Thursday Update... 3 Down, 1 To Go!

(to watch on youtube: http://www.youtube.com/watch?v=Ir5Bvc3Mwqk)

It looks like the mystery missile was fired from a Chinese Nuclear Submarine, or at least that's who is going to be blamed for it. While I don't know if that's true or not, something isn't right here. It sounds like the gangsters at the Fed are going to try and provoke China here... for what I'm not sure? But leaking out that it was a Chinese sub that fired the missile sounds like a plot to get American's upset with China. I'm not buying it. The Fed's are responsible here... I just know it.

Colleen Thomas was interviewed on Russian TV and she says that the good Aliens shot down the missile, which very likely could have happened. I've seen on the history channel where every nuclear missile in America was powered down once in the 90's. It was to let the gangsters know that the good aliens have the power to stop any nuke from going off. I don't have the link for it, but I'm sure it's probably up on youtube somewhere.

(to watch on youtube: http://www.youtube.com/watch?v=7UAeSsvHhTg)

Here are the links to the sites I talk about in the video:

http://weeklyworldnews.com/headlines/24841/red-hot-streak-over-new-york/

http://www.infowars.com/wayne-madsen-china-fired-missile-seen-in-southern-california

http://www.iamrogue.com/skyline

http://divinecosmos.com/index.php/start-here/davids-blog/872-disclosureevent

http://prophecyinthemaking.blogspot.com/

Many thanks go out to all the commenters who keep us all informed by posting links to important information.

Red

_____________________________________________________________________________________

Will we make it?

(to watch on youtube: http://www.youtube.com/watch?v=frdaIpWk9Us)

Only 2 more ritual dates left before the crash zone is over with. We passed the November 6th date that was suggested as a possible date for a false flag nuclear bomb event in the Simpson video. And now we passed the November 9th date that would have be another 911 in reverse (11-9 = 9-11 backwards), so what's left?

Well, the gangsters love the number one, as in 11, 111, or 11-11... which happens to be tomorrow. That would be our third of four ritual dates that they could possibly stage another false flag event on. The fourth would be on the 14th, as that date is 777 days from the Dow's one day loss of 777 point back in September of 2008.

It is quite possible that the missile that fired off the coast of California yesterday was the "false flag" event, but it failed. I hope and pray that's what it was, and that no other event is scheduled to happen. Of course we won't know until after the 14th, but I'm hopeful that the "event" was stopped by the good guys.

Many people have been talking about it on the internet now, exposing it to the world. This serves to derail the bad guys as they might be forced to change their evil plans if too many people figure it out. At least that's what I'm hoping will happen.

Also, since the upside FP of DIA 118.16 is still 400-500 Dow points away, maybe nothing bad will happen yet? Even when we hit the print, maybe only some financial disaster will happen, and not a physical one that kills hundreds or thousands of innocent people.

It's only a matter of time before the Federal Reserve Bank will have too declare bankruptcy anyway, so why not release that information once we hit the FP target? That wouldn't hurt anyone physically... except maybe Bernanke, Geithner, Blankfein, etc... who might jump out a window from a tall building or something? That wouldn't be any loss of life or anything, as vampires aren't human anyway.

Maybe I'm being too optimistic now, but I really don't want any disaster to occur. I'd just like to see the market have an overdue correction... maybe down to the 1060 level or so? A crash will hurt too many Americans, all while getting the gangsters richer as they profit from shorting the market and buying up assets at below wholesale prices.

I know what you're think... but Red, it's how they rob everyone... I know, you're not telling me anything I don't already know. But I remain hopeful that nothing horrible will happen, and any "event" won't involve the loss of any lives.

As for tomorrow, barring any false flag event, we should go up a little in the morning based on the 60 minute chart, and then rollover into the close. We could go down to the 1195 area into the close, where I would expect the market to find support from the rising trendline and the horizontal support level.

If the 1195 area breaks, look out below as the market could fall pretty quickly once that very important rising trendline is broken. But as long as it holds, they could bounce from there and continue to rise into next week to hit that upside FP on the DIA. However, if the "event" wasn't the rogue missile, but instead something else yet to come... then we may never see the FP?

So again... let's all hope that nothing bad happens. Be safe everyone, and good luck tomorrow...

Red

P.S. Something you should watch...

Dow Jones analysis after closing bell

http://niftychartsandpatterns.blogspot.com/2010/11/dow-jones-analysis-after-closing-bell_11.html

Hi Red!

