WEDNESDAY UPDATE (for Thursday, August 5th, 2010)

Well,

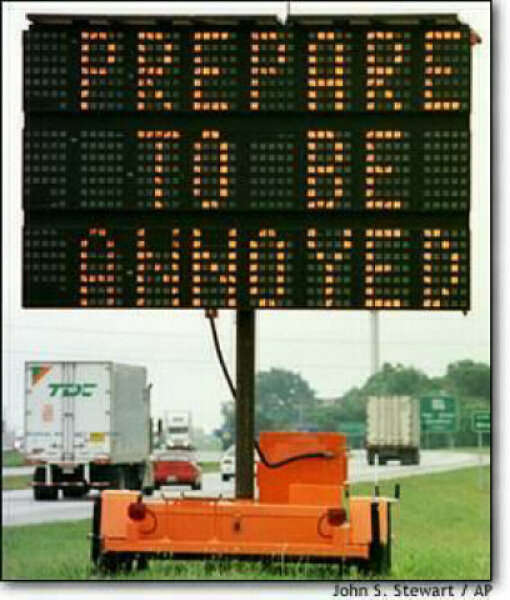

I'm officially annoyed, are you?

Red

-----------------------------------------------------------------------------------------------------

I have NO Idea...

Sorry folks, but today end with a lot of mixed signals. The 60 minute chart is finally rolling over as the histogram bars are now at the zero mark and ready to cross down. But, the overall price level simply traded sideways to slightly down. That's call a "Bull Flag" pattern, and could easily play out tomorrow morning.

However, when a pattern fails, it commonly makes a big move in the opposite direction... meaning down! We still have the FP prints of 107.12 spy and 107.35 from last week, but we don't know when they are going to play out? If we start back down tomorrow, then we could easily hit that target by this Friday.

But, that daily chart is still rising right now, and the weekly is also pushing up higher too. While the daily is overbought, it's still not showing any signs of turning back down yet. Some people have August 6th as a turn date, so we could chop around here until then.

I could easily see a move down into tomorrow morning, and then a rally back into the afternoon. With that 60 minute chart just now getting ready to go negative, I think it will only put in a small tower below zero and rise back up into tomorrow's close. This would allow it to put in a smaller histogram tower above zero, forming a negative divergence on the chart.

That would set up Thursday as a possible big down day as the 60 rolls back down in the morning on the bad jobs data. By that time, the daily could also be rolling over a little too. But understand this, it is common to see a higher price level with a second lower high on the histogram tower of any chart. Meaning... while we could sell off early tomorrow morning, the afternoon rally could push us up toward that 1131 level (or more), as it squeezes all the shorts that just piled on.

Be cautious about going short right now, as no selling is likely to stick until the daily chart rolls over. That might not happen until this Friday... or even next week? With the weekly pushing up the daily, it's hard to see any selling stick yet. We need the daily to start turning down first, and then I think the weekly will follow it.

So for tomorrow, if will sell off in the morning, look for the 60 minute chart to start to turn back up and then bail on your shorts. Usually all the action happens within the first 1-2 hours of the day, so that's when I'd expect the selling pressure to lighten up a little.

A move down to fill the gap at 1105 spx would be my likely guess for a downside target. That would also hit the rising trendline that supporting this whole move up from the 1010 lower. If that line breaks, then the market should fall hard. But on the first hit of that trendline, I'd expect a bounce from it.

This all assumes the government doesn't release some bogus news or data tomorrow morning to cause a gap up to fulfill the bull flag. From a technical point of view, it's not really a good bull flag on the 60 or 15 minute charts. And on the daily chart, it needs another 2-3 days of sideways trading to be called a bull flag. So while it looks like a bull flag, I don't think it actually meets all the proper qualifications.

Anyway, that's about the best guessing I can do for you...

