feel the upside is limited to S&P 1123 and Nasdaq 1928

Since we exited the S&P around 1200 and Nasdaq around 2005, we are still not in a hurry to go long again

However, a close above these levels might change that

For now, we are still looking to go long on weakness

Sector

There really is nothing more to say about Gold

Based on cycles, it is still too early to go long

However, until now, we see little weakness based on cycles

We will soon will have to decide whether to buy back the long position in Gold which we exited around 1225 last Dec

VIX finally hit 24

I think Monica said the fake print was 24.10 on the VIX, so we still have a little bit more to go.

Iam picking up a position in VXX at these levels.

I remember this chart that Dreadwin posted awhile back. I forgot who he got it from, but it shows a pattern that if it plays out again, we will have one final high before dropping…

http://reddragonleo.com/wp-content/uploads/2010…

I don't have an updated one, but you get the idea.

Dow jones resistance line in daily line chart

http://niftychartsandpatterns.blogspot.com/2010…

Just saw fake print of 67.53 on IWM. Could be where we close around today

I see it… that means they are going to take the spy higher too.

I have said time and time again bp is croutons!

on a wilted salad 🙂

day after the spill ask Red heheheh

It's really a matter of time.

that's why I go way out

🙂

Looks like some lovely negative divergences in RSI and STO this morning.

If everybody hurries, there's still a chance to cover very near the top. 😀

http://hotoptionbabe.com/blog/22-all-things-sil…

Anna i too have been bullish on GLD and slv. but i have been playing it carefully. Got burned years ago when it went from 300-600 and back to 300.

Right now iam seeing a pullback around the corner to maybe as low as 1150 again before a jump. i also notice the time spans between rises in gold. seems like it goes sideways for 4 months then a rise then sideways etc.

Hey Jim, this time Gold silver are the fear trades and you can probably figure out why 😉

Red gold gold silver and gold

Question: How far and fast can this POS fall by 4:00?

mY guess is 111 spy or 1110 spx 🙂

My target for the whole move is 1075, but I think for today 1095 would be about the limit. You are probably right.

Read your stuff about silver and gold, Anna, and I think you are right on there, too. This is an opportunity for serious accumulation.

🙂 Gold silver higher highs higher lows pretty easy 🙂

Lately, I've noticed some very good articles about the economy and the market in ETFGuide, linked on Yahoo Finance. Very blunt and fact-based, right down our alley.

http://www.etfguide.com/research/350/8/It-Will-…

Dow jones broadening bottom formation

http://niftychartsandpatterns.blogspot.com/2010…

Nice one again, San. ::thumbs up

Looking forward to the third touch on the bottom trendline.

It looks like we finally got some nice RSI divergence on the 60 min. 5 waves down off the high. Then a little bounce and hopefully forming nested 1-2s

¿Ingles?

I need to learn EW lingo.

It means hopefully we're chopping sideways until the big plunge.

A plunge today would be a dream come true (some expiring OTM options), but I am not that lucky.

Next week will very red, I think.

Ah, I see. Here is the bounces, and the nested 1-2s will be what I would call going to hell in a handbasket. 🙂

I think any shorts are going to be hammered rest of day.

May be an point late day.

The spy 111 end of day

Hope you are right.

me too 🙂

Ford motor co hourly chart in a triangle

http://niftychartsandpatterns.blogspot.com/2010…

The volume is so low today, that I need to zoom in 10x on my charts just to see a the bars! I think if I bought one share of Apple, the SPX would rally 10 points…

anyone know why SPY is down today, while futures and SPX are flat?

Dividend payout, I believe.

$vix got down to 23.3 at its low today.

Wow… I think I seen the turtle… errr the market move a whole inch today. Maybe in another month or two, he'll make it across the road.

A note for those who watch the $VIX:

http://dailyoptionsreport.com/blog/post/another…

I'd say it's going to be a long hot summer now… and a very boring one too. Looks like we are on our way up to DIA 118.16 for a final high, before falling into the abyss.

That's assuming we don't have some false flag event next week, or so after. Man, when this thing falls, it will never come back up again.

Possible. Most anything's possible.

As it is, I don't think sentiment is anywhere near complacent enough to support a big move down. Barring some exogenous shock, buying the dips seems the better way to go for now.

Right now, the dailies out of the June lows look like bull flags to me, though volume is low (volume wasn't anything spectacular during the 2009 bull run either, for the most part). The Russell never came close to testing its Feb. low, IYR is actually closer to its highs than its lows, $TRAN never confirmed the lows, $NYSI curling up, etc. etc. XLF parked itself on the bull side of the 200dema today, and see what OIH, one of the most despised and beaten-down sectors of the market, did while the indexes were printing their OPEX dojis.