Here’s your bad event—-Black Thursday it will be.

CSCO DOWN 13% IN AH—

I have heavy shorts on FFIV, lucky lucky me….

Good luck on that Z…

Let’s hope it take the rest of the market down with it.

Thursday, my advice, don’t go long anything, until the last 5 minutes of trading. That’s about when you will get the best intraday price.

Buy the dips…..seasonals very favorable starting with Veterans Day…..

The highest I can see the market going Robert is to the FP of DIA 118.16 (about 11,800 Dow), but I wouldn’t dare chase it at these overbought levels.

If you’re daytrading, then fine… but I do options and look for a several day move. Go long here is too risky for my blood. Going all in short at the DIA print is what I’m waiting for.

But for now, I’ll just take small short positions until I see the up trend break. I’ll go long when the market hits Dow 8300, but not now. Good luck on those long though…

The drop in the market is enough to regain what my options lost from their premiums. I’ll be moving my puts to december next week depending on mondays action. Going long is insane and ridiculous at this point. Why bother? It’s too risky. Maybe if you’re day trading and you want to run the markets movements up for a little while, but in that case you’re far better off working with stocks that have a reason to go up. I have 51, 52, and 53 puts on the Qs all for November. I’ve been averaging up and am already down about $2000. If the Qs open up at what they’re at now, $53 even and head down all day, I’ll break out above even and hit the profit point. If the market does that 10% correction, woo boy I’ll finally have enough to actually make some moves.

I think the Fake Print analysis is very effective, and have paid attention to them in the past, but mostly during times I haven’t been trading options. After following your blog for the past 2 weeks Red, I am convinced that they have FAILED to hit the fake print fast enough, and that the number is out the window at this point. Today’s upward movement was bullshit, and reeked of manipulation BUT!!! because of Cisco and its weight in pulling down the Qs after hours, along with aapl and goog, i think tech is down for tomorrow, and with that goes the nasdaq. I think the resistance of holding the nasdaq up (which I think is the most overbought index) and pushing through with the fake rally to the fake print, is not going to overcome the weight down due to the rest of the major sectors. Down comes the nasdaq, down comes the other indices, and they toss the FP out the window and go for the sell signal. It’s probably timed to the DAY rather than just the number and I anticipate some more down days leading into a gap down on monday.

I could be completely wrong, obviously, but I’m all in short and I’m going with my guns. Americanbulls.com had the qs sell confirmed yesterday, but todays movement on the qs flipped that to buy-if. I think that’s nonsense, and its completely out the window with the 1 1/2% drop for the Qs after hours. I think tomorrow will confirm bearish indicators across the board, tossing the 60 minute out the window.

Here’s to a healthy correction!

I’m with you on that… I’m 50% short, and saving the remaining amount for the FP… if we get there? But if we tank from here… I’d be a happy camper too!

Let’s just see how hard they try to save Cisco tomorrow morning, as that’s the real key to whether tomorrow starts selling right at the open or rallies first… then sells off.

Also, keep your eyes on the dollar. They will likely tank it to push up the market.

Hi Red,

You said that you would like to heal people, first you must Learn how to meditate. Try this, start with 5 minutes and every day add a minute until you reach your age then continue for a month.

http://www.youtube.com/user/vibrantenergy#p/u/17/mAN_ykzXzoM

Then learn Reiki treatment for mind, body and spirit

http://www.reiki.nu/treatment/treatment.html

enjoy

http://www.youtube.com/user/vibrantenergy#p/u/17/mAN_ykzXzoM

Thanks, I’ll check out those links. But what I was really talking about was the DNA changes that everyone will go through after 2012. Many believe that some people will then have special powers… like the X-men movies.

So, if I were to be one of the lucky ones to get some special power, I’d want to heal people.

🙂

For healing, check out ORGONITE at sites like http://www.orgonite.info

http://www.warriormatrix.com

http://www.orgonecrystals.com

http://www.whale.to/b/cr39.html

You can make some, buy some, but ultimately get your hands on a power wand red, and you can heal yourself and others by using your own energy and using the power wand as a healing tool.

Nice move in Copper the last hour……….sign of good things to come………..

Do you day trade Robert? Or futures in the afterhours?

Not sure if this means anything, so take it for what it’s worth.

I’m looking at a few shorts…VXX (short futures), TZA (short Russell 2000) & FAZ (short financial).