Red

P.S. Since the government has super computers telling them all the technicals in the market, releasing good job's data (bogus numbers of course) would allow the technicals to play out to the upside. Basically, with the daily still pointing up, and the weekly too, whatever news they release will determine "When" they both roll back over. Good news means they will likely extend into overbought territory more. Bad news means they roll over at any point now.

Good post Red, thanks for the update. Not sure if someone posted this yesterday, but here is another good bear article. Please disregard if duplicate.

Andy Zacky 8/2

http://seekingalpha.com/article/217966-warning-…

Thanks for the post… very interesting. It's probably not wise to bet against the Sun…

🙂

Ditto Red, lol! I am looking forward to the new dawn and perhaps we will get to see some amazing Northern lights in the skies tonight . Peace!

Everyone is super bullish out there. Everyone is calling for another leg up in the rising wedge and those are the bears. But I don't think we can get another jam up job with today's candle and today's decidedly negative breadth. If today had been a doji with mixed breadth, then I would be worried. Dow rallied up to basically 10666 on Monday per a prediction by someone on another board with a close at 10674.?? (which equated to 911). All the other indices had similarly special numerological closes. The oil stocks are so overextended that it's almost impossible for them to continue to rally and copper has virtually gone straight up for a few weeks without a drop. It seems to be a sign that the euro will soon top and it looks like it has had a blowoff the last two days. Euro MACD is topping and flattening on both 60 min and daily charts.

Cobra has the latest update showing Rydex market timers are getting decidedly exuberant.

Red I am annoyed already no need to prepare LOL

Dow Jones futures before opening bell

http://niftychartsandpatterns.blogspot.com/2010…

At this point, I'd say we are going to make another run for 1131 or so. Don't know if we make it or not, but they sure are going to try.

Looks like a nothing day to me. Cannot read any significance into anything at this open.

Looks pretty weak right now, but once the light volume period comes they can push it up a little higher if they want too.

Yeah It looks like it is starting. Another red day for my books.

ADP will prop today. Slightly better but continuing will be very bad on Thursday and Friday.

That was a big pop. Looks like 1131 will be hit today after all.

They never make it easy Jim…

R2K is carrying day again with a 5X lead.

Tomorrow and Friday could be very ugly, as this market is out of steam right now. Some really bad jobs data could start the selling.

If past means anything market should be moving down until options week.

Based on what data? “Past” what? I think we are going down, but opx week is usually bullish.

SPY hit 113.03. Does that count for the SPX 1131 FP?

I don't have any FP of 1131 spx. I only mention that level because it's where we would hit the up trendline resistance, and because it would be a double top from weeks ago.

There is nothing saying that we will get up that high. The top could already be in, and those waiting for 1131 would miss the boat.

The only FP I have now is for 107.12 spy from 2 weeks back. Anna caught it again last week, but it was only 107.35… so about that 107 area is our downside target. Upside target is unknown?

Ahh… if it's a trendline or resistance, then it's close enough IMHO. I prefer resistance ranges anyway. 🙂 So, please! By all means, let's hit the 107.XX SPY now. 😀

Saw a chart posted by CXO group for Aug indicating S/P averages from 1990-2009. Bearishness before options seems to be the play………..

Sounds good too me. Let's see it tank into opx this time, instead of the usual B.S. rally. If you have a link to that post, I'd like to read it. Post it if you do. Thanks.

S&P 500 rectangle pattern in 15 minutes chart

http://niftychartsandpatterns.blogspot.com/2010…

It could possibly breakout to the upside, but the shorter time frame (10 minute) is putting in a bear flag right now.

If the bear flag breaks down it may find support around 1116

It really looks to me like they will pop this higher into the close today. Squeeze out the last bear, and sucker in the last bull… just before bad claims numbers come out tomorrow.

I just saw this alert from Weiss research FYI

Buy the SPDR S&P 500 ETF (Symbol SPY) for 40% of your current portfolio value. Good news, bad news, it doesn’t matter – this market does not want to be held down. Important technical levels have been breached, and the corresponding price action is painting a very, very bullish scenario. I am looking for a move to the 1200 level for the S&P 500 in the next few weeks.