One or two outsized selloffs could change that picture fairly quickly, but the risk/reward of playing a swing short doesn't appeal to me at present.

The market can always surprise, but the expectation of imminent collapse expressed here just hasn't been supported by the market action, IMO.

I will try to note any clustering of red candles that impede further moves up before I consider taking a short position (note the SPX dailies around the January and April tops), and when I do it will likely be hedged at first, small and ready to be abandoned if the market proves me wrong (note the action during the Nov.-Dec. sideways consolidation before the move to the January highs).

The same goes for my current longs, currently and heavily weighted toward the precious metals sector.

The markets are always showing a new face, and a successful trader needs to be willing to change his/her position if the market says its wrong. Hope is not a strategy.

Best of luck, Red. Have a good weekend.

You have good weekend too Rosa… I agree with you, as it looks like the bull is back for now.

I agree, but there are plenty of reasons to remain wary, and an overconfident bull is just as vulnerable to being cut off at the knees as an overconfident bear.

Red, if this is what I think it is, an EW4 retrace, it is amazing how quickly it can fall into the EW5 down. On another site, I called a similar situation, actually it was the B down leg of this ABC move, while others were calling for SPX 1120 to 50 and saying straight to the moon and they were in some pain after getting stopped out and losing all of their hard earned profits. One does not want to mess around with an ABC move as a long term investment strategy.

I think there will be a buying opportunity next week after a shallow pullback (2.5%ish) from today's highs. Bears will jump on it and short with both fists, but I think that's the wrong move.

*However*, $rut has not been able to close an important gap that every other index I can find has. It has stubbornly resisted every move so far, and could be a warning sign.

LOL @ the video…

As you said once, VIX is more tail than dog. Still fun to watch, though.

What a waste of my day……..Good news though. My best turnday cycle came into today not June 21st as I had been expecting. I had been counting off the April 26 intraday high instead of April 23 closing high when it once appeared. We've got the nested 1-2s to launch a downmove also. Only disappointment was that we didn't get a close below 1087 to extend the TD weekly downcount. But treasuries are on an weekly 8 upcount (it's rare for the count to extend beyond 9) so there should be some fireworks next week.

SP 500 analysis after closing bell

http://niftychartsandpatterns.blogspot.com/2010…

Dow jones analysis after closing bell

http://niftychartsandpatterns.blogspot.com/2010…

Red:

Is there a way to have a synthesis of TA and other predictive sciences such as Financial Astrology so that we can better capture the trend shifts?

Here is what I mean:

Using purely TA, blogs such as Daneric's (and yourself) were decidedly bearish the week of June 7th. Daneric was asking for sub SPX 1040 targets but as soon as we had this week's mini rally his stance changed overnight to predicting high targets in the SPX 1170 area. As you can understand this is hardly conducive to profit making in trading the markets successfully.

The same with EWI. Having a bearish bias EWI was saying that the downward trend was ready to resume, yet by today's short update they finally conceded that the SPX 1130 and 1150 targets should perhaps be achieved first.

On the other hand, Ray Merriman had said that once the downtrend was complete then a possible bounce of a 1000 Dow points would occur in a very short time. The question was when the turning point would occur.

Merriman said that June 10 was such a point. Here is how he put it in his weekly updates:

“In retrospect, we now have a case where the U.S. (and many other world) stock markets made their yearly high exactly on the date that Saturn was in opposition to Uranus (April 26), and their bottom exactly on the date that Jupiter was in conjunction to Uranus. This is why Financial Astrology “kicks ass” compared to other market timing tools. This is how Financial Astrology works, and why it is extremely valuable, especially when used in combination with other studies like technical analysis, pattern recognition, and cycles’ analysis. But fortunately we live in a time when Financial Astrology is not overly used (or even considered valid) by the majority of investors, thus allowing us to continue with this “edge that all traders seek.””

Apart from the apparent lack of hubris, one might say that the June 10 to June 24th (next expected turning point date) would have been a marvelous long opportunity. (We have bounced already 600+ Dow points from the June low and perhaps we have a few hundred more to go).

So, the question is:

How can we bring these disciplines together and get an accurate picture in advance?

Here is another site which might provide some clues (even though I am not certain if it is reliable):

http://www.tradersaffiliates.com/WEEKLY%20UPDAT…

I can not tell you how demoralizing it is to fall under the spell of a bias because by the time the error is realized opportunity is gone.

Listening to TA experts stick to a trend path and then having to negate it is both wasteful and financially painful.

So, the question again is whether we can perfect the targets ahead of time by incorporating other valid signals instead of desire and hope.