Many of these shorts are active in after hours. Usually these ETF’s extend their losses in after hours by a few pennies because I watch them all the time. But, VXX is up 0.84 cents (1.88%), TZA is up 0.37 cents (1.89%) and FAZ up 0.26 (2.40%). I mean there is no impending doom news, the dollar is weakening and nothing to really warrant a reversal of this bull trend.

I don’t trade the futures, so I’m not familiar with their patterns, and movements. Are the moves you are talking about more then usual?

It’s unusual for inverse ETF’s to go up on a positive or flat day.

ERY, DRV, BGZ, EDZ, VXX, TZA & FAZ all have similar moves in the after hours.

Last time I saw this the market went down.

Either people are hedging or jumping off the bull bandwagon expecting these ETF’s to be at or close to 52 week lows.

I noticed you had a Bilderberg video up.

I think everyone should watch the Rothschild documentary:

http://www.youtube.com/watch?v=uehhnzIuK7g

The real life train was crazy eights.. Railcar #8888. So to use 777 makes no sense unless it is some kind of message…

I think that is the point Goldieee… to send a message. If they wanted to be accurate in the movie, then they should have used the real number instead of the 777. But they are sending a message I believe.

This was a warning from Tony Robbins back in early August. He knows what the most powerful people on earth are doing because they are his clients. He mentioned beginning of 2011 going to 2012 as the worst period for the world,the market , the economy.

http://business.tonyrobbins.com/78/an-important-note-of-caution/#comments

So far… so good gang. We are looking like we are going to open down this morning. If that trendline of support breaks around 1195, we should fall hard from that point.

guys… if this drops hard.. it will bounce… on the bounce SHORT YOUR ASS OFF!!!

Let’s see if 1195 area holds or not? A break there would a serious blow to the bulls.

red,

“last week’s insider selling of all stocks (not just S&P) hit an all time record of $4.5 billion.”….. why last week – vs this week or next week??? what do the rats know??? this is further confirmation of something that will collapse this market??? the time here IS NO ACCIDENT!!!

richie//

Thanks for the update Richie…

Dow Jones near support level

http://niftychartsandpatterns.blogspot.com/2010/11/dow-jones-near-support-area.html

Thanks anoopsan only thing now is BREAK dam it BREAK

I wonder myself which one they’ll do? Close the gap above them, on the one below them? The 60 minute is still oversold and is trying to move back up, but it seems too weak with the daily now rolling over.

However, we still have light volume and no “event” yet, which favors the upside. It’s going to be the bulls that start the sell off, not the bears.

I think will probably go back up into the close today, as the lack of any further news leans bullish for the market.

SPY support and resistance levels

http://niftychartsandpatterns.blogspot.com/2010/11/spy-support-and-resistance-levels.html

Probably back and fill today, and waiting for tomorrow to see if $9B is enough to stem the tide. If not, ba-woooooooooooosh!!!

Maybe the “event” will be Irish default this weekend?

10yr now over 9%.

Or maybe the “event” was stopped? Maybe it was that missile that never reached it’s target?

Well i was out of the market for the last couple of days and wow what a roller coaster.I will only be doing more checking on how things are going on for tomorrow as todays move is quite important for me.Looks to me that we are heading down however once again we have SUPER FEDS coming to the rescue tomorrow.Man honestly this has been the hardest 2 months of trading and i feel like im breaking down.I am going to jump back on once i regain my focus but for now im just watching good luck to all traders over this weekend.

Im looking at the 5 and 15 mins but it seems to be rolling over it should start working off the oversold conditions before going back down but tomorrow is one tough nut to crack for the bears.Going into friday we all know that the guys over on wall street want to close of the week at least on a stronger note on top of that the bonds market will be open and even if POMO doesnt affect the market in a direct sense the safe buying mentality comes into play.The bulls have not had a chance to rally the whole week and imho this was the one week in which the bears could make a dent.On the DJ30 we see that it has pushed down into the 11200 region but its bouncing off it right now unless it breaks in the next few hours it means that on the daily chart the up trend hasnt broken.Right now im actually confused i dont know weather to look at the charts or listen to the news.Each one to me is equally important but my gut is twisting in knots right now.If anyone would like to carry on this discussion please do so cause i want to see if im missing out on anything

Im looking at the 5 and 15 mins but it seems to be rolling over it should start working off the oversold conditions before going back down but tomorrow is one tough nut to crack for the bears.Going into friday we all know that the guys over on wall street want to close of the week at least on a stronger note on top of that the bonds market will be open and even if POMO doesnt affect the market in a direct sense the safe buying mentality comes into play.The bulls have not had a chance to rally the whole week and imho this was the one week in which the bears could make a dent.On the DJ30 we see that it has pushed down into the 11200 region but its bouncing off it right now unless it breaks in the next few hours it means that on the daily chart the up trend hasnt broken.Right now im actually confused i dont know weather to look at the charts or listen to the news.Each one to me is equally important but my gut is twisting in knots right now.If anyone would like to carry on this discussion please do so cause i want to see if im missing out on anything

do you think todays down day had to do with Cisco dropping 16% ?