2. For the Asset class “Currencies.”

Buy the CurrencyShares Euro Trust ETF (FXE) for 20% of your current portfolio value. I am looking for the euro to be worth between 1.38 and 1.50 USD in the near term. This position will profit if my

I don't know about that Jim? The technicals say we are very close to overbought on the daily, and the weekly could turn back down at any time now.

While it's possible that we go higher, I wouldn't go long from these levels. I trust the FP's, and until I see that 107.12 level tagged, I'd stay out of the longs.

I actually agree more with your position. when this came out this am i was really surprised.

But i have been hammered of late w/ my small short positions. i have been prepared to move aggressively short.

One opinion that has me perplexed is a statement the other day from Stuart Barney that explained this market rally as a possibile celebration that the Democrats will most likely lose the house in November effecting an immediate change in federal spending.

I just do not know. there are many conflicting points.

Weiss is certainly correct about one thing. news good or bad has not mattered.

Triangle Pattern of Russell 2000

http://niftychartsandpatterns.blogspot.com/2010…

Feels like the calm before the storm right now…

QQQQ's might be down 1% tomorrow. I have the signal. It works here and there.

Look at BB band on 60 minute Dow and S& P. What do you think that tight pinch is leading to??

I was wondering about the BB on the 60min this morning. It should be tightening and that should be good sign for the bears. The daily is tightening a little. And anything on a smaller time frame than the 60 must have a vice lock tightening. MACD on 60 min looks like it would be almost impossible to reverse with a moonshoot out of these doldrums.

There is a trader who has been hot the last few months who waits for a bubble to form in the BBs and then waits for it to tighten to do a counter-trend move. There is more to it though I am sure but that is one of the components for his trades.

YGM

We should get a pop into the close today (maybe that 114.00 target?).

The Euro is down .6% in today's session. The rest of the market needs to comply.

PBI is 10% under it's lower bb band…That's a great ,GO LONG NOW, signal

Breadth is too strong. There is very little hope for a reversal today. Just hope it stays about same today. Then there will be some familiarity to the April highs. Transports are repeating their April May high fractal (of course it could be interpreted that there is one more thrust higher). Transports were the last index to top on May 3.

Its a pattern also seen at the Jan highs. Decent down day followed by an equal sized up day the next day. It could be argued Dow and Sp are mimicking the Jan 5,6 2009 highs.

Larry Pesavento has August 5 as a big down day but of course Jaywiz had a flash crash for this morning.

Patrick Hughes has the turn on the 6th

August 6 is the one year anniversary of the lunar eclipse following the Saros 136 series solar eclipse of economic destruction which was the most powerful eclipse of this century. This might energize things to the downside. (since we just had another solar eclipse in July and had the first full moon following it last week) Shanghai topped out right around this time last year. August 6,7 is also when the Cardinal Climax reaches its tightest most powerful formation. I expect something big to happen on 08-09-10 just on the basis of the date's numeroligical value (the market did bottom on 07-08-09 last year).

Remember gang that everyone is looking for 1131, so an intraday stop sweep above that level is too be expected… if we hit that target.

No new post gang, as not much changed… but I did put up another video for you. Refresh the page to see it.

Interesting video about the spy elliottwaves from BAM Investor…

http://screenr.com/kMO

His dates are 8th to 18th.

I have been seeing the 6th -9th Friday monday.

i wonder???

It gets confusing sometimes, as on one hand we know that if everyone is expecting the same turn date period then it won't work. The masses are the sheep that the wolves take from.

So, if Bam, Larry Pesavento, and host of other people are all calling for the same time period… it shouldn't work. But, on the other hand, the charts clearly say that we are close to an end to this rally up.

The charts never lie, but the way one reads them can be mistaken. So, am I the only one that sees a big leg down coming after we hit the 1131-1140 area? I doubt it, as I'm sure many other people see the same elliottwave pattern… which goes back to the first point, if too many people see it then it won't happen.