I hope you do not mind some long term Elliott Wave analysis. This is what I am getting, pretty efficient huh? Both right up snug to the .618s. My concern is that slight curling up in the WEEK MACD, now it looks like the next down will not come so soon as I originally thought. IMO we now have some sideways to go through. But we will see. What I'd like to see is some divergence, like under the purple arrow apparent somewhere.

Now, you can believe in E Waves or not believe in them. But everything has been very predictable up to now, look at that MONTH chart, Ralph's prophesies have certainly worked their magic as these wave components have stopped exactly where they should. And look at the size of that oscillator, yes, it is not done forming yet but if this was a major move the 4 oscillator would be huge (W), wouldn't it?

http://www.screencast.com/users/katzo7/folders/…

Drill down to a smaller scale. This recent ABC on a smaller scale is/was expected, logical, normal. At one point I felt it would fail sooner but it seems bent on fulfilling its ABC task. ABCs are killers to trade unless you are aware of what they are all about. They rob both sides equally and do a good job at it. Now, look at the oscillator, it is small in comparison to the ones to the left, typical for an EW4 one

http://www.screencast.com/users/katzo7/folders/…

As far as short term, we are either done to the upside or have one more run to 1124 ish, then down IMO. Anything above 1131 blows out my call. Mondays after OPEX can be brutal to the downside, all of the pent up energy during OPEX week being expounded on that day. Just one day, Monday, can force the divergence issue as Friday;s antics would form the last rounded high, and set this thing off to the downside. But I am pontificating.

There are lots of reasons to think this is going down hard next week. From an Astrology point of view, this coming time period has more negative influence then 1929 did.

http://www.traders-talk.com/mb2/index.php?showt…

The news out there is super negative right now too. We should have started down this week, but it didn't happen? Maybe their plans changed after the June 4th-6th meeting, I don't know? They clearly pumped more money into the system, as pointed out on Cobra's blog, showing the institutional buying, and the liquidity inflow and outflow.

Then there is the fake print issue. They are almost always hit at some point. When is the big question? If they decide to take it down next week, will they have the ability to go back up and make a new high later this year?

http://reddragonleo.com/wp-content/uploads/2010…

I don't know if it's possible to get back up this high again, once a move down toward retesting the March 2009 lows starts. I think that once we start down below 7000-8000 range, the high is in for good.

Over the next few years I see a Dow 3000-4000, as this economy is only going to get worst, not better. So, this might be their last chance to make a new high before plunging into the abyss.

Of course that print doesn't have too be met, as it could have simply been a mistake (if you believe in accidents?). I have several downside prints that would scared the pants off of you.

So, I'm not sure what to expect next week. Sure, we will probably sell off some… that's a given. How much is the real question? Is it just enough to make a “B” leg down, in an ABC move up, or is it wave 5 down from the current high? I wish I knew?

http://www.traders-talk.com/mb2/index.php?showt…

There are lots of reasons to think this is going down hard next week. From an Astrology point of view, this coming time period has more negative influence then 1929 did.

http://www.traders-talk.com/mb2/index.php?showt…

The news out there is super negative right now too. We should have started down this week, but it didn't happen? Maybe their plans changed after the June 4th-6th meeting, I don't know? They clearly pumped more money into the system, as pointed out on Cobra's blog, showing the institutional buying, and the liquidity inflow and outflow.

Then there is the fake print issue. They are almost always hit at some point. When is the big question? If they decide to take it down next week, will they have the ability to go back up and make a new high later this year?

http://reddragonleo.com/wp-content/uploads/2010…

I don't know if it's possible to get back up this high again, once a move down toward retesting the March 2009 lows starts. I think that once we start down below 7000-8000 range, the high is in for good.

Over the next few years I see a Dow 3000-4000, as this economy is only going to get worst, not better. So, this might be their last chance to make a new high before plunging into the abyss.

Of course that print doesn't have too be met, as it could have simply been a mistake (if you believe in accidents?). I have several downside prints that would scared the pants off of you.

So, I'm not sure what to expect next week. Sure, we will probably sell off some… that's a given. How much is the real question? Is it just enough to make a “B” leg down, in an ABC move up, or is it wave 5 down from the current high? I wish I knew?

Looks like a gap down on Monday. On another site I said 1115 ES was a hard target, meaning it might do a meaningless non-sustained spike over that 1115 but be pulled back. While on the 15 it looks formidable, on the 120 & 240 is appears like nothing.

http://www.screencast.com/users/katzo7/folders/…

Babe just sent you an email, you should be a-ok to get in, don't understand why you can post. Please let me know or call me if you can't 🙂

Love Anna

aaaah hooow sweet

http://www.youtube.com/watch?v=NNC0kIzM1Fo

🙂

How far do you expect the gap down to be.

SP 500 approaching Ichimoku cloud resistance

http://niftychartsandpatterns.blogspot.com/2010…