Honestly its like trying to pin the tail on the donkey.Someone has to take the blame i could call out quantas on their engine problems but when 25 out of 30 companies on the DJ is in the red who is really to blame.Honestly this to me is how the market should react if there wasnt any monopoly money coming in but is it gonna stop anytime soon doesnt look like it.

Could be? The short term charts were all mixed, and could have open down or up. Since Cisco dropped yesterday, the opened down. If Cisco would have went up in afterhours yesterday, then we could have just as easily opened up this morning.

Now that the 30 and 15 minute charts have worked off their overbought condition by becoming oversold, they can now move back up in sync with the 60 minute chart.

The daily is still putting downward pressure on the market, so the upside move should be limited. Overall, just a bunch of choppy waters.

do you think todays down day had to do with Cisco dropping 16% ?

Red for tomorrow you wanna call it now or wait till closing

Should be up, as all the short term charts are now pointing up together, from oversold conditions all day today. But the daily is pointing down, and more powerful then the shorter term charts.

That suggests a flat day as the charts again fight each other. The daily will push down, and the 60, 30 and 15 will push up. It’ possible that once they all become over bought that selling could happen into the close.

However, most Friday’s are positive for the market and may again be manipulated up. I don’t see it going up too far though, even if they push it up with more monopoly money.

honestly when i saw the time table release my heart kindda sank cause it basically means they are gonna float the market all the way till Dec and by doing so at that time the retail sector will no doubt be in the green and give the market enough momentum to rally again.Unless something major shifts and the majority of the retail traders jump on board the bears train its a real uphill battle to try and even make a dent on this market right now.The bulls have only allow the bears to either bring it down to the res point in the channel which anoopsan is so kind to post and after that its nothing but bounce bounce bounce from there.Next week we have the GM IPO and the opx meeting so moving down from here seems further and further away now.

Yes it does seem further and further away now. It simple means too me that we are till on target for hitting the upside FP, as it appears we are not going to have any “event” at this time period.

I’m sure they’ll try again, but this time looks like the good guys may have stopped them? I do believe that missile was the “event” and it was stopped from reaching it’s target… hence we have NO event now.

Of course that’s bad news for us Bears, but good news for anyone who would have lost their lives should that missile hit it’s target.

The market hasn’t even touched its 20dma in months. Would not be surprised to see green at the close. Plenty of steam left in this bull…………

and time as well the one hour shift has thrown me off abit with 2 hours left on the market it is very possible to close off today with a doji and maybe in perpetration for tomorrow even push up higher.

We may indeed get up to the DIA FP before she rolls over for good? As long as we don’t have any “false flags” that succeed, anything is possible in this market.

ES Descending Triangle pattern

http://niftychartsandpatterns.blogspot.com/2010/11/descending-triangle-of-s-500.html

anoopsan you have only posted charts which i love but do you have any personal comments on the market itself.Would love to hear your views.

My technical analysis is better than the fundamental analysis that’s why i am sticking to the charts. I will try to share my views here as often as possible.

no no i ment as in your views when you look at the charts and what you look out for heheheh im trying to learn and not just depend on other people for charts and pattens im really impressed by the charts that you have posted dont know if your the one drawing them but doesnt really matter.I used to be fixated on only the charts but over time i have learnt that its not just one simple thing that will show you the clear path thats why im on a mission to gather as much info from every possible source and to place everything together like a huge jigsaw puzzle.So any views from tech to personal to news is just as equally important to me.

The only way to truly gain the superior edge and win all the time is to work for Goldman Sachs and do insider trading. Let me know if you get hired on… maybe you can send your old buddy a tip from time to time. LOL

HAHAHAHAHAH if only my man i would JUMP on an offer to even clean their toilets.In this day and age information is power charts news and other stuff is for the masses.Honestly do you see a broker or anyone working in goldman in (bad times) that just shows you how when your swimming with the big sharks its only a matter of how much you can feed on the small fishes.

this is for Red: http://www.abovetopsecret.com/forum/thread627275/pg1.