Confusing you yet? I know I am… LOL

Completely????????????????????????????????????

I see pattern matches to the April May highs with the Transports and pattern matches to Jan 2009 highs with Dow,SP,and Nasdaq. And the entire rally since the early July low to today has striking similarity to the Nov 21 '08 to Jan 6 '09 rally although it has rallied in a quicker time frame. I have even seen a striking similarity to the mid October 2010 fractal with the Transports and other indexes. After bouncing from its October 10 2008 low the indices rallied for a few days and then put a top similar to the candle at the June 21st high. There was a drop to a new low in the Naz and Transports but a double bottom in the SP. There was another rally attempt up to the mid October top candle which wasn't exceeded and then the market collapsed into its Nov 21st low. And there weren't any dojis at the second rally high.

——-

There were posters over at Danerics rooting for a thrust higher and everyone seems to expect that it will happen. My feeling is bullishness is getting out of hand. I expect the AAII poll that comes out tonight will reflect that bullishness. I will add more positions tomorrow if there is a May 4 type open tomorrow. ie a gap down substantial negative breadth and the euro tumbling. I'll probably pick up some TLT nevertheless unless it gaps below its 50 day average.

S&P 500 analysis after closing bell

http://niftychartsandpatterns.blogspot.com/2010…

Dow Jones Futures before opening bell

http://niftychartsandpatterns.blogspot.com/2010…

Market is barely reacting to the job numbers. we open down and close up

A little selling here Jim… but will it stick?

I think we are getting played.

turn may have already started.

This is nothing in response to jobs report which just shows there is no improvement on the horizon.

I still see the possibility of tomorrow a s a neg start.

Vix is currently up 4% which is unusually high for the level of indexes.

That's good news for the bears. We have too watch for larger volume buyers on VIX calls, as the last time that happen the market tanked within a couple of days.

Feels like market wants to pull in some more bulls before drop today…….

5 and 15 minute charts look like the bulls are about to run

Not if your looking at the ES

What is the ES you all post about??

S&P mini-futures.

thank you

I would really have like to have seen that 1131 target (plus a little more to sweep out the stops overhead) hit today on a morning gap up. But, I guess they didn't fudge the claims numbers enough this morning. Bummer.

Turning around?

Which way??

I am being a bit factious.. At these levels is goes w/ a light breeze

I'm feeling very down right now…. (and hopefully profitable!)

Last 1 out the door is a rotten egg………….

Well, they sure are frustrating a lot of bulls and bears right now. This is now 3 days in a row of going absolutely nowhere!

It's just a step to the left…

And a hop to the right….

Put your hands on your hips…. (or someone else's!)

And bring your knees in tight!

Getting really tired of this effen bs. This market is being propped hard, no doubt.

Yep… total B.S. right now! They don't have the juice to higher, but they won't let it fall either. We either have the big boys loading up long right now, with the intention of exploding up to that FP of DIA 118.16, or…

They are unloading longs and getting short with the intentions of selling off hard. But which one is it? Got any friends at Goldman Sachs? LOL.

The only way to get this going is for us to bomb somebody. No other news will do it.

Tomorrows job report is expected and will do nothing. The only way it will moves is if a cycle moves it.

It sure looks that way too me Jim. Probably just another yawner day… unless they stage another false flag event cause a huge sell off? You know they are going to fudge the non-farm payroll report tomorrow… so that's not likely to move the market down, unless they are honest about it (about as likely as finding a snowball in hell).

BP pumping cement in the well head as I type, you never know about the false flags?

The will eventually set off a nuke to seal the hole. Could that be the false flag? Who knows?

Yep… total B.S. right now! They don't have the juice to higher, but they won't let it fall either. We either have the big boys loading up long right now, with the intention of exploding up to that FP of DIA 118.16, or…

They are unloading longs and getting short with the intentions of selling off hard. But which one is it? Got any friends at Goldman Sachs? LOL.

Well I've built up some call positions in TZA and SDS since close yesterday, and just added some more SDS

Its reversal bar after reversal bar on a 5 minute and it still won't go down.

I can't imagine too many traders staying long in front of the non-farm payroll news tomorrow, so I would expect some profit taking into the close.

Pump after Pump after Pump. They seriously won't even let it go down more than 1-2 ES points

Apples broken triangle

http://niftychartsandpatterns.blogspot.com/2010…

Apple is a leading stock… this isn't good for the overall market.

So frustrating to watch

If they are going to ramp this, I wish they would just do it and get it over with.

50 period crossed beneath the 200 period on the 5 min chart although both are flat at the moment. Maurice Walker is writing that this is great to time to enter a position on the first pullback after this technical formation. He is updating in real time it appears. Check page 2 of his stock charts. There is a link to the right.

I haven't added any positions so far today but if there is a drop to new lows and breadth turns more negative I might. Looks like the euro is putting in a positive doji day so far. $xoi is holding up with a doji. Good news though: everything off today's low looks like ugly corrective slop.

You know… even if they fudge the numbers out tomorrow, I just can't see another explosive move up. All the bulls are already onboard now, so who's left to buy?

On such low volume it will not matter.

Are you implying to go short or long?

Does anyone have any access to whether or not there has been any large VIX call buying, like the last time we tanked?

I know VXX calls for the August 22 calls had huge volume yesterday. Like 25,000 contracts. This is from the Vix and More blog:

http://vixandmore.blogspot.com/2010/08/record-c…

The average according to the above has been 20,000 per day. Excuse me that is total contracts

2/3 have been calls.

Call volume on Tuesday for VXX set a record 49,000

http://seekingalpha.com/article/216678-what-inc…

There's been large VXX call buying recently. There is an option article too that I'll provide a link to.

15 minute BB pinching again. Macd poised . they are going to run it up.

Well gang… it looks like all of you guys are up on the call buying in the VIX. Do it feel like we are going to explode upward to you guys? It feels more like dead silence as all the animals and birds flee away just before danger arrives.

The quiet before the storm? Looking at the charts right now, it could go either way tomorrow. None of the longer term (30 min, 1 hr, etc.) are that oversold or overbought. Just a an FYI, on June 21 SPX hits the 200 SMA on the 4-hour chart and sold off. It hit it again the last couple of days but hasn't closed above it. Right now that is 1127. If we get a close at the end of the day above it, i think we are headed higher.

Here's the option article. Larry McMillan is writing that there has been a lot of put buying in the SP 500 futures and the buyers don't care what price they are buying at and they are buying them at streched premiums.

—-

http://www.marketwatch.com/story/whos-buying-all-those...

Who is so eager to buy that they keep stepping in even if we drop a point. Just unreal.

Just the computer bots… that's the only one's dumb enough to buy at these levels… LOL

It looks like a mini ending diagonal the last hour. LOL.

FYI, a lot of VXX call buying today as well at that Aug $22 strike

Bastards are going to pop all the stops right above the HOD going into the close. Seems very obvious.

Spoken not a minute too soon

If you were the market makers, wouldn't you clear the overhead shorts just before you tank the market for real? I would…

i wish that is what it is but I think this consolidation is going to break up now and that 1200 target is getting very real.

News just does not matter and i have been fighting the tape.

This is one of the most manipulated, ramped up tape in the since the 2008 crash. Atleast the whole run up previously from March 2009 and even from Feb – April 2010, there was a genuine recovery and reason for bullishness. There is absolutely none right now, and yet we sit at higher levels with ramps jobs on a daily basis.

Story of the last few days has been move down a few points, trade sideways to burn off oversold charts, move back even higher. Sell-off a few points again, trade sideways and move back even higher again. It's ridiculous. You would think there would be some profit taking or shorting up here to get a healthy pullback, even if we move higher after that. But absolutely nothing. Instead we just keep ramping higher like right now.