Here is one more accidental event you might like to read about that happened in AZ.

Also I heard that the TV show The Event is airing internationally right now not after 6mo like they do it with other shows. Also the second E that is printed backwards in mathematics means: THERE EXISTS

Thanks… do you have a link for the TV show info?

I read in on David Wilcock blog, he has a lot of info he has collected from different sites on this show, but regarding the show airing now all over the world I have read on the comments of the blog written by Jennifer on Nov 10th, she picked that up, I can’t pinpoint where in the blog was disclosed.

http://divinecosmos.com/index.php/start-here/davids-blog/872-disclosureevent

And regarding Nov 9th and important events, besides the California mistaken missile launch read the yahoo article regarding the “Massive gamma ray bubbles” posted on Nov 9th and I am assuming that is when is happened.

here is the link: http://news.yahoo.com/s/afp/20101109/sc_afp/usastronomy

http://www.investopedia.com/articles/bonds/09/babs-are-born.asp

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2010/11/10/MNJA1GA39R.DTL

http://online.wsj.com/article/SB10001424052748703585004575604910264748850.html?KEYWORDS=New+Risks+Emerge+in+Munis

Red

did you see the “Red hot streak ” over NY and the “Blue UFO” over Virginia?

They were discussed on Fox 5 News and CBS,

see the link for the “weekly world news” where they were posted

http://weeklyworldnews.com/headlines/24841/red-hot-streak-over-new-york/

Thanks for the link. I didn’t see that one. There out there, that’s for sure.

Those gangsters in Washington, are getting better at cooking the books..The average rent is up 9.7% this year.

http://www.bloomberg.com/news/2010-11-02/vornado-quarterly-earnings-climb-on-rising-rental-income-from-properties.html?cmpid=yhoo

I did not get my 11166.6 on The Dow today…I’m pissed! I’ll get it…

hahahah dont worry by the looks of things its heading there however with more $$$$ on its way i would take a screen shot if it ever hits 161616 or 16661 hahahhaha

If I see 11111.1, I’ll try to screenshot that for RED!

57% bulls AAII poll. An incredible number. I know it got to 60% at the 1987 peak. This is by far the highest number I have seen in years if ever.

Recoreds are made to be broken.

so do you think this is bullish? I would think this is the dumb money going in at the end….

More bad news for New Orleans, (Voodoo city, getting hit by Voodoo economics)

HAL, off topic, if you work at a well site, robots are fully going to eliminate 35% of the workforce, next 3 years..that’s a 10% year increase in productivity—EXPECT a PINKSLIP if you work at a well site.

Logic says, HAL headed to 37-38.EASILYSee if you agree.Here’s why…http://zstock7.com/?p=3653

Well it’s now become a case of the euro getting flushed down the toilet vs nonstop Pomo for a mini-eternity. Euro broke through its double-bottom today and the tankage continues in after-hours. Irish 2year bonds trading at the same spread to German bonds as the longterm rates which shows the markets have little faith in Irish bonds in general. I would like to see the McClellan Oscillator continue to drop tomorrow and finally penetrade that -100 range to the downside. That would encourage me that Monday could be the tipping point. Since today was a semi-holiday, it was expected that the decline would be muted. I don’t like the red hollow bars for the Nasdaq. They were buying calls at semi decent rate on ISEE.

Hey Red, follow up—I made 35% on the FFIV puts. That was the max the market gave. Can’t short FFIV anymore…CSCO starts going up, so does FFIV.

btw, CSCO in the 19’s is a MAJOR BUY…good IRA buy too, at that price.

btw, My IRA buy recommendations, on average go up 30% to 40%, in less than 6 month’s.

ES Descending triangle http://niftychartsandpatterns.blogspot.com/2010/11/descending-triangle-of-s-500.html

Check this out RED!!!

A new alert for nov 15th:

Nasa will have a televised conference anouncing a new discovery of an exceptional object in our cosmic neighborhood.

http://www.nasa.gov/home/hqnews/2010/nov/HQ_M10-157_Chandra_Update.html

New development on the missile fired from LA

http://www.infowars.com/wayne-madsen-china-fired-missile-seen-in-southern-california/

Thanks for the update…

Refresh page for update…

Leo,

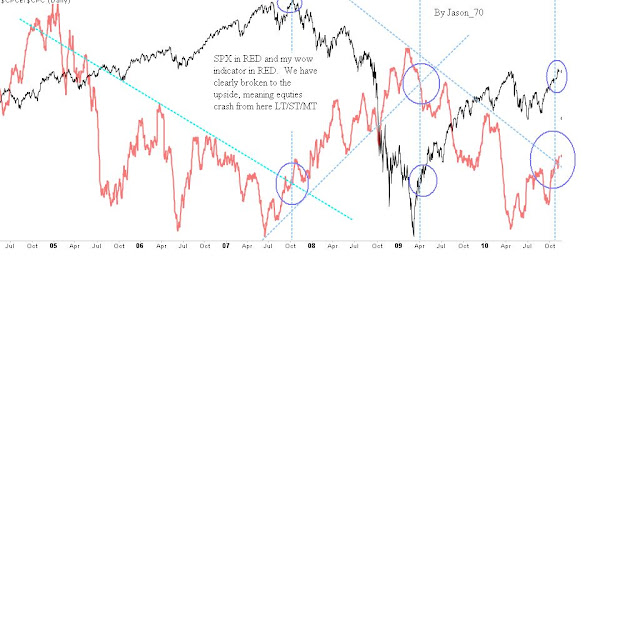

Just wanted to update my WOW chart once again. We are now in an LT/MT/ST bear market that was confirmed about a week back.

Latest ->

About 1 week back ->

Regardless of all the omens etc, this has proven absolutely correct in it’s predictions until now. Let’s see…

Thanks Jason… looks like the crash is still coming.

I think your right Red, it looks like we will go down some more and we do have some fundamental basis for this drop.

This run up in stocks has set the bar high for expectations. The government is cutting back on spending on products from CSCO and other companies. Yahoo is to cut from between 10% to 20% of it’s workforce. Ireland is having debt issues. I think we glossed over that the foreclosure fraud could cost banks up to 100 billion. Insider selling of 12:1. Steve Ballmer wants to sell over 1 billion in shares of MSFT. If you didn’t probe for information, Ballmer hasn’t sold any shares in 7 years!

Be smart. Wisdom and money can get you almost anything, but only wisdom can save your life.

Look for a drop in at least Finance and Technology.

Yes, not many speak of it, but insiders are rarely wrong. That speaks volumes too me that the crap is about to hit the fan soon.

Dow futures overnight—I got my 11,111…and my 11166.6..told you I’d get it….Most folks can’t recognize a pullback, until it’s over.

Cool well asia side threw a huge move everything was reporting in the red during asia trading but somehow i get the feeling that we weill close green today just me

What are you saying? This is only a pullback before another move higher?

I think we will pullback a little.. to sucker more bears in… then move higher….. and then Drop… this way the gangstahs make more money…. both ways, this is how an OG (Original GANGSTAH) WOULD DO IT.

looks like we are tanking at the open…. … Open Lower and the feds come in and save the day… and making it a DOJI!!! same routine….

S&P 500 Futures before opening bell: CLICK HERE

SPY support level

http://niftychartsandpatterns.blogspot.com/2010/11/spy-support-levels_12.html

There seems to be a fight between the 60 minute chart that’s pushing up and the daily, 30 and 15 that’s pushing down. The end of the day these short term charts will realign themselves and should give us the next directional move.

SPY breaks support

http://niftychartsandpatterns.blogspot.com/2010/11/spy-support-levels_12.html

happened a few mins back but i want to see if it will test it and hold or weather it breaks back up things are not looking good for bulls today and im gonna eat a truck load of mud on my up day call

The hour chart trend is clearly down. So moving up may not be easy from here. One thing to not in SPY chart is that the GAP near 119 is almost filled so bulls may try to move up

hmmmmmmmmmmmm ok noted on that will take a closer look at that

We are close to major support right now, with low volume. This 1195 spx area has a major rising trendline of support intercepting with horizontal support. I don’t see it breaking with some news event to panic the market.

Red, saw a FP for aapl at 220 : stockcharts/shadburn

Did you get a screenshot of it? Can you post it, or email it too me?

i dont know how to post it. please give me your email

i dont know how to post it. please give me your email

i have pasted on word doc. don’t know how to post

Anoopsan if im not seeing things im looking at a break in the trend channel on the DJ30 and its quite a big one does your charts confirm this ????

That’s right DJ. Trend line violated

That’s right DJ. Trend line violated

ok thanks

DJ let me see the